- RT @bargainr: Life in North Korea is absolutely dreadful http://nyti.ms/dAcL26 #

- RT @bitfs: Weekly Favorites and Gratitude!: My Favorite Posts this Week Jeff at Deliver Away Debt threw together the .. http://bit.ly/9J0gGo #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X # #

- Baseless claims, biased assumptions, poor understanding of history. Don't bother. #AnimalSpirits #KeynesianCult #

- RT @zappos: Super exciting! "Delivering Happiness" hit #1 on NY Times Bestseller list! Thanks everyone! Details: http://bit.ly/96vEfF #

- @ericabiz Funny, we found a kitten in a box last week. Unfortunately, it was abandoned there, not playing. Now, we have a 5th cat. in reply to ericabiz #

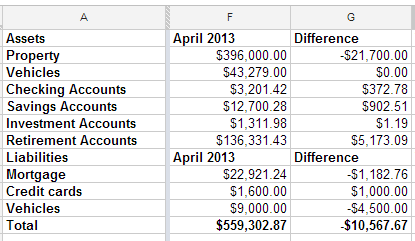

Net Worth Update

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.

Experiences v. Stuff

- Image by hunterseakerhk via Flickr

On Friday, I went to see Evil Dead: The Musical with some friends. The play obviously isn’t a good match for everyone, but we are all horror movie fans, I’m a Bruce Campbell fan, and all of us had seen and enjoyed at least Army of Darkness. It was a good fit for us.

The play, followed by a late dinner and drinks with people I care about, was easily the most money my wife and I have spent on a night out in years. That’s including an overnight trip for my cousin’s wedding.

Now, several days later, I keep thinking about that night, but not with regret about the price. I keep thinking about the fun I had with my wife and some of our closest friends. We saw a great play that had us in stitches. We had a few hours of good conversation. We had a good time. I would happily do it all over again. In fact, I would happily reorganize our budget to make something similar happen every month.

I don’t remember the last time I spent 3 or 4 days happily thinking about something I bought.

I look around my house at the years of accumulated crap we own and I see a big rock tied around my neck. Even after a major purge this spring, we’ve got more stuff than we can effectively store, let alone use. When something new comes in the house, we spend days discussing whether we really need it or if it should get returned. When we plan a big purchase, we debate it, sometimes for weeks.

Getting stuff is all about stress.

My wife and I are both familiar with the addictive endorphin rush that comes with some forms of shopping. I wish the rational recognition of a shopping addiction was enough to make it go away. Buying stuff makes us feel good for a few minutes, while high-quality experiences make us feel good for days or weeks, and gives us things to talk about for years to come.

It’s really not a fair competition between experiences and stuff. Experiences are the hands-down winner for where we should be spending our money.

Why then, does stuff always seem to come out ahead when it comes to where our money actually goes?

Let me check….

A few days ago, I asked a coworker if she wanted to go out for lunch. She said she’d have to check her bank account before she decided.

What?

If you have to check your bank balance to know if you can afford something, you can’t afford it. It really is that simple.

Now, strict budgets aren’t for everyone, but everyone should know how much money they have available to spend. If you don’t know what you have to spare, you need to set up a budget.

Period.

After you’ve done that, you can ignore it, with the exception of knowing how much you have available to blow on groceries, entertainment, and other discretionary purchases.

If you don’t know where your money needs to go, how can you determine how much you can spend on the things you want?

Olivia Wilde is Having a Baby: What are the first-month expenses?

Olivia Wilde recently announced her pregnancy with fiance Jason Sudeikis as she’s due with her first child in the coming year. Although the couple have declined to reveal their due date, they likely are expecting to set aside a budget for their baby, even with their high incomes. With forty percent of moms saying that having a baby is more expensive than they initially assumed, it’s important to look at the overall costs in the first month for plenty of preparation and financial planning.

Food

The first-month’s expenses can slightly range, depending on if the mother is using formula to feed the baby or is breastfeeding.

Breastfeeding is free and will not cost a dime, besides the breastfeeding supplies that cost an average of $15 in the first month due to nursing pads and milk storage bags for freezing.

Name-brand formula can be expensive, an average cost of $25 a week as the baby will be feeding on it several times a day, totaling about $100 in the first month. Generic brands of formula cost half the amount, an average of $12 a week.

Medical

Health insurance is one of the most expensive costs for newborn babies with 39 percent of mothers paying $1,000 with their childbirth. Some even pay at least $5,000. Health insurance will also likely increase to $200 a month for the child with co-pays that range from $30 to $100 per visit. Some health insurance will refuse to cover certain costs, which include vaccines and immunizations.

Daycare

Paid maternity leave is considered a luxury in the U.S. and is often unavailable for mothers who are self-employeed or do freelance work, making daycare a necessity. Daycare for newborns averages to $100 a month, but can be at least $1,000 for celebrities that use an in-home nanny.

General Care

Wipes will cost an average of $13 in the first month with a $5 increase in the water bill for the baby’s laundry and baths.

Diapers are one of the scariest expenses that are priced at $80 for basic Pamper diapers for newborns. Using cloth diapers are a one-time expense, so if provided by a friend or relative at a baby shower, they are free to use consistently and do not require much water or detergent to wash every other day.

Bath soap, detergent, and baby-safe shampoo will cost $30 a month to maintain the hygiene of your baby.

Although Olivia Wilde’s baby will be unique in its feeding habits and the materials for diapers used, the average cost in the first month will likely total $200 and can go as high as $4,000 for a celebrity. Many of the costs simply depend on the baby and are determined by the type of diapers used, the amount of doctor visits, daycare that may be needed, and whether the baby prefers breastfeeding or feeding on formula.

Related articles

Five Ways to Save Money On Cable

Cable is a luxury. There are very few people out there who can actually and legitimately consider cable television to be a necessity of life. For the rest of us, it’s just something that’s nice to have. Unfortunately, it’s expensive. In my area, prices come as high as $90 plus tax, and that’s not including any of the fancy channels that could feed my True Blood addiction. If you start adding on channels, you can get up to $250 per month.

That’s a lot of cash.

Cutting back on cable TV is one of the easiest ways to get your spending under control. Here are 5 ways to make it happen.

1. Ditch it

Do you really need cable at all? How much of your life do you waste in front of the TV? This wouldn’t work well in my house. We enjoy too many shows, and a lack of TV aggravates my insomnia. When I wake up at 2AM, I need something mindless to distract me while I fall back asleep.

2. Netflix Instant

I love my Netflix. With Instant, as long as you aren’t too hooked on watching the latest show as it comes out, you can catch most of the show you enjoy. There are thousands of TV series to choose from. I make a habit of choosing a couple of shows at a time, and watching the entire series before moving on. This does have the drawback of leaving you a couple of seasons behind for some shows, like In Plain Sight. Grr.

3. Go basic

If you do need TV, do you need the extended cable-only channels? Can you get by with basic cable, and just get the shows that would be otherwise broadcast? That’s what we did. This, combined with #2, make TV cheap and easy.

4. All internet

Did you know that you can use a Roku box to get Netflix Instant, Hulu Plus, Crackle, and more? I have more channels available there than I’ve ever had on cable. Starting at $50, it’s a steal.

5. Drop the fancy channels

HBO, Skinimax, and Showtime are pure unnecessary luxuries. Save yourself some money and buy each series on DVD as they come out. If you buy one a month, you’ll still come out ahead.

I’m not about to tell you that cable is evil or that TV is rotting your brain. I enjoy my rot, and you should be able to do so, too. Try not to waste extra money doing it.

How do you save money on TV?