- @fcn Yahoo Pipes into GReader. 50 news sites filtered to max 50 items/day–all on topic. in reply to fcn #

- @fcn You can filter on keywords, so only the topics you care about come through. in reply to fcn #

- It's a sad day when you find out that your 3 year old can access anything in the house. Sadder when she maces herself with hairspray. #

- 5 sets of 15 pushups to start my day. Only 85 to go! Last 5 weren't as good as first 5. #30DayProject #

- What happens to your leftover money in your flex-spending account? http://su.pr/9xDs6q #

- Enter to Win iPod Touch from @DoughRoller http://tinyurl.com/y8rpyns #DRiPodTouch #

- Arrrgh! 3 year old covered in nail polish. And clothes. And carpet. And sister. #

- Crap. 5 sets of 5 pushups. #30dayproject #

- Woo! My son just got his first pin in a wrestling meet! #

- RT @Doughroller: Check out this site that gives your free credit report AND score without asking for a cc# or social… http://bit.ly/bRhlMz #

- Breaking news! Penicillin cures syphilis, not debt. https://liverealnow.net/KIzE #

- Win a $25 Amazon GC via @suburbandollar RT + Fllw to enter #sd1Yrgvwy Rules -> http://bit.ly/sd1Yrgvwy2 #

- This won't be coming to our house. RT @FMFblog: Wow! Check out the new Monopoly: http://tinyurl.com/ygf2say #

- @ChristianPF is giving away a Flip UltraHD Camcorder – RT to enter to win… http://su.pr/2ZvBZL #

Experiences v. Stuff

- Image by hunterseakerhk via Flickr

On Friday, I went to see Evil Dead: The Musical with some friends. The play obviously isn’t a good match for everyone, but we are all horror movie fans, I’m a Bruce Campbell fan, and all of us had seen and enjoyed at least Army of Darkness. It was a good fit for us.

The play, followed by a late dinner and drinks with people I care about, was easily the most money my wife and I have spent on a night out in years. That’s including an overnight trip for my cousin’s wedding.

Now, several days later, I keep thinking about that night, but not with regret about the price. I keep thinking about the fun I had with my wife and some of our closest friends. We saw a great play that had us in stitches. We had a few hours of good conversation. We had a good time. I would happily do it all over again. In fact, I would happily reorganize our budget to make something similar happen every month.

I don’t remember the last time I spent 3 or 4 days happily thinking about something I bought.

I look around my house at the years of accumulated crap we own and I see a big rock tied around my neck. Even after a major purge this spring, we’ve got more stuff than we can effectively store, let alone use. When something new comes in the house, we spend days discussing whether we really need it or if it should get returned. When we plan a big purchase, we debate it, sometimes for weeks.

Getting stuff is all about stress.

My wife and I are both familiar with the addictive endorphin rush that comes with some forms of shopping. I wish the rational recognition of a shopping addiction was enough to make it go away. Buying stuff makes us feel good for a few minutes, while high-quality experiences make us feel good for days or weeks, and gives us things to talk about for years to come.

It’s really not a fair competition between experiences and stuff. Experiences are the hands-down winner for where we should be spending our money.

Why then, does stuff always seem to come out ahead when it comes to where our money actually goes?

Advertise

Thank you for your interest in advertising on http://LiveRealNow.net.

Advertising opportunities here include, but are not limited to:

- Sidebar ads

- Sidebar widgets

- Banner ads, either at the top of the page, the top of each post, or embedded in a post

- Other. I’m open to most forms of advertising.

Terms

Advertising fees must be paid in advance. I reserve the right to remove any ad for any or no reason. In the unlikely event that this happens, you will be reimbursed a pro-rated fee.

I do not accept ads for payday loans or debt settlement companies.

Please email me at ![]() or use the contact form below.

or use the contact form below.

[contact-form 2 “Advertiser”]

Side Hustle: Garage Sale Wrap-Up

We are now to the end of Garage Sale Week here at Live Real, Now. I hope you’ve enjoyed it.

After you shut down on the last day, take the evening off. You’ve just been hard at work for 2-3 days and need a break. Deal with the stuff tomorrow. Tomorrow–and probably the next few days–you’ve got work to do. What do you do with everything that didn’t sell? If you’re planning on making garage sales a regular side-hustle, just box it all up and put it to the side until next time. After all, it’s all priced, sorted, and ready-to-go, right? If, like me, your goal was to declutter, then it’s time for some serious downsizing. Let’s dump the crap.

The first thing we did was box up all of the books and movies to bring to the used book store. We dropped the items at the sell table and spent half an hour browsing a bookstore. That’s never a good way for me to save money. The store we went to checks the demand for everything you bring in. If there’s no demand, they donate or recycle the items and you don’t get paid. DVDs bring about $1 each. VHS is demand-based. Paperbacks are something less than half of the retail price. Hardcovers are demand-based. We were offered $28 and pointed to the huge pile of discard/recycle items that we were free to reclaim. I picked out 4-5 books and movies that I thought had value and left the rest. Bringing the clutter back home would defeat the purpose of going there.

