- Getting ready to go build a rain gauge at home depot with the kids. #

- RT @hughdeburgh: "Having children makes you no more a parent than having a piano makes you a pianist." ~ Michael Levine #

- RT @wisebread: Wow! Major food recall that touches so many pantry items. Check your cupboards NOW! http://bit.ly/c5wJh6 #

- Baby just said "coffin" for the first time. #feelingaddams #

- @TheLeanTimes I have an awesome recipe for pizza dough…at home. We make it once per week. I'll share later. in reply to TheLeanTimes #

- RT @bargainr: 9 minute, well-reasoned video on why we should repeal marijuana prohibition by Judge Jim Gray http://bit.ly/cKNYkQ plz watch #

- RT @jdroth: Brilliant post from Trent at The Simple Dollar: http://bit.ly/c6BWMs — All about dreams and why we don't pursue them. #

- Pizza dough: add garlic powder and Ital. Seasoning http://tweetphoto.com/13861829 #

- @TheLeanTimes: Pizza dough: add lots of garlic powder and Ital. Seasoning to this: http://tweetphoto.com/13861829 #

- RT @flexo: "Genesis. Exorcist. Leviathan. Deu… The Right Thing…" #

- @TheLeanTimes Once, for at least 3 hours. Knead it hard and use more garlic powder tha you think you need. 🙂 in reply to TheLeanTimes #

- Google is now hosting Popular Science archives. http://su.pr/1bMs77 #

- RT @wisebread 6 Slick Tools to Save Money on Car Repairs http://bit.ly/cUbjZG #

- @BudgetsAreSexy I filed federal last week, haven't bothered filing state, yet. Guess which one is paying me and which one wants more money. in reply to BudgetsAreSexy #

- RT @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- RT @MoneyCrashers: 4 Reasons To Choose Community College Out Of High School. http://ow.ly/16MoNX #

- RT @hughdeburgh:"When it comes to a happy marriage,sex is cornerstone content.Its what separates spouses from friends." SimpleMarriage.net #

- RT @tferriss: So true. "Nearly all men can stand adversity, but if you want to test a man's character, give him power." – Abraham Lincoln #

- RT @hughdeburgh: "The most important thing that parents can teach their children is how to get along without them." ~ Frank A. Clark #

Saturday Roundup

- Image via Wikipedia

Congratulations to Claudia for winning the $100 Amazon gift card.

This week started with my wife getting sick and ended with her passing it on to me. I hate being sick.

On a positive note, Tron is out this week, and is on IMAX 3D at a theater near me. I get to share a piece of my childhood with my son this afternoon.

Best Posts

When a guy named Dragon says, “Hold my beer a second,” you know something badass is about to happen.

Michael Moore’s Cuban healthcare lies propaganda is too much even for Cuba. Apparently, they are afraid the proles would revolt if they saw how good the ruling class has it in comparison to the 150-year-old rat-hole hospital the peasants are forced to use. But hey, it’s free!

I could think of worse ways to get laws passed than Last Man Standing. It would at least put a stop to frivolous crap that hurts everyone.

I had an eBay seller try to screw me once. I had access to a number of skiptracing tools at the time. When I sent him his phone number, his girlfriend’s phone number, his parents’ phone number, his place of employment, and all of those address, I got my refund the next day.

ChristianPF has a post on buying bulk herbs and spices. Not all spices can be stored for long, even in the freezer.

LRN Timewarp

This is where I revisit the posts I wrote a year ago.

4 Ways to Flog Your Inner Impulse Shopper was my first bondage-themed post. I still smile when I re-read it.

My post on cheap birthday parties is something I need to read every year. The party this fall wasn’t nearly as cheap as it has been in recent years.

And finally, my Grinch post on saving money on Christmas. My secret: buy less for fewer people.

Carnivals I’ve Rocked

First Steps – Ramsey Was Wrong was included in the Carnival of Personal Finance.

A Moment of Clarity was included in the Carnival of Money Stories.

Top 7 Reasons To Trade Forex Over Other Financial Instruments was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

5 Ways to Change Your Spending Habits

If you keep doing what you’ve always done, you’re going to keep getting what you you’ve always gotten. One of the hardest things about getting out of debt is changing your habits. You need to break your habits if you’re going to get yourself to a new place, financially.

How can you do that? Habits aren’t easy to break. Ask any smoker, junkie, or overeater what it takes. There are a lot of systems to break or establish habits, but they don’t all work for everyone.

Here are my suggestions:

- Commit to just 30 days. I’m a big fan of doing new things for 30 days. If you can do it for a month, you can do it forever, no matter what “it” is. For just one month, don’t buy anything. I don’t mean avoid buying groceries or toiletries and I certainly don’t mean to stock up on new crap the day before your 30 day spending fast or rush out for a shopping spree on day 31. Just don’t buy anything for a month, no exceptions but the things necessary to stay alive and healthy. No movies, no games, no cars, no toys, and no expensive meals. Just 1 month.

- Switch methods. If you pay for everything with a credit card, restrict yourself to just cash. If you pay cash for everything, switch to a credit card. Breaking your long-established habits is a way to get used to spending consciously: taking the time to think about what you are doing, instead of just spending mindlessly.

- Identify your spending triggers. I can’t go into a book store and come out empty handed. So, I avoid bookstores. My wife has problems with clothing stores. A friend can’t walk out of a music store without some body piercing equipment. What are your triggers? What makes you spend money without thinking? Figure out what those things are and then avoid them like the plague…or the clap.

