- I tried to avoid it. I really did, but I’m still getting a much bigger refund than anticipated. #

- Did 100 pushups this morning–in 1 set. New goal: Perfect form by the end of the month. #

- RT @BudgetsAreSexy: Carnival of Personal Finance is live 🙂 DOLLAR DOODLE theme: http://tinyurl.com/ykldt7q (haha…) #

- Hosting my first carnival tomorrow. Up too late tonight. #

- Woot! My boy won his wreslting match! Proud daddy. #

- The Get Home Card is a prepaid emergency transportation card. http://su.pr/329U6L #

- Real hourly wage calculator. http://su.pr/1jV4W6 #

- Took my envelope budget out in cash, including a stack of $2s. That shouldn’t fluster the bank teller. #

IRA or Powerball?

“When I win the Powerball, I’m going to buy that house and kick him out. I play diligently, so you know it’s going to happen.”

I had a friend say this to me this week. He’s poor–living on about $500 per month–and he was recently evicted from his apartment.

His plans for the future involve taking nearly 20% of his income and burning it playing the lottery. When he found out that I don’t play, he looked at me like I was stupid.

The odds of winning a life-changing amount of money are 1 in 5,153,632.65. That’s for a $1,000,000 prize. The next step down is $10,000, which, while helpful, won’t change many people’s situation for long. One in 5 million. That’s 5 times worse than your odds of being hit by lightning this year. It is, however, 4 times better than your odds of being sainted and 12 times worse than your odds of dating a supermodel.

It’s not going to happen.

Sure, play for fun–because turning cash into valueless slips of paper is a blast–but don’t play the lottery instead of working to improve your future. The lottery is NOT a retirement plan.

Instead, a much more reasonable plan is to date a millionaire. The odds of making that happen are just 215 to 1, and you can do things to improve your chances.

Improving the odds of dating a millionaire:

- Hang out where millionaires go. Yacht clubs, nice restaurants, rehab, that dark corner of their bedroom where the lamp never quite reaches that just looks perfect for a stalker-cam.

- Do what millionaires do. Golf, high-stakes poker, oppress third-world countries, Centrifugal Bumblepuppy.

- Look like millionaire-bait. For my friend, the 50-year-old black man, it might be hard to look like a 23-year-old blonde hardbody, but it’s worth the effort.

- Be nice, be polite, give good h…nevermind.

Seriously, getting a regular job and socking money away every month will give you a far better return on your investment than playing the lottery. Even if you’re saving it in a mayonnaise jar buried in the backyard next to that obnoxious guy who used to live next door, you will be building security and peace of mind. Every month, you will be better prepared for the storm of crap life tends to throw around.

Do you play the lottery? Why or why not?

Winning the Mortgage Game

There’s a game that’s often mistakenly called “The American Dream”. This game is expensive to play and fraught with risk. It single-handedly ties up more resources for most people than anything else they ever do.

The game is called Home Ownership.

At some point, most people consider buying a house. On the traditional, idealized life-path, this step comes somewhere between marriage and kids. That’s usually the easiest way to organize it. If you have kids first, you’re much less likely to buy a home. This is a game with handicaps.

Once you get to the point where you are emotionally ready to invest in the 30-year commitment that is a house, your first impulse tends to be to rush to the bank to find out how much money you can borrow.

That’s a mistake. If you take as much as the bank will qualify you for, you’re most likely to overextend yourself and end up losing your house. That’s the quick way to lose the home ownership game.

The best thing you could do is figure out how much you can afford before you visit a bank. Conventional wisdom says that your mortgage payment should be no more than 28% of your gross income, but that’s absurd. Who builds their budget on their gross income? I like 28%, but only of your net income. To make the numbers easier to remember, I’d round it to 30%. If you take home $3000 per month, your mortgage payment should be no more than $900 per month.

From there, it pretty easy to figure out how much house you can afford. Using this e mortgage calculator, you’d be able to afford a mortgage of $175,000 if we assume an interest rate of 4.5%. Throughout most of the United States, that will buy you a reasonably sized home, though certainly nothing ostentatious. Clydesdale Bank also has an excellent loan calculator.

Some people like to start out with an interest-only loan. That same emortgage calculator shows that an income of $3000 per month would be able to afford a $240,000 with almost the same payment. That seems like a good plan, but eventually, you’ll have to pay more than just the interest. Taking out a loan that will one day be more than you can afford on the assumption that you’ll be making more money by then is not sound financial planning. That’s the same logic that helped me bury myself in debt.

When you buy a house, make sure to base your payments and your mortgage on what you can realistically afford. Anything else, and you’ll only end up poorer and less happy than when you started.

The Evils of a Reverse Mortgage

Picture it: Sicily, 1922.