The clothes were handled two ways. First, all of the little girl clothes were bagged and set aside for some friends with a little girl. The rest were bagged and loaded in the truck for a run to Goodwill. The clothes filled the box of our pickup.

The random knick-knacks were also boxed up and delivered to Goodwill, along with most of the leftover toys. This was another completely full truck box. We had a lot of stuff in our sale.

The beat-up or low-value furniture that didn’t sell was put on the curb with “FREE” signs. I posted the free items on Craigslist and they were gone in just a few hours. The Craigslist ad said “Please do not contact, I will remove the listing when the items are gone.” Otherwise, there are usually 10-15 emails per hour asking if the items are still available. The ad didn’t even have pictures and it worked quickly.

Some of the furniture–the toddler bed, changing table, china cabinet, and the good computer desk–were hauled back to our garage to post on Craigslist with a price-tag. They are too good to give away. If the camera wouldn’t have died two nights ago, the pictures would already be up. Some of the other items were also reserved for individual sale. The extra router, the 6 inch LCD screen, and a few other toys will go on Ebay.

Finally there was some stuff that we decided we weren’t going to get rid of. We kept a few movies, but only because I didn’t notice them until I got back from the bookstore. My wife kept a box of Partylite stuff–though most of the leftovers were donated. Very little of the things we had ready for sale are being kept in our lives. Almost all of it is gone, or will be soon.

All in all, this was a cathartic end to last month’s 30 Day Project. There was some surprising emotional attachment to some things I didn’t think I cared about. It’s good to see it gone.

Note: The entire series is contained in the Garage Sale Manual on the sidebar.

Credit Cards: How to Pick a Winner

We live in a decidedly credit-centric culture. Whip out cash to pay for $200 in groceries and watch the funny looks from the other customers and the disgust from the clerk. It’s almost like they are upset they have to know how to count to run a cash register.

If someone doesn’t have a credit card, everyone wonders what’s wrong, and assumes they have terrible credit. That’s a lousy assumption to make, but it happens. For most of the last two years, I shunned credit cards as much as possible, preferring cash for my daily spending. Spending two years changing my spending habits has made me comfortable enough to use my cards again, both for the convenience and the rewards.

Having a decent card brings some advantages.

Credit cards legally provide fraud protection to consumers. Under U.S. federal law, you are not responsible for more than $50 of fraudulent charges. many card issuers have extended this to $0 liability, meaning you don’t pay a cent if your card is stolen. Trying getting that protection with a wallet full of cash.

The fraud protection makes it easier to shop online, which more people are doing every day. At this point, there is no product you can buy in person that you can’t get online, often cheaper. How would you order something without a credit card? Even the prepaid cards you can buy and fill at a store will often fail during an online transaction because there is no actual person or account associated with the card. The “name as it appears on the card” is a protective feature for the credit card processors and they dislike accepting cards without it.

If you’re going to use a credit card, you need to make a good choice on which credit card to get. There are a few things to check before you apply for a card.

Annual fee. Generally, I am opposed to getting any card with an annual fee, but sometimes, it’s worth it. If, for example, a card provides travel discounts and roadside assistance with its $65 annual fee, you can cancel AAA and save $75 per year. A good rewards plan can balance out the fee, too. I’m using a travel rewards card that has a 2% rewards plan. That’s 2% on every dollar spent, plus discounts on some travel purchases. In a few months, I’ve accumulated $500 of travel rewards for the $65 fee that was waived for the first year. The math works. A card that charges an annual fee without providing services worth several times that fee isn’t worth getting.

Interest rate. This should be a non-issue. You should be paying off you card completely every month. In a perfect world. In the real world, sometimes things come up. In my case, I was surprised with a medical bill for my son that was 4 times larger than my emergency fund. It went on the card. So far, I’ve only had to pay one month’s interest, and I don’t see the balance surviving another month, but it’s nice that I’m not paying a 20% interest rate. Unfortunately, as a response the CARD Act, the days of fixed rate 9.9% cards seems to be over.

Grace period. This is the amount of time you have when the credit card company isn’t charging you interest. Most cards offer a 20-25 day grace period, but still bill monthly. That means that you’ll be paying interest, even if you pay your bill on time. To be safe, you’ll need to either find a card that has a 30 day grace period, or pay your balance off every 15-20 days. Some of the horrible cards don’t offer a grace period of any length. Avoid those.

Activation fees. Avoid these. Always. There’s no card that charges an activation fee that’s worth getting. An activation fee is an early warning sign that you’ll be paying a $200 annual fee and 30% interest in addition to the $150 activation fee.

Other fees. What else does the card charge for? International transactions? ATM fees? Know what you’ll be paying.

Service. Some cards provide some stellar services, include concierge service, roadside assistance, and free travel services. Some of that can more than balance out the fees they charge. My card adds a year to the warranty of any electronics I buy with it, which is great.

Credit cards aren’t always evil, if you use them responsibly. Just be sure you know what you’re paying and what you’re getting.

What’s in your wallet?

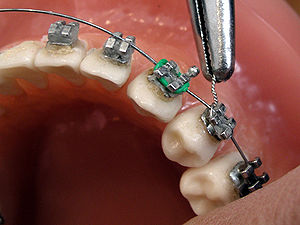

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.