- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

ING Direct – 2 Day Sale

Today and tomorrow, ING Direct is having a “Financial Independence Days Sale”.

It’s a good sale. If you open a checking account or Sharebuilder account and you’ll get $76. Apply for a mortgage and you’ll get $776 off of the closing costs.

I have accounts at 4 different banks. Two of those were opened for specific debt-reduction purposes. Of the others, one is used for most of my cash flow and bill payments, and the other is ING. As of this moment, I have 15 accounts or sub-accounts with ING Direct.

Opening an account is painless and only takes a few minutes. They are currently offering up to 1.25% in an interest-bearing checking account, though I’ve never qualified for more than .25%. That account comes with overdraft protection, so you are charged interest instead of overdraft fees.

Once you have your first account set up, sub-accounts can be created in literally seconds. Why would you want a bunch of sub-accounts? I have a number of saving goals. Each of these goals has its own account at ING. I can tell at a glance how much we have saved for our vacation next month and far away we are from affording my son’s braces. My kids each have an account here because, currently, the interest rate is at 1.1%, which is miles ahead of most traditional banks. Combined with the convenience of total online control, there’s no contest.

Money transfers are smooth. I use one of my accounts as a transfer account to get money to and from two separate banks.

I also have a Sharebuilder account. For those who aren’t familiar with it, it is a stock brokerage with low fees and a low barrier to entry. If you set up an automatic investment, you get $4 stock trades with no minimum. I’m not aware of any place cheaper.

That all sounds like a lot of ad copy and the links are affiliate links, but the truth is, I am just that happy with ING. I’ve never had an accounting error, or any problems at all.

The downside? Paper checks are verboten. They will not accept paper checks, but you do have a check card to use. You can hit 35,000 ATMS for free withdrawals, but any deposits are held for a few days before you have access to the funds. It can also take 3-4 days to transfer money from ING to another bank. I keep enough in the accounts that I’m always spending or transferring older deposits while I wait for the new ones to clear.

Even if you don’t like the bank, get a checking account, use it a few times and get $76 for very little trouble. Open a Sharebuilder account, buy some stock and collect $76 for it. Without an automatic payment, it will cost you less than $20 to buy, then sell the stock, netting you $56.

Who doesn’t like free money?

Net Worth Update

Now that my taxes are done and paid for, I thought it would be nice to update my net worth.

In January, I had:

Assets

- House: $252,900

- Cars: $20,789

- Checking accounts: $3,220

- Savings accounts: $6,254

- CDs: $1,105

- IRAs: $12,001

- Investment Accounts: $1,155

- Total: $297,424

Liabilities

- Mortgage: $29,982

- Credit card: $18,725

- Total: $48,707

Overall: $249,717.00

Here is my current status:

Assets

- House: $240,100 (-12,800) Estimated market value according to the county tax assessor. This will be going down in a few months when the estimates are finalized for the year. I don’t care much about this number. We’re not moving any time soon, so the lower the value, the lower the tax assessment.

- Cars: $15,857 (-4,932) Kelly Blue Book suggested retail value for both of our vehicles and my motorcycle.

- Checking accounts: $4,817 (+1,597) I have accounts spread across three banks. I don’t keep much operating cash here, so this fluctuates based on how far away my next paycheck is.

- Savings accounts: $6,418 (+164) I have savings accounts spread across a few banks. This does not include my kids’ accounts, even though they are in my name. This includes every savings goal I have at the moment. I swept a chunk of this into an IRA to lower my tax bill, which is also why my IRA balance is up as much as it is.

- CDs: $1,107 (+2) I consider this a part of my emergency fund.

- IRAs: $16,398 (+4,397) I have finally started to contribute automatically. It’s only $200 at the moment, but it’s something.

- Investment Accounts: $308 (-847) I pulled most of this out and threw it at a credit card.

- Total: $285,005 (-12,419)

Liabilities

- Mortgage: $28,162 (-1,820)

- Credit card: $16,038 (-2,687) This is the current target of my debt snowball. This has actually grown a bit over the last week. I did a balance transfer that cost $400, but it gives me 0% for a year, versus the 9% I was paying. That will pay for itself in 3 months, while simplifying my payments a bit and saving me almost a thousand dollars in payments this year.

- Total: $44,200 (-4,507)

Overall: $240,805 (-8,912)

Well, I lost some net worth over the last quarter, but it’s still a good report. If I disregard the change in value of my house and cars–two thing I have no control over–my overall total would have gone up almost $9,000.

All in all, it’s been a good year for me, so far, though paying off that credit card by fall is going to be a challenge.

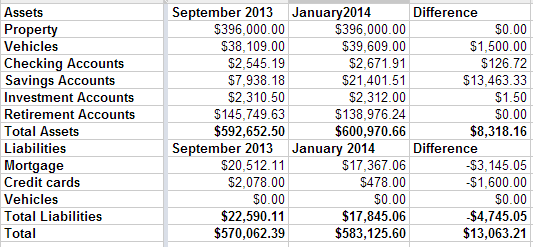

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

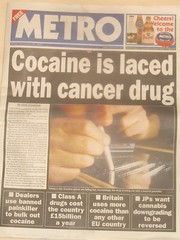

Cheap Drugs – How I Saved $25 in 3 Minutes

- Image by cackhanded via Flickr

Today, I stopped by the grocery store to pick up a couple of prescriptions. I always get the generics, because they are less than half the price of the name-brands, while still being chemically identical. That’s not what I’m talking about, although it did save me about $75 today.

