- Time to steal my son’s Wii. RT @fcn: Dang, watch Hulu on your Wii… http://bit.ly/9c0U8F #

- RT @FrugalDad: 29 Semi-Productive Things I Do Online When I’m Trying to Avoid Real Work: http://bit.ly/a4mcEI via @marcandangel #

- With marriage, if winning is your goal you will always lose. via @ChristianPF http://su.pr/2luvrz #

- RT @hughdeburgh: “There is no worse death than a life spent in fear of pursuing what you love.” ~ from http://FamiliesWithoutLimits.com #

- @chrisguillebeau The continental US can be done in 6 days on a motorcycle, but it’s not much of a visit. in reply to chrisguillebeau #

- Ugh. Google’s a twitter competitor now. #

- Took this morning off. Just did 45 pushups in 1 set/135 total. #30DatProject #

- RT @Moneymonk: To solve the traffic problems of this country is to pass a law that only paid-4 cars be allowed to use the highways. W Rogers #

- RT @SimpleMarriage Valentine’s Week of Giveaways: A Private Affair http://ow.ly/1oolpT #

- Your baseless fears do not trump my inalienable rights. — Roberta X http://su.pr/2qBR3P #

- RT @WellHeeledBlog: Couple married for 86 years(!!) will give love advice via Twitter on Valentine’s day: http://tinyurl.com/ybuqqtu #bp Wow #

- 193 pushups today, including1 set of 60. Well on my way to a set of 100. #30DayProject #

- @prosperousfool Linksys makes wireless repeater to extend the range of a router. in reply to prosperousfool #

- RT @MyLifeROI: Is anyone else unimpressed with Google Buzz? #

Paying for Rat

I’m cheap. I don’t even consider myself to be frugal. I’m cheap. A few days ago, I spent my entire year’s Halloween budget–on November 1st–so I could store my new treasures

for an entire year before using them, just to save $145.

However, there are some things that just aren’t worth going cheap.

When I first moved out on my own, a good friend walked me through the mistake of buying cheap cheese. A slice of the generic oil-and-water that some stores pass off as cheese will not cure a sandwich made from Grade D bologna.

That advice got me through some less horrible meals when I was younger.

Now, I’ve expanded the crappy cheese rule to extend to any meal I pay someone else to prepare. While I do occasionally hit a fast food restaurant when I’m traveling, I almost never do so any other time. I enjoy sitting down for a nice meal in a nice atmosphere while friendly people cater to my every whim. Well, almost every whim.

I’m not saying I go to $100 per plate steak houses every week, but I’m certainly not afraid to drop $20-$30 per meal.

My reasoning is simple: anything I can buy at a fast food restaurant or a cheap restaurant, I can make better at home for less. Why would I pay good money to sit at a sticky table and eat food that won’t let me forget it for 3 days?

If I’m going to spend the money, I’m going to eat something I either can’t make at home, or can’t make as well. Chinese food is one example. I can make it at home, but I don’t stock the ingredients, and I don’t enjoy the preparation, so I go out for it. Cheap Chinese food tends to be worse than anything else I’ve eaten, so I spring for good food. Cheap rat isn’t good rat.

How about you? What are you willing to pay full price for?

5 Things Guaranteed To Annoy Your Wife

One from the vaults….

If you’re married, or anything close to being married, you’ve irritated your wife. Even if you think you are perfect and the epitome of unannoyingness, I promise, there has been a day when she strongly wished you traveled for a living.

It’s long been known that the two things most likely to break up a marriage are money and sex. The former because there is too much, too little, or just the right amount going to the wrong places, and the latter because there is too much, too little, it’s not with each other, or it is with each other, but you’d really prefer otherwise. If your problem is the latter, I can’t help you.

If your problem is the former, I can help you understand some things you may be doing that are driving her batty. Kill-you-in-your-sleep-and-pretend-it-was-the-dog type of batty.

1. Nagging her about her shopping, but buying whatever you want. Gentlemen, this is known as a double standard. Don’t do it. In my house, my wife’s on an allowance. It was her idea. A few months later, I realized that I needed to be on one, too. Naturally, her allowance is bigger than mine. I don’t mind the disparity, because she still smokes. If her allowance didn’t give her room to smoke and shop, her allowance would be nothing more than a polite fiction. Whatever you do, find something that works for both of you and meets both of your needs, fairly. Anything else will only build a resentment that will burn for a long time.

