If you don’t know why you are hear, please read about the 21 Day Happiness Training Challenge.

7 Benefits of Investing Internationally

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

Diversification of Your Funds

A diversified financial portfolio gives investors options in terms of economic fluctuations and, by investing internationally, your finances will have alternative sources of stability. In other words, if your money is spread out among various countries, then an economic crash in one country won’t affect other investments.

It goes without saying that with diversification also comes a learned understanding of various global economies and markets, but with the help of a financial adviser or with a little research, you’ll have the ability to make informed global investments, which is always better than the “eggs in one basket” approach.

Investing Abroad Means More Options

Just like there’s diversification with investing internationally, there are also many options when it comes to the way you want to invest your finances. And, with international investing growing in popularity, the investment options available in today’s market are quickly becoming commonplace.

Three of the most popular forms of international investments are mutual funds, exchange traded funds (ETFs), and American depository receipts (ADRs). And, although mutual funds are a common form of investment, ETFs and ADRs trade much like stocks and therefore take a little more financial knowledge to navigate.

International Protection and Confidentiality

If you’re the type of investor that’s worried about financial scares associated with foreclosures and lawsuits, investing internationally has an added advantage of asset protection. With investing abroad, many foreign financial institutions are able to protect your investments from seizure and other threats.

Likewise, investing internationally also comes with confidentiality concerning your finances. International financial institutions are not legally required to divulge your monetary details to anyone. Confidentiality isn’t to say that international investments are exempt from legalities, but they’re entitled to more freedoms.

Investment Growth on an International Level

In terms of household incomes, import/export strengths, younger working populations, and the lean toward free-market economic policies, investing internationally has the potential for more growth than investing in the United States alone, which translates to an increase in return potential in overseas investments.

In fact, according to the International Monetary Fund, the United States is expected to fall below the rest of the world for the next two years when it comes to economic growth. Because of this, companies like Fisher Investments Institutional Group are strategizing toward international investments in strong economic climates across the world.

Currency Diversification Strengthens Portfolios

Much like international investing gives your portfolio safety in numbers as opposed to having all assets invested in one country’s economy, so do currency differences from country to country. In relation to the US dollar, many countries across the world have stronger currencies, which helps boost returns over time.

The flip side of this coin is the idea that fluctuations in currency strengths can just as easily work against your portfolio as they can strengthen it. It’s wise to keep an eye on international currency rates and how they compare to the US dollar, but never invest solely based on rates as a country’s currency can drop in strength overnight.

A Reduction in Taxes

Otherwise known as tax havens, many countries across the world offer attractive tax incentives to foreign investors. These incentives are meant to strengthen other country’s investing environments as well as attract outside wealth.

These tax incentives are particularly attractive to US investors due to the increasingly high taxes in the country. As a result, the United States government is creating more defined restrictions and laws when it comes to international investment tax incentive regulations.

Investment Potential in the United States is Dwindling

Because the United States has both the world’s largest economy and stock market, financial opportunities are almost maxed out due to over-investing. On the other hand, emerging markets in other countries are growing in size and strength, which is quickly resulting in stronger economies and more investment opportunities.

By ignoring the potential of other world markets, you’re also ignoring global economies and stock markets that offer unforeseen investment potential when compared to the United States, which is something every investor should keep in mind.

So, from portfolio diversification to investment growth, investing internationally is a great way to expand your financial horizons.

This is a guest post.

Giving Up The Magic

It’s a sad day when kids stop believing in Santa Clause, the Tooth Fairy, and fairies.

Not because I enjoy lying to my kids, but because–on the day they stop believing–a piece of their innocence is lost. An unforgettable, valuable part of childhood dies.

Believing in magic is a beautiful thing.

Do you remember the last time you looked around the world with a sense of wonder? When seeing a puppy form in the clouds was a miracle? When the idea of an ant carrying 1000 times its own weight was something worth watching? When the impossible goodness of a fat man squeezing down your chimney fills you with hope instead of making you call 911?

Do I believe in Santa?

Of course not, but I believe the concept of Santa is worthy of my children’s belief. I don’t want them to lose that innocence and wonder.

When my teenager was young, he asked if Santa was real. I responded by asking what he thought. When he told me he didn’t believe, I offered to let Santa know. His panic told me he wasn’t ready to give up the magic.

The day that conversation didn’t cause a panic, he looked hurt, like he’d lost something precious. He had.

His world of magic was gone.

The he asked why I had spent his lifetime lying to him. I told him the truth. I said I couldn’t bear to be the one to shatter his belief in magic before he was ready.

Then, I informed him that he was in on the conspiracy. He was not allowed to ruin it for anyone else. Not his sisters, not his friends.

That Christmas, my little boy helped me stuff stockings, which was an odd feeling.

The magic was over, but we still got to share the magic of his cousins and sisters.

Net Worth Update – January 2014

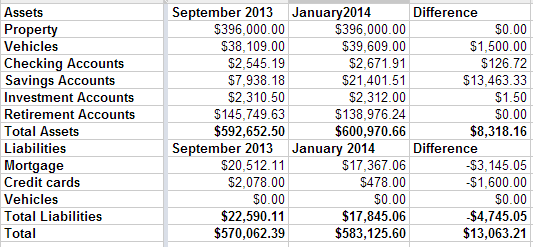

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.