Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

No one likes to think about the possibility of dying too young. But knowing that potential exists, you take the smart step of protecting those you love by carrying term life insurance. But what about preventing the worst? Did you know your iPhone or Android device can call for help or record vital information if you ever find yourself in a life-threatening situation? Here are five personal safety apps that could save your life.

1) myGuardianAngel

Once this app allows you to reach all of your emergency contacts with the push of one button. You enter the contact information for anyone you would want to get in touch with if you were in any sort of emergency as soon as you download it. If you are in an emergency, the app will call your contacts, send them an e-mail with your GPS location and immediately begin recording audio and video from your phone.

2) StaySafe

This app is good for anyone who works or travels alone. You can schedule the app to automatically notify friends or family after a certain period of time when your phone is inactive. For example, you can estimate how long you expect to drive from one location to another on your own and then the phone will contact someone automatically if you are out of contact longer than expected. That way your friends will know to send help because something is wrong, even if you aren’t in a position to contact them yourself. StaySafe sends your contacts a detailed GPS location for you so that they can easily find you and bring help.

3) RESCUE

This full-service app can help you on the scene as well as notify your emergency contacts for you. If you are in trouble, you can trigger the app to sound a loud alarm that might frighten off anyone who might be planning to do you harm. The alarm can also help someone find you if you are lost or unable to move from your current location. When the alarm is triggered, the app will also send immediate notifications to your emergency contact list so that they can begin to send help right away. Emergency services such as the police and fire department can also be set for notification through the RESCUE app.

4) Night Recorder

This is a good app to have when you need to make a quick recording of your surroundings for any reason. The app can be set to begin recording at a touch. If you are stranded, you could create a recording by speaking about the landmarks you can see and explaining how you got to your current location. The recorder can then send an email of your recording to anyone on your contact list.

5) iWitness

With this app, you can instantly make video or audio recordings of your situation so that there is a permanent first-hand record of everything that happens. It is a handy tool for anyone who has been in a car accident or involved in a medical emergency because you can go back and look at the video to see exactly what happened if there is any question about it later. The app will also contact emergency services or your personal emergency contacts if you are in trouble. The built-in GPS locator will transmit your exact location so that people can find you quickly and easily.

Post by Term Life Insurance News

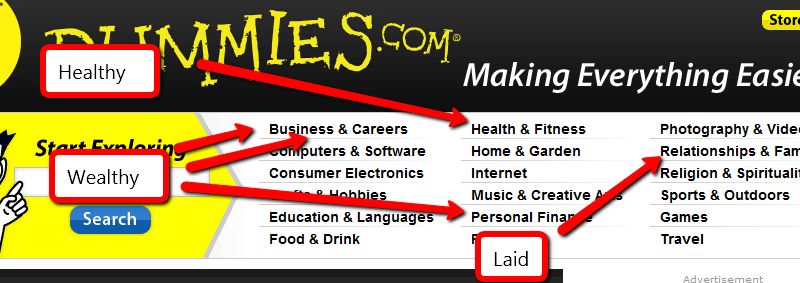

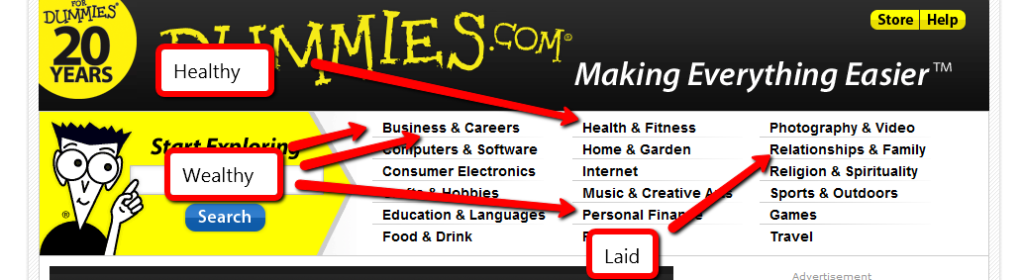

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Welcome to the Best of Money Carnival #87, the Gold Rush Edition.

On January 24th, 1848, gold was discovered in Coloma, California by construction overseer James W. Marshall. The following year, one hundred thousand people moved to California to either strike it rich, or profit from those who were trying to strike it rich. The gold rush began 163 years ago today.

10. N.W. Journey presents Business use of Home Deduction posted at Networth Journey and says, “How to deduct your business home expenses.”

Some people recommend stockpiling gold so you’ll have something of value to spend after society as we know it collapses. Does anyone know how to make change from a gold bar for a loaf of bread?

9. Darwin presents Present Value of Money Explained – MBA Monday posted at Darwin’s Money and says, “One of the most important financial concepts is also one of the most misunderstood. Make sure you understand the Present value of Money – with these real life examples. It will save you thousands!”

