- RT @moneycrush: Ooo, ING is offering a $100 bonus for opening a business savings account with code BSA324. Guess what I’ll be opening… #

- My kids have pinkeye and are willing to share, if anyone is interested. #

- RT @bitterwallet: If you haven’t yet, pop over to http://enemiesofreason.co.uk/ to see how @antonvowl dealt with lousy content thieves. #

- RT @zen_habits: Excellent: No One Knows What the F*** They’re Doing http://bit.ly/9fsZim #

- @bargainr RE:Hypocrites. No, they aren’t. They have paid for those services, even if unwillingly. in reply to bargainr #

- RT @PhilVillarreal: If vegetables tasted good, there would be no such thing as salad dressing. #

- RT @The_Weakonomist: w00t RT @BreakingNews: Obama announces $8 billion in loan guarantees to build first U.S. nuclear plant in three decades #

- @SuburbanDollar CutePDF. PDF export as a printer. in reply to SuburbanDollar #

- RT @bargainr: There are stocks that have paid out dividends consistently for 50+ years… they’re Dividend Champions http://bit.ly/cSYXrY #

- “Four M&M’s if I poop” Economics lessons from a toddler. http://su.pr/2akWF9 #

- @The_Weakonomist Is seaweed a meat, now? in reply to The_Weakonomist #

Missing Money

Last week, I checked my credit card account only to discover I was over budget by nearly $1000.

What.

The.

Heck?

It threw me into a bit of a panic. How could we possibly have spent an extra grand without knowing it?

We didn’t buy new furniture. We didn’t buy new computers. We didn’t buy a new car. We didn’t take any trips.

Oh, wait.

I did take a trip. I went to work headquarters for three days. That’s about a $500 mileage allowance, plus three days of restaurant meals.

I forgot to file my expense report.

That’s where my money went.

Somehow, in all of life’s wonderful hustle, I neglected to ask my company for the almost $1000 they owe me. That’s an oversight, for sure.

Luckily, we keep that much padding in our other accounts, so I don’t have to pay interest on that money, but still.

That’s my money and I forgot about it.

I’m so not happy with myself.

What’s worse, is that even though I figured out the problem last week, I still haven’t gotten that expense report filed.

It’s not procrastination, I swear. I’ve just been absentminded and keep forgetting to do it. Right now, I’ve got “EXPENSE REPORT” written on my whiteboard to remind me to file it.

Cuz I’m going to do it tomorrow.

What Can Cause Damage to Your Credit?

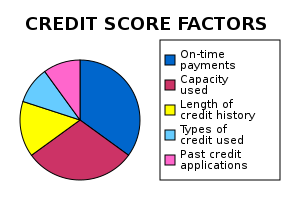

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

Fighting Fair

This was a guest post on another site early last year.

Everyone, at times, has disagreements. How boring would life be if everyone agreed all of the time? How you handle those disagreements may mean disaster.

This is particularly true when you are arguing with your spouse. You spend most non-working moments with this one person, this wonderful, loving, infuriating person. Your emotions will naturally run high while discussing the things you care most about with the person you care most about. Arguments are not only natural, but inevitable.

How do you have an argument with someone you love without lasting resentment?

You have to argue fairly. There are a few principles to remember during an argument.

- When your partner is talking, your job is to listen with all of your energy. You are not interrupting. Your are not planning your rebuttal while waiting for your turn to talk. Your are listening, nothing else. If you don’t listen, you can’t understand. If you don’t understand, you can’t find a resolution.

- Remember that your partner cares. If she didn’t care, she wouldn’t feel so strongly about the argument. This isn’t a war, just an argument. She still wants to spend the rest of her life with you. Keeping this in mind will change the entire tone of the argument into a positive interaction. You will still disagree, but you will be looking for a solution together, instead of finding a “win” at any cost.

- Search for the best intent. Remember #2? There is an incredibly good chance that, if there are two ways to interpret something your partner has said–a good way and a bad way–your partner probably meant the good way. Even if you are wrong, it is far better to err on the side of resolution than the side of antagonism.

- When your partner has finished speaking, it’s still not your turn to argue. Your job now is to repeat your understanding of the issue, without worrying about problem-solving. Before you can refute the argument–or even establish your disagreement–you have to know that you understand her position and she has to know that you do. Without understanding, there can be no path to resolution that doesn’t cause resentment. If you have too much resentment, you won’t have a marriage.

