Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

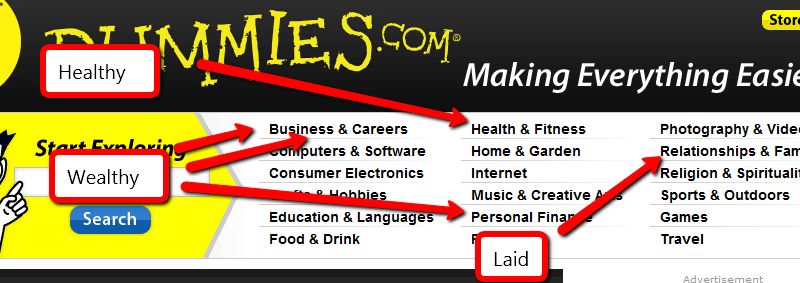

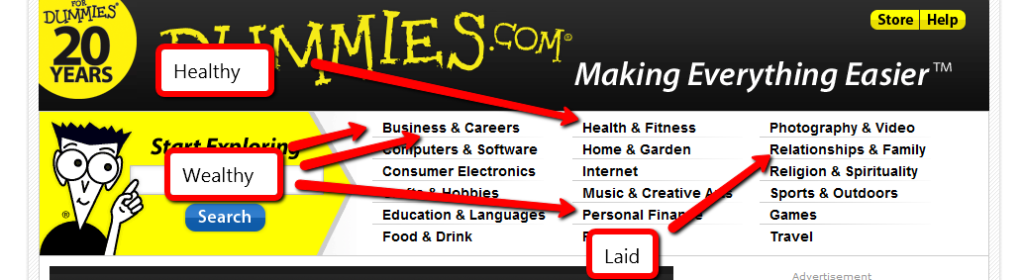

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Today, I continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

This is day 3 and today, you are going to take a look at your income.

We are only interested your take-home pay, because that is what you have to base a budget on. If you base your budget on your gross pay, you’re going to be in trouble when you try to spend the roughly 35% of your check that gets taken for taxes and benefits.

Income is a pretty straight-forward topic. It is—simply—how much money you make in a month. If you are like most people, the easiest way to tell how much money you make is to look at your last paycheck. Then, multiply it by the number of pay periods in a year and divide the total by 12.

Here’s the formula: Cash x Yearly Pay Periods / 12. Yay, math!

If you get paid every 2 weeks, multiply your take-home pay by 26, then divide by 12 to figure your monthly pay. For example, if you make $1000 every two weeks, your annual take-home pay is $26,000. Divide that by 12 to get your monthly pay of $2166.66. If you get paid semi-monthly, you’ll take that same $1000 x 24 / 12, for a total of $2000 per month.

Now you know how much you make each month. Woo!

Is it enough? Who knows? We’ll get into that later. In the meantime, spend some time thinking about ways you can make more money. Do you have a talent or a hobby that you can turn into cash?

There are always ways to make some extra money, if you are willing. Sit down with a friend or loved one and brainstorm what you can do. Write down anything you can do, you enjoy, or you are good at. Remember, there are no stupid ideas when you are brainstorming. The bad ideas will get filtered out later.

How could you make some (more) side cash?

When you realize that you’ve buried yourself in debt and decide to get out from under that terrible burden, the first thing you’ve got to do is build a budget because, without that, you’ve got no way to know how much money you have or need. After you’ve got a budget, you’ll start spending according to whatever it says. Hopefully, you’ll stay on budget, but what happens when an emergency does come up? What do you do when your car dies? When you suddenly find out your kids needs vision therapy? How do you manage when your job suddenly gets shipped off to East De Moines?

Your budget isn’t going to help you meet those expenses. Most people don’t have enough money in their bank account to make it all the way to the next payday, let alone enough to keep the lights on and food on the table. How can you possibly hope to deal with even the little things that come up?

You whip out your emergency fund.

The problem with a budget is that it does a poor job of accounting for the unexpected. That’s where an emergency fund comes in. An emergency fund is money that you have set aside in an available-but-not-too-accessible account. Its sole purpose is to give you a line of defense when life rears up and kicks you in the butt. Without an emergency fund, everything that comes unexpectedly is automatically an emergency. With an emergency fund, the things that come up are merely minor setbacks. Without an emergency fund, your budget is nothing but a good intention waiting to get shattered by the next thing that comes along. With an emergency fund, you are managing money. Without it, it’s managing you.

Every “expert” has their own opinion on this. Dave Ramsey recommends $1000 to start. Suze Orman says 8 months. The average time spent looking for work after losing your job is 24.5 weeks(roughly 6 months), so I recommend 7 months of expenses. That’s enough to carry you through an average bout of unemployment and a little more, but that’s not a goal for your first steps toward financial perfection. To start with, get $1000 in a savings account. That’s enough to manage most run-of-the-mill emergencies, without unduly delaying the rest of your debt repayment and savings goals.