In 1854, a 195 pound gold nugget was found at Carson Hill in California. It was valued at $43,534. That would be worth $3,160,357.20 today.

8. RJ Weiss presents What Your Optimal Income? posted at Gen Y Wealth and says, “An exercise to find your optimal income level.”

Q: Which weighs more: a pound of feathers, or a pound of gold? A: A pound of feathers. Gold is weighed using Troy Weight, which only has 12 ounces per pound.

7. BWL presents How To Select A Financial Advisor posted at Christian Personal Finance and says, “Find out how to select the best financial adviser for you.”

Until the onset of modern electronics, which use gold because it doesn’t corrode or tarnish, gold had no practical value of its own. Its entire value resided in the fact that it was pretty and relatively scarce.

6. Miss T presents 10 Ways to $ave Energy Comfortably | Prairie EcoThrifter.com posted at Prairie Eco-Thrifter and says, “How great is it to save money and the planet at the same time?!”

Q: Which weighs more: a ounce of feathers, or a ounce of gold? A: A ounce of gold. Troy Weight has fewer ounces that avoirdupois, but each ounce weighs more. There are 31.1 grams in a Troy ounce, but only 28.4 grams in a standard ounce.

5. Craig Ford presents Employers Look at Credit Reports | Ludicrous or Smart Business? posted at Money Help For Christians and says, “Should employers be able to see your credit report?”

Outside of collectible or government-issued coins, gold is priced according to it’s spot price, which fluctuates constantly. Dealers will generally pay a percentage under spot when buying gold, then sell for a percentage over spot. Always know the spot price of gold before you agree to buy or sell any.

4. MoneyNing presents Tax Time: Do I Have to Report that Income? posted at Money Ning and says, “Did you receive any income last year? Do you really have to report everything?”

Gold is the 58th most rare natural element, out of 92.

3. Silicon Valley Blogger presents I Just Lost My Job! How I’m Downsizing My Household Expenses posted at The Digerati Life and says, “I share my story of job loss and what ideas I have for paring down my expenses in order to cope with this loss of income. In the meantime, I’m doing what I can to find a new job!”

Only 20% of the gold from the Gold Rush deposits has been reclaimed. The rest is still out there.

2. The Financial Blogger presents 5 Reasons Why You Need A Partner In Your Business posted at The Financial Blogger and says, “A post outlining the benefits of a business partner.”

As of the end of 2009, more than 160,000 tons of gold have been mined, most of which was done in the latter half of the 20th century.

And the winner is…

1. Amanda L Grossman presents Frugal Lessons from People Who Survived the Great Depression posted at Frugal Confessions – Frugal Living and says, “Have you ever met someone who was alive during the Great Depression? They are changed people. The Great Depression left a great impression on their thoughts, their styles, and their habits. I am fascinated by this time period, and researched the question of what frugal habits these people developed to survive.”

I’d like to thank everyone who participated. Next week’s host is PT Money, so don’t forget to submit your entry!

Welcome to the Totally Money Carnival #5, the Superbowl Edition. It’s my privilege to be the first outside host for this carnival.

I don’t watch the Superbowl. I’ve never been into spectator sports unless I have some skin in the game. If I’m playing, or have some money riding on the outcome, I’m watching. Other than that, I’ll usually pass. Yesterday, a bunch of grown men in tights earning envy-inducing amounts of money ran around for a few hours in front of people, some of whom paid 5 figures for the privilege of watching. Yay!

http://www.youtube.com/watch?v=hpjaOUjUPUc

Mike Piper presents Protecting Your Private Files posted at Oblivious Investor, “How can you keep your sensitive documents (scanned tax returns, for instance) both backed up and protected in the event of computer theft?” Ed. I love this solution, and I use it. All of my tax returns, online receipts, and documents I don’t want to lose get treated this way.

Suzanne K. presents The Psychology of Why You Can’t Budget—And Five Tips to Help You Do It posted at PsychologyDegree.net. Ed. I’ve always been a fan of trying to understand what makes people tick.

Silicon Valley Blogger presents Prepare Your Tax Return: Tax Products vs Tax Pros posted at The Digerati Life, saying “If you don’t enjoy preparing your taxes, you’re not alone. There are various ways to get your tax returns done. How do you go about preparing your taxes: DIY or with the help of a pro?” Ed. Tax time sucks. If we abolished payroll deductions and made everybody in the country write a check to the IRS every year, there would be a revolt on the next April 15th.

Kevin McKee presents How To Know if Your Job is Expendable posted at Thousandaire, saying “When businesses start doing poorly, some people are at risk of losing their job, while others are safe. Find out which category you fall in with these simple questions.” Ed: I was given a demonstration that defines expendability in the workplace. Fill a glass with water and place it on the counter in front of you. Stick your finger in the glass. Now, pull it out. See the impression you’ve made? I’ve done the rockstar bit, and I’ve been in positions that were necessary for the profitability of larger divisions of large companies. It doesn’t matter. Corporate loyalty is a joke.

