LRN got hacked this morning. Thankfully, I backup weekly and subscribe to my own RSS feed. 20 minutes to total restoration.

Credit Card Glossary

As evil as credit cards are, most adults have one. Have you ever wondered what percentage of those people know the details of[ad name=”inlineright”] their credit card agreement, or even what all of the terms mean?

Here’s a quick list of the terms and their definitions.

- Average daily balance – This is the balance most card companies use to calculate your interest. They add the balance each day and divide it by the number of days in the billing cycle. This number times the interest rate is (roughly) the interest you have to pay.

- Annual Percentage Rate(APR) – This is the interest rate expressed as the interest accrued in one year. The actual calculation is much more complicated.

- Balance transfer – If you’ve ever paid your VISA with your Mastercard, you’ve done a balance transfer. These often have a great introductory rate and a lousy permanent rate.

- Cardholder agreement – This is the contract that defines all of the terms of your card: interest, default consequences, payment terms, and everything else. You should never sign for a card without reading and understanding this document.

- Charge-back – If you dispute a charge on your card, the issuer may issue a charge-back, and take the money back from the merchant to return to you.

- Credit line – This is the amount you are able to charge. You should fear this number and stay as far away from it as possible.

- Default – When you stop paying your card, you become delinquent. If it goes on too long, you will be in default. Read: screwed. This is when they crank your interest rate to the sky and cut your limit to match your balance. It’s also the point that affects your credit rating.

- Due date – This is the day which, if you miss it, will cause you to acquire an extra $15-39 fee for the privilege of misreading your calendar. Always pay your bill before this date.

- Finance charge – This is the actual interest accrued for the billing period. This is money you are paying for the privilege of borrowing the rest of the money. Next month, you’ll pay a finance charge on this money, too. Yay!

- Grace period – For most cards worth owning, you get 20-25 days before the issuer starts charging interest. The best way to manage your card is to pay it off completely twice a month. That way, you’ll never use up your grace period and never pay a cent of interest.

- Introductory rate – Many cards will offer a crazy-low interest rate for six months to lure you in…like crack. They’ll get you hooked, then raise the rate and force you to charge new toys at the higher rate. Ideally, you’ll never carry a balance, so you’ll never have to worry about the introductory rate.

- Minimum payment – If debt has an evil heart, this is it. If you pay nothing but the minimum required payment, you will be in debt for the rest of your life. Always pay more, even if it’s just an extra $20.

- Over-the-limit fee – If you ignore your credit limit and keep spending, you’ll get hit with another $15-39 fee for the privilege of not controlling your irresponsible impulses.

- Periodic rate – This is your APR expressed in relation to a specific time frame, usually as a daily periodic rate. For example, if your interest rate is 18%, your daily periodic rate is 18/365 or 0.0493%

- Pre-approved – When you get a pre-approved card, you are actually just getting a notice that you have been pre-screened as not being too much of a deadbeat for that particular card. You will still have a full credit check before the card is issued.

- Secured card – If you’ve got lousy credit, sometimes your only choice to repair it is to get a prepaid card. You give the company $200 and they will let you charge $200. They are almost always loaded with fees and are usually a very bad deal, but if it’s the only game in town…?

- Universal default – Sometimes, if you default on one card, every other card you have decides to gang up on you, because your “risk profile” has changed. Yet more proof of the evil that is credit-card debt.

- Variable interest rate – Some card tie your rate to the Prime interest rate, so when that changes, your rate does, too.

Did I miss any terms?

20 Happy Thoughts

Since I’ve been on a bit of a death theme lately, I thought I post something purely happy.

Here it is. In no particular order, twenty unequivocated things that make me happy.

- My three year old has the most beautiful blue/silver/gray eyes I have ever seen.

- In the past 32 months, I’ve reduced my total debt load by $42,859.70. That’s an average reduction of $1,339.37 per month.

- My insane work schedule is paying off. I’m more than halfway to making my day job’s income redundant.

- My preteen son is currently showing none of the signs of the horrible rebellion that I put my parents through.

- The world hasn’t imploded, exploded, or tilted its axis recently.

- My parents did a good job of raising me.

- I haven’t touched my overdraft line of credit in more than 2 years.

- My wife loves me.

- I love her.

- Wrestling season starts tomorrow, and Punk ended last season with real promise.

- I’ve dropped 12 pounds in the last 16 days.

- Bacon is good.

- Daughter #1 is starting kindergarten in September and excited about it.

- Our cars are paid off.

- This site helps me stay motivated to eliminate my debt.

- You rock.

- I may get out of debt just before the world ends.

- The Yakezie Network has helped get this blog to where it is. If you’ve got a finance blog, join today. You won’t regret it.

- FINCON 2012 is is Denver and I won’t be napping on my motorcycle on the way there, like I did the last time I went to Denver. It’s not something I recommend, but it makes a neat story.

