What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

I’ve spend the last 10 days at home with my two youngest kids. It’s been a lot of fun. It’s amazing watching them interact with each other and seeing how their imaginations works. It’s also been a helpful reminder that, if I don’t turn on the TV, they will happily find something else to do.

This month, I am trying to establish the Slow Carb Diet as a habit. At the end of the month, I’ll see what the results were and decide if it’s worth continuing. For those who don’t know, the Slow Carb Diet involves cutting out potatoes, rice, flour, sugar, and dairy in all their forms. My meals consist of 40% proteins, 30% vegetables, and 30% legumes(beans or lentils). There is no calorie counting, just some specific rules, accompanied by a timed supplement regimen and some timed exercises to manipulate my metabolism. The supplements are NOT effedrin-based diet pills, or, in fact, uppers of any kind. There is also a weekly cheat day, to cut the impulse to cheat and to avoid letting my body go into famine mode.

I’m measuring two metrics, my weight and the total inches of my belly, waist, biceps, and thighs. Between the two, I should have an accurate assessment of my progress.

Weight: I have lost 11 pounds since January 2nd. This is crazy. At least part of this has to be due to the natural swing of up to 5 pounds from day to day, and part of it is due to the fact that I was wearing jeans when I weighed in the first time and cotton pajamas this morning. From now on, this is going to be the first thing I do on Saturday mornings, so everything is as consistent as possible. Another factor is that I’ve cut most of the crap out of my diet for a week. My body has been flushing garbage. But dang! 11 pounds in a week. I’m a bit excited.

Total Inches: I have lost 5.5 inches in the same time frame. This is proof that it’s not just water that I lost, which is where first, dramatic losses usually originate in a diet.

The loss seems a little bit nuts. Here’s hoping it stays consistent.

Your retirement account shouldn’t be an optional investment. Do you know how to maximize retirement savings?

I’m a big fan of making extra money. Money Crashers lists 6 sites to help you rake in the cash, without needing any special skills.

Unclutterer is giving away three Fujitsu Scansnaps. I want one of these is a way that isn’t quite right.

I’ve been moving to LED lights instead of CFLs for a few years. CFLs make lousy security lights in Minnesota in the winter. They take 5 minutes to get to full brightness when it’s cold. LEDs last forever.

This is where I review the posts I wrote one year ago.

I posted about the difference between bribes and rewards and the problems inherent in trying to buy good behavior.

Lesson 2 of my budget series went live, detailing my monthly bills.

We made some changes to our budget plans that haven’t worked very well. Over the course of the last year, every one of these ideas has either been partially or totally abandoned, but it’s working for us.

How to Complain – The Squeaky Wheel Gets the Grease was included in the Carnival of Personal Finance.

3 Things You Need to Know About Homeowner’s Insurance was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

That’s all for today. Have a great weekend!

This topic has been blatantly stolen from Budgets are Sexy.

1) How do you spend: cash, debit or credit? I use cash almost exclusively. I live in Minnesota and have two small children, so bundling the brats up to go inside the gas station to pay is nuts. Gas stations get the debit card. Online shopping, or automatic payments set up in the payee’s system are done on a credit card that gets paid off every month.

[ad name=”inlineright”]2) Do you bank online? How about use a financial aggregator (Mint, Wesabe, Yodlee, etc.)? I bank online. I use USBank for my daily cash flow, INGDirect for savings management and Wells Fargo for business. I used Mint strictly as a net worth calculator and alerting system. I use Quicken to manage my money and a spreadsheet for my budget, but I really like the quick, hands-off way that Mint gathers my account information and emails low balance alerts.

3) What recurring bills do you have set on autopay? Absolutely everything except daycare, 2 annual payments, and 1 quarterly payment.

4) How are your finances automated? I use USBank’s billpay system, instead of setting up autopayments at every possible payee. This gives me instant total control and reminders before each payment. The exceptions are my mortgage, netflix, and Dish. My mortgage company takes the money automatically from my checking. The other two hit a credit card automatically. Our paychecks are direct-deposited and automatically transferred to the different accounts and banks, as necessary.

5) Do you write checks? If so, how often? Once per week, for daycare. Occasionally for school fundraisers.

6) Where do you stash your short-term savings? I have quite a few savings accounts with INGDirect to meet all of my savings goals. For the truly short term, I add a line item in Quicken and just leave the money in my checking account.

Who’s next?

In this installment of the Make Extra Money series, I’m going to show you how to set up a WordPress site. I’m going to show you exactly what settings, plugins, and themes I use. I’m not going to get into writing posts today. That will be next time.

