- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

Swamp Finance

I wrote this post was as a guest post a year ago, to answer the question, “What is the best financial advice or tool you have found or been given?”

Once upon a time, there was a young man–an arrogant man barely out of childhood–who thought he new more than anyone he had ever known, trusted, or respected. In his arrogance, he left his family and friends behind to enter the wilderness in search of a long lost teacher.

He found the teacher. He even managed to convince the teacher to accept him as his pupil.

However, he didn’t change his ways. He insolently ignored the fundamental lessons, assuming he already understood them. When he was rebuked by his teacher, his only defense was to whine that he was “trying”.

“Do or do not. There is no ‘try’,” replied Yoda.

These words of wisdom represent one of the most fundamental rules of personal finance, or even life, itself. If the best you have to offer is a half-hearted “try”, you will never succeed.

When my wife and I decided that it was time for our debt to die the death of a sad specter of self-loathing hiding in a cave, we went at it with a relish that would have launched a poor astromech droid to the freakin’ moon!

We never said we’d give it a shot for a month and see how it went. We knew that we either needed to succeed or we’d have to file bankruptcy. We didn’t try, we did it. Rather, we are doing it. Friends told us it was impossible to live without credit; that we were foolish to try. They were right, so we didn’t try.

Similarly, when it was time to get started on a college fund instead of hanging our hopes on scholarships, we just did it. Sure, we started the fund with just $10, and it is only growing by $10 per month, but it’s there and it’s growing. When we get our debt paid off, we’ll see exactly how close we can get to giving our kids a self-funded full ride to college.

When it comes time to get the things done that you know need to be done, the trick is to do it. Don’t make excuses. Don’t “try” to find time. Just make it happen. Cut up your credit cards, make your budget, or sell the stuff you don’t need. Whatever it is, do it.

There is no try. There is only DO!

Pros and Cons of Cashback Credit Cards

The news that the Bank of America is introducing a cashback credit card is of little surprise. The credit card industry is competitive and customers enjoy the thought of earning while they are spending!

There are both pros and cons of cashback credit cards however and they are not suitable for every circumstance. So, before committing to a card, consider the advantages and disadvantages.

Firstly, cashback cards can be financially profitable but this depends on whether you have the funds to make the repayments. If you are having difficulties with debt, these cards are probably not the most suitable.

The strategies for maximizing your benefits from cashback credit cards depend on making repayment deadlines. Prioritize cards that have a 0% APR introductory rate.

If you can make your repayments within this 0% interest rate, or on time each month, you will not incur any interest charges. It is important to be organized so that you always meet repayment dates.

Once the 0% APR has finished, cashback credit cards will often then revert to a high APR. If you cannot pay all your debt, these charges will mount up quickly.

If this is likely to happen to you, consider looking at alternative cards with a low but constant APR, so that you do not encounter such high charges while repaying your debt.

Cashback cards are not always the smartest move financially when it comes to outstanding debt. Although they may offer a 0% balance transfer, this is not always as simple as it sounds.

If you transfer an outstanding balance to a new card, even with a 0% APR introductory period, any repayments made will be charged against your newest purchases.

This means that it is more difficult to pay off the original balance transfer if you are also using the card to purchase new items and of course, it is very tempting to do so as you have the 0% APR available.

Be aware that if you do not pay the balance transfer amount by the end of the 0% period, you will then have to pay a much higher rate on this amount.

So you either need to be sure that you can pay off the balance transfer in full in addition to new purchases or consider using a separate card just for a balance transfer.

Although this may seem more work, it can potentially save you a great deal of money in interest charges. Remember any credit card is only worthwhile if it helps you manage your money.

Some cashback cards also have a minimum spend requirement and often this is paired with a specific time frame. Read all the criteria about the card before committing to it.

Otherwise, you could be charged for not reaching the minimum spend limit or not doing so within the required time frame. Consider these issues when choosing a card.

Cashback cards can be very useful and allow you to earn money while you are spending, but they need to be used with wisdom. Research your options to ensure you select the right card for you.

Post by MoneySupermarket.

BUYING LIFE INSURANCE ONLINE: THE PROS & CONS

This is a guest post.

In today’s day and age, nearly everything that we do in our day-to-day lives can be done online and we’ve come to not only expect that, but somewhat rely on that convenience. Insurance, however, is kind of a grey area when it comes to online purchases – no matter what kind of insurance you’re purchasing. After all, an insurance policy is no small purchase; it’s major and can have a profound financial effect on your life, and the lives of your loved ones.

Think about it like this – how wary are you of even just making a small eBay purchase? Most of us look at the seller’s rating, read their feedback, and try to accurately gauge what the risk is compared to the reward. This same mentality should apply to making a life insurance policy online and is far more deserving of it. You can follow this link to learn more from Suncorp today.

This isn’t to say that making an online life insurance purchase can’t be beneficial; depending on your situation, it can be very beneficial, indeed. However, it is going to take substantially more research on your part to get to where an insurance agent might be able to get you, sometimes in half the time.

Pros of Buying Online

One of the most alluring reason for life insurance seekers to buy online are the prices, the comparing conveniences, and sometimes the lack of medical exam. There’s plenty of aggregator sites out there that can take a sampling from across the internet and return you a quote within a matter of seconds – how’s that for convenience?

Probably the most favored feature, though, is the comparison shopping. Once an aggregator provides you with a slew of options, with a wide variety of price points, you’re able to compare all of the details among them, quickly and easily. Something that would easily take your hours if you were having to do all of that research yourself, one by one.

At the minimalist level, though, you’ll often find that some individuals just truly feel more comfortable making insurance purchases from the comfort of their own home, without any agents or appointments. Either because these situations make them nervous, or because they simply don’t have the time to sit down with an agent.