Sorry, wrong channel. Let’s try again.

Picture it: 20, 30, 50 years from now. You’re old. The money you’ve been failing to save so you could stock up on Fritos and obsolete video game consoles(to survive the zombie apocalypse in style) would come in handy about now, since the end of the world never happened. Note to self: Never trust an ancient Mayan.

You’re 70, with no savings and no income aside from the Social Security check that hasn’t been adjusted for inflation since the Palin(Bristol) administration.

But you own your house and that nice young man down at Yersk Rude Bank recommended a reverse mortgage. That could give you all of the money you need to live a comfortable retirement and pay for a bit of a funeral.

Right?

Nazzofast.

Of all of the possible social security strategies, this is one of the worst.

What is a reverse mortgage?

In a traditional mortgage, you’re given a chunk of money guaranteed by your home. You have to pay that money back over time, or you’ll lose your house. In a reverse mortgage, you’re still converting your home’s equity into cash, but you don’t have to pay it back until you die or move, including moving into a nursing home. You are effectively abandoning future-house in exchange for now-money.

Who qualifies for a reverse mortgage?

If you are 62 or older, and live in a home you own, you qualify. Credit and income are not considered.

Why would you want a reverse mortgage?

If money is tight and you have no prospects, a reverse mortgage may be a valid consideration. A better consideration would be to take out a traditional loan and make monthly payments out of that lump sum, or sell your house outright and move someplace more affordable.

What are the downsides of a reverse mortgage?

You lose your house. Technically, your heirs lose your house. A reverse mortgage becomes due when you die. If your heirs can’t cover the loan, the house will be foreclosed. Also, this is a loan. It accumulates interest, even if you aren’t paying it back. If you borrow $200,000 and die in 10 years, your estate may owe $400,000 on the reverse mortgage. If this is a treasured family home, losing it could come as a shocking blow at a time when your family would already be reeling from the loss of, well, you.

What if you really don’t like your heirs?

I’d still recommend getting a traditional mortgage. You can throw a killer party and then, you’ll rebuild equity over time. That way, if you live longer than you expect, you can refinance and throw another killer party. If you go this route, don’t invite the kids, but be sure to hire a videographer so they can see how you’re spending their inheritance.

I’m not a banker or a financial advisor, but I’d recommend against a reverse mortgage in almost all circumstances.

How about you? Would you get one, or recommend one? What’s your preferred method to hurt your ungrateful heirs?

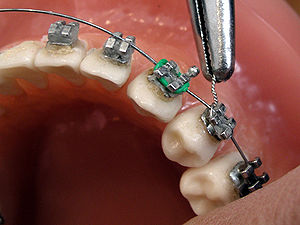

Braces

Grr!

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.

Debanking

I’m overbanked.

The National Bank, Oamaru, built 1871: a prostyle Palladian portico on a neoclassical facade (Photo credit: Wikipedia)I’ve mentioned that before.

I won’t give up my herd of CapitalOne 360 accounts. I use those to track my savings goals, all 17 of them. I can’t drop my business accounts, my kids’ savings accounts, or the personal accounts that I actually use to spend money.

I do, however, need to simplify a bit.

Last month, I went through the hassle of transferring my 401k from two jobs ago and my IRA from my last job. Now, I’m down to just two retirement accounts. One is for my current job, and the other is a self-managed IRA with Sharebuilder.

Two down.

A few months ago, I went to yet another bank to close an account. My last job offered crappy health insurance, but balanced it out with an HSA. It complicated things, but the actual costs came to almost the same as the previous plan that didn’t have a high deductible. When I left, my HSA just sat there.

Last year, my oldest got braces, so I cleaned out the HSA ahead of time so we could pay up front and save 5% without paying interest.

Another one down.

That’s three accounts down out of 34.

Thirty-four?

Crap. That’s retirement accounts, business accounts, and personal accounts for two adults and three kids.

Bank 1 has the checking account we use, plus two savings accounts, one of which is where we store the rent money until we take a payday.

Bank 2 has a checking account, 16 savings accounts, and stock-trading account, a CD, and two IRAs for my wife and I.

Bank 3 has a checking account, and savings account for each of two businesses I own, a spare set of personal accounts, a savings account for each of the kids, and a checking account for my teenager.

Bank 4 holds nothing but my current 401k.

The only thing I can simplify without sacrificing my organizational jungle is to combine the personal accounts from bank 1 and 3. The problem is that Bank 1 has all of my bill pay information and there is still an account open for my mother-in-law’s estate. We keep that open just in case we find any other checks we need to cash. Bank 3 has my business accounts tied to my personal account and is the bank that my business partner uses, so that’s convenient to move money around.

I may be stuck.