What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 10, we’re going to talk about debt insurance.

Debt insurance is insurance you pay for that will pay your lender in the event of your death, dismemberment, disfigurement, disembowelment, or unemployment. Exactly what is covered varies by insurer, type of debt, and what you are willing to pay for.

Private Mortgage Insurance(PMI) is a common form of debt insurance. Generally, if you take out a mortgage with a down payment under 20%, you’ll be expected to pay for PMI. According to the Homeowners Protection Act of 1998, you have the right to request your PMI be cancelled after reducing your loan amount to 78% of the appraised value of the property. That ensures that the lender will be able to recoup their money by seizing the mortgaged property if you should happen to fall under a bus or get hit by a meteorite.

Another common form of debt insurance is for your credit cards. Card companies love it when you buy their insurance. If you buy their life insurance, your card is paid off when you die. Disability insurance pays it if your get hurt. Unemployment insurance…you get the idea.

Here’s the deal: Get life insurance and disability insurance separately. It’s cheaper than getting it through your credit card company and let’s you get enough to actually live on if something tragic happens. Unless, of course, you die. Then it will leave enough for your heirs to live on.

As far as unemployment insurance, build up your emergency fund instead. That’s money that gives you options. Credit card insurance is money flushed down the toilet. Many of these policies cost 1% of your balance. If you’ve got a $5,000 balance, that will mean you are paying $50 per month. By comparison, if you’ve got a 9.9% interest rate, you’ll be paying about $40 per month in interest.

Debt insurance is a bad idea, if you can possibly avoid it. A combination of life insurance, disability insurance, and an emergency fund provide better protection with more flexibility.

Your task for today is to review your credit card statements and mortgage agreement and see if you are paying debt insurance on any of it. If you are, cancel and set up the proper insurance policies to protect yourself and your family.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 8, we’re going to talk about insurance.

What is insurance? Insurance is, quite simply a bet with your insurance company. You give them money on the assumption that something bad is going to happen to whatever you are insuring. After all, if you pay $10,000 for a life insurance policy and fail to die, the insurance company wins.

A more traditional definition would be something along the line of giving money to your insurance company so they will pay for any bad things that happen to your stuff. How do they make money paying to fix or replace anything that breaks, dies, or spontaneously combusts? Actuary tables. Huh? The insurance company sets a price for to insure—for example—your car. That price is based on the statistical likelihood of you mucking it up, based on your age, your gender, your driving history, and even the type of car you are insuring. What happens if a meteor falls on your car? That would shoot the actuary table to bits, but it doesn’t matter. They spread the risk across all of their customers and—statistically—the price is right.

What kinds of insurance should you get?

For most people, their home is, by far, the largest single purchase they will ever make. If your home is destroyed, by fire, tornado, or angry leprechauns, it’s gone, unless you have it insured. Without insurance, that $100, or 200, or 500 thousand dollars will be lost, and that’s not even counting the contents of your home.

Homeowner’s insurance can be expensive. One way to keep the cost down is to raise your deductible. If you’ve got a $1500 emergency fund, you can afford to have a $1000 deductible. That’s the part of your claim that the insurance company won’t cover. It also means that if you have less than $1000 worth of damage, the insurance company won’t pay anything.

You can get optional riders on your homeowner’s insurance, if you have special circumstances. You can get additional coverage for jewelry, firearms, computer equipment, furs, among other things. You base policy will cover some of this, but if you have a lot of any of that, you should look into the extra coverage.

Car insurance is required in most states. That’s because the kind caretakers in our governments, don’t want anyone able to hit you car without being able to pay for the damage they caused. To my mind, I think it would be more effective to just make whacking someone’s car without paying for it a felony. If someone is a careful driver or has the money to self-insure, more power to them.

Auto insurance comes with options like separate glass coverage, collision, total coverage (comprehensive), or just liability. Liability insurance is what you put on cheap, crappy cars. It will only pay for the damage you do to someone else.

I’ve never had rental insurance. The last time I rented, I could fit everything I owned in the back of a pickup truck with a small trailer, and it could all be replaced for $100. Heck, I had the couch I was conceived on. Err. Ignore that bit.

Almost everything you can get homeowner’s insurance to cover will also cover renter’s insurance, except for the building. It’s not your building, so it’s not your job to replace it.

If you care about your family, you need life insurance. This is the money that will be used to replace your income if you die. I am insured to about 5 times my annual salary. If that money gets used to pay off the last of the debt, it will be enough to supplement my wife’s income and support my family almost until the kids are in college. You should be sure to have enough to cover any family debt, and bridge the gap between your surviving family’s income and their expenses. At a minimum. Better, you’ll have enough to pay for college and a comfortable living.

