What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Everyone needs an emergency fund. More than that, you will eventually need retirement savings, a new car, a big-screen TV, or maybe just a new kidney. Whatever the reason, one day, have a comfortable savings account will make your life easier.

But, Jason, you say, it’s hard to save money! How can I start saving when I can’t make ends meet? I’ve got rent, 9 kids, and a DVD addiction that won’t quit. My mortgage is underwater, my Mercedes still has 8 years on the loan, and the Shoe-of-the-Month Club only carries Christian Louboutin’s. What can I do?

Well, I’ll reply, since I am Jason and you asked for me by name, you need to find a way to make it happen. I’d never recommend someone give up their diamond-studded kicks, but something’s gotta give. In the meantime, there are some ways you can save money without feeling the sting of delayed gratification.

1. Save your raise. When you get your next raise, pretend you didn’t. Set up an automatic transfer to stick that new 5% straight into a savings account. Don’t give yourself an opportunity to spend it.

2. Find it, hide it. When your Aunt Gertrude dies and leaves your her extensive collection of California Raisins figurines, sell them and save the money. If you find a $20 bill on the ground, throw it right into your savings account. When your 30th lottery ticket of the week gives you a $10 prize, save it! Don’t waste found money on luxuries. Use it to build your future.

3. Let it lapse. Do you have magazine subscriptions you never read? Or a gym membership you haven’t used since last winter? Panty-of-the-Month? Crack dealer who delivers? Stop paying them! Let those wasted services fall to the wayside and put the money to better use. I don’t mean flipping QVC products on eBay, either. Save the money.

4. Jar of 1s. Roughly once a week, I dig through my pockets and my money clip looking for one dollar bills. Any that I find go in a box to be forgotten. I use that box as walking-around money for our annual vacation, but it could easily get repurposed as a temporary holding tank for money I haven’t gotten to the bank, yet.

5. Round it up. Do you balance your checkbook? If you don’t, start. If you do, start doing it wrong. Round up all of your entries to the nearest dollar. $1.10 gets recorded as $2. $25.75 goes in as $26. If you use your checkbook or debit card 100 times a month, that’s going to be close to $75 saved with absolutely no effort. It even makes recording your spending easier.

There you have it, 5 easy ways to save money that won’t cause you a moment’s pain.

Do you have any tricks to help you save money?

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 6, we’re going to talk about cutting your expenses.

Once you free up some income, you’ll get a lot of leeway in how you’re able to spend your money, but also important–possibly more important–is to cut out the crap you just don’t need. Eliminate the expenses that aren’t providing any value in your life. What you need to do is take a look at every individual piece of your budget, every line item, every expense you have and see what you can cut. Some of it, you really don’t need. Do you need a paid subscription to AmishDatingConnect.com?

If you need to keep an expense, you can just try to lower it. For example, cable companies regularly have promotions for new customers that will lower the cost to $19 a month for high-speed internet. Now, if you call up the cable company and ask for the retention department, tell them you are going to switch to a dish. Ask, “What are you willing to do to keep my business?” There is an incredibly good chance that they will offer you the same deal–$20 a month–for the next three or four months. Poof, you save money. You can call every bill you’ve got to ask them how you can save money.

I called my electric company and my gas company to get on their budget plans. This doesn’t actually save me money but it does provide me with a consistent budget all year long, so instead of getting a $300 gas bill in the depths of January’s hellish cold, I pay $60 a month. It is averaged out over the course of the year. It feels like less and it lets me get a stable budget. Other bills are similar. You can call your credit card companies and tell them everything you take your business to another card that gave you an offer of 5% under what ever you are currently paying. It doesn’t even have to be a real offer. Just call them up and say you are going to transfer your balance away unless they can meet or beat the new interest rate. If you’ve been making on-time payments for any length of time–even six months or a year–they’re going to lower the interest rate business, no problem. Start out by asking for at least a 5% drop. In fact, demand no more than 9.9%.

Once you’ve gone through every single one of your bills, you’ll be surprised by how much money you’re no longer paying, whether it’s because somebody lowered the bill for you or you scratched it off the list completely.

As the President is so quick to point out, ten years ago, there was a large budget surplus. Naturally, the government went into a massive cycle of lifestyle expansion. That expansion, combined with lower tax revenue and a recession has brought us from a $230 billion surplus to a $1.4 trillion deficit. That’s a bit above the trivial level. A definite binge.

In Minnesota, there was a $2 billion surplus just a few years ago, which was obliterated by, once again, government expansion and a recession. During the boom years, government programs were enacted with no thought to sustainability. Nobody thought about the fact that a surplus isn’t a balanced budget, either. We just kept adding to the budget, thinking the good times would last forever. Another binge.

