Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.

What would you do if you were handed $10,000 tomorrow? $20,000?

The easy default answer–if you spend time in the personal finance world–is to pay off debt and save the rest.

But is that the right answer?

When my mother-in-law died, we inherited a little bit of money, a house that hasn’t been updated since the 60s, and a new-ish car that still has an active loan.

We also have about $16,000 in credit card debt and a small mortgage.

The Dave Ramsey answer would be to pay off the card at all costs and worry about the inherited house later, but that seems off. If we modernize the house and fix the things that are broken, we have a mortgage-free rental property. Our local rental market is strong; we should be able to clear $800 per month after expenses.

Is the right answer to pay off our card and scrape to get the house ready or should we fix up the house and use that new income to pay off the card?

My wife has also inherited an IRA that–due to its status as a Beneficiary IRA and the fact that there have been disbursements–has to be drained within 5 years. It’s not huge. After taxes, it’s about the size of the car loan. Should we make the $200/month payments, or cash out the temporary IRA and make the car loan go away immediately? Should we cash out the IRA and open one for my wife?

Although the cause was sad, these are good problems to have. If we manage this right, we’ll be more financially stable than we would have been for decades, otherwise.

I want your opinion, please.

2 questions:

1. House or credit card?

2. What would you do with a $10,000 IRA that has to be cashed out over the next 5 years?

For the past couple of years, my daughters have been riding in horse shows with a local saddle club. We’ve been lucky in that my wife’s cousin has let us borrow her horse for the shows, so costs have been minimal.

Unfortunately, that horse isn’t available this year. We knew that a few months ago, so the plan was to take a year off from the shows and focus on lessons, to get the girls some real skills. We found a great instructor at a stable about 30 miles from our house. Since we live less than two miles from the border of the biggest city in the state, that’s a comparatively short drive.

We pay her $200 per month for 1 lesson per week for both girls. They each get 30-45 minutes on the horse during each lesson.

Now that show season has started, the plan seems to have changed. The girls will be riding a different borrowed pony tomorrow. The shows cost about $50 for registration, lunch, and gas. Our club has 1 show per month, but my wife has assured me they’ll only be hitting three shows this season and limiting the number of events to keep the cost down.

The direct costs aren’t too bad, but there’s a problem with keeping-up-with-the-Joneses accessorizing. Vests and boots and helmets and belts and shirts, oh my.

I’d guess our costs for the summer will be $300 per month.

One thing we’ve been considering is buying a pony. We can get an older pony for around $500-1000. Older is good because they are calmer and slower. Boarding the thing will cost another $200 per month. We’ve been slowly accumulating the stuff to own a horse, so I’m guessing the “OMG, he let me buy a horse, now I need X” shopping bill will come to around $1500, but I’ll figure $2000 to be safe. We already have a trailer, a saddle, blankets, buddy-straps, combs, brushes, buckets, rakes, shovels, and I-bought-this-but-I-will-just-put-it-in-the-pile-of-horse-stuff-so-Jason-will-never-notice stuff. We’re certainly close to being ready to buy.

(FYI: If you’re starting from scratch, don’t think you’re going to get into horse ownership for less than $10,000 the first year, and that’s being a very efficient price-shopper.)

So we’re looking at $5400 for a horse, gear, and boarding the first year. If we cancel the lessons, by spring we’d have $2000 of that saved and most of the rest can be bought over time.

On the other hand, if we go that route, we’ll never save enough to buy the hobby farm we’re looking for.

Decisions, decisions. I should just buy a new motorcycle. Within a year, I win financially.

At 8PM Friday night, our power went out.

We had 70 MPH straight-line winds and horizontal rain. Trees came down all over the neighborhood. Two houses down, 3 tree played dominoes, creaming the house, the fence, and two cars.

How did we do?

The skeleton I keep hanging in my tree lost its right shin-bone and we lost power. So did 610,000 other people in the area.

It’s interesting to watch what happens when the power goes out.

I’m assuming every generator in the area sold out. I don’t know, because I already had one. I do know that most of the gas stations near me ran out of gas on Saturday. Most places were out of ice, too. Batteries were hard to scrounge.

