- @ScottATaylor Thanks for following me. in reply to ScottATaylor #

- RT @ChristianPF: 5 Tips For Dealing With Your Medical Debt http://su.pr/2cxS1e #

- Dining Out vs Cooking In: http://su.pr/3JsGoG #

- RT: @BudgetsAreSexy: Be Proud of Your Emergency Fund! http://tinyurl.com/yhjo88l ($1,000 is better than $0.00) #

- [Read more…] about Twitter Weekly Updates for 2009-12-12

Book Review: The Art of Non-Conformity

We grew up in a world of expectations: Eat your vegetables, don’t poop on the carpet, do your homework. It continues right up to “Go to college”, “Get married”, “Having a dozen kids”. Are those the expectations you want to use to guide your life?

Chris Guillebeau, author of The Art of Non-Conformity (the blog and the book) puts the question like this: We we were younger, we heard “If everyone else was jumping off of a cliff, would you do that too?” In theory, that meant we were supposed to think for ourselves. Yet, as adults, we are absolutely expected to conform and do the things everyone else is doing. Work your 40, take a week’s vacation once a year, and repeat until retirement or death.

Is that our only choice?

The Art of Non-Conformity attempts to be a guidebook, showing you how to live the live you want to live. Chris has made a lifelong series of decidedly unconventional choices, from dropping out of high school to attending 3 colleges simultaneously to spending 4 years as a volunteer in Africa. For the past few years, he has been working his way through visiting every country in the world. He is an expert on non-conformity.

The books tells a lot (a LOT) of stories of people who have either made the leap into a self-defined life or people who have done nothing but talk about taking that leap while staying comfortable in their soul-numbing careers.

The Good

The Art of Non-Conformity is an inspirational book. It spends a lot of time explaining how to break through the wall of fear to take control of your like. More important, it explains why you’d want to. It does not pretend to define how you should live your life, it just provides the framework for the mentality to help you make that decision for yourself.

The Bad

If you’re looking for a step-by-step guide, complete with a list of possible work-alternatives, this isn’t the book for you. This book approaches lifestyle design from the conceptual end rather than the practical. If you want a practical manual, I’d get the 4 Hour Workweek by Timothy Ferris. Ideally, you should get both. They complement each other well.

Overall, I thoroughly enjoyed the book. If you’re considering taking a non-standard path or just hate the career- or life-track you are on, you should read The Art of Non-Conformity. I’m planning to read it again in a couple of weeks, just to make sure I absorb all of the lessons.

Sunday Roundup: Reddit Rocks

Friday was my biggest traffic day, ever. Mike‘s guest post, Brown Bagging Your Way to Savings, went slightly nuts on reddit. For a few hours, it was in the top 10 on the front page, generating more traffic every half hour than I normally see in a day. That was fun.

In other news, my kid is in the #2 slot for wrestling the heavyweight slot on his wrestling team.

30 Day Project Update

This month, I am trying to establish the Slow Carb Diet as a habit. At the end of the month, I’ll see what the results were and decide if it’s worth continuing. For those who don’t know, the Slow Carb Diet involves cutting out potatoes, rice, flour, sugar, and dairy in all their forms. My meals consist of 40% proteins, 30% vegetables, and 30% legumes(beans or lentils). There is no calorie counting, just some specific rules, accompanied by a timed supplement regimen and some timed exercises to manipulate my metabolism. The supplements are NOT effedrin-based diet pills, or, in fact, uppers of any kind. There is also a weekly cheat day, to cut the impulse to cheat and to avoid letting my body go into famine mode.

I’m measuring two metrics, my weight and the total inches of my waist , hips, biceps, and thighs. Between the two, I should have an accurate assessment of my progress.

Weight: I have lost 25 pounds since January 2nd. That’s 3 pounds since last week. 17 more to meet my goal for February.

Total Inches: I have lost 14 inches in the same time frame, down 2.5 since last week.

Best Posts

J. Money has launched an awesome new project called Love Drop. Once a month, they go make a huge difference in someone’s life. Wise Bread interviewed them yesterday.

Tip: Use the word “solved” in a google search to find the answers to tech problems.

If OMG and Awesome got drunk and made a baby with Optimus Prime, Arnold Schwarzenegger and Cobra Commander’s nastiest fantasies, the offspring wouldn’t be this good. Holy crap. Major cheese alert.

Q. Why do some business lobby hard for excessive regulation in the name of protecting the environment or forcing people into decisions they disagree with, only to turn around and lobby for waivers to those regulations once they are passed? A. Because it’s not about the environment or health or giving-a-crap. It’s about the money. When an established company pushes for regulations, it’s to keep upstarts from entering the market. Regulations add barriers to entry. Anybody who’s trying to force you to do something for your own good has a product to sell to meet that “need”.