Life insurance comes in two varieties: whole and term. Whole life…sucks. It’s expensive and overrated. The sales-weasels pushing it will tell you that it builds value over time, but it’s usually only about 2%. It’s a lousy investment. You’re far better off to get a term life policy and sock the price difference in a mutual fund that’s earning a 5-6% return.

Term life is insurance that is only good for 5, 10, or 20 years, then the policy evaporates. If you live, the money was wasted at the end of the term. The fact that it’s a bad bet makes it far more affordable than whole life. It doesn’t pretend to be an investment; it’s just insurance. Pure and simple

An umbrella policy is lawsuit insurance. If someone trips and hurts themselves in your yard, and decides to sue, this will pay your legal bills. If you get sued for almost anything that was not deliberate(by you!) or business related, this policy can be used to cover the bill.

If you call your insurance company to get an umbrella policy, they will force you to raise the limits on your homeowner’s and auto insurance. Generally, those limits will be raised to $500,000, and the umbrella coverage will be there to pick up any costs beyond the new limit.

A little-known secret about umbrella policies: They set the practical limit of a lawsuit against you. Most ambulance chasers know better than to sue you for 10 million dollars if you only have a policy to cover 1 million. They will never see the other 9 million, so why bother? They’ll go for what they know they can get.

The flipside to that is that you should not talk about your umbrella policy. Having a million dollars in insurance is a sign of “deep pockets”. It’s a sign that it’s worthwhile to sue you. You don’t want to look extra sue-able, so keep it quiet.

Insurance is a great way to protect yourself if something bad happens. Today, you should take a look at your policies and see where you may have gaps in coverage, or where you may be paying too much.

Skip to the bottom if you’re familiar with PRISM and don’t want to hear any political talk and rampant violations of our Constitutional rights, but still want to protect your privacy.

For those of you who haven’t been paying attention, the PRISM program is an NSA program to monitor electronic activity.

Lots of electronic activity.

The companies identified to be working with the NSA in this grand overreach include AOL, Apple, Facebook, Google, Microsoft, PalTalk, Skype, Yahoo! and YouTube. For most people, that is the definition of “the internet”. If you’re doing it online, the NSA is–or could be, at their leisure–watching.

This isn’t a crazy conspiracy theory. This is happening, and the government has admitted it. In fact, when this broke, the executive branch’s response was along the lines of, “Don’t worry, we’ll find the guy who leaked this information.”

On top of that, the government has been demanding phone records from at least Verizon on a daily basis.

In addition, the Justice Department was just busted wiretapping Associated Press phones.

Seriously, if you put this in fiction, nobody would buy it, because it’s ridiculous in the land of the free.

As far as the people who say I’ve got nothing to worry about if I’m not doing anything wrong: shut up. You can speak again when you give me your email passwords, bank records, and let me install a toilet cam in your house. What are you trying to hide?

Seriously, there is such a mess of non-legislative administrative regulations that are considered felonies that the best estimate is that most people commit three felonies a day, without realizing it.

When we live in a system with so many rules that have never been voted on and our legal system refuses to consider legitimate ignorance of the law to be a defense and we have a collection of secret laws that are a felony to disclose or violate, government spying gets far more dangerous.

The Foreign Intelligence Surveillance Act of 1978(FISA) is the law the NSA is using to justify all of these data requests. The law, that we all must obey, is being overseen by a small subcommittee in Congress, and the FISA courts are just a small subset of the judges. The judges are signing warrants allowing the wiretaps and massive surveillance, but that is clearly unconstitutional and, hence, illegal.

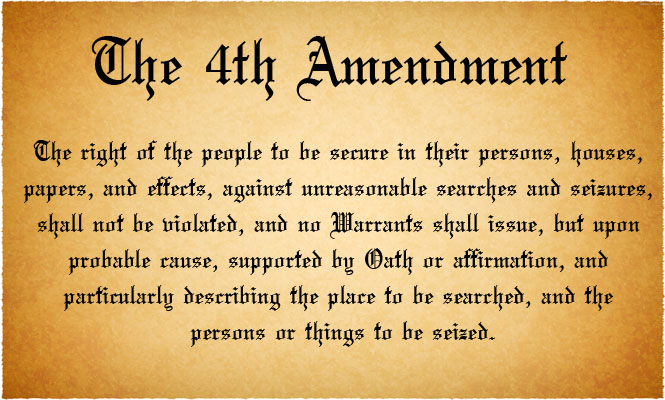

The text of the Fourth Amendment to the Constitution, the supreme law of the United States is: “The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated, and no Warrants shall issue, but upon probable cause, supported by Oath or affirmation, and particularly describing the place to be searched, and the persons or things to be seized.”

Any warrant that cannot name a place to be searched is illegal.

Any warrant that cannot describe the person to be monitored is illegal.

Any warrant that is not backed by probable cause is illegal.

Tell me how “I want to watch what everyone is saying on Facebook and seize all of the data” meets any of those criteria.

