- RT @MoneyMatters: Frugal teen buys house with 4-H winnings http://bit.ly/amVvkV #

- RT @MoneyNing: What You Need to Know About CSAs Before Joining: Getting the freshest produce available … http://bit.ly/dezbxu #

- RT @freefrombroke: Latest Money Hackers Carnival! http://bit.ly/davj5w #

- Geez. Kid just screamed like she'd been burned. She saw a woodtick. #

- "I can't sit on the couch. Ticks will come!" #

- RT @chrisguillebeau: U.S. Constitution: 4,543 words. Facebook's privacy policy: 5,830: http://nyti.ms/aphEW9 #

- RT @punchdebt: Why is it “okay” to be broke, but taboo to be rich? http://bit.ly/csJJaR #

- RT @ericabiz: New on erica.biz: How to Reach Executives at Large Corporations: Skip crappy "tech support"…read this: http://www.erica.biz/ #

How to Prioritize Your Spending

Don’t buy that.

At least take a few moments to decide if it’s really worth buying.

Too often, people go on auto-pilot and buy whatever catches their attention for a few moments. The end-caps at the store? Oh, boy, that’s impossible to resist. Everybody needs a 1000 pack of ShamWow’s, right? Who could live without a extra pair of kevlar boxer shorts?

Before you put the new tchotke in your cart, ask yourself some questions to see if it’s worth getting.

1. Is it a need or a want? Is this something you could live without? Some things are necessary. Soap, shampoo, and food are essentials. You have to buy those. Other things, like movies, most of the clothes people buy, or electronic gadgets are almost always optional. If you don’t need it, it may be a good idea to leave it in the store.

2. Does it serve a purpose? I bought a vase once that I thought was pretty and could hold candy or something, but it’s done nothing but collect dust in the meantime. It’s purpose is nothing more than hiding part of a flat surface. Useless.

3. Will you actually use it? A few years ago, my wife an cleaned out her mother’s house. She’s a hoarder. We found at least 50 shopping bags full of clothes with the tags still attached. I know, you’re thinking that you’d never do that, because you’re not a hoarder, but people do it all the time. Have you ever bought a book that you haven’t gotten around to reading, or a movie that went on the shelf, still wrapped in plastic? Do you own a treadmill that’s only being used to hang clothes, or a home liposuction machine that is not being used to make soap?

3. Is it a fad? Beanie babies, iPads, BetaMax, and bike helmets. All garbage that takes the world by storm for a few years then fades, leaving the distributors rich and the customers embarrassed.

4. Is it something you’re considering just to keep up with the Joneses? If you’re only buying it to compete with your neighbors, don’t buy it. You don’t need a Lexus, a Rolex, or that replacement kidney. Just put it back on the shelf and go home with your money. Chances are, your neighbors are only buying stuff so they can compete with you. It’s a vicious cycle. Break it.

5. Do you really, really want it? Sometimes, no matter how worthless something might be, whether it’s a fad, or a dust-collecting knick-knack, or an outfit you’ll never wear, you just want it more than you want your next breath of air. That’s ok. A bit disturbing, but ok. If you are meeting all of your other needs, it’s fine to indulge yourself on occasion.

How do you prioritize spending if you’re thinking about buying something questionable?

Identity Theft: What To Do When You’ve Been Victimized

Credit Card Theft” width=”240″ height=”189″ />

Credit Card Theft” width=”240″ height=”189″ />Have you ever been surprised by having a credit application denied? Or been told that you’re paying too much for your car insurance because you have bad credit?

There are 15 million victims of identity each year with an estimated loss of $50 billion. That’s a lot of cake. If you’re credit card gets stolen, you’re only liable for up to $50 of the theft, but what if your checking account is cracked or someone is opening accounts in your name? What is the indirect cost coming form higher interest rates?

Identity theft happens. It could happen to you.

What should you do if you become a victim of identity theft?

- File a police report. You’ve been victimized, make sure you have some documentation of that.

- Contact any credit card company that has possibly been affected. If you lost your wallet, call them all. If somebody has opening cards in your name, call all of those.

