- RT @ScottATaylor: The Guys on "Pickers" should just follow the "Hoarders" teams around- perfect mashup #

- PI/PNK test: http://su.pr/2umNRQ #

- RT @punchdebt: When I get married this will be my marital slogan "Unity through Nudity" #

- http://su.pr/79idLn #

- RT @jeffrosecfp: Wow! RT @DanielLiterary:Stats show 80% of Americns want to write a book yet only 57% have read at least 1 bk in the last yr #

- @jeffrosecfp That's because everyone thinks their lives are unique and interesting. in reply to jeffrosecfp #

- @CarrieCheap Congrats! #CPA in reply to CarrieCheap #

- @prosperousfool I subscribe to my own feed in google reader. Auto backup for in between routine backups. Saved me when I got hacked. in reply to prosperousfool #

- @SuzeOrmanShow No more benefits? I bet the real unemployment rate goes down shortly thereafter. in reply to SuzeOrmanShow #

- Losing power really make me appreciate living in the future. #

Avoid Getting Ripped Off On Ebay

My son, at 10 years old, is a deal-finder. His first question when he finds something he wants is “How much?”, followed closely by “Can I find it cheaper?” I haven’t–and won’t–introduced him to Craigslist, but he knows to check Amazon and eBay for deals. We’ve been working together to make sure he understands everything he is looking at on eBay, and what he needs to check before he even thinks about asking if he can get it.

The first thing I have him check is the price. This is a fast check, and if it doesn’t pass this test, the rest of the checks do not matter. If the price isn’t very competitive, we move on. There are always risks involved with buying online, so I want him to mitigate those risks as much as possible. Pricing can also be easily scanned after you search for an item.

The next thing to check is the shipping cost. I don’t know how many times I’ve seen “Low starting price, no reserve!” in the description only to find a $40 shipping and handling fee on a 2 ounce item. The price is the price + shipping.

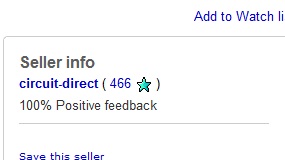

Next, we look at the seller’s feedback. The feedback rating has a couple of pieces to examine. First, what is the raw score? If it’s under 100, it needs to be examined closer. Is it all buyer feedback? Has the seller sold many items? Is everything from the last few weeks? People just getting into selling sometimes get in over their heads. Other people are pumping up their ratings until they have a lot of items waiting to ship, then disappear with the money. Second, what is the percent positive? Under 95% will never get a sale from me. For ratings between 95% and 97%, I will examine the history. Do they respond to negative feedback? Are the ratings legit? Did they get negative feedback because a buyer was stupid or unrealistic? Did they misjudge their time and sell more items than they could ship in a reasonable time? If that’s the case, did they make good on the auctions? How many items are they selling at this second?

[ad name=”inlineright”] After that, we look at the payment options. If the seller only accepts money orders or Western Union, we move on. Those are scam auctions. Sellers, if you’ve been burned and are scared to get burned again, I’m sorry, but if you only accept the scam payment options, I will consider you a scammer and move on.

Finally, we look at the description. If it doesn’t come with everything needed to use the item(missing power cord, etc.), I want to know. If it doesn’t explicitly state the item is in working condition, the seller will get asked about the condition before we buy. We also look closely to make sure it’s not a “report” or even just a picture of the item.

Following all of those steps, it’s hard to get ripped off. On the rare occasion that the legitimate sellers I’ve dealt with decide to suddenly turn into ripoff-artists, I’ve turned on the Supreme-Ninja Google-Fu, combined with some skip-tracing talent, and convinced them that it’s easier to refund my money than explain to their boss why they’ve been posting on the “Mopeds & Latex” fetish sites while at work. Asking Mommy to pretty-please pass a message about fraud seems to be a working tactic, too. It’s amazing how many people forget that the lines between internet and real life are blurring more, every day.

If sending them a message on every forum they use and every blog they own under several email addresses doesn’t work and getting the real-life people they deal with to pass messages also doesn’t work, I’ll call Paypal and my credit card company to dispute the charges. I only use a credit card online. I never do a checking account transfer through Paypal. I like to have all of the possible options available to me.

