- RT @moneycrush: Ooo, ING is offering a $100 bonus for opening a business savings account with code BSA324. Guess what I’ll be opening… #

- My kids have pinkeye and are willing to share, if anyone is interested. #

- RT @bitterwallet: If you haven’t yet, pop over to http://enemiesofreason.co.uk/ to see how @antonvowl dealt with lousy content thieves. #

- RT @zen_habits: Excellent: No One Knows What the F*** They’re Doing http://bit.ly/9fsZim #

- @bargainr RE:Hypocrites. No, they aren’t. They have paid for those services, even if unwillingly. in reply to bargainr #

- RT @PhilVillarreal: If vegetables tasted good, there would be no such thing as salad dressing. #

- RT @The_Weakonomist: w00t RT @BreakingNews: Obama announces $8 billion in loan guarantees to build first U.S. nuclear plant in three decades #

- @SuburbanDollar CutePDF. PDF export as a printer. in reply to SuburbanDollar #

- RT @bargainr: There are stocks that have paid out dividends consistently for 50+ years… they’re Dividend Champions http://bit.ly/cSYXrY #

- “Four M&M’s if I poop” Economics lessons from a toddler. http://su.pr/2akWF9 #

- @The_Weakonomist Is seaweed a meat, now? in reply to The_Weakonomist #

Obama Signals Change by Appointing Janet Yellen to Run the Federal Reserve

President Barack Obama just announced that he is nominating Janet Yellen to run the Federal Reserve. The announcement heralded one of the most significant decisions in his presidency. Yellen is currently the Vice Chairwoman of the Fed, so her succession would be a natural progression. The White House struggled with the selection, and the joint press conference with Obama and Yellen capped off a contentious deliberation. Ultimately, the new nominee’s reign could signal a series of unexpected changes.

Not the First Choice

Previously, Obama has demonstrated a tendency to be extremely loyal to his inside circle. This practice of favoritism was intended to extend to the Federal Reserve. The president’s primary candidate was Lawrence Summers, who has been a close political ally. Unfortunately, members of Obama’s Democratic Party derailed Summers’ chances by demanding a liberal nominee. After being undermined by his own establishment, Obama had no choice but to pick a Democrat.

Likelihood of Confirmation

The Senate chamber has a Democratic majority, and this coalition has vocalized widespread support for Yellen. Although her initial selection required a little extra luck and patience, she appears to be on the fasttrack to confirmation. Republicans have voiced concerns about her economic philosophy, but they will be powerless to obstruct her path to leadership.

First Chairwoman

The announcement was immediately considered to be a major symbolic victory for womens’ rights across the country. Yellen will be the first woman to operate this crucial organization. This is another convenient boost for Obama’s progressive agenda, especially since his second term cabinet has been unusually lacking in female members.

First Democrat in Decades

For some incongruous reason, the last two Democratic Commanders in Chief both nominated Republicans to head the Fed. Obama reinstated Ben Bernanke, and Bill Clinton appointed Alan Greenspan before him. By finally choosing a Democrat, Obama can help his party reclaim governmental economics. As a result, Yellen will be expected to switch ideological course on a variety of monetary issues. Still, liberals hoping for a grand overhaul will be sorely disappointed.

Financial Consequences

Because she spent her tenure serving under Ben Bernanke, the transition of leadership is expected to be conducted in a seamless fashion. This means that there will not be instantaneous transformations; instead, Yellen is expected to subtly shift the direction of countless economic debates. It will be done is a slow moving manner that remains undetected by the general public. Under the radar, she is expected to facilitate mild increases in inflation to effectively combat unemployment. She also appears more inclined to regulate big banking industries. At least from the start, Yellen will only be making minor adjustments.

Pristine Qualifications

This pragmatic economist has earned doctoral honors from Yale, and she was a professor at Harvard. She had successful experiences operating the Fed in California, and her tenure witnessed a substantial economic turnaround for the region. Now, she has navigated a tenuous stimulus recovery for the entire nation. She will only expand these efforts when she ascends to the top.

How Refinancing Your Student Loans Can Save You Thousands

Students who graduated college in 2015 were said to have graduated with an estimated $35,000 in student loan debt. Of course, some students will have less and some more depending on what you did throughout your time in college. Either way, it is a lot of money and money that must be paid back whether you want to or not.

Student loan refinancing is an available option for many students and it will provide them with some of the relief they need financially. Did you know that refinancing your student loans can save you thousands of dollars? It’s okay if you didn’t – I will show you just how it can save you money and ease the strain on your budget.

Student Loan Refinancing: What the Heck Is It?

Before you can apply for refinancing, you need to understand what it is. When you refinance your student loan, your new lender will pay off your old loans and gives you a new loan with updated terms and rates.

Most student loan refinancing is done through a private lender, which means that there may be eligibility requirements that need to be met before you can actually go through with the refinancing.

How Can Refinancing Save Me Thousands?

There are a couple of different ways that refinancing can help save you thousands. First and foremost, you will receive a new interest rate. The rate itself will often vary depending on your situation, but usually falls somewhere between 2-5% for most students. The jump from a 6-8% interest rate to a 2-5% interest rate it immense. Let’s take a look.

For example, if you have a student loan balance of $25,000 at a 6.5% interest rate and your term is 10 years, you will pay a total of $9,065 in interest over the course of the term. Now, if we change the interest rate down to 3.5%, you will only pay $4,665 in interest payments over the course of the 10 years. That is a savings of $4,400!

The second way that you can save thousands is by adjusting the length of your payback period. Often times, the default is set at 10 years, but students often extend it out to 20 or 25 years. This will increase the amount you pay in the long run because you now need to pay interest over that extended period.

