Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

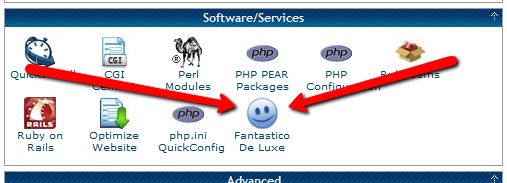

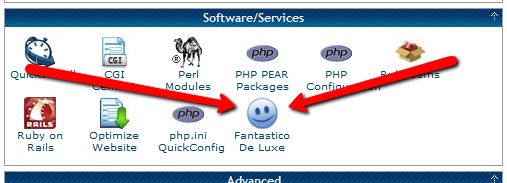

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

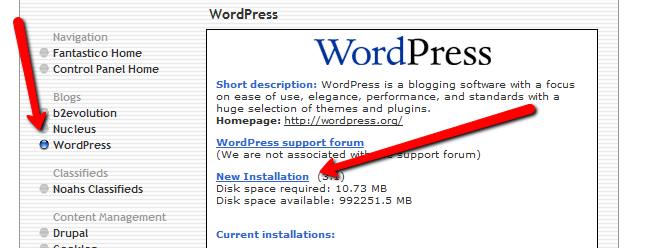

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

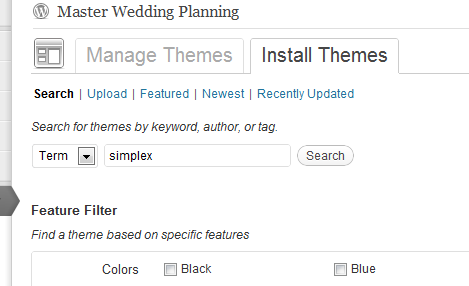

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

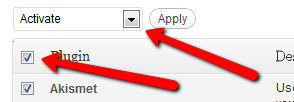

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

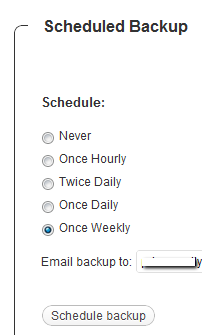

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

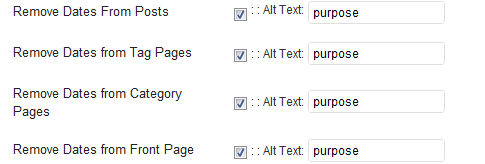

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

Today, I am continuing the detailed examination of my budget. Please see part one to catch up.

This time, I’m going to look at my monthly bills. These are predictable and recurring expenses, though not all of them are entirely out-going.

Let’s dig in: [Read more…] about Budget Lesson, Part 2

budget” width=”300″ height=”185″ />

budget” width=”300″ height=”185″ />Over the next few weeks, I will be going over my budget in detail.

The first section is income, but that’s straightforward. A line for each income source, bi-weekly, monthly and annual totals. Simple.

Before we start, a word on the organization. There are five columns:

The first section I am actually going to address is discretionary spending.

Initially, we used a “virtual envelope” system. We had a spreadsheet and every time something was spent in this category, we entered the amount and stopped when the category was spent. Didn’t work. We are going on a pure, cash-only system as of the first of the year. No money, no spendy.

I keep calling these lessons, but they are examples and explanations, more than lessons. Names aside, please see Part 1 and Part 2 to catch up. The Google Doc of this example is here.

This time, I’m going to review my non-monthly bills. These are the bills that have to be paid, but not on a monthly basis. Some are annual, others are quarterly, or even weekly. Every month, the amount–adjusted to the monthly equivalent–is set aside in Quicken.

There aren’t too many items here that can be legitimately and responsibly trimmed.

When you realize that you’ve buried yourself in debt and decide to get out from under that terrible burden, the first thing you’ve got to do is build a budget because, without that, you’ve got no way to know how much money you have or need. After you’ve got a budget, you’ll start spending according to whatever it says. Hopefully, you’ll stay on budget, but what happens when an emergency does come up? What do you do when your car dies? When you suddenly find out your kids needs vision therapy? How do you manage when your job suddenly gets shipped off to East De Moines?

Your budget isn’t going to help you meet those expenses. Most people don’t have enough money in their bank account to make it all the way to the next payday, let alone enough to keep the lights on and food on the table. How can you possibly hope to deal with even the little things that come up?

You whip out your emergency fund.

The problem with a budget is that it does a poor job of accounting for the unexpected. That’s where an emergency fund comes in. An emergency fund is money that you have set aside in an available-but-not-too-accessible account. Its sole purpose is to give you a line of defense when life rears up and kicks you in the butt. Without an emergency fund, everything that comes unexpectedly is automatically an emergency. With an emergency fund, the things that come up are merely minor setbacks. Without an emergency fund, your budget is nothing but a good intention waiting to get shattered by the next thing that comes along. With an emergency fund, you are managing money. Without it, it’s managing you.

Every “expert” has their own opinion on this. Dave Ramsey recommends $1000 to start. Suze Orman says 8 months. The average time spent looking for work after losing your job is 24.5 weeks(roughly 6 months), so I recommend 7 months of expenses. That’s enough to carry you through an average bout of unemployment and a little more, but that’s not a goal for your first steps toward financial perfection. To start with, get $1000 in a savings account. That’s enough to manage most run-of-the-mill emergencies, without unduly delaying the rest of your debt repayment and savings goals.

Let’s not kid ourselves, $1000 is a lot of money when can barely make it from one check to the next. Unfortunately, this vital first step can’t get ignored. If you really work at it, you should be able to come up with $1000 in a month or so. Here are some ideas on how to manage that:

Dave Ramsey’s advice is to get your fund up to $1000 and then leave it alone until your debt is paid off. Screw that. I’ve got money going into my fund every month. It’s only $25 per month, but over the last two years, it has almost doubled my fund. Don’t dedicate so much money that you can’t meet your other goals, but don’t be afraid to keep some money flowing in .

When can you pull the money out? That is entirely up to you. I have ju st two points to make about withdrawing from your emergency fund:

An emergency fund makes your life easier and your budget possible when the unexpectable happens. Don’t forget to fund yours.

How much money do you keep in your emergency fund? What would it take to get you to spend it?