Cons of Buying Online

One of the big ones revolves around the last “pro” that I mentioned – if you don’t have the time to sit down with an agent for a limited amount of time, and let them do all of the work from there, you certainly don’t have the time to handle all of the research that comes along with going through this process on your own.

Also, you shouldn’t always assume that shopping around yourself is going to save you money with it comes to life insurance – after all, life insurance agents have personal connections, favors to call in, and think-on-their-feet knowledge that might drum up an innovative solution; something that online aggregators can’t do.

Furthermore, building that one-on-one relationship with your life insurance agent can be incredibly beneficial. For one thing, you can have every last little thing that you don’t understand about the fine print thoroughly explained to you – this is a big one. Another thing is having such a relationship with you agent, that you can call them at any time, when anything comes up, or when you need sound financial advice. Try calling an aggregator and see if you get much beyond the auto-answering system – I assure you, it’ll be a challenge.

If You Do Decide to Buy Online…

- Don’t Give Out all of your Personal Information – No matter what the insurer tells you, you don’t need to provide any crucial personal data just to obtain a quote.

- Enlist the Service of an Aggregator that Can Give You a Wide Variety of Options – Comparing an insurer there and an insurer there, means very little actually. You need a plethora of results in order to make a decision that will best be tailored to your situation.

- Don’t Get Swindled – Make sure that you’re getting the right information, from a reputable company, that doesn’t deal in the ole’ “Bait-and-Switch”; which refers to when crooked life insurance agents inflate your worth and buy you either a higher policy than requested, or even a different policy entirely – all for their commission!

- Thoroughly Research all Potential Candidates – Obtain the financial rating of any establishment, online or otherwise, to find out more about the reputability of both.

Saturday Roundup

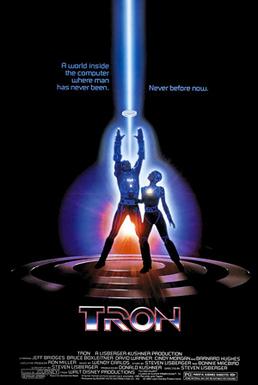

- Image via Wikipedia

I wrote this yesterday. According the forecast, when this post goes live, I’ll be moving 5-8 inches of snow off of my driveway.

That, or watching TV and thinking about moving snow.

Maybe I’ll just sleep in and wait for spring to melt the snow.

Don’t forget to enter my drawing for a $100 Amazon gift card! Go here for details. It ends on the 15th, so don’t wait too long.

Best Posts

Crazy-easy ice cream bread. How could this possibly be bad?

Tron comes out in 2 weeks. I’d love to show up on a custom street-legal Troncycle.

Arsenic-based lifeforms are shaking up the way we understand life to work. I’m of the opinion that life will probably exist almost everywhere that isn’t a completely dead dry rock. I say that as an expert in…well, nothing related to astrobiology.

Following Erica’s advice is currently making me a few hundred dollars per month, with every sign of growing as time goes on. I hate to sound like a fanboy, but if she pimps a product, I’m at least going to give it some serious consideration.

Carnivals I’ve Rocked

10 Dumb Money Moves was featured in the Carnival of Debt Reduction.

Book Review: The Art of Non-Conformity was included in the Carnival of Personal Finance.

Things You Should Buy Online to Save Money was included in the Festival of Frugality.

Thank you! If I missed anyone, please let me know.

LRN Timewarp

This is a new feature to share the gift that is me with anyone new to LRN. This week, I’m going to share some posts from my first week blogging here.

The $10 College Fund. In the last year, not only have I not changed my mind about the $10 college fund, but I haven’t raised the amount. The point is to just get started. I’ve done that. I’ll raise the amount when my debt is paid off. We are now up to $166.09. The numbers are off because I stuck a little bit extra in one month.

In the last year, our dreams haven’t changed. We haven’t made any direct progress, but indirectly we are doing well. First things first. We need to pay the debt off before we look at a hobby farm.

My second day blogging, I wrote about why we handled money so poorly.

The Happy Challenge

Watch this video.

Done?

Great.

For the cheaters, the part I am most interested in is the bit about reprogramming your brain for happiness. Studies are showing that you can rewire yourself to be happier by doing happy things.

The science is sound. Good things trigger a dopamine reaction. Your body likes dopamine, so you start craving the things that make it happen, which all happen to be good things. As you suffer dopamine withdrawal, you become driven to do what it takes to get your fix.

The process is similar to heroin withdrawal, with no downside.

Hugging your kids(assuming you like them) triggers the reaction. So does sex, successes at work, and beating a video game.

The specific plan mentioned in the video is to write down three things that you are grateful for, once per day, for 21 days in a row. That will begin the self-reinforcing training that can get you hooked on being happy.

That’s a win. 75% of job success is predicted by your attitude. You are 31% more productive when you are happy. You’re also more fun to be around.

That’s a win.

Here’s my challenge:

For the next 21 days, do it. Write down 3 thing you are grateful for. What makes you happy? It’s okay if it’s hard. If it’s hard for you, you need it more than most.

Now, the truly hard part:

Fill out this form every day. Your answers can be as long or as short as you’d like, but there has to be 3 new things every day for 21 days. We’re going to train your brain to look for the positive, so you can’t give me 63 things on day 21. 3 things, 21 days.

On day 22, tell me how the previous 3 weeks have been.

When it’s over, I’ll hold a drawing for everyone who completed the challenge. Not everyone will see this immediately, so I’m going to run the challenge until May 15. That means you have until April 24th to get started.

3 answers per day means three prizes. I’ll give away a total of $250 to three lucky participants. That’s a $125 prize, a $75 prize, and a $50 prize, but you have to obey the rules. 3 things, 21 days in a row.

Be happy. I dare you.