LRN Timewarp

This is where I review the posts I wrote a year ago. Did you miss them then?

Have you ever given any thought to the idea that debt is a social disease? It’s taboo, you usually didn’t do anything nice to get it, and it’s hard to get rid of.

In case I haven’t made it obnoxiously clear, I’m more than a bit of a geek. The post I wrote about D&D and personal finance should make it more obvious.

Carnivals I’ve Rocked and Guest Posts I’ve Rolled

Medical Costs and Choices was included in the Festival of Frugality.

How to Save Money On Anything was included in the Carnival of Personal Finance.

Mike from http://savingmoneytoday.net presented Brown Bagging Your Way to Savings, which is the post that went kinda nuts on reddit. He also hosted my post, Resisting Temptation.

Thank you! If I missed anyone, please let me know.

Get More Out of Live Real, Now

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great weekend!

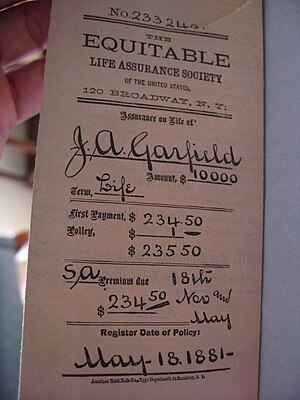

Protection for your Loved Ones

This is a guest post.

Life cover insurance acts as a safety net to pay for a family’s expenses should a wage earner become critically ill or die prematurely. Life cover includes life insurance as well as disability, critical illness, mortgage and income protection insurance policies.

Importance of life cover insurance

In most families, at least one adult is a wage earner and uses their income to pay for necessities such as food, clothing and rent or mortgage. If the wage earner becomes disabled, too ill to work, or dies, life cover insurance can pay for these expenses.

Stay-at-home parents provide valuable, though unpaid, services to the family. Without that person, the family would have to pay for childcare, household upkeep, errand running, and every other chore the stay-at-home parent did. If the stay-at-home parent has life insurance, these expenses can be covered.

Life cover insurance can pay off mortgages and education loans.

Live cover insurance policies will pay funeral costs, which can be substantial.

Family owned businesses can be insured and protected if the owner dies.

Objections

Life cover insurance is too expensive.

Insurance companies have plans to suit every budget and life circumstance. While young and healthy adults will generally receive the most affordable policies, older adults have plenty of reasonably priced options as well.

Disability or severe illness is unlikely.

Actually, 32% of men and 25% of women, ages 40 to 70, will experience a critical illness or disability. http://www.healthinsuranceguide.co.uk/statistics_mainbody.asp

Discussing disability or death is awkward and uncomfortable.

Agreed, but avoiding the topic puts loved ones into economic jeopardy. Without the wage earner’s life cover, a family could lose their home and have to lower their standard of living.

Variety of life cover insurances

Life Insurance

Term insurance is a protection policy, paid for during a specific time period (term), and is active during that time only. Permanent, whole, variable, universal and universal variable life insurance policies all are investment policies. They combine a death benefit (the amount paid out when the insured person dies) with an investment account. Licensed and experienced life insurance agents can help individuals make the best choice for their life situation.

Critical Illness/Disability Insurance

This type of insurance pays for living expenses if a person is diagnosed with a serious illness or disabled and can no longer work.

Mortgage Insurance

This is paid when the mortgage owner dies. This could help prevent the surviving family from having to sell the home.

The time to buy life cover insurance is now!

A 2010 survey (http://www.prnewswire.com/news-releases/ownership-of-individual-life-insurance-falls-to-50-year-low-limra-reports-101789323.html) stated that individual life insurance ownership was at a 50 year low in the United States. An estimated 35 million (30% of households) Americans do not have life insurance, and 11 million of these households have children under 18. Already living paycheck to paycheck, any debilitating injury or death of a wage earning adult could spell financial disaster to the family. Buying life cover insurance is a vital part of caring for loved ones. Just as a wage earner provides a home, food and daily necessities for their family, life cover insurance can take over and provide for the family if the wage earner unable to do so.

Sunday Roundup: Yep, It’s Saturday

Yes, it’s Saturday. Tomorrow, I’m hosting the Yakezie Carnival, so I bumped this up a day.

This week has been super relaxing. Wrestling season is over. We’re done with activities for a while.

30 Day Project Update

Last month, I was trying to do 100 perfect push-ups in a single set. I recorded each session in a spreadsheet. I hit my goal on the 28th, 3 days early. Since then, I’ve cut down to just one session per day. I’m now doing 35 slow, deep push-ups every morning. It’s not a goal, or a challenge, just part of a general effort to be healthier.