Bueller?

Wiretapping the AP is a serious violation of the First Amendment, too. “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.”

“Congress shall make no law…abridging the freedom of speech, or of the press..and to petition the Government for a redress of grievances.”

Monitoring the press in case somebody breaks a story the government doesn’t want broken is crap.

How can we petition the government for redress of grievances that they call a felony if the company discloses the violation to us? It’s self-serving circular crap.

When you throw the IRS harassing charities working for the “wrong” politics, you start to pine for the good old days of Nixon-level fair play and integrity.

To be fair, FISA got nasty with the Patriot Act, which was an abomination enacted by a different political party. Hey, Washington, next time try to remember that your laws will someday be administered by your political enemies, k? (NSA: I trust you’ll pass the message for me?)

There are four main pieces to discuss, based on the scandalous Constitutional violations reported recently.

1. Social media monitoring. There’s nothing to this. If you post things on Facebook, the government sees it and knows it’s you. Don’t post anything you don’t want broadcast to the police, your grandmother, and your priest.

2. Internet browsing. There is very little that is secure on the internet. The government can subpoena your ISP and get any records they keep. Unless you go anonymous and encrypted. Welcome to TOR. The Onion Router is a system that encrypts your internet traffic and bounces it all over the world. Once you enter TOR, nothing you do can be tracked, until your internet request leave the TOR system. The system is not centrally owned or controlled, so nobody in the system can track what you are doing.

For example, if I use the TOR browser to search Wikipedia, a snoopy NSA goon could tell I’m using it, and they could tell there was a request from the TOR system to Wikipedia, but they can’t tie one request to the other. If I’m dumb and log into Facebook, I lose that anonymous shield.

That’s solid protection from anyone watching your internet traffic.

How do you use it?

Easy. Just install the Tor Bundle. When you want the NSA to stop snooping over your shoulder because you want to do a search on erectile dysfunction, you launch TOR and the TOR browser and search without having to share your embarrassing secrets.

3. Email. Email is easily the least secure means you can communicate. When you send an email, that message is in plain text, and it bounces from server to server until it reaches the recipient. Any of the involved servers can keep a log of the traffic and read your email.

Never, ever, ever, ever put anything incriminating or important in an email. Don’t send credit card numbers, your social security number, or the address of your meth lab.

But what if you want to have a dirty conversation with your spouse without letting the sick voyeurs at the NSA listen to you ask your wife what she’s wearing and how would she like it torn off?

Use PGP. OpenPGP is a free software encryption program that is basically impossible to decrypt. It’s known as public-key encryption, which means that anybody can encrypt a message to you that only you can read.

It’s like magic.

To use PGP, the easy way(for Windows users) is to get Gpg4win. Install that, then open Kleopatra. This will let you generate your encryption key. You do that by:

You now have a set of PGP keys. To get your public key that others can use to send you messages, right-click your certificate and select “Export certificates”. Pick a path to save the certificate, then do so. You can open this file with notepad to get your public key, or you can email the file out. There is no need to worry about security with this file.

You will end up with something that looks like my public key here:

—–BEGIN PGP PUBLIC KEY BLOCK—–

Version: GnuPG v2.0.20 (MingW32)mQENBFGyPPkBCAC8zc5B7srG/ZyRMpokP3KyIMd9GA4n94wT89sP/yWFylbTKXDM

S2vC0yXh4zDJshJ1odj+spJGeYaXHCJM21buzKYf0gZsUGIbkVZWRy8ch16+umFl

DuTMaCN5Yue6ehGsjH8N+4q7pmXSlyRXRXzG0A4d9de4SQnfO65e1CMaQhFMpJu0

mXK8KFLqJ560efzlTTZvN3o5RfxYhtB3ODoDfkGeBLIxGVYn1kYbowTcvwymATOb

iSHwNfH+vY+kuTnrG9ilLyprDKwAF+ErD87WP0pLKVIQvoMV69VHEoRhHqK45iJG

j0ZhtTA4emnGZtCNsdfPLUdws1k9SNeIpd9pABEBAAG0H0phc29uIDxqYXNvbkB3

YWxiZXJnb25saW5lLmNvbT6JATkEEwECACMFAlGyPPkCGw8HCwkIBwMCAQYVCAIJ

CgsEFgIDAQIeAQIXgAAKCRDRFT/09vSoj10ECACVE/ngHyzX1lnMlucW4Rx8b8ii

KK8v/AmVkrJZgI3umuJn906sGGA8fNjxUGYH5fX6R7Diud4SEnZWADSq5pAImOv+

qZnPdpJKjMaY6qr+trr0DGsCoen+TxzM7rClBz3TTURI5SbySojHvQoEiCHHPBw1

yY3+leoUzLmso98ocA2lY4Iuvr7/fAzuQEFhBdxxLtS7mDWdmUca+A6GsrCr4LZ7

fpovRCNv07BoAa5ql+GrPOcsIcLwSoEtkhjCo4vPDeveqsnLT0W7N9YBPiGMpHPm

0oFxniC6/eWtI+3C8QFYO3X+CC5yTYpqJJ0BJWhXjiqYmr290d3AN+hYck3T

=fHba

—–END PGP PUBLIC KEY BLOCK—–

To get your private key, that you can use with any number of plugins for your email client, right-click on your certificate and select “Export secret keys.”