Last year, the governor of Minnesota had to “unallot” money from the budget. He went through the budget with a red pen and struck line items until the budget was balanced, a requirement in this state. This infuriated his political opposition. They were not prepared for the purge.

Federally, the purge hasn’t happened, yet. Give it time. Excessive spending using imaginary money can only last so long. It will stop. The longer the binge, the harder the purge.

Families are doing the same thing. Four years ago, I got a raise and immediately bought a new car. Binge. Two months later, I was laid off and had to cut everything possible to make ends meet. Purge. Tax refunds, inheritances, drawings. So many of these things give us an excuse to commit to long-term expenses without planning for long term sustainability. If I inherit $5000, is that a good time to add $500 to my monthly bills? No! That’s an unhealthy binge. In ten months, if the money lasts even that long, I will be forced to purge something to keep afloat.

The responsible, healthy way is the same as healthy, responsible eating. Diet and exercise. Spend less, save and earn more. That’s the strategy that will let you level out life’s valleys, instead of puking all over the floor. Don’t spend every cent you see, just because it is there. Set some aside for a rainy day.

Leave the binge-and-purge financing to the politicians.

Update: This post has been included in the Festival of Frugality.

As we leave flooding season here in Minnesota, it’s important to remember that there are low-lifes who don’t mind preying on people when they are at their weakest and most vulnerable. That’s true in many situations, but the one I’m talking about specifically is the post-disaster scam.

The most prevalent is probably the home-repair con. If you have damage to your home from a disaster, be prepared to have people knocking on your door offering to fix your house. We had a nasty hail storm a couple of years ago and were plagued with contractors for months. Most of these were not con-men, but it is a safe bet that some were. There are two basic home-repair cons after a disaster.

The first is to over-promise and under-deliver. These people may just be inexperienced, but if someone claims to be able to replace your roof, your siding, and your deck for half of what anyone else is offering, run. The solution is to get multiple quotes and to check licenses and references. Then, get a written estimate. No reputable company will complain about any of that. If it feels to good to be true, it probably is.

The second common home-repair scam is to take your money and run. Most big contracting companies want to deal with your insurance company directly. That’s because they know they can pad the labor costs and add a mark-up to materials. Some just want to get the insurance money and run. Either way, I insist on dealing with the insurance company myself, so I can pay the contractor when the work is finished to my satisfaction.

Another common scam is the advance-fee loan con. This is perpetrated by scum preying on those people unfortunate, unlucky, or unwise enough to not have insurance to cover disaster damage. They will promise below-market interest rates, fast closing, and no credit check. All you have to do is give them a large down payment to seal the deal and they will “guarantee” the loan. In my world, guarantee does not refer to the art of leaving the state with someone else’s money, but that’s how this scam ends. Once again, don’t fall for “dream deals”. Never give money to a company you haven’t verified is legitimate and never(ever, ever, ever) give money or personal information to a stranger over the phone. If you didn’t initiate the contact and verify the company, don’t do business with them.

The third major con attacks the generous nature of most people when faced with another’s hardship. The charity con. Donating money to help people in need is an honorably act. Please make sure that you are donating to an actual charity, not a scam artist with a credit-card machine. If you didn’t initiate the contact, hang up and verify the charity is legitimate, then call back and donate money on your own. You can verify a charity’s status by contacting your state government, usually the Attorney General’s office.

As always, you are in charge of your safety and security, both financial and otherwise. Don’t let yourself be scammed.

In this installment of the Make Extra Money series, I’m going to show you how I do keyword research.

Properly done–unless you get lucky–this is the single most time-consuming part of making a niche site. If you aren’t targeting search terms that people use, you are wasting your time. If you are targeting terms that everybody else is targeting, it will take forever to get to the top of the search results.

Spend the extra time now to do proper keyword research. It will save you a ton of time and hassle later. This is time well-spent.

If you remember from the last installment, when we researched products to promote, we narrowed our choices down to a few products.

What I’ve done is create a spreadsheet to score the products. You can see the spreadsheet here. I’ll explain the columns as we populate them.

The first column contains the name of the product. Easy. We’ve got 10 products. I’m going to walk through scoring 1 product, then, through the magic of the internet, I’ll populate the rest, and you’ll get to see the results instantly. Wow.

The second column is the global search volume for the exact search term. I base my product niche sites primarily on the demand for a given product. Everything else is a secondary consideration.

