- RT @Dave_Champion Obama asks DOJ to look at whether AZ immigration law is constitutional. Odd that he never did that with #Healthcare #tcot #

- RT @wilw: You know, kids, when I was your age, the internet was 80 columns wide and built entirely out of text. #

- RT @BudgetsAreSexy: RT @FinanciallyPoor "The real measure of your wealth is how much you'd be worth if you lost all your money." ~ Unknown #

- Official review of the double-down: Unimpressive. Not enough bacon and soggy breading on the chicken. #

- @FARNOOSH Try Ubertwitter. I haven't found a reason to complain. in reply to FARNOOSH #

- Personal inbox zero! #

- Work email inbox zero! #

- StepUp3D: Lame dancing flick using VomitCam instead or choreography. #

- I approve of the Nightmare remake. #Krueger #

Twitter Weekly Updates for 2010-05-22

- RT @MoneyMatters: Frugal teen buys house with 4-H winnings http://bit.ly/amVvkV #

- RT @MoneyNing: What You Need to Know About CSAs Before Joining: Getting the freshest produce available … http://bit.ly/dezbxu #

- RT @freefrombroke: Latest Money Hackers Carnival! http://bit.ly/davj5w #

- Geez. Kid just screamed like she'd been burned. She saw a woodtick. #

- "I can't sit on the couch. Ticks will come!" #

- RT @chrisguillebeau: U.S. Constitution: 4,543 words. Facebook's privacy policy: 5,830: http://nyti.ms/aphEW9 #

- RT @punchdebt: Why is it “okay” to be broke, but taboo to be rich? http://bit.ly/csJJaR #

- RT @ericabiz: New on erica.biz: How to Reach Executives at Large Corporations: Skip crappy "tech support"…read this: http://www.erica.biz/ #

The Magic Toilet

- Image by tokyofortwo via Flickr

My toilet is saving me $1200.

For a long time, my toilet ran. It was a nearly steady stream of money slipping down the drain. I knew that replacing the flapper was a quick job, but it was easy to ignore. If I wasn’t in the bathroom, I couldn’t hear it. If I was in the bathroom, I was otherwise occupied.

When I finally got sick of it, I started researching how to fix a running toilet because I had never done it before. I found the HydroRight Dual-Flush Converter. It’s the magical push-button, two-stage flusher. Yes, science fiction has taken over my bathroom. Or at least my toilet.

I bought the dual-flush converter, which replaces the flusher and the flapper. It has two buttons, which each use different amounts of water, depending on what you need it to do. I’m sure there’s a poop joke in there somewhere, but I’m pretending to have too much class to make it.

I also bought the matching fill valve. This lets you set how much water is allowed into the tank much better than just putting a brick in the tank. It’s a much faster fill and has a pressure nozzle that lies on the bottom of the tank. Every time you flush, it cleans the inside of the tank. Before I put it in, it had been at least 5 years since I had opened the tank. It was black. Two weeks later, it was white again. I wouldn’t want to eat off of it, or drink the water, but it was a definite improvement.

Installation would have been easier if the calcium buildup hadn’t welded the flush handle to the tank. That’s what reciprocating saws are for, though. That, and scaring my wife with the idea of replacing the toilet. Once the handle was off, it took 15 minutes to install.

“Wow”, you say? “Where’s the $1200”, you say? We’ve had this setup, which cost $35.42, since June 8th, 2010. It’s now September. That’s summer. We’ve watered both the lawn and the garden and our quarterly water bill has gone down $30, almost paying for the poo-gadget already. $30 X 4 = $120 per year, or $1200 over 10 years.

Yes, it will take a decade, but my toilet is saving me $1200.

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

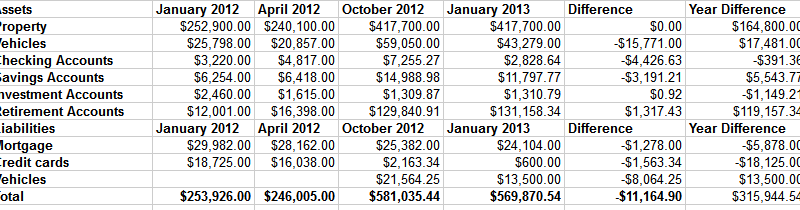

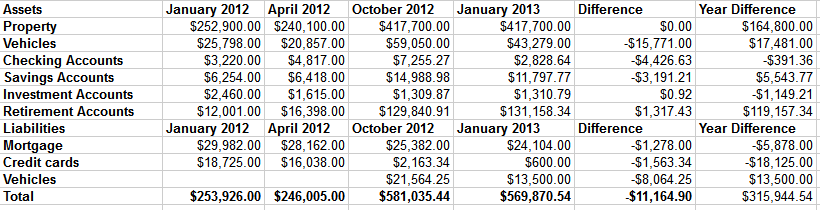

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

Late Pass: Insurance for the Terminally Ill?

This is a guest post.

Uh oh. Not only have you put in decades of loyal service for a company that does not offer a life insurance policy to employees, now you have a terminal disease that has numbered your days. You always meant to get a life insurance policy at some point, but it was just one of those things that there was never enough money left for at the end of a month after bills, groceries and just enough fun to make worthwhile.

Your life is one that needs insuring to protect your family following the now-inevitable, but has that ship sailed? Is it possible to make up for lost time by obtaining a life insurance policy as a terminally ill patient?

You already know that insurance companies are experts at assessing risk. Each potential policy holder is effectively examined to determine their likelihood of living a reasonably long time, and a terminal illness is an obvious negative in this department.

Many insurance companies will be hesitant to offer a comprehensive policy that they know they will have to pay out in fairly short order, but you may be able to get a type of life insurance known as graded premium life insurance.

With graded premium life insurance, you pay a monthly premium to retain coverage. If your illness should terminate within two years, your family will receive all the premiums you have paid as a benefit. Should you last longer, the insurance provider pays the full value of the policy. This is a compromise that gives you the peace of mind that a life insurance policy can provide while allowing the insurance provider to minimize their risk.

These policies typically have cash values ranging from $10,000 to $50,000, so while they might not guarantee the permanent stability of your family, it will offer them much-needed assistance through what is sure to be a difficult time in their lives. Premium amounts vary by age and relative health, but generally the closer you are to qualifying for a payout, the more it costs to enter the lottery.

Life is unpredictable except for its certain end, and sometimes this reality leaves us less prepared for the future as we would like. Fortunately, a terminal illness does not make a person completely uninsurable in most cases. Of course, it is much easier and less expensive to get life insurance as a person who is not dying, so the best strategy may be to invest before your health becomes an issue.