- Call the credit bureaus* and have a fraud alert put on your credit report. This will force any new creditor to take extra steps to verify your identity before opening a new account. Ideally, your identity thief won’t be able to make the grade. If that isn’t enough, look into an identity freeze. That will stop a lender from even seeing your credit report without your explicit permission.

- Close your bank accounts Depending on how severe the theft, you may need all new accounts at every level. If the thief has a box of your checks, or even your account and routing numbers, you need to close the accounts to protect your money.

- Report the theft to the FTC at 877.438.4338. You’ll get additional documentation of the theft, including an ID Theft Affidavit that can make it easier to clean up the mess.

- Hire a witchdoctor to curse the soul of your attacker. No, he probably won’t actually turn into a warty toad, but what if? Maybe the universe will wield the Magic Karma Hammer and beat him into a little greasy stain in the street.

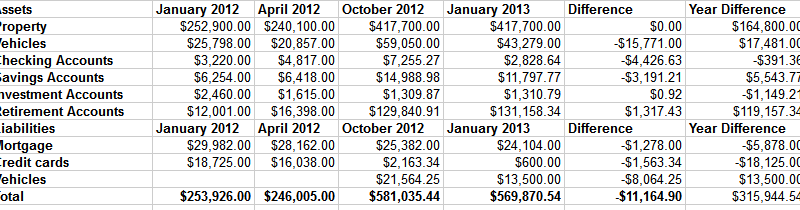

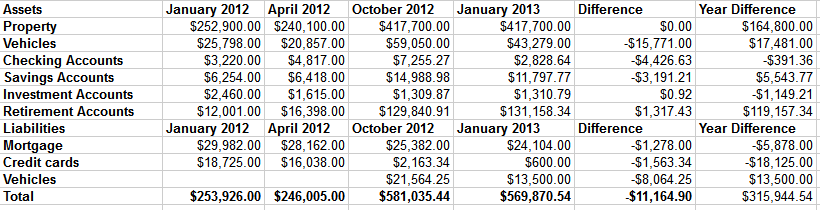

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

Beat the Check

- Image via Wikipedia

Have you ever played a game of “Beat the Check”? Your rent is due tomorrow, but you don’t get paid until Friday, so you write the check today an, on payday, you run to the bank to get your paycheck deposited before it has a chance to clear. To stretch out the time, you write yourself a check from another account to cover the deficit, knowing that will take a few more days to clear. This is called “floating” a check.

Sound familiar?

I think most people who write checks have tried to rush a deposit in before a check clears.

In 2004, the Check 21 act went into effect, which turned the game on its head. This law gave check recipients an option to make a digital copy of a check, slashing processing time. Instead of boxes of checks being transported around the country, the check began getting scanned and instantly transferred, along with all of the encoding necessary to keep the digital checks organized. This dramatically cut the amount of time it took to clear a check. What was once a week was reduced to as little as 48 hours.

Now, as technology improves and banks update their infrastructure to match, the “float” time has been reduced even further. Many banks are using image control systems to instantly convert all incoming checks to digital format. Within a couple of hours, these images can be transmitted to the Federal Reserve, to be transmitted nearly instantly to the issuing bank. If both the issuing and the receiving banks are using modern image control systems, it is impossible to float a check. “Beat the Check” is a thing of the past. It’s like betting on purple at the roulette wheel.

Of course, this doesn’t mean that the funds are instantly available. That would eliminate the banks being able make use of the funds during that time. Don’t expect the banks to make a habit of allowing you the use of your money before the federal regulations demand it.

Twitter Weekly Updates for 2010-07-17

- RT @mymoneyshrugged: The government breaks your leg, and hands you a crutch saying "see without me, you couldn't walk." #

- @bargainr What weeks do you need a FoF host for? in reply to bargainr #

- Awesome tagline: The coolest you'll look pooping your pants. Yay, @Huggies! #

- A textbook is not the real world. Not all business management professors understand marketing. #

- RT @thegoodhuman: Walden on work "spending best part of one's life earning money in order to enjoy (cont) http://tl.gd/2gugo6 #