Weight Loss Update

I am on the Slow Carb Diet. At the end of the month, I’ll see what the results were and decide if it’s worth continuing. For those who don’t know, the Slow Carb Diet involves cutting out potatoes, rice, flour, sugar, and dairy in all their forms. My meals consist of 40% proteins, 30% vegetables, and 30% legumes(beans or lentils). There is no calorie counting, just some specific rules, accompanied by a timed supplement regimen and some timed exercises to manipulate my metabolism. The supplements are NOT effedrin-based diet pills, or, in fact, uppers of any kind. There is also a weekly cheat day, to cut the impulse to cheat and to avoid letting my body go into famine mode.

I’m measuring two metrics, my weight and the total inches of my waist , hips, biceps, and thighs. Between the two, I should have an accurate assessment of my progress.

Weight: I have lost 41 pounds since January 2nd. That’s 1 pound since last week and 8 pounds in March, while doing an insane amount of push-ups and packing on a few pounds of muscle. Seriously, for the last couple of weeks, on the days I haven’t totally slacked off, I’ve been doing 500+ push-ups a day. That’s a lot.

Total Inches: I have lost 23 inches in the same time frame, up 1 inch since last week. That makes me sad, but it seems to be muscle growth, so it’s not too bad.

Best Posts

Mint shows how lazy employees are, on average. Surprisingly, only 2.09 hours are wasted in the average 8 hour day. The rule I’d heard before is that employers expect 2-3 good, solid hours of work our of their employees every day.

Money Crasher has some cheap appetizer recipes. I can’t wait to make the biscuit meatballs.

The Mars Rover died. Tragic.

Get Rich Slowly has a post on emergency preparedness. If I mentioned that I keep enough supplies in my car to live for a week, would that make me a survivalist or just a fun guy?

LRN Timewarp

This is where I review the posts I wrote a year ago. Did you miss them then?

First, I examined the value of exchanging your time to save a bit of money.

Then, I talked about the futility of trying to force your spouse into frugality.

Carnivals I’ve Rocked and Guest Posts I’ve Rolled

Filing Bankruptcy: Pride or Shame? was an Editor’s Pick in the Totally Money Blog Carnival at Debt Free Divas. Thank you!

Budgeting tips – sticking to your budget was included in the Festival of Frugality.

Saving Money: The Warranty Fund was included in the Carnival of Personal Finance.

Thank you! If I missed anyone, please let me know.

Get More Out of Live Real, Now

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great week!

Why Companies Need to Acquire MIS Graduates

This is a guest post.

Most companies recognize that technology will play an increasing role in future success. That realization doesn’t necessarily mean that businesses know what type of professionals to hire. These four benefits should convince companies that they need to acquire MIS graduates.

To Reach More Customers

The Internet has radically changed the way that people shop. Consumers spent about $210.6 billion buying products from online retailers. At $4,778.24 billion, the business-to-business e-commerce volume is even greater. The trend is quite clear: businesses that want to increase sales need to offer their clients online options.

Despite its popularity, e-commerce is still an evolving industry that presents several unanswered questions to businesses that want to take advantage of it. Adding an information systems manager to a technology development team makes it easier to find solutions as businesses encounter new problems.

To Protect Customer Information

In January 2014, hackers stole information about 110 million Target customers. In September of the same year, hackers stole information from Kmart. When companies suffer security breaches, media outlets pick up the stories and spread them across the Internet. This creates terrible public relations scenarios that can make consumers cautious of using credit cards when shopping online or at stores.

A strong computer security team is the only way businesses can stop hackers from stealing customer information. That team needs to include several types of professionals who specialize in specific areas of computer technology. Someone with an Information Systems Management degree can bring those professionals together to create a security program that outwits even the best hackers.

To Become More Efficient

Companies need to cut spending and increase profits to remain competitive. Computer technology that focuses on efficiency accomplishes both of those goals. Without someone trained to build and maintain computer systems, businesses can’t keep up with competitors who understand that spending a little more money today on the right team members can lead to long-term benefits.

Businesses that don’t use computer technology to improve efficiency will likely fail to meet the needs of their customers. Either their services will suffer or their prices will go up. Either way, refusing to adopt new technology puts businesses at a significant disadvantage.

To Improve Communications

Communications plays a key role in helping businesses meet their goals. Today’s latest technology helps companies stay in contact with customers, transfer large amounts of information between offices, and develop database systems so employees and managers can access information instantly.

Improved communication technology doesn’t just happen on its own. It takes a commitment to building reliable computer networks that can transmit information securely. MIS graduates who enjoy traveling can use this as an opportunity to help businesses while exploring the world. While small businesses probably don’t need to hire a staff member dedicated to building computer networks, medium and large companies can benefit from hiring their own information technology staff members.

As technology continues to evolve, companies will need to rely on more IT professionals. What advantages do you think an MIS graduate could offer businesses in your community?