2. Nagging her about her shopping, yet demanding she do all of the shopping. My wife has a weakness: clearance tags. If something is on sale, there’s a good chance it’s going to come to our house. I have an aversion to shopping. I hate it. Our budget dies a little bit each time my wife shops alone. We’ve come to an agreement. Now, I do most of the shopping, so she doesn’t feel tempted. I’m learning to embrace my inner material girl so we don’t have to have “discussions” every time she steps out for milk and comes home with $100 worth of clothes for the younger brats.

3. Nagging her about her shopping. Nobody likes being nagged. If you’re having a problem that keeps repeating itself, talking about it more won’t help. Neither will talking about it louder. You need to find a way to communicate that she will hear and understand. Different people communicate in different ways. Find the way that works for both of you.

4. Nagging her. A wise man once said, if everyone around you is a jerkface, maybe the problem isn’t everyone around you. Have you ever considered the idea that the problem might be you? If nagging is the only way you have to deal with people, you need to work on that. Don’t blame her. Maybe you’re ticked off about something that isn’t irritating. If that’s the case, she certainly has the right to be annoyed that you are nagging her.

5. Going on and on about how much you’d like to be me. Yes, I live the rockstar life, driving the station wagon with 6 disc changer and all. Yes, I am the neatest thing since sliced bread, and even that was a close contest, but really, confidence is important. You don’t have to be me to be cool. You’re swell, too. You’re right, this one isn’t about money, but it’s probably still irritating.

There you have it, my perfect solution to a happy marriage: don’t nag and quit trying to be me. There are other important bits, like love, respect, and communication, but this is a good start.

What do you do that annoys your spouse?

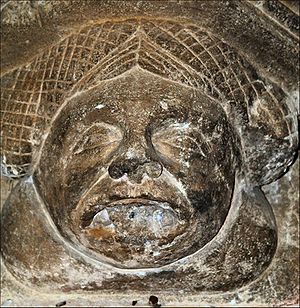

Cthulhu’s Guide to Finance

This is a guest post from Cthulhu, written in his house at R’lyeh. In the eons of his imprisonment, he has never contributed a blog post…until now. Be nice, this is his first post ever.

Cthulhu fhtagn. Cthulhu waits. Eons in R’lyeh–dead but dreaming–have taught me well the virtue of patience. Rush not into the abyss of hasty decisions.Lie patiently until the stars align and you can once again dominate your investments. As much as I despise virtues, patience is the one I practice.

Just as looking upon my form may cost you your sanity, obsessing over your finances may cost your loved ones the same. Instead, set your finances on a path of prosperity and work to hasten my return. Spend less than you earn. Earn more than you need. Give the rest to me.

Use the Shoggoth. Thought the postules of greenish light light may disgust those who have never devoured an entire planet, they are good for menial work. Use them, or their demented cousin, the automatic payment, to pay your bills. Set them to the task of making sure all of your bills are paid on time, leaving you free for more productive works. Do not, however, make the mistake of Ubbo-Sathla, whose fecundity spawned the vermin prototype known as homo sapiens. Keep your Shoggoth under control so they do not spend what you have not yet earned.

Avoid the Deep Ones. When dealing with the paramount evil(though I shouldn’t say that as a bad thing) of lenders, beware my servants. If they catch you in over your head, you will be screwed. If you cannot pay the price, there will be fees and punishments galore. A proper Cthulhu-fest of Chaos and Mayhem at your expense! A pound of flesh for every dollar not paid will be the standard when I arise, but for now, it is $39 for missing a payment or spending more than your limit.

“The only saving grace of the present is that it’s too damned stupid to question the past very closely.” This quote by my favorite historian demonstrates the futility of your mortal existence. If you learn from your mistakes, or–less painfully–the mistakes of others, you will grow as a person. Personal growth is entirely at odds with my goals as the Greater Evil. Learning from your mistakes will prevent you from making the same mistakes in the future. Einstein once said “doing the same thing over and over again and expecting different results” is the definition of insanity. That, or looking upon my form. One of those acts can be avoided. It is in your best interests to avoid insanity, at least until I awaken.

So many of those inhabiting my Earthly domain seem to suffer from my get Ghatanothoa‘s curse–absolute petrification in the face of their travails. When faced with a foe, fight! Do not collapse under the burden of your debts! Work! An inch, a dollar, a pound at a time: Defeat it! Do not quit and do not give up. Cthulhu does not forget or forgive.

That is the wisdom brought forth from my dead-but-dreaming slumber in R’yleh. Read it, understand it, follow it. It will serve you well until my return.