I use WordPress because it makes it easy to develop good-looking sites quickly. You don’t have to know html or any programming. I will be walking through the exact process using Hostgator, but most hosting plans use CPanel, so the instructions will be close. If not, just follow WordPress’s 5 minute installation guide.

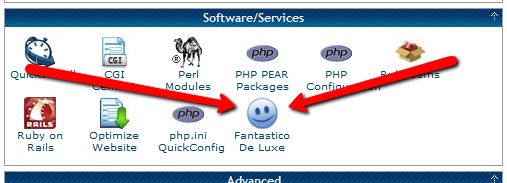

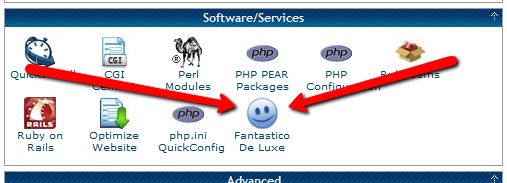

Assuming you can follow along with me, log in to your hosting account and find the section of your control panel labeled “Software/Service”. Click “Fantastico De Luxe”.

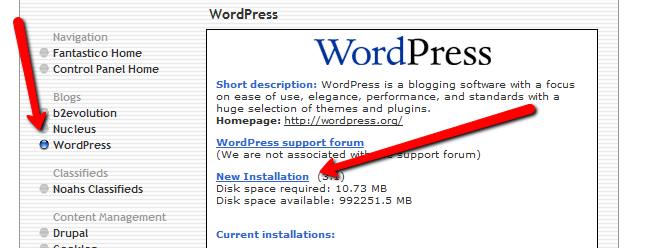

On the Fantastico screen, click WordPress, then “New Installation”.

On the next screen, select your domain name, then enter all of the details: admin username, password, site name, and site description. If you’ll remember, I bought the domain http://www.masterweddingplanning.net. I chose the site name of “Master Wedding Planning” and a description of “Everything You Need to Know to Plan Your Wedding”.

Click “install”, then “finish installation”. The final screen will contain a link to the admin page, in this case, masterweddingplanning.net/wp-admin. Go there and log in.

After you log in, if there is a message at the top of the screen telling you to update, do so. Keeping your site updated is the best way to avoid getting hacked. Click “Please update now” then “Update automatically”. Don’t worry about backing up, yet. We haven’t done anything worth saving.

Next, click “Settings” on the left. Under General Settings, put the www in the WordPress and site URLs. Click save, then log back in.

Click Posts, then Categories. Under “Add New Category”, create one called “Misc” and click save.

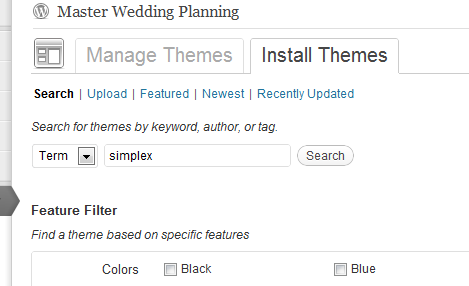

Click Appearance. This brings you to the themes page. Click “Install Themes” and search for one you like. I normally use Headway, but before I bought that, I used SimpleX almost exclusively. Your goal is to have a simple theme that’s easy to maintain and easy to read. Bells and whistles are a distraction.

Click “Install”, “Install now”, and “Activate”. You now have a very basic WordPress site.

A plugin is an independent piece of software to make independent bits of WordPress magic happen. To install the perfect set of plugins, click Plugins on the left. Delete “Hello Dolly”, then click “Add new”.

In the search box, enter “plugin central” and click “Search plugins”. Plugin Central should be the first plugin in the list, so click “install”, then “ok”, then “activate plugin”. Congratulations, you’ve just installed your first plugin.

Now, on the left, you’ll see “Plugin Central” under Plugins. Click it. In the Easy Plugin Installation box, copy and paste the following:

All in One SEO Pack Contact Form 7 WordPress Database Backup SEO SearchTerms Tagging 2 WP Super Cache Conditional CAPTCHA for WordPress date exclusion seo WP Policies Pretty Link Lite google xml sitemaps Jetpack by WordPress.com

Click “install”.

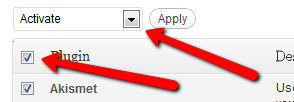

On the left, click “Installed Plugins”. On the next screen, click the box next to “Plugins”, then select “Activate” from the dropdown and click apply.

Still under Plugins, click “Akismet Configuration”. Enter your API key and hit “update options”. You probably don’t have one, so click “get your key”.