Let’s not kid ourselves, $1000 is a lot of money when can barely make it from one check to the next. Unfortunately, this vital first step can’t get ignored. If you really work at it, you should be able to come up with $1000 in a month or so. Here are some ideas on how to manage that:

Dave Ramsey’s advice is to get your fund up to $1000 and then leave it alone until your debt is paid off. Screw that. I’ve got money going into my fund every month. It’s only $25 per month, but over the last two years, it has almost doubled my fund. Don’t dedicate so much money that you can’t meet your other goals, but don’t be afraid to keep some money flowing in .

When can you pull the money out? That is entirely up to you. I have ju st two points to make about withdrawing from your emergency fund:

An emergency fund makes your life easier and your budget possible when the unexpectable happens. Don’t forget to fund yours.

How much money do you keep in your emergency fund? What would it take to get you to spend it?

Welcome to the November 1, 2010 edition of the Carnival of Money Stories. One thing I didn’t do when volunteering to host this was to check my calendar. Did you know that November 1 follows October 31, every year? On Saturday, I had 30 people over for my annual Halloween party. On Sunday, I ran a haunt in my yard and coordinated to get a dozen kids out begging for candy while using my house as a base of operations. I’ve had guest from out-of-town since Friday. Halloween weekend is, by far, the busiest weekend of the year at my house.

J. Savings presents Side Hustle Series: I’m a Restaurant Server posted at Budgets Are Sexy, saying, “Is serving tables thankless work? Yes. Are customers sometimes unpleasant? Of course. But the benefits are plenty!”

Wenchypoo presents Marketing, Marketing Everywhere–There’s No Escape! posted at Wisdom From Wenchypoo’s Mental Wastebasket.

The Wise Squirrel presents Does it Matter Who is the Main Provider Between Husband and Wife? posted at Squirrelers, saying, “Money story about a dual-income couple in which the husband had the opportunity for a big promotion that would have required a move, AND his wife to leave her job. Their different viewpoints are discussed.”

Ryan @ CML presents Get a Tax Deduction for a Working Vacation posted at Cash Money Life, saying, “Tips on how to write off a business trip as a tax deduction.”

Jeff Rose, CFP presents How to Pass the CPA Exam and Become a Certified Public Accountant posted at Jeff Rose, saying, “If you are interested in becoming a CPA, here are some of the experiences of someone who just recently passed the CPA exam.”

Jason @ Redeeming Riches presents What Sam Walton Teaches Us About Money, Success, and Family posted at Redeeming Riches, saying, “Sam Walton had it all – or did he? Find out the biggest regret he had on his death bed.”

Mr Credit Card presents Cash Vs. Credit, A Real World Experiment posted at Ask Mr Credit Card.

The Family CEO presents Debt Snowflakes: Or How I Made $821.73 in Extra Credit Card Payments This Month posted at The Family CEO.

Kaye presents Stuck in the Middle posted at Mrs Nespy’s World, saying, “The beginning of the journey was excited, the end will be exhilarating, but this “in the middle” stuff is for the birds.”

Kate Kashman presents Why Not To Bounce Checks posted at The Paycheck Chronicles, saying, “An accidental bounced check in college is still causing trouble, 20 years later.”

Michael Pruser presents Managing $225,000 in Debt Is Starting to Ware on Me posted at The Dough Roller, saying, “My struggles on managing a ton of debt!”

PT presents 5 Lessons Learned From Filing Bankruptcy posted at Prime Time Money, saying, “Lessons learned from an actual account of going through a bankruptcy.”

Silicon Valley Blogger presents Should You Pay Off Loans or Invest Your Money? posted at The Digerati Life, saying, “So you’ve got some money. Should you pay off your debt with it or invest the money? Here’s a personal account on what I’ve done.”

BWL presents Success Story: Paying Off A House In 5 Years While Tithing posted at Christian Personal Finance, saying, “This is an encouraging story of a woman who stuck to her convictions about giving 10% of her income and still managed to pay off her house in less than 5 years!”

Miranda presents Do I Really Want to Rent Out My House? posted at Personal Dividends – Money+Lifestyle.

2 Cents presents What Would Make Me Invest in the Stock Market? posted at Balance Junkie, saying, “We have not invested in the markets for a while now. A reader recently asked what it would take for us to get back in. Here’s my answer!”

FIRE Getters presents Early Retirement Case Study – Sandy Aldridge and Dale Lugenbehl posted at FIRE Finance, saying, “At times the fast pace of our city lives appear stifling making us long for a slower pace of life with more exposure to clean air and green vegetation. Our souls yearn for a simple life which is in greater harmony with Mother Nature. Of late our work related health problems have been making us yearn, almost every morning, for a more relaxed life with greater freedom. So we were thrilled to read about Sandy Aldridge and Dale Lugenbehl who retired early (at ages 48 and 47 respectively) more than a dozen years ago to their eight-acre farm in Cottage Grove, Oregon …”

Neal Frankle presents Find A High Paying 2nd Job Using Craigslist posted at Wealth Pilgrim: Money Management Advice, Financial Stess Management, Addiction Recovery Plan & Resources, saying, “You Can Find A High Paying 2nd Job Using Craigs List If you’re looking for high paying 2nd jobs, look no further than your computer screen.”