This post has been resurrected because I want to see it on the front page again.

Five Signs You Don’t Need That

Everybody occasionally buys things they don’t need, from DVDs to luxury cars. There are signs that what you’re buy may not be an actual necessity.

Here are five signs you should put that back:

- You’re buying that sweater or video game for the endorphin hit, you’re shopping for the addictive high not to fill an actual need. It’s a habit that’s as hard to break as smoking, if not harder. You can’t, after all, stop shopping altogether.

- You already have one. Or 10. A relative can’t turn down a sale and she buys for life. She regularly buys 3 of whatever useful gadget is available on the shopping channel. Her house has turned into a sad story of compulsive hoarding.

- The rationalizations for your purchase include “It’s cool” or “My friends all have one.” If you are buying something just for the bragging rights, it has become an ego purchase, which is something to avoid. The insidious part of an ego purchase is that you have to keep topping your last purchase and the last purchase of your social circle, or the purchases lose value. It’s a vicious circle.

- It doesn’t have a “place”. Where are you going to put it? Is it going to go in the corner, or is there a drawer or shelf it can live on. If there’s no play to consider “away”, you’re just buying clutter. If you must have it, go home and toss, sell, or donate 2 things to make room. If possible, do that before you actually by the new toy. If it’s important, you’ll come back for it.

- You didn’t know you needed it 10 minutes ago. If you actually need it, it’s on your list, right? Impulse purchases have been the biggest budget-killer in my house. That’s why we use Alice for the household goods. If we don’t see the it, we can’t throw it in the cart at the last minute. We no longer shop with the debit card, so we have to watch what we buy. It’s embarrassing to have to undo a purchase at the checkout because I didn’t bring enough cash.

What did I miss?

3 Things You Need to Know About Homeowner’s Insurance

- Image by ecstaticist via Flickr

If you are a homeowner, you need homeowner’s insurance. Period. Protecting what is mostly likely the biggest investment of your life with a relatively small monthly payment is so important, that, if you disagree, I’m afraid we are so fundamentally opposed on the most basic elements of personal finance that nothing I say will register with you.

If, however, you have homeowner’s insurance, or–through some innocent lapse–need homeowner’s insurance and you just want some more information, welcome!

The basic principle of insurance is simple. You bet against the insurance company that you or your property are going to get hurt. If you’re right, you win whatever your policy limit is. If you’re wrong, the insurance company cleans up with your monthly premium. Insurance is gambling that something bad will happen to you. If you lose, you win!

Now, there are some things about homeowner’s insurance that you may not realize.

1. Homeowner’s insurance will not protect you against a flood. For that you need flood insurance. The easiest way to tell which policy covers water damage is to see if the water touched the ground before your house. An overflowing river, or heavy rain that seeps through the ground and your foundation are both considered flooding. On the other hand, hail breaking your windows and allowing the rain in or a broken pipe are both generally covered by your homeowner’s policy.

Do you need flood insurance? I would say that, if you live on the coast below sea level, you should have flood insurance. If you’re on a flood plain, you need flood insurance. If you’re not sure, use the handy tool at http://www.floodsmart.gov to rate your risk and get an estimate on premium costs. My home is in moderate-to-low risk of flooding, so full coverage starts at $120.

2. You can negotiate an insurance claim. When you have an insurance adjuster inspecting your home after you file a claim, most of the time they will lowball you. Generous adjusters don’t get brought in for the next round of claims. If you know the replacement costs are higher than they are offering, or even if you aren’t sure, don’t sign! Once you sign, you are locked into a contract with the insurance company. Take your time and do your research. Get a contractor out to give you a damage estimate, if you can.

3. Your deductible is too low. If you’ve built up an emergency fund, you can safely boost your deductible to a sizable percentage of that fund and save yourself a bunch of money. When we got our emergency fund up to about $2000, we raised our deductible from $500 to $1000 and saved a couple of hundred dollars per year. That change pays for itself every 2 years we don’t have a claim. I absolutely wouldn’t recommend this if you don’t have the money to cover your deductible, but, if you do, it can be a great money-saver.

Bonus tip: If you get angry that your homeowner’s insurance doesn’t cover flooding, even if you haven’t had to deal with a flood, and you cancel your insurance out of spite, and you subsequently have a ton of hail damage, your insurance company won’t cover the crap that happened during the window where you weren’t their customer.

Are you one of the misguided masses who prefer to trust their home to fate?

Do you have an insurance horror story?