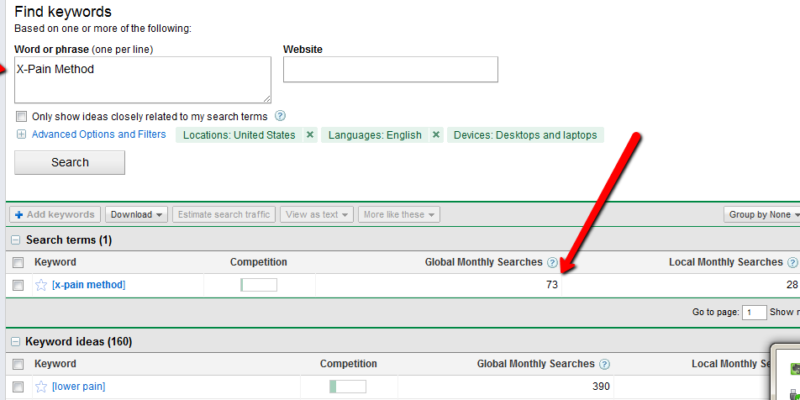

To find the demand for a product, go to the Google Adwords Keyword Tool. In the “word or phrase” box, enter your product name, exactly. In this case, it’s “X-Pain Method”. When the search results come up, change the match type to “Exact”. You should have something like this:

Enter the global search volume in column 2. In this case, it’s 73. Keep this window open, because we’ll be coming back to it.

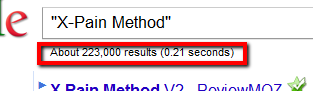

Column 3 is the search competition. Go to google and enter your product name, in quotes. In this case, “X-Pain Method”. Put the total number of search results in column 3: 223000.

Column 4 is the search competition, but only what appears in a page’s title. Your search query is intitle:”X-Pain Method”, which yields 4400 results.

The next column is for the average PageRank of the first page of search results. For this, I use Traffic Travis. I use the 4th edition, which is paid software, but you can get the free version of version 3, instead. I’ll use version 3 for this example. Open the software and click on “SEO Analysis” on the bottom left of the screen. Put your search term (“X-Pain Method”) in the “phrase to analyze” and set the “Analyze Top” to 10, then hit “Analyze”. When it’s done running, just add up all of the PRs and divide by 10. Ignore Travis’s difficulty rating.

Now, for the rest of the columns, we’re going to look at the keyword tool again. We’re going to pick 3 alternate search terms. Here are the criteria:

Once we pick the keywords, we’ll throw them into google to get the competition, just like we did to populate column 2.

“Exercises for back pain” has medium competition and 1900 monthly searches. It also has an estimated cost-per-click of $3.02, which means people are paying for this.

“Lower back pain exercises” has 6600 searches and medium competition. It’s actually on the lower end of medium, so it looks really promising.

“Lower back” has 4400 searches and low competition, with a CPC of $6.24. This should be a good one. Scratch that. It has 40 million search results, but only 4400 searches. That’s a lot of competition for a small market.

Instead, I’m going to search for “cure back pain” in the keyword tool and see what I get. “Upper back pain” is better. Low competition, 18000 searches each month, and only 2000000 competing search results. Now, I’ll score it.

You really want at least 500 searches per month for the product name. More than 2500 is better. I’m going to assign 1 point per 500 monthly searches.

You also want a lower number of search results. Less than 10,000 is ideal. Less than 100,000 is still decent. More than 250,000, I’d walk. So, under 10,000 gets 5 points. Under 50,001 gets 4. Under 100,001 gets 3. Under 200,001 gets 2. Under 250,001 gets 1. Any higher gets 0.

The ideal intitle search will have less than 2000 results. More than 100,000 is too time-consuming to deal with. 0-2000: 5 points; 2001-10,000: 4 points; 10001-25000: 3 points; 25001-50000: 2 points; 50001 to 100000: 1 point.

The perfect product will have the first page of search result all with a PageRank of 0. That’s a 5 point product. I’ll knock off half a point for every point of average PR.

The related terms are more relaxed. They are what’s known as “Latent Semantic Indexing” (LSI) terms. We will be creating articles to match those search terms, mostly to make our niche site look as natural and real as possible. Any actual traffic those pages drive is just gravy. Points for the related searches start at 10 and get 1 point knocked off for each 3 million results. We’ll be treating the 3 terms as one for this score.

That gives us a perfect score of about 25. There’s no actual upper limit, since the score for the search volume has no upper limit. X-Pain Method scored 18.22.

Now, excuse me a moment while I score the rest.

I’m back. Did you miss me?

I’ve finished scoring each of the products and sorted the results by score. The clear winner is the back pain product, but the lack of searches bothers me. The wedding guide looks much nicer, especially if I target the phrase “wedding planning guide” during the SEO phase of the project. That change alone brings the score almost to first place.

Frankly, I’d take either 2nd or 3rd place over the back pain product. The bare numbers don’t support it, but my judgement tells me they are better products to promote.

There is one final step before deciding on the product. I have to buy it. I can’t review the product without seeing it and I can’t promote it without approving of it.

That’s the secret to ethical niche marketing, you know. Only promote good products that you’ve personally read, watched, or used.