- RT @mymoneyshrugged: The government breaks your leg, and hands you a crutch saying "see without me, you couldn't walk." #

- @bargainr What weeks do you need a FoF host for? in reply to bargainr #

- Awesome tagline: The coolest you'll look pooping your pants. Yay, @Huggies! #

- A textbook is not the real world. Not all business management professors understand marketing. #

- RT @thegoodhuman: Walden on work "spending best part of one's life earning money in order to enjoy (cont) http://tl.gd/2gugo6 #

New Year Goals

I’m not a fan of New Year’s Resolutions. They are generally drunken promises made on December 31st that are broken by the middle of January, if they are remembered at all. I don’t make resolutions.

My goal for 2010 is to complete one major self-improvement project each month. That’s an entire year of 30-day projects. As each month goes on, I will be updating this blog with the status of each project. Some of the projects will be physical, some will be mental, some will be improvements on my relationships. My goal is to do something meaningful, useful and challenging each month.

Here’s my list:

- January: Wake up at 5am AND read to my kids every night before bed.

- February: Do 100 push-ups at one time by the end of the month. There is also a secret project this month. I’ll be keeping notes and posting in March.

- March: Do 100 sit-ups at one time by the end of the month.

- April: Spring Cleaning. I will declutter every room in my house this month.

- May: Have a sit-down dinner with my family, at the dining room table at least 3 times per week.

- June: No computer use, while anyone else in the family is awake, except for household necessities, such as bills.

- July: Write fiction every day.

- August: Buy nothing new this month.

- September: Attempt to learn a new language. http://ijaar.com/29-free-websites-to-learn-a-new-language/

- October: No yelling at the kids.

- November: No complaining. Not at home, not at work.

- December: I will have done 14 projects this year. December is a month off.

Regret

There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

The Luxury of Vacation

This was a guest post I wrote last year to answer the question posed by the Yakezie blog swap, “Name a time you splurged and were glad you did.”

There are so many things that I’ve wanted to spend my money on, and quite a few that I have. Just this week, we went a little nuts when we found out that the owner of the game store near us was retiring and had his entire stock 40% off. Another time, we splurged long-term and bought smartphones, more than doubling our monthly cell phone bill.

This isn’t about those extravagances. This is about a time I splurged and was glad I did. Sure, I enjoy using my cell phone and I will definitely get a lot of use out of our new games, but they aren’t enough to make me really happy.

The splurge that makes me happiest is the vacation we took last year.

Vacations are clearly a luxury. Nonessential. Unnecessary. A splurge.

When we were just a year into our debt repayment, we realized that, not only is debt burnout a problem, but our kids’ childhoods weren’t conveniently pausing themselves while we cut every possible extra expense to get out of debt. No matter how we begged, they insisted on continuing to grow.

Nothing we will do will ever bring back their childhoods once they grow up or—more importantly—their childhood memories. They’ll only be children for eighteen years. That sounds like a long time, but that time flies by so quickly.

We decided it was necessary to reduce our debt repayment and start saving for family vacations.

Last summer, we spent a week in a city a few hours away. This was a week with no internet access, no playdates, no work, and no chores. We hit a number of museums, which went surprisingly well for our small children. Our kids got to climb high over a waterfall and hike miles through the forest. We spent time every day teaching them to swim and play games. Six months later, my two year old still talks about the scenic train ride and my eleven year old still plays poker with us.

We spent a week together, with no distractions and nothing to do but enjoy each other’s company. And we did. The week cost us several extra months of remaining in debt, but it was worth every cent. Memories like we made can’t be bought or faked and can, in fact, be treasured forever.

Delayed Gratification, Take II

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.

Net Worth, April 2016

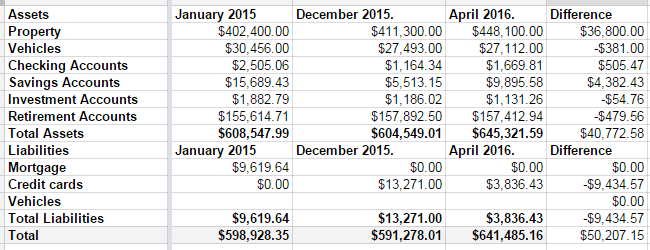

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.