- Quit buying things for pleasure. Buying things makes us feel good. It sends a rush of endorphins through our bodies. The more we get that rush, the more we crave that rush, so the more we do to get it. You need to stop that. Before you buy something, ask yourself if it’s something you actually need, or if you just want a pick-me-up.

- Avoid shopping online. E-commerce sites make it far too easy to buy things at a moment’s notice. You don’t have to think about what you are doing or if you actually need whatever you are buying. You just buy. The best way too avoid them is to delete your credit card information from any site that save the information and delete the sites from your bookmarks. Whatever you can do to slow down the buying process will make it easier to avoid buying things, which can soon be stretched into NOT buying things at all.

Habits—especially bad habits—are hard to break. There is an entire self-help niche dedicated to breaking habits. Hypnotists, shrinks, and others base their careers on helping others get out of the grip of their bad habits, or conning them into thinking it is easy to do with some magic system. How do you avoid or break bad habits?

Net Worth Update

Now that my taxes are done and paid for, I thought it would be nice to update my net worth.

In January, I had:

Assets

- House: $252,900

- Cars: $20,789

- Checking accounts: $3,220

- Savings accounts: $6,254

- CDs: $1,105

- IRAs: $12,001

- Investment Accounts: $1,155

- Total: $297,424

Liabilities

- Mortgage: $29,982

- Credit card: $18,725

- Total: $48,707

Overall: $249,717.00

Here is my current status:

Assets

- House: $240,100 (-12,800) Estimated market value according to the county tax assessor. This will be going down in a few months when the estimates are finalized for the year. I don’t care much about this number. We’re not moving any time soon, so the lower the value, the lower the tax assessment.

- Cars: $15,857 (-4,932) Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $4,817 (+1,597) I have accounts spread across three banks. I don’t keep much operating cash here, so this fluctuates based on how far away my next paycheck is.

- Savings accounts: $6,418 (+164) I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment. I swept a chunk of this into an IRA to lower my tax bill, which is also why my IRA balance is up as much as it is.

- CDs: $1,107 (+2) I consider this a part of my emergency fund.

- IRAs: $16,398 (+4,397) I have finally started to contribute automatically. It’s only $200 at the moment, but it’s something.

- Investment Accounts: $308 (-847) I pulled most of this out and threw it at a credit card.

- Total: $285,005 (-12,419)

Liabilities

- Mortgage: $28,162 (-1,820)

- Credit card: $16,038 (-2,687) This is the current target of my debt snowball. This has actually grown a bit over the last week. I did a balance transfer that cost $400, but it gives me 0% for a year, versus the 9% I was paying. That will pay for itself in 3 months, while simplifying my payments a bit and saving me almost a thousand dollars in payments this year.

- Total: $44,200 (-4,507)

Overall: $240,805 (-8,912)

Well, I lost some net worth over the last quarter, but it’s still a good report. If I disregard the change in value of my house and cars–two thing I have no control over–my overall total would have gone up almost $9,000.

All in all, it’s been a good year for me, so far, though paying off that credit card by fall is going to be a challenge.

Resolutions That Don’t Suck

I’m not a huge fan of New Year’s resolutions. Generally speaking, if you don’t have the willpower to do something any other time of the year, you probably won’t grow that willpower just because the last number on the calendar changed.

Seriously, if you’ve got something worth changing, change it right away, don’t wait for a special day.

That said, this is the time of the year that many people choose to try to improve…something. Some people try to lose weight, other people quit shooting meth into their eyeballs, yet others(the ones I’m going to talk about) decide it’s time to get out of debt.

Now most people are going to throw out some huge and worthless goals like:

- I need to lose some weight.

- I need to save more.

- I need to be a better person.

- I need to shoot less meth into my eyeball.

The problem with goals like that is the definitions. What is “some”, “more”, “better”, or “less”? How do you know when you’ve won.

It’s better to take on smaller goals that have real definitions.

Try these:

- I’m going to lose 20 pounds.

- I’m going to save $1200.

- I need to stop locking my children in the closet when I go to the movies.

- I am never ever going to shoot meth into my eyeball again.

But Jason, I hear you saying, where am I going to find $1000 to save? Well, Dear Reader, I’m glad you asked. Next time though, could you ask in a way that others can hear so my wife doesn’t feel the need to call the nice men in the white coats again?

Let’s break that goal down even further.

Instead of saving $1200, let’s call it $100 per month. That’s a bite-sized goal. Some people don’t even have that to spare, so what can they do?

Let’s make that resolution something like “I’m going to have frozen pizza instead of my regular weekly delivery.” If your house is anything like mine, that brings a $60 pizza bill down to $15 for some good frozen pizza for a savings of $45. If you order pizza once a week, that’s $180 saved each month, double your goal. That’s a win with very little suffering.

Now, you can take that extra $80 that you hadn’t even planned for and throw it at your credit cards. That’s a free payment every month. Before you know it, you’ll have your cards paid off and a decent savings account.

Then you can thank me because I made it all possible.

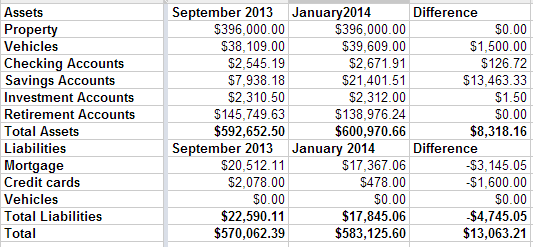

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.