You can either use PGP as a plugin for your email client, or you can use Kleopatra’s feature “Sign/encrypt files”. To do that, write your message in a file, then select the feature inside Kleopatra. You’ll end up with an encrypted file you can attach to your email that snoopy government man can’t read.

4. Phone calls. This would appear to be harder, since your phone is largely out of your control. There’s nothing practical you do about a landline, except to avoid saying anything sensitive. On your cell phone, you have options, assuming you use a smartphone.

For Android users, it’s free an easy. Install Redphone. If you place a call with Redphone, it checks to see if the caller also uses Redphone. If he does, it places an encrypted call over your data plan to the other phone. Nobody can listen in to an encrypted call. The same company also makes a program for texting.

For iPhone users, you’re stuck with Silent Circle for $10/month, which may be a better option, since there is support for more devices, including Android. It was designed by the guy who designed PGP and handles texting and email, too.

There you are, the whats, whys, and hows of modern, hassle-light, private communications. Doing what we can to foil bad government programs is our patriotic duty.

Today, I continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, day 2 of the series, you need to gather all of your bills: your electric bill, your mortgage, the rent for your storage unit, everything. Don’t miss any.

Go ahead, grab them now. I’ll wait.

Did you remember that thing that comes in the plain brown wrapper every month? You know, that thing you always hope your neighbors won’t notice?

Now, you’re going to sort all of the bills into 5 piles.

Pile #1: These are your monthly bills. This will probably be your biggest pile, since most bills are organized to get paid monthly. this will include your credit cards, mortgage(do you rent or buy?), most utilities and your cellphone.

Pile #2: Weekly expenses. When I look at my actual weekly bills, it’s a small stack. Just daycare. However, there are a lot of other expenses to consider. This stack should include your grocery bill, gas for your car, and anything else you spend money on each week.

Pile #3: Quarterly and semiannual bills. I’ve combined these because there generally aren’t enough bills to warrant two piles. My only semi-annual bill is my property tax payment. Quarterly bills could include water & sewer, maybe a life insurance policy and some memberships.

Pile #4: Annual bills. This probably won’t be a large pile. It will usually include just some memberships and subscriptions.

Pile #5: Irregular bills. The are some things that just don’t come due regularly. In our house, school lunches and car repairs fall into this category. We don’t have car problems often, but we set money aside each month so our budget doesn’t get flushed down the drain if something does come up.

Now that you have all of your expenses together, you know what your are on the hook for. Next time, we’ll address income.

Today, I am continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, Day 6, we’re going to talk about cutting your expenses.

Once you free up some income, you’ll get a lot of leeway in how you’re able to spend your money, but also important–possibly more important–is to cut out the crap you just don’t need. Eliminate the expenses that aren’t providing any value in your life. What you need to do is take a look at every individual piece of your budget, every line item, every expense you have and see what you can cut. Some of it, you really don’t need. Do you need a paid subscription to AmishDatingConnect.com?

If you need to keep an expense, you can just try to lower it. For example, cable companies regularly have promotions for new customers that will lower the cost to $19 a month for high-speed internet. Now, if you call up the cable company and ask for the retention department, tell them you are going to switch to a dish. Ask, “What are you willing to do to keep my business?” There is an incredibly good chance that they will offer you the same deal–$20 a month–for the next three or four months. Poof, you save money. You can call every bill you’ve got to ask them how you can save money.

I called my electric company and my gas company to get on their budget plans. This doesn’t actually save me money but it does provide me with a consistent budget all year long, so instead of getting a $300 gas bill in the depths of January’s hellish cold, I pay $60 a month. It is averaged out over the course of the year. It feels like less and it lets me get a stable budget. Other bills are similar. You can call your credit card companies and tell them everything you take your business to another card that gave you an offer of 5% under what ever you are currently paying. It doesn’t even have to be a real offer. Just call them up and say you are going to transfer your balance away unless they can meet or beat the new interest rate. If you’ve been making on-time payments for any length of time–even six months or a year–they’re going to lower the interest rate business, no problem. Start out by asking for at least a 5% drop. In fact, demand no more than 9.9%.

Once you’ve gone through every single one of your bills, you’ll be surprised by how much money you’re no longer paying, whether it’s because somebody lowered the bill for you or you scratched it off the list completely.