When the pharmacist rang up my medications, the total came up to $35. That just wasn’t right.

Many chain pharmacies have gone to a cheap pricing model for generic drugs. That usually means $4-6 per monthly prescription. Cub Foods doesn’t have that.

So I asked for the price match.

Cub Foods matches prices on generics with whatever large pharmacy is nearby. In this case, they matched Target’s prices, bringing the price from $35 to $10. Instant $25 savings. I just had to wait for them to look up my prescriptions in their match-book.

Pharmacies with cheap generics:

K-Mart offers a 3 month supply for $15.

Target and Wal-Mart both have a 30-day supply for $4.

Publix offers a 14-day prescription for some antibiotics for free. That’s insane! It’s also a heckuva way to get people in the door. “Why don’t you shop for half an hour while I fill your scrip?”

If your pharmacy is anywhere near any of these stores, call and ask if they’ll match the price for generic drugs.

A few tips:

Before you go get your cheap drugs, call ahead and make sure what you need is on the cheap list. Don’t assume.

You won’t be able to use your insurance to buy the cheap generics. The overhead in insurance processing would mean that the pharmacies would be operating at a loss for each prescription. You can’t make that up in volume. Between our copays and deductibles, it’s far cheaper to just pay the generic price without involving the insurance company.

Don’t be afraid of generics. It’s not like Nike. Generics are chemically identical to the name brands. There are two differences: the price and the letter stamped on the side of the pill.

The stores offering cheap drugs are generally bigger stores hoping to use the drugs as a loss leader. Places like Walgreens or CVS make up to 70% of their profits from the pharmacy. They can’t stay open treating that as a loss leader.

How do you save money on prescriptions?

Resisting Temptation

This guest post was written as a guest post (by me!) in 2010.

There I was, minding my own business, when suddenly, Sumdood came out came out of nowhere and forced me to buy a new flat-panel TV, a time share in St. Thomas, and join one of those overpriced underwear-of-the-month clubs. Talk about a bad day, rivaled only by the day the odd, lacy package gets delivered on the first of the month.

No, really, as I go about my business each day, the temptation to spend my money can be almost irresistible. Yet somehow, I manage. Is it because I have superhuman willpower? I don’t. Is it because I’m chased by a leather-clad, sjambok-wielding pixie who chastises me for every unbudgeted purchase? That’s not it either, but it makes for a fun picture.

What’s my secret?

I follow a principle I like to call “Don’t buy that!” Don’t buy that! is a simple plan that is surprisingly hard to implement, mostly because following the plan means delaying gratification for a while. Delayed gratification is never as much fun as instantly indulging every whim.

I can hear your shouts of protest. If it’s so hard, how can I expect you to do it? Easy. Just follow the rules. There are a few things you can do to make Don’t buy that! a realistic plan of action for you.

1. Find a slap-me-upside-the-head buddy. I use my wife. It works for me and she tends to enjoy it. If I’m in a store and I get tempted to buy something awesome, I call her for a reality check. Sometimes, it’s as straight-forward as my calling her and saying “Honey, tell me ‘no’.” Other times, she actually has to talk me down using–horror of horrors–logic and reasoning. Usually, she just invokes rule #2.

2. If you have to check if you can afford it, you can’t. If I’m not immediately sure that we have the money to buy something, it is far too big of a purchase to buy on an impulse. Big purchases need to be planned. “Honey, I found this great TV on sale!” “Can we afford it?” “I don’t know, let me che…crap. Nevermind.”

3. You can have anything you want, but you can’t have everything. We could afford a fancy vacation in Paris every year, but not if we also pay for extended super-cable, Netflix, dinner out every night, and a new car every three years. Expenses need to be prioritized.

4. The little things can ruin you. There’s a story about a nail missing from a horse’s shoe, which lamed the horse, which made the knight miss a battle, which was lost, which led to the loss of the war, which led to the loss of the kingdom. For want of a single nail, a nation fell. If I buy a new book or movie every week, will I end up short on my mortgage payment? It’s far easier to pick up some of the little things after the necessities are met than it is to try to pay the mortgage after squandering your paycheck on lottery tickets and Mad Dog. Handle your needs before you worry about your wants. Sometimes, that means putting off the things you want, but having the things you need makes it worthwhile.

5. Remember the past. When I bought a bunch of movies a few months ago, I was happy. New movies go great the the movie screen and projector in my living room. Want to take a guess at how many of those movies I’ve taken the time to watch? I certainly enjoyed the act of buying the movies and the anticipation of watching them far more than I’ve enjoyed seeing them site on the shelf, unopened. What a waste. It happens regularly. Often, we get far more enjoyment out of the idea of doing something that the actual doing. If I can remember that the anticipation is better than the act, before I buy whatever is tempting me, I can usually avoid buying it.

These 5 rules have helped me to follow my master plan of Don’t buy that! That plan is the single most useful thing I have ever used to save money.

What’s your best tip to save money?