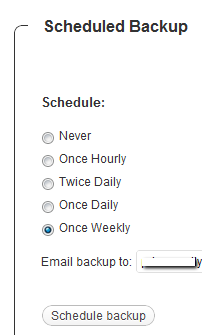

The only tool I worry about is the backup. It’s super-easy to set up. Click “Tools”, then “Backup”.

Scroll down to “Schedule Backups”, select weekly, make sure it’s set to a good email address and click “Schedule Backup”. I only save weekly because we won’t be adding daily content. Weekly is safe enough, without filling up your email inbox.

There are a lot of settings we’re going to set. This is going to make the site more usable and help the search engines find your site. We’re going to go right down the list. If you see a section that I don’t mention, it’s because the defaults are good enough.

Set the Default Post Category to “Misc”.

Visit this page and copy the entire list into “Update Service” box. This will make the site ping a few dozen services every time you publish a post. It’s a fast way to get each post indexed by Google.

Click “Save Changes”.

Uncheck everything under “Email me whenever…” and hit save. This lets people submit comments, without actually posting the comments or emailing me when they do so. Every once in a while, I go manually approve the comments, but I don’t make it a priority.

Select “Custom structure” and enter this: /%postname%/

Click save.

Set the status to “Enabled”, then fill out the site title and description. Keep the description to about 160 characters. This is what builds the blurb that shows up by the link when you site shows up in Google’s results.

Check the boxes for “Use categories for META keywords” and “Use noindex for tag archives”.

Click “Update Options”.

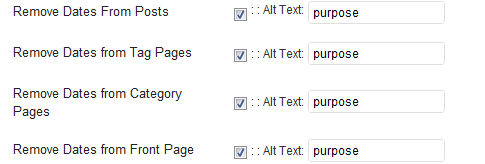

Check the boxes to remove each of the dates and set the alt text to “purpose” or something. This will suppress the date so your posts won’t look obsolete.

This plugin reinforces the searches that bring people to your site. It’s kind of neat. Skip the registration, accept the defaults and hit save.

Scroll to the bottom and click import. We’ll come back to this.

Select “Caching On” and hit save.

Across the top of the screen should be a giant banner telling you to connect to WordPress.com and set up Jetpack. You’ll need an account on WordPress.com, so go there and set one up. After authorizing the site, you’ll be brought back to the Jetpack configuration screen. Click “Configure” under “WordPress.com Stats”. Take the defaults and hit save.

On the contact configuration page, copy the code in the top section. You’ll need this in a moment.

Now, we going to create a couple of static pages. On the left, click “Pages”, then “Add new”.

Name the first page “Contact” and put the contact form code in the body of the page. Hit publish.

Under Appearance, click “Menu”. Enter a menu name and hit save.

Then, under “Pages”, click the box next to “Contact”, “Disclaimer”, and any other policies you’d like to display. Hit save.

Also under Appearance, click “Widgets”. This is where you’ll select what will display in the sidebar. All you have to do is drag the boxes you want from the middle of the page to the widget bar on the right. I recommend Text, Search, Recent Posts, Popular Search Terms and Tag Cloud. In the text box, just put some placeholder text in it, like “Product will go here”. We’ll address this next time.

We’re not going to worry about getting posts in place, yet. That will be the next installment. However, the steps in the next installment could take 2 weeks to implement, and we want Google to start paying attention now. To make that happen, we need to get a little bit of content in place. This won’t be permanent content. It’s only there so Google has something to see when it comes crawling.

To get this temporary, yet legal content, I use eZineArticles. Just go search for something in your niche that doesn’t look too spammy.

Then, click “Posts”, then delete the “Hello World” post. Click “Add new”. Copy the eZine article, being sure to include the author box at the bottom, and hit publish.

To see your changes, you may have to go to Settings, then WP Cache and delete the cache so your site will refresh.

Congratulations! You now have a niche blog with content. It’s not ready to make you any money, yet, but it is ready for Google to start paying attention. In the next installment, I’ll show you how I get real unique content and set it up so Google keeps coming back to show me the love.

Last weekend, I was in Denver for the Financial Blogger Conference. Last week, I had a sore throat that got worse each day until my tonsils started touching on Friday. I could barely talk, so I went to the doctor, then to bed.

It apparently wasn’t strep throat, but beyond that, it could be anything from motaba to weaponized syphilis*.

This is one of those occasions when I’m happy to be living in the future, where a quick trip to the clinic can knock out what would have been hopeless and fatal and few hundred years ago. Antibiotics and a day spent in bed watching super hero movies made me better. That beats bloodletting any day.

