- Guide to finding cheap airfare: http://su.pr/2pyOIq #

- As part of my effort to improve every part of my life, I have decided to get back in shape. Twelve years ago, I wor… http://su.pr/6HO81g #

- While jogging with my wife a few days ago, we had a conversation that we haven’t had in years. We discussed ou… http://su.pr/2n9hjj #

- In April, my wife and I decided that debt was done. We have hopefully closed that chapter in our lives. I borrowed… http://su.pr/19j98f #

- Arrrgh! Double-posts irritate me. Especially separated by 6 hours. #

- My problem lies in reconciling my gross habits with my net income. ~Errol Flynn #

- RT: @ScottATaylor: 11 Ways to Protect Yourself from Identity Theft | Business Pundit http://j.mp/5F7UNq #

- They who are of the opinion that Money will do everything, may very well be suspected to do everything for Money. ~George Savile #

- It is an unfortunate human failing that a full pocketbook often groans more loudly than an empty stomach. ~Franklin Delano Roosevelt #

- The real measure of your wealth is how much you'd be worth if you lost all your money. ~Author Unknown #

- The only reason [many] American families don't own an elephant is that they have never been offered an elephant for [a dollar down]~Mad Mag. #

- I'd like to live as a poor man with lots of money. ~Pablo Picasso #

- Waste your money and you're only out of money, but waste your time and you've lost a part of your life. ~Michael Leboeuf #

- We can tell our values by looking at our checkbook stubs. ~Gloria Steinem #

- There are people who have money and people who are rich. ~Coco Chanel #

- It's good to have [things that money can buy], but…[make] sure that you haven't lost the things that money can't buy. ~George Lorimer #

- The only thing that can console one for being poor is extravagance. ~Oscar Wilde #

- Money will buy you a pretty good dog, but it won't buy the wag of his tail. ~Henry Wheeler Shaw #

- I wish I'd said it first, and I don't even know who did: The only problems that money can solve are money problems. ~Mignon McLaughlin #

- Mnemonic tricks. #

- The Wilbur and Orville Wright Papers http://su.pr/4GAc52 #

- Champagne primer: http://su.pr/1elMS9 #

- Bank of Mom and Dad starts in 15 minutes. The only thing worth watching on SoapNet. http://su.pr/29OX7y #

- @prosperousfool That's normal this time of year, all around the country. Tis the season for violence. Sad. in reply to prosperousfool #

- In the old days a man who saved money was a miser; nowadays he's a wonder. ~Author Unknown #

- Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~Norman Vincent Peale #

- RT @MattJabs: RT @fcn: What do the FTC disclosure rules mean for bloggers? And what constitutes an endorsement? – http://bit.ly/70DLkE #

- Ordinary riches can be stolen; real riches cannot. In your soul are infinitely precious things that cannot be taken from you. ~Oscar Wilde #

- Today's quotes courtesy of the Quote Garden http://su.pr/7LK8aW #

- RT: @ChristianPF: 5 Ways to Show Love to Your Kids Without Spending a Dollar http://bit.ly/6sNaPF #

- FTC tips for buying, giving, and using gift cards. http://su.pr/1Yqu0S #

- .gov insulation primer. Insulation is one of the easiest ways to save money in a house. http://su.pr/9ow4yX #

- @krystalatwork It's primarily just chat and collaborative writing. I'm waiting for someone more innovative than I to make some stellar. in reply to krystalatwork #

- What a worthless tweet that was. How to tie the perfect tie: http://su.pr/1GcTcB #

- @WellHeeledBlog is giving away 5 copies of Get Financially Naked here http://bit.ly/5kRu44 #

- RT: @BSimple: RT @arohan The 3 Most Neglected Aspects of Preparing for Retirement http://su.pr/2qj4dK #

- RT: @bargainr: Unemployment FELL… 10.2% -> 10% http://bit.ly/5iGUdf #

- RT: @moolanomy: How to Break Bad Money Habits http://bit.ly/7sNYvo (via @InvestorGuide) #

- @ChristianPF is giving away a Lifetime Membership to Dave Ramsey’s Financial Peace University! RT to enter to win… http://su.pr/2lEXIT #

