What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

I once saw a sign on the wall in a junkyard that said, “Failure to plan on your part does not constitute an emergency on my part.”

Another good one: “If everything is top priority, nothing is top priority.”

Once a week, I meet with my boss to discuss my progress for the previous week and my priorities for the coming week. This is supposed to make sure that my productivity stays in line with the company’s goals.

Great.

Once a day, my boss comes into my office to change my top priority based on whichever account manager has most recently asked for a status update for their customer.

Not so great.

At least twice a week, he asks for a status update on my highest priority items. Each time, he could mean the items we prioritized in the weekly meeting, or the items he chose to escalate later. Somehow, getting a new task escalated doesn’t deescalate an existing task.

Everything is a top priority.

To compensate, I’ve been working a few 12 hour days each week, and occasionally coming in on the weekends.

I’m dedicated and still behind.

Prioritizing is treated as an art, or in the case I just mentioned, a juggling act. It should be considered a science. It’s usually pretty simple.

That’s it. Too many times, we get hung up on urgent-but-not-important items and neglect the important things.

The hard part comes when it’s someone else setting your priorities, particularly when that person doesn’t rate things on urgency, importance, and cost but rather “Who has bitched the loudest recently?”

Can I tell my boss that I’m not going to do things the way he told me too? No. A former coworker very recently found out what happens when you do this.

Can I remind him that I’m busting my butt as hard as I can? Yes, but it will just earn me a request to come in on the weekend, too.

Can I ignore the official priorities part of the time, and work on what I feel is most important to keeping our customers happy? Yes, but it’s easy to go too far. “Boss, I ignored what you said, but this customer is happy, now!” won’t score me any points if it happens every week.

Priorities are simple, but not always easy. How do you balance your priorities?

I know I haven’t been doing the Sunday roundups very regularly. Do you miss them? Would you like to see something else here? When I do post them, I use it as a place to post some updates about my life that aren’t necessarily finance-related, and I post some links worth visiting.

Please let me know, I love feedback.

In the meantime….

Vacation, Shmaycation, Staycation? was included in the Canadian Finance Carnival.

The Unfrugal Meal was included in the Yakezie Carnival and the Totally Money Carnival.

Annoying Your Wife: 5 Ways to Succeed was included in the Carnival of Financial Planning.

Money Problems, Day 11 was included in the Best of Money Carnival.

Is that the best you can do? was included in the Totally Money Carnival, by a different host.

Thank you! If I missed anyone, please let me know.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great week!

For the past couple of years, my daughters have been riding in horse shows with a local saddle club. We’ve been lucky in that my wife’s cousin has let us borrow her horse for the shows, so costs have been minimal.

Unfortunately, that horse isn’t available this year. We knew that a few months ago, so the plan was to take a year off from the shows and focus on lessons, to get the girls some real skills. We found a great instructor at a stable about 30 miles from our house. Since we live less than two miles from the border of the biggest city in the state, that’s a comparatively short drive.

We pay her $200 per month for 1 lesson per week for both girls. They each get 30-45 minutes on the horse during each lesson.

Now that show season has started, the plan seems to have changed. The girls will be riding a different borrowed pony tomorrow. The shows cost about $50 for registration, lunch, and gas. Our club has 1 show per month, but my wife has assured me they’ll only be hitting three shows this season and limiting the number of events to keep the cost down.

The direct costs aren’t too bad, but there’s a problem with keeping-up-with-the-Joneses accessorizing. Vests and boots and helmets and belts and shirts, oh my.

I’d guess our costs for the summer will be $300 per month.

One thing we’ve been considering is buying a pony. We can get an older pony for around $500-1000. Older is good because they are calmer and slower. Boarding the thing will cost another $200 per month. We’ve been slowly accumulating the stuff to own a horse, so I’m guessing the “OMG, he let me buy a horse, now I need X” shopping bill will come to around $1500, but I’ll figure $2000 to be safe. We already have a trailer, a saddle, blankets, buddy-straps, combs, brushes, buckets, rakes, shovels, and I-bought-this-but-I-will-just-put-it-in-the-pile-of-horse-stuff-so-Jason-will-never-notice stuff. We’re certainly close to being ready to buy.

(FYI: If you’re starting from scratch, don’t think you’re going to get into horse ownership for less than $10,000 the first year, and that’s being a very efficient price-shopper.)

So we’re looking at $5400 for a horse, gear, and boarding the first year. If we cancel the lessons, by spring we’d have $2000 of that saved and most of the rest can be bought over time.

On the other hand, if we go that route, we’ll never save enough to buy the hobby farm we’re looking for.

Decisions, decisions. I should just buy a new motorcycle. Within a year, I win financially.

We’re making some changes to how we manage our finances this year. Our destination isn’t changing, but the trip is.

This is all stuff my wife and I have talked about and agreed to, but now, it’s organized and laid out. We HAVE to do it or something similar. We are both on board with this plan. We should see our debt management plan skyrocket, without feeling like we are missing out on life.

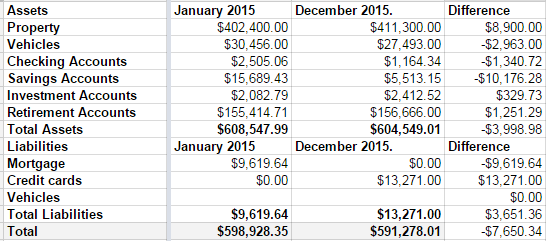

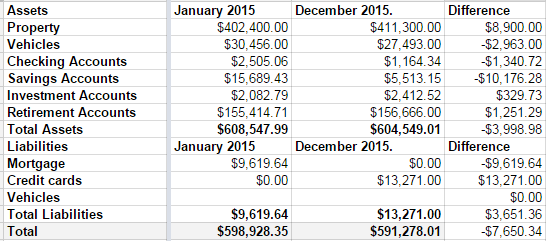

This was not a good year for our net worth.

Over the summer, we remodeled both of our bathrooms. At the same time.

1 out of 10: Don’t recommend.

We love the bathrooms, but–as with any project–it went over budget. Sucks to be us.

Then, towards the end of the year, we decided to push hard and pay off our mortgage in 2015. Part of doing that meant paying the credit card off slower than we’d like. It wasn’t the best long-term decision, but we’re mortgage-free now.

Those decision, coupled with a small slump in our investment accounts means we are worth $7650 going into 2016 than we were at the start of 2015.

Disappointing.

I’m also disappointed that our credit card discipline slipped last year.

New plan: No debt before tax day. Every cent of Linda’s paycheck, every cent of my monthly bonus checks, and every cent of any extra money we make is going into the remaining credit card debt. My math says that last debt will die on April 1st.

Then we get to talk about what to do with out money when there’s no debt. But never fear, I have a plan. A boring, boring plan.

So not that boring.

And when our kids all decide to become certified sign-spinners, we’ll have a huge nest-egg in the college fund savings account to spend on lottery tickets.