After all of this, it will finally be your turn to make your point. Hopefully, your partner will be following the same rules so you can solve your problems together, without learning to hate each other.

Arguments in your marriage aren’t–or shouldn’t be–intended to draw blood. Fights happen. If your goal is to win at any cost, you will both lose, possibly everything.

Why I Hate Payday Loans

I hate payday loans and payday lenders.

The way a way a payday loan works is that you go into a payday lender and you sign a check for the amount you want to borrow, plus their fee. They give you money that you don’t have to pay back until payday. It’s generally a two-week loan.

Now, this two week loan comes with a fee, so if you want to borrow $100, they’ll charge you a $25 fee, plus a percent of the total loan, so for that $100 loan, you’ll have to pay back $128.28.

That’s only 28% of actual interest; that’s not terrible. However, if you prorate that to figure the APR, which is what everyone means when they say “I’ve got a 7% interest rate”, it comes out to 737%. That’s nuts.

They are a very bad financial plan.

Those loans may save you from an overdraft fee, but they’ll cost almost as much as an overdraft fee, and the way they are rigged–with high fees, due on payday–you’re more likely to need another one soon. They are structured to keep you from ever getting out from under the payday loan cycle.

For those reasons, I consider payday loan companies to be slimy. Look at any of their sites. Almost none are upfront about the total cost of the loan.

So I don’t take their ads. When an advertiser contacts me, my rate sheet says very clealy that I will not take payday loan ads. The reason for that is–in my mind–when I accept an advertiser, I am–in some form–endorsing that company, or at least, I am agreeing that they are a legitimate business and I am helping them conduct that business.

In all of the time I’ve been taking ads, I’ve made exactly one exception to that rule. On the front page of that advertiser’s website, they had the prorated APR in bright, bold red letters. It was still a really bad deal, but with that level of disclosure, I felt comfortable that nobody would click through and sign up without knowing what they were getting into. That was a payday lender with integrity, as oxymoronic as that sounds.

Why Companies Need to Acquire MIS Graduates

This is a guest post.

Most companies recognize that technology will play an increasing role in future success. That realization doesn’t necessarily mean that businesses know what type of professionals to hire. These four benefits should convince companies that they need to acquire MIS graduates.

To Reach More Customers

The Internet has radically changed the way that people shop. Consumers spent about $210.6 billion buying products from online retailers. At $4,778.24 billion, the business-to-business e-commerce volume is even greater. The trend is quite clear: businesses that want to increase sales need to offer their clients online options.

Despite its popularity, e-commerce is still an evolving industry that presents several unanswered questions to businesses that want to take advantage of it. Adding an information systems manager to a technology development team makes it easier to find solutions as businesses encounter new problems.

To Protect Customer Information

In January 2014, hackers stole information about 110 million Target customers. In September of the same year, hackers stole information from Kmart. When companies suffer security breaches, media outlets pick up the stories and spread them across the Internet. This creates terrible public relations scenarios that can make consumers cautious of using credit cards when shopping online or at stores.

A strong computer security team is the only way businesses can stop hackers from stealing customer information. That team needs to include several types of professionals who specialize in specific areas of computer technology. Someone with an Information Systems Management degree can bring those professionals together to create a security program that outwits even the best hackers.

To Become More Efficient

Companies need to cut spending and increase profits to remain competitive. Computer technology that focuses on efficiency accomplishes both of those goals. Without someone trained to build and maintain computer systems, businesses can’t keep up with competitors who understand that spending a little more money today on the right team members can lead to long-term benefits.

Businesses that don’t use computer technology to improve efficiency will likely fail to meet the needs of their customers. Either their services will suffer or their prices will go up. Either way, refusing to adopt new technology puts businesses at a significant disadvantage.

To Improve Communications

Communications plays a key role in helping businesses meet their goals. Today’s latest technology helps companies stay in contact with customers, transfer large amounts of information between offices, and develop database systems so employees and managers can access information instantly.

Improved communication technology doesn’t just happen on its own. It takes a commitment to building reliable computer networks that can transmit information securely. MIS graduates who enjoy traveling can use this as an opportunity to help businesses while exploring the world. While small businesses probably don’t need to hire a staff member dedicated to building computer networks, medium and large companies can benefit from hiring their own information technology staff members.

As technology continues to evolve, companies will need to rely on more IT professionals. What advantages do you think an MIS graduate could offer businesses in your community?