My kids are being raised to avoid scams wherever possible. Hopefully, I can teach them to balance the line between skeptical and cynical better than I do.

Corporate Bankruptcy Hurts Employee’s Most

This is a guest post from Hunter Montgomery. He writes for Financially Consumed on every-day personal finance issues. He is married to a Navy meteorologist, proud father of 3, a mad cyclist, and recently graduated with a Master’s degree in Family Financial Planning. Read his blog at financiallyconsumed.com.

Bankruptcy has evolved from something that people and businesses were deeply ashamed of a few decades ago, to a seemingly acceptable path to restructuring; towards a more sustainable future. Bankruptcy is so common in corporate America that it is referred to by some as an acceptable and necessary business tool.

This bothers me on a number of levels, but mainly because corporate bankruptcies hurt the humble employee the most. The laws are supposedly designed to help the company stay in business, and continue to provide jobs. But at what cost to those employees?

When a company declares bankruptcy, they are essentially admitting to the world that they failed to compete. Their business model was flawed, they were poorly managed, and they simply did not organize their resources appropriately to meet their consumer needs.

Given this failure, it shocks me, that bankruptcy laws are designed to allow management to get together with their bankers. They essentially protect each other. Management is obsessed with holding on to power. The bankers are obsessed with avoiding a loss.

The bankruptcy produces a document called first-day-orders. This is a blueprint for guiding the organization towards future prosperity. But this is essentially drafted by the existing company management, and their bankers. Do you see any conflict of interest emerging here?

Bankers are given super-priority claims to the money they have loaned the company. Even before employee pension fund obligations. This is absurd. Surely if they loaned money to an enterprise that failed, they deserve to lose their money.

Management generally rewards itself with large bonuses, after declaring failure, paying off their bankers, shafting the employees, and finally re-emerging with a vastly smaller company. This is ridiculous.

The humble employee pays the highest price. Assuming there is even a job to return to after restructuring they have likely given up pay, working conditions, healthcare benefits, and pension benefits.

This is exactly what happened at United Airlines in 2002 after they filed for chapter 11 bankruptcy protections. The CEO received bonuses, and was entitled to the full retirement package. The banker’s enjoyed super-priority claims over company assets to cover their loans. Meanwhile, the employees lost wages, working conditions, healthcare benefits, and a 30% reduction in pension benefits.

An adjustment like this would force a serious re-evaluation of retirement plans. For most people, it would require additional years in the workforce before retirement could even be considered a real possibility.

Employees of General Motors, which recently went through bankruptcy proceedings, also had to give up significant healthcare benefits, and life insurance benefits. Entering bankruptcy, it was the objective to reduce retiree obligations by two-thirds. That’s a massive cut.

The warning to all of us here is that we must do everything possible not to fall victim to corporate restructuring. Save all you can, outside of your expected pension plan, because you never know when poor management, or a terrible economy, will force your employer to file bankruptcy. Always plan for the worst possible outcome.

It’s a competitive world and it’s quite possible that the traditional American system of benefits is uncompetitive, and unsustainable in the global market place. The tragedy of adjusting to a more sustainable system is that the employee suffers the most.

Zombie Wheels: How to Own a Car That Just Won’t Die

The average car dies somewhere between 100,000 and 150,000 miles. My car is coming up on the lower end of that range and I’d like to see it last a lot longer than the top end. I paid the thing off in January, and I’ve grown fond of not having a car payment. Extending the useful life of your car–and continuing to use it–means fewer car payments and cheap auto insurance premiums.

Who really wants to keep making car payments month after month, year after year? I want my car to outlast me. Scratch that. If that wish come true, I’ll have a meteor fall on me the day before the transmission explodes.

How can you help your car continue past undeath, past the point when other cars have given up and accepted the True Death?

Keep Your Gas Tank Full

Here in the frozen north(though not as frozen or as north as some of you), it’s conventional wisdom to keep your gas tank full in the winter to prevent your fuel lines from freezing. Did you know you should keep it full the rest of the year, too? An empty tank is more likely to rust. Even before the rust eats a hole through the tank, there are tiny flakes of rust drifting into the gas lines and clogging the fuel system.