- I have 20 things to be happy about. That’s a recursive happy-maker right there.

Can Bad Credit Cost You Your Job?

Did you know that having a bad credit history could cost you your job? An increasing number of American employers have turned to running credit checks to screen job

applicants. Some companies even evaluate existing employees on a regular basis by checking their credit reports. If you have outstanding debts, you might consider getting one of those credit cards for bad credit to clean up your report before you apply for your dream job.

Not all companies run your credit history when you apply for a position. However, if you’re applying for a job that entails working with money or valuables, it’s a safe bet that they’ll be checking your credit history. Financial institutions, brokerage companies and jewelry manufacturers all run credit checks, as do hotels, accounting firms, human resource departments and government agencies.

Companies run credit checks because they want to hire employees who won’t be tempted to embezzle company funds to pay off large debts. Some companies fear that employees who carry large debt loads are susceptible to blackmail or bribery. The federal government carries this concern even further, indicating that citizens who owe large debts are considered national security risks.

Many companies feel that your credit report gives them a sneak peak at your true character. Having a good credit history indicates that you are a responsible person with excellent character. Having a bad credit history means that you are an unreliable person of poor character. True or not and fairly or not, this is the current belief running throughout company hiring departments.

Unfortunately, you can’t relax about your credit report even after you’ve been hired for a position. Once you’ve given a company written permission to check your credit report, they can recheck it at a later date. Government and financial organizations often run periodic credit checks on all of their employees. Some companies only recheck your credit history if you are up for a promotion. It’s a good idea, therefore, to keep your credit history squeaky clean.

Keep in mind that having a couple of late payments probably won’t kill your chances of employment or promotion. Most employers look for the really big issues, such as high credit card balances, defaulted student loans, repossessions and foreclosures. Some companies also look for charge-offs and consistent late payments as well.

Steps You Can Take

Financial experts suggest checking your credit report before you start your job search. Read your credit report carefully and make sure that all of the information is accurate. If your report contains incorrect details or any unauthorized charges, dispute these errors immediately and have them corrected to raise your credit score.

If you have a host of unpaid bills, find a way to settle those debts to improve your credit history before applying for jobs. Many people turn to credit cards for bad credit consumers. These cards allow you to consolidate all of your debts into a single debt. Just don’t forget to make the payments on this card.

Be upfront with potential employers about any negative marks on your credit history. Just tell them that you have had past issues with your credit and are now working to clear up all of your debt. There’s no need to go into explicit detail.

Once you have a job, be sure that you check your credit report at least every six months to ensure it contains only correct information. Pay all of your creditors on time. Never take out any new lines of credit unless you are absolutely positive that you can pay it back in a timely manner.

Post by Moneysupermarket

Net Worth Update – September 2014

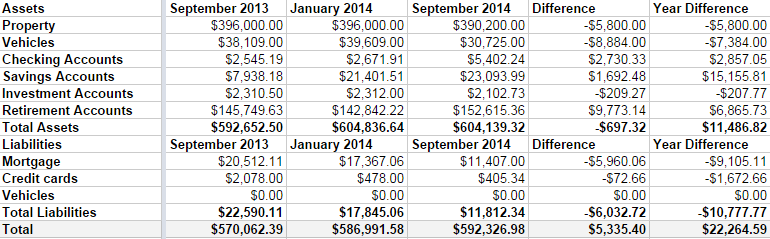

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Insurance

On Tuesday, a potential customer took my business partner and I out for sushi.

The sushi bar was fun. There was a little canal going around the bar. The canal had little boats. The boats had little plates. The plates had sushi. Lots and lots of sushi. When you wanted something, you just reached out and took it.

Yum.

My only complaint with the place is the width of the chairs. If you’re going to use narrow chairs, you really shouldn’t choose chairs with armrests.

Between the narrow chairs, the armrests, and my fat butt, my cell phone got knocked off of my belt.

Crap.

I normally check my money clip, car keys, pocket knife, and cell phone every time I stand up, but didn’t this time.

I noticed it was missing 15 miles later.

Of course, when I called, no one answered my phone.

The restaurant hadn’t seen my phone.

When we went back to retrace our steps, my phone was nowhere to be found. Some busboy got a nice tip that night.

Now, I don’t carry insurance on my cell phone. I still have every cell phone I’ve ever owned, in working condition. Well, minus one, now. At $5/month, that has saved me more than $1000 over the years.

Of course, it’s a bit painful this week.

Thankfully, I sock a bit of money away every month to cover things that break. It’s my warranty fund. That, combined with a good(hopefully) find on eBay, means that losing my phone, while irritating, isn’t going to break my budget. It won’t actually touch my budget in any way.

On a side note, a parking ramp with a flat, “all night” charge and a lost ticket fee makes me angry.