- @The_Weakonomist At $1173, it's only lost 2 weeks. I'd call it popped when it drops back under $1k. in reply to The_Weakonomist #

- @mymoneyshrugged It's worse than it looks. Less than 10% of Obama's Cabinet has ever been in the private sector. http://su.pr/93hspJ in reply to mymoneyshrugged #

- RT: @ScottATaylor: 43 Things Actually Said in Job Interviews http://ff.im/-crKxp #

- @ScottATaylor I'm following you and not being followed back. 🙁 in reply to ScottATaylor #

Shattering Taboos

ta·boo

-adjective

1. proscribed by society as improper or unacceptable: taboo words.

There is a societal prohibition against talking about money, especially actual money. Talking about a deal, or the hypothetical bundle you lost on the Super Bowl is ok, but discussing how much money you make, or how much you have saved for retirement is almost as bad as talking about sex. In many social circles, it’s far worse.

Money is one of the primary causes of divorce, second only to infidelity. It can cause myriad problems, including anxiety, depression, paranoia, impotence, impulse spending, gambling, social isolation, suicide, and murder. Yet even therapists hesitate to discuss finance with their patients.

Occasionally to the chagrin of my family and friends, I’ve almost completely destroyed that taboo in myself. After spending a year and a half writing about everything I do financially, I’ve found myself with very little hesitation to talk about my finances in real life. I don’t mind discussing my credit card debt, my projections on paying off my mortgage, or almost anything else, with the exception of my salary. I’ve never seen anything good come from coworkers comparing paystubs. Somebody always gets hurt feelings.

Aside from that one exception, I think it’s healthy to talk about money. How many kids launch into adulthood financially clueless because their parents wouldn’t talk about money? How many marriages could be saved if couples would talk about their financial problems before they became financial disasters?

How can you go about breaking down the mental barrier to talking about money? Starting a personal finance blog and writing three to four times per week for a couple of years isn’t a practical solution for everyone.

Start small.

Mention the fact that you have a credit card balance(assuming you do) when you are talking to a friend. Suggest a coworker appeal his property taxes, or offer a couple of tips to help your cousin negotiate her rent.

Most importantly, start having these conversations with your spouse/significant other/life partner. If you can plan to spend the rest of your life with someone, you can certainly plan to discuss one of the most important topics in your life with her. If you can’t, are you really a good fit?

Try it. Break down that taboo. Your life will be better for it.

Are you afraid to talk about money?

A Perfectly Maid Home

Last night, I got home after a 13 hour day at the office and found a spotlessly clean house. The laundry was folded. The dishes were done, and everything was put away.

It was great.

I work 80 hours a week, 90 if you count commuting time.

That’s about 50 hours at my day job, 10-15 hours working on this site, and 20-30 hours working on my other side hustles. Some weeks, my volunteer geek skills get put to use for a local non-profit, too.

My wife works at least 40 hours every week.

We chase our kids around, plan or birthday parties, visit family, take care of the yard, and do everything else that every other family does.

The difference is that, if I take work in all of its forms out of the equation and give myself permission to get a full night’s sleep every night, I have a total of 20-30 hours per week to eat, socialize, and spend time with my family. That not a lot.

I hate cleaning.

Between my work schedule and my cleaning aversion, I’m not always a lot of help around the house.

Half of my work time is spent at home. It’s hardly fair to expect my wife to clean up after me.

This has been a huge point of contention between us. She sees me on the computer and gets frustrated when I’m not helping her clean up. I get frustrated because I’m trying to make us some extra money, but she’s complaining that I’m not cleaning.

About a month ago, we hired a housekeeper. She comes every other week for a few hours and does a phenomenal job cleaning our house. We pay her about $150 per month for the work.

It’s been great.

My wife is happy because the house is clean. I’m happy because the complaining has stopped. Our housekeeper is happy because it’s more money. It’s a win/win/win scenario.

Now, $150 is a decent amount to add to our debt snowball, but paying for the cleaning services facilitates my side hustles, which bring in quite a bit more than $150 per month, so it’s even a good idea financially.