35% of people who attend the game write it off as a corporate expense. (source)

Miss T presents 5 Ways to Lower Your Monthly Bills | Prairie EcoThrifter.com posted at Prairie Eco-Thrifter, saying “Believe it or not, there are lots of ways to save money, no matter how much of it you have- or don’t have.”

http://www.youtube.com/watch?v=jRYLhkOV2so

Tim Chen presents Pentagon Federal Offers Best Gas & Airfare Credit Card Rewards, Period. posted at NerdWallet Blog – Credit Card Watch, saying “There is only one credit card in America that offers no strings attached 5% cash back at any gas stations (excluding the likes of Costco) – the Pentagon Federal Platinum CashBack. It also gets you 2% back at grocery stores.”

Miranda presents Accelerate Your Credit Card Debt Pay Down posted at CreditScore.net, saying “Use these techniques to pay down your credit card debt faster.”

Buck Inspire presents Moving Up and On From Prepaid Debit Cards posted at Buck Inspire.

Ryan Hudson presents How I Got a Credit Card Late Fee Waived posted at Best Credit Cards IQ, saying “Don’t take accidental late fees laying down. Do something about it. Here’s how I got rid of my late fee.”

No network footage exists of Super Bowl I. It was taped over, supposedly for a soap opera.(source)

John presents Get Out of Debt Fast – How to Speed Up the Process posted at Passive Family Income, saying “There are quite a few people today that are beginning to dig their way out of debt. They have monitored their spending, created a budget, and have done the best that they can to stick with it. But, as many of you have experienced, the excitement of becoming debt-free gets pretty old after a while.”

http://www.youtube.com/watch?v=VRDx18GYITw

Mike Collins presents Defined Benefit vs Defined Contribution posted at Saving Money Today, saying “Understanding the different types of retirement plans.”

Boomer presents 10 Ways For Women To Obtain Financial Empowerment posted at Boomer & Echo, “It’s not that difficult to get your financial life under control (your control). Remember, a man is not a financial plan.”

The Super Bowl is measured in Roman numerals because a football season runs the span over two calendar years. This year the season began in 2010 and ends in 2011. (source)

Madison DuPaix presents Substitute, Improvise, and Make Do With What You Have posted at My Dollar Plan, saying “So often, when we run out of things we need, we run to buy something or spend money when we don’t have to. Find out how you can avoid this trap.”

Money Beagle presents The Power Of The Free Calendar posted at Money Beagle.

Amanda L Grossman presents Homemade Diversion Safes: Save Money by Making Your Own posted at Frugal Confessions – Frugal Living, saying “You can purchase your own home security money safes (diversion safes), but I thought it would be more frugal and fun to think of ones to make on your own. See what I can do with a used deodorant!”

http://www.youtube.com/watch?v=KQkK1UCH1EU

MoneyNing presents What Would You Do with a Million Dollars? posted at Money Ning, saying “I know what I would do with a million dollars. How about you?”

More drivers are involved in alcohol-related accidents on Super Bowl Sunday than any other day of the year (except St. Patrick’s Day), according to the Insurance Information Institute. (source)

Joe Morgan presents Is Gen Y Irresponsible, Or Is It A Matter Of Perspective? posted at Simple Debt-Free Finance, saying “Generation Y has a reputation for having a sense of entitlement, but here’s one reason it may just be a matter or perspective.”

http://www.youtube.com/watch?v=_78ylMLa0JQ

Ryan @ MFN presents Roth IRA Qualifications posted at The Military Wallet, saying “Are you qualified to open a Roth IRA? Find out income and contribution requirements to see if you are eligible!”

Brian @ BeBetterNow presents Money’s Golden Rule: Spend Less Than You Earn posted at Be Better Now, “In the end, most personal finance advice boils down to spending less than you earn. Here’s another article to reinforce that.”

http://www.youtube.com/watch?v=g364TG_8Qmw

Barb Friedberg presents Wealth in Life: 25 Cheap Ideas for Fun posted at Barbara Friedberg Personal Finance, “Join in to build a massive list of low cost fun!”

http://www.youtube.com/watch?v=R55e-uHQna0

PT presents Tax on Unemployment Compensation posted at PT Money, saying “A detailed look at what taxes are due on your unemployment compensation.”

Ken presents Important Tax Update for 2010 You Don’t Want To Miss posted at Spruce Up Your Finances, saying “A few of the tax provisions applicable to tax year 2010 such as the extension of tax filing date, expanded tax benefits, phase out on some limitations, etc.”

Fanny presents Top 10 Tax Deductions for Parents posted at Living Richly on a Budget, “Being a parent is one of the most important roles in life. Why not take advantage of all the deductions you qualify for?”

Thank you all for participating! Next week’s host is Saving Money Today, so be sure to submit your posts.

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?