Change Your Oil

When you run old oil, you’re leaving contaminants and little flakes of metal flowing through all of the important moving bits of your engine. Changing your oil removes those tiny abrasive bits from the equation. I don’t recommend buying into the propaganda put out by the oil-change stores and changing it every 3000 miles, but do it regularly. I aim for about every 5000 miles, but a better recommendation is to do whatever your owner’s manual says.

In between changes, don’t forget to check your oil level and top it off when it’s needed. All by itself, that will improve your fuel efficiency and keep your car running happy.

Consistently keeping up with just these two small things will keep your car running smoothly for a long time.

How many miles are on your car? How long do you plan to keep it?

Sunday Roundup

My girls have been riding in horse shows lately. Sometimes, it seems like that’s all we’ve been doing on the weekends, but they love it. My wife’s favorite hobby now matches my daughters’ favorite pastime. As a bonus, we’ll never have to paint their room again, with the way they are accumulating ribbons.

Best Posts

It is possible to be entirely too connected.

My life is now complete. It’s possible to buy 95 pounds of cereal marshmallows for just $399. Breakfast at my house just got perfect.

I wholeheartedly agree with Tam, “You don’t need to make any excuses for crashing things into each other at the speed of light in an underground tunnel longer than Manhattan that’s had the air pumped out and been chilled to a couple degrees above absolute zero. That doesn’t need a reason. “

Carnivals I’ve Rocked

Credit Cards: My Failed Experiment was included in the Best of Money Carnival, the Carnival of Wealth, and the Totally Money Blog Carnival.

My niche site article on how to Make Extra Money with Keyword Research was included in the Totally Money Blog Carnival.

Thank you! If I missed anyone, please let me know.

The Story of Sammy

As I’ve mentioned, we’re cleaning out my mother-in-law’s house. She was a hoarder who passed away a couple of months ago. As of yesterday, we’ve filled two 30-yard dumpsters. For perspective, that’s big enough to park our F150.

I’m not here to talk about that, or the 20 year old can of green beans that burst and ran down my leg on Saturday.

Last month, we put a recliner out on the curb with a free sign. A few minutes later, a couple of guys stopped by and grabbed it.

Last week, one of the guys–I’ll call him Sammy–stopped by and left a note on the windshield of one of our inherited cars, asking about buying it.

Long story short, we sold him two cars. One hadn’t been run in a year or two, and one had been parked for almost 20 years. We signed this titles and let him take the cars while he was still $50 short of the purchase price. This isn’t a story about the cars.

It’s a story about Sammy.

Sammy doesn’t have a lot of money. He’s living off of a monthly check from an old injury, and his fiancee works part-time. They’re living in Section 8 housing, and consistently have more month than money. When he was younger, he made some decisions that make some forms of employment difficult now.

On Friday, Sammy stopped by. He was supposed to give us $50, but said that getting one of the cars running had cost more than expected, and it still had a problem that was keeping it from being safe on the road. He asked about an extension.

No problem.

Then, he looked around my mother-in-law’s overgrown yard and asked if he could help. After we negotiated the price, he asked if he could a) borrow our tools for the work, and b) get a ride Saturday morning.

I am a nice guy.

Saturday, I was planning to pick him up, then drive downtown to pick up a friend who has been living at the Salvation Army since moving to the area. His friend was so excited about the work, he hopped on a bus at 6am and got to Sammy’s house.

When I got there, Sammy also had a teenager he was mentoring. He told me that his dream was to start a lawn-care business with his friend, so they can put kids to work and help them turn into productive citizens. Idle, broke, and bored teenagers are a recipe for disaster. Teenagers who grow into men not believing they have a chance to change their future are worse.

I dropped them off and went to have a chat with my wife.

We’re far from rich but, at the moment, we are fairly flush. We’ve found some cash, and a there is a bit of life insurance money. Most of that will be going into remodeling the house, but we have a bit extra. If we can take a few hundred dollars, and help launch Sammy into a business that will help him, his family, and a circle of kids with few prospects, I think it’s the right thing to do.

When I told Sammy what we were considering, he started to break down. It was a truly emotional experience for him to know that somebody was willing to take a chance on him.

I told him to put together plan. I want to know what it would take for him to get started. Hopefully, he’s serious enough to do that. I’d like to help.