The restaurants that either didn’t lose power or had backup generators were raking in money all weekend. Sunday morning, McDonald’s had a line of cars backed up an entire block.

Our power came back on Monday night. 74 hours of living in the dark ages. We had to read books on paper and cook all of our food on the grill.

We did okay. A few years ago, when the power went out for a day, I bought a generator. Saturday morning, I finally had a reason to take it out of the box.

The generator cost me $450. Over the weekend, we put about $40 worth of gas into it. That kept our refrigerator and freezer running, saving at least $5-600 worth of food. Two neighbors filled up our available freezer space, so that’s another $200 worth of food that didn’t die.

That’s a $500 investment to save nearly $800 worth of food.

Pure win.

The generator also allowed us to keep a couple of fans running, which is great when the power goes out when it’s 90 degrees outside. We also fired up the TV and DVD player at night to help the kids settle down for bed. This is one time I was glad to have an older TV, because cheap generators don’t push out a clean electricity that you can safely use to run nice electronics.

We have a couple of backup batteries for our cell phones, so we got to stay in touch with the world. We borrowed an outlet at our rental property to charge the batteries when they died.

We had about 5 gallons of gas on hand, which was convenient, but not enough. I’m going to grow that. A little fuel stabilizer and a couple of 5 gallon gas cans and we can be set for the next time gas runs out.

We cooked everything on the propane grill. I keep two spare propane tanks on hand, but we didn’t use them. Sunday night, my wife made spaghetti on the grill. The hard part was keeping the noodle from falling through. Nah, we threw the cast iron on the grill and cooked away. Had pancakes and bacon made the same way on Sunday.

We had to buy more lanterns. We had two nice big ones, but at one point, we had 9 people in our house. That’s a lot of games, books, and bathroom breaks to coordinate with only two main lights. This weekend did teach our daughters that the emergency flashlights are not toys. Two of them had dead batteries that needed to be replaced.

Going out to dinner Monday evening was a treat. We sat in a building with air-conditioning!

All said, we spent about $250 that we wouldn’t have if the power would have stayed on. That’s $40 for gas, $80 for dinner(you try feeding a family of 5 for less than that at a restaurant that doesn’t have a drive-through) and $130 on new lanterns. The lantern bill caught me by surprise, by a lot, but now we are set for next time.

How would you do without power for three days?

Grr!

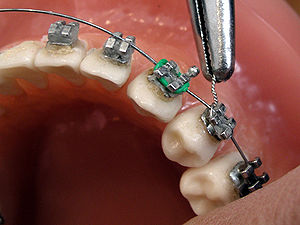

Monday, I brought Punk #1 to the orthodontist. He’s got an underbite and some crooked teeth, but I didn’t realize how off it was until I saw the pictures they took. Some of the closeups could be inspiration for a Halloween mask.

It look like he started with a small underbite that made his teeth line up wrong, which–as they grew–accentuate the wrong. Now, it’s very, very wrong.

Next week he goes in to get his top teeth done.

At a cost of $5800.

If we pay up-front, they’ll knock 5% off, bringing it down to $5500. That covers everything, all of the follow-ups, broken hardware, every stage the whole way through. If we pay monthly, it will be $1450 down and $200 per month (interest free) for almost 2 years.

Almost six grand.

Fortunately, we knew this was coming, so we’ve been saving for this for a few years.

Unfortunately, we’ve only been saving $50-100 a month. We can’t wait much longer. With an underbite, you have more options if you do the work before the kid is done growing. I’d really like to avoid jaw surgery for him, so we have to make things happen.

Our braces account has $3100 in it. My HSA account has $875. That’s from my last job, so that’s as big as it gets. That leaves us almost exactly $1500 short.

I hate the idea of touching our emergency fund, although it does have enough money in it.

We’ve also got some money tucked away in an account leftover from my mother-in-law dying last year. I think that’s where we’re going to come up with the difference.

How else could we save money?

We could shop around, but this isn’t something I want to give to the lowest bidder. I want to do it right, and I know several people who have had braces put on by this office, either by this orthodontist or her father.

I asked about a cash discount and got turned down.

That’s it. Next week, I burn $5500. Hope the kid eventually appreciates it.