Super Saver presents Retiree Financial Lessons from the Recession posted at My Wealth Builder, saying, “Although I wish this recession had not happened, I am glad that it happened early in our retirement, while we were better able to meet the financial challenges.”

Craig Ford presents Medi-Share Medical Sharing | A Health Insurance Substitue posted at Money Help For Christians, saying, “Medical sharing is a great way to reduce your health insurance costs.”

passive family income presents Cutting Out Wasted Expenses to Save More Income posted at Passive Family Income, saying, “How many wasted expenses are you paying for? After sorting through my family’s past years credit card and bank statements, I have found several small money leaks in our personal finances.”

Kristina presents Our Parents Estate posted at Dual Income No Kids, saying, “If your parents are divorced, how has their separation affect the way you have planned your estate?”

Donna Freedman presents Rockin’ the surveys — when it’s worth it. posted at Surviving and Thriving, saying, “Online surveys can be a nice source of extra income — except when they aren’t.”

Joe Plemon presents My Car Needs an Engine. Should I Sell it, Fix it or Junk it? posted at Personal Finance By The Book, saying, “What do you do when your beloved car needs an engine: sell it, fix it or junk it? This post explores the options.”

FMF presents My Type of Couple posted at Free Money Finance, saying, “Story of a couple who collected 400k cans to pay for their wedding.”

Lindy presents Once Upon a Time…I Used an Iron posted at Minting Nickels, saying, “One of the likely first stops in expense-slashing is the luxury of paying for laundered shirts. This is a tale of my ironing saga (yes, it qualifies as a saga). And it’s not as boring as this description sounds. Thanks!”

Sandy presents One Disaster Away posted at Yes, I Am Cheap, saying, “We sometimes pass judgment on others for the financial situation, but most of us need to realize that all it takes is one disaster to be in the same situation.”

Bucksome presents Top 7 Ways I Budget My Time posted at Buck$ome Boomer’s Journey to Retirement, saying, “Budgets are needed for more than money in this story about 7 ways to budget time.”

Tom @ Canadian Finance Blog presents How to Watch Cheap and Free TV in Canada posted at The Canadian Finance Blog, saying, “Want to know how to see free TV in Canada? You have a few options with over the air free HDTV, broadcaster’s websites and cheap services like Netflix!”

Lauren Mendel presents A Very Scary Money Story posted at Richly Reasonable – Successes and failures, all in the name of living reasonably., saying, “This Halloween week read the true, terrifying tale of how Husband and I almost lost literally every important document that we have. Muahahaha! You might want to lock your doors and close the blinds before reading this one…”

Sun presents What’s in My Wallet? posted at The Sun’s Financial Diary.

Money Beagle presents Costco Coupon Policies – Truth or Fiction? You Decide posted at Money Beagle.

ctreit presents Our family budget has to accommodate this chocolate snob posted at Money Obedience, saying, “Name brands versus store brands.”

Rachel presents Sometimes Less Is More | MomVesting posted at MomVesting, saying, “Melinda talks about how the value of many things isn’t necessarily determined by their cost.”

That concludes this edition. Submit your blog article to the next edition of Carnival of Money Stories using the carnival submission form. Past posts and future hosts can be found on the blog carnival index page. Thank you, everyone, for participating!

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 6, we’re going to talk about cutting your expenses.

Once you free up some income, you’ll get a lot of leeway in how you’re able to spend your money, but also important–possibly more important–is to cut out the crap you just don’t need. Eliminate the expenses that aren’t providing any value in your life. What you need to do is take a look at every individual piece of your budget, every line item, every expense you have and see what you can cut. Some of it, you really don’t need. Do you need a paid subscription to AmishDatingConnect.com?

If you need to keep an expense, you can just try to lower it. For example, cable companies regularly have promotions for new customers that will lower the cost to $19 a month for high-speed internet. Now, if you call up the cable company and ask for the retention department, tell them you are going to switch to a dish. Ask, “What are you willing to do to keep my business?” There is an incredibly good chance that they will offer you the same deal–$20 a month–for the next three or four months. Poof, you save money. You can call every bill you’ve got to ask them how you can save money.

I called my electric company and my gas company to get on their budget plans. This doesn’t actually save me money but it does provide me with a consistent budget all year long, so instead of getting a $300 gas bill in the depths of January’s hellish cold, I pay $60 a month. It is averaged out over the course of the year. It feels like less and it lets me get a stable budget. Other bills are similar. You can call your credit card companies and tell them everything you take your business to another card that gave you an offer of 5% under what ever you are currently paying. It doesn’t even have to be a real offer. Just call them up and say you are going to transfer your balance away unless they can meet or beat the new interest rate. If you’ve been making on-time payments for any length of time–even six months or a year–they’re going to lower the interest rate business, no problem. Start out by asking for at least a 5% drop. In fact, demand no more than 9.9%.

Once you’ve gone through every single one of your bills, you’ll be surprised by how much money you’re no longer paying, whether it’s because somebody lowered the bill for you or you scratched it off the list completely.