Yakezie Carnival: FINCON Edition hosted by Finance Product Reviews

Carnival of Money Pros hosted by My University Money

Carnival of Retirement #36 hosted by Making Sense of Cents

Carnival of Personal Finance #377 hosted by Money Life and More

Yakezie Carnival: Labor Day Edition hosted by Stock Trend Investing

Yakezie Carnival: The Best of Summer Edition hosted by On Target Coach

Carnival of Money Pros hosted by Simple Finance Blog

Carnival of Retirement #34 hosted by My Family Finances

Lifestyle Carnival #17 hosted by The Free Financial Advisor

Yakezie Carnival: Dog Days of Summer Edition hosted by Frugal Portland

Carnival of Money Pros: Back to School Edition hosted by See Debt Run

Nerdy Finance #7 hosted by Nerd Wallet

Yakezie Carnival hosted by The College Investor

Yakezie Carnival – Rescue Edition hosted by See Debt Run

Carnival of Financial Camaraderie #45 hosted by My University Money

Carnival of Money Pros hosted by Aaron Hung

Carnival of Retirement #32 hosted by Young Family Finance

Thanks for including my posts.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

This involves giving each of the syphilis spirochetes an M16 and a Manifest Destiny indoctrination before releasing them into the wild. The transport mechanism (the “insertion method”) remains as fun as ever.

Have a great weekend!

When you are up to your eyeballs in debt, praying for a step-stool, sometimes life–more accurately, con-artists–try to trip you when you are vulnerable and look for a solution. They aren’t muggers on the street. They come at you wearing ties, invite you to a real office, with real furniture and a real nameplate on a real desk. They are a real company, but that doesn’t mean they aren’t trying to scam you out of the little money you have left to put towards your debt.

Yes, I am talking about debt management scams. These scams come in 4 main varieties.

Debt Settlement companies instruct you to stop paying your bills completely and send them the money instead to be placed in a settlement fund. When your creditors get desperate enough, they will be willing to settle for pennies on the dollar.

In theory, this can be a good strategy for some debtors. Unfortunately, it has some drawbacks, even if the company is legitimate. They tend to charge high fees as a percentage of your deposits. Some take another fee when a settlement is accepted. The entire time you are building your settlement fund, your credit rating is sinking, leaving you open to being sued or garnished. The bad companies take the fund and run, while even the good companies can’t guarantee your creditors will play ball.

Ultimately, they aren’t doing anything you can’t easily do yourself. If you want to go the settlement route, stop making your payments and funnel the money into a savings account that you will use to offer settlements from. It takes discipline, but there is no upside to paying someone else for the same function.

Debt Management plans are used when you owe more than you can afford to pay. These companies work with your creditors to adjust interest rates and minimum payments and they try to get some fees waived for you.

A good company will work with you and your creditors to make sure everyone is working together towards the goal of eliminating the debt. A bad company will tell you they are working with your creditors while ignoring any contact from the creditor. They’ll tell you the creditor isn’t willing to negotiate while never stepping up to the negotiation table. Another trick is to offer the creditor a set payment, with a “take it or leave it” clause. Any input from the creditor is interpreted as a refusal to participate. This, coupled with high fees paid by the debtor, make debt management firms a risky proposition. Most states require the firms to be licensed. Check to make sure they are before giving them any information.

Debt/Credit Counseling companies work with you to establish a budget and eliminate expenses; in effect, they are training you to be in control of your finances. They are often organized as a nonprofit, but not always.

Some–the sleazy ones–lie about what they are doing, or attempt to misconstrue what you are agreeing too. Be careful not to use your home as collateral to consolidate unsecured debt and don’t walk into a Chapter 13 bankruptcy without that being your intention. Both of those are common debt counseling scams. If the company isn’t able to provide all of the details of a transaction–company name, address, licensing information–or they aren’t willing to spend as much time as necessary explaining the details of the transaction, walk away. This is your life, you are in charge of it. Don’t let anyone bully or prod you into signing something you aren’t comfortable with.

Credit Repair is almost always a scam. There are ways to get correct bad information removed from your credit report. If the information is correct, those methods are illegal. There are two legal methods to repair your credit. First, stop generating bad credit. Make your payments on time and eventually, the bad items will fall off. Second, write letters disputing the actual incorrect items on your credit report. There are no quick fixes, and anybody telling you different is flirting with a jail sentence, possibly yours.

How do you avoid the scammers?

There is no magic bullet to kill debt. You’re not fighting a werewolf, you’re fighting a lifetime of bad or unfortunate choices and circumstances. It’s important to keep a realistic outcome in mind.

Update: This post has been included in the Carnival of Debt Reduction.