Even if it’s not, the peace of mind of knowing that I didn’t have to fold all of the laundry that was waiting for me yesterday makes it worthwhile.

How about you? Would you consider hiring a maid? Why?

Emergency Fund Goodness, Reasons #491,207 and #491,208

When you run a big company that handles a lot of one-year renewable contracts with the government at every level from city to federal, you tend to expect that you’ll need to do some legwork on the contract renewals before they expire. Preferably, you’d do this a few weeks before they expire so the bureaucratic mess that is the federal government can process the renewal on their end.

That’s a reasonable expectation after 30 years in the industry.

If, instead, you wait until the expiration date on the contract to submit the renewal to the federal agency in question, you’ll have a department to shut down for a week due to lack of work.

Then, at the end of that week, you’ll be reminded that the wheels of the federal government grind. very. slow.

So slow, in fact, that the department in question gets to stay shut down for at least another 2 weeks.

If you haven’t been doing the math, that is a surprise, unpaid, three-week vacation for my wife.

Our emergency fund hasn’t grown to the size that can handle this, but it is enough to take the edge off for a couple of weeks. Yay!

We’d already decided that we would be skipping a vacation this year, to give us more time to deal with my mother-in-law’s estate and hoarding remnants, so the vacation fund will be tapped. That should cover the rest, assuming her job does come back.

That’s part 1.

Part 2 is the story of a cat whose butt exploded on our bed at 1AM last week.

Poo–the cat named for her coloration–has been acting funny. She’d suddenly sprint in a circle around the room, then poop on the floor. Irritating.

One night, her sprint crossed our bed, so my wife pinned her down, hoping to break the cycle.

The cat screamed, then sprayed blood from her butt all over the pillows, blankets, sheets, and my wife.

That’s called a midnight visit to the emergency vet.

See, cats have anal glands that they use to sign their work when they are marking their territory. Sometimes, these glands get infected. Sometimes, the infection gets so bad the glands kind of…explode.

On my bed.

While I’m sleeping.

Pop.

Fixing that involves sedation, an ice cream scoop, and a sewing kit. Or something. I wasn’t really pushing for details when my wife called from the vet’s office.

For those of you who’ve never had a cat’s butt explode in your bed at one in the morning (and if you have, I’m not sure I want to hear the story), the emergency vet isn’t cheap. This visit cost us $500. It probably would have been half of that if we would have waited until the regular vet opened, but…ewww.

We’ll be starting our emergency fund from about 0 in the next few weeks, but it beats going in to debt over a couple of setbacks.

How’s your emergency fund? Is it enough to carry you through any unexpected setback?

My Credit Cards

This announcement is a bit premature, but not everything that’s premature has to end in an evening of disappointment.

At the beginning of the year, I transferred the balance of my last credit card onto two different cards, each with a 0% interest rate. One card got a $4,000 transfer and the other got $13,850. The approximately $415 in fees I paid for the transfer saved me nearly $1500 in interest this year.

The card that got the big balance is the card we use for a lot of our daily spending. On my statement dated 2/18/2012, the balance on the this card was $14,865.23. At the same time, the smaller card had a balance of $3,925.09, for a total of $18,790.32. When I started my debt-murder journey in April 2009, it had peaked at just under $30,000.

When my payments clear later today, that balance will be gone.

That is nearly $19,000 paid down in 8 months.

Now, the inheritance we picked up did accelerate our repayment a bit, but only by a few months.

Starting from $90,394.70 in April 2009, we have paid down $63,746.70, leaving $26,648.00 on our mortgage.

I’m more than a little excited, which–as usual–is the cause for the prematurity.

New goal: pay off the mortgage in 2013.

Net Worth Update

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

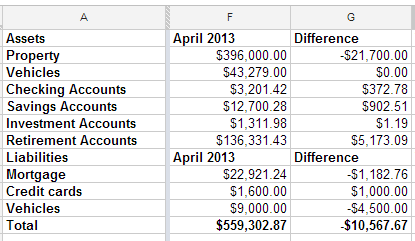

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.