When you refinance your student loans, you are able to shorten the term of your loan, which means you pay thousands less because you do not have to continue to pay interest over the extended length of the loan.

Final Thoughts on Student Loan Refinancing

Student loan refinancing is a great option for students looking to destroy their debt, but it is not always an option for everyone. You do need to qualify, which means you need a good credit score or a cosigner with a good credit score. Refinancing your student loans can help save you thousands of dollars over time, so if you do have the option to do it, you should.

Net Worth Update

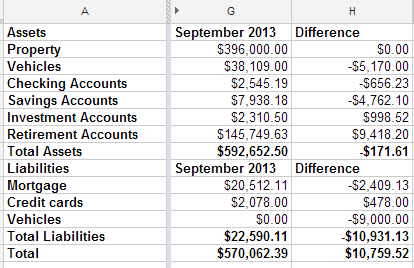

Time to update my net worth. Here are the highlights:

We paid off the Tahoe we bought last fall, but the value of my Pacifica fell $5,000 since April. That made me sad.

In August, we had $1000 worth of car repairs and $5500 for braces. We had most of the money saved for braces, but had to juggle some savings accounts around to cover it. We didn’t have enough money in our car repair fund to cover the repairs. Between the two, we beat up our credit card a bit more than usual last month. I’m not happy about it, but I’m confident we’ll catch up this month. My current goal is to get that paid off by the end of September. If I do, I should be able to avoid paying any interest on the balance.

All in all, it’s not bad progress. Our assets dropped $171.61, but our liabilities dropped $10,931.13, so our net worth is up $10,000. You won’t catch me complaining about that.

What’s going to happen in the future? We’re going to remodel both of our bathrooms this winter. We’re hoping to buy a pony before spring.

I’m excited to see our budget evolve over the next few months.

My wife is working and my kids are all in school. With the way our schedules work, we’ve pulled the youngest two out of daycare, so that expense is gone. And there are a couple of other things in the works that I’ll be sharing when they are finalized. If things progress the way they are looking, we’re going to spend the winter living off of my income, and saving her’s. That makes me feel like putting on an ant costume and kicking grasshopper’s butt all over town.

Memorial Day

JUST A COMMON SOLDIER

(A Soldier Died Today)

by A. Lawrence Vaincourt

He was getting old and paunchy and his hair was falling fast,

And he sat around the Legion, telling stories of the past.

Of a war that he had fought in and the deeds that he had done,

In his exploits with his buddies; they were heroes, every one.

And tho’ sometimes, to his neighbors, his tales became a joke,

All his Legion buddies listened, for they knew whereof he spoke.

But we’ll hear his tales no longer for old Bill has passed away,

And the world’s a little poorer, for a soldier died today.

He will not be mourned by many, just his children and his wife,

For he lived an ordinary and quite uneventful life.

Held a job and raised a family, quietly going his own way,

And the world won’t note his passing, though a soldier died today.

When politicians leave this earth, their bodies lie in state,

While thousands note their passing and proclaim that they were great.

Papers tell their whole life stories, from the time that they were young,

But the passing of a soldier goes unnoticed and unsung.

Is the greatest contribution to the welfare of our land

A guy who breaks his promises and cons his fellow man?

Or the ordinary fellow who, in times of war and strife,

Goes off to serve his Country and offers up his life?

A politician’s stipend and the style in which he lives

Are sometimes disproportionate to the service that he gives.

While the ordinary soldier, who offered up his all,

Is paid off with a medal and perhaps, a pension small.

It’s so easy to forget them for it was so long ago,

That the old Bills of our Country went to battle, but we know

It was not the politicians, with their compromise and ploys,

Who won for us the freedom that our Country now enjoys.

Should you find yourself in danger, with your enemies at hand,

Would you want a politician with his ever-shifting stand?

Or would you prefer a soldier, who has sworn to defend

His home, his kin and Country and would fight until the end?

He was just a common soldier and his ranks are growing thin,

But his presence should remind us we may need his like again.

For when countries are in conflict, then we find the soldier’s part

Is to clean up all the troubles that the politicians start.

If we cannot do him honor while he’s here to hear the praise,

Then at least let’s give him homage at the ending of his days.

Perhaps just a simple headline in a paper that would say,

Our Country is in mourning, for a soldier died today.

Filing Bankruptcy: Pride or Shame?

I’m a big fan of personal responsibility. If you’ve promised to do something, you should do it. With that said, it seems odd to some people that I don’t have an ethical problem with bankruptcy. For some people, it is the only option after a long series of problems.

Don’t get me wrong, it should be a shameful decision. Reneging on your word should never be a source of pride. It should be a difficult decision to make. A couple of years ago, I came very close to making that decision myself.

It should not be a reason to celebrate and it should absolutely not be a reason to behave irresponsibly. Some people don’t see a need to take care of their responsibilities because, when it gets bad, they’ll be able to file bankruptcy and make the creditors go away. They are abusing a safety net. That abuse hurts everyone. Credit card companies have to charge higher interest rates so the paying customers can cover the risk of those who default or file bankruptcy.

There is one prominent local bankruptcy attorney who files every 10 years, and has filed consistently for decades. He runs a thriving practice, so it’s not a matter of poor choices, it’s a matter of deliberately living beyond his means and screwing his creditors. He’s one of the slime-balls that give lawyers a bad name. He is one of the many who abuse a lifeline designed to save people from a life of destitution they didn’t ask for, and he does it to finance his extravagant lifestyle.

If you have found yourself buried in a debt you didn’t plan for, if life threw you a curve-ball that you are entirely unable to deal with, if you have to file bankruptcy, it’s okay. Really. When you go in front of the judge, have the decency not to enjoy it, and try to learn from the experience.