What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

Life is all about trade-offs. You trade your time for a paycheck. Your trade your paycheck for food, rent, and security. Don’t get so obsessed with saving and security that you forget to live your life. There are many good reasons to put your savings on hold in order to really live. Here are five of them:

1. You have an adequate emergency fund. You will never hear me advise against an emergency fund. If you don’t have one, stop reading this and get one. Go. Without an emergency fund, your budget is a financial crisis waiting to happen. With an emergency fund, you can weather life’s speed-bumps without watching them become total train-wrecks.

2. Your retirement is on autopilot. You are not allowed to stop saving and investing for retirement. Ever. Assuming you have a traditionally scheduled career that involves you working until you hit 65 and deferring a huge chunk of living until then, your income will cease when you retire. Do you know how long you will live? Do you want to spend your retirement broke and bored? Are you relying on the responsible financial management of the federal government to make sure you will still get your Social Security? Invest in your retirement and get this investment on autopilot so you can stop worrying about it.

3. Your income is set. I don’t believe in the fairy tale of a company being loyal to its employees. The aren’t. However, if you have a stable-ish job, an in-demand career, and some side-income coming from alternate sources, your emergency fund can be enough to carry you through the low times. That’s what it’s there for.

4. You have dreams. If you’ve always wanted to travel the world, follow a band on your, volunteer extensively, or anything else, it’s time to do it. Don’t postpone your passion.

5. Deathbed regrets suck. Very few people lie on their deathbed lamenting the things they did. Regrets tend to be focused on opportunities missed, skipped, or indefinitely postponed. Do the things that are important to you before it’s too late to do them. Don’t abandon your future in favor of current pleasures, but don’t forget to live, now.

Do you have any other reasons to stop saving?

With the new year looming, it’s the perfect time to review the things that may not have gone as well as planned in the current year, and plan ahead for the coming year, to make sure things go well from now on.

To get a good start in the new year, you should focus on three things.

A good budget is the basis of every successful financial plan. If you don’t have a budget, you have now way of knowing how much money you have to spend on your necessities or you luxuries. Do you really want to guess about whether or not you can afford to get your car fixed, or braces for your kid? I’ve gone over all of the essentials to make a budget before. Now is the perfect time to review that series and make sure your own budget is functional and ready for the new year.

At the same time, spend some time thinking about how your what has gone wrong with your budget over the previous year. In my case, when we got back from vacation in August, our mindset had changed a bit about spending money, and we got out of the habit of staying strictly on budget. By the time we got back on track, it was Christmas and our plans got shot, again. If it weren’t for my side hustles–money that I don’t track in the budget because the money isn’t consistent, yet–we would have had some serious problems this fall. Where have you gone wrong, and what could you do to improve next year?

In the new year, if you haven’t already done so, make sure you throw your credit cards away. The most basic law of debt reduction is, “If you don’t stop using debt, you’ll never be out of debt.” That’s why you need to set up your budget first. Make sure that your expenses are less than your income, so you can make ends meet without having to charge the difference.

How has your debt use worked out over the last year? Have you used it at all, or have you eliminated the desire to pay interest? What have you used your credit cards for? How much of that could you have done without?

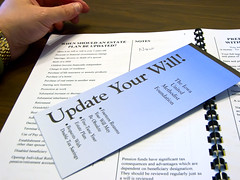

Now is the time to make sure that all affairs are in order, if the worst should happen. If you die, what happens to your money? Your kids? I’ve gone over everything you need in an estate plan before, so I won’t beat that horse again. You owe it to your family to make sure they are taken care of if something should happen to you. At a bare minimum, write a will and get it notarized.

Have you putting off writing your will? You know you need one, but it’s a morbid thought, so it’s easy to put off, right? Get over it. If you love your family, you’ll do better and get your affairs together next year.

That’s a good financial start for 2011. What are you missing in your financial life?

Today, it is my please to host the 287th Festival of Frugality, the Independence Day Edition. Yesterday, was Independence Day in the US. It’s the day we celebrate throwing off the yolk of high-tax, no-rights tyranny and blowing stuff up.

That’s not what this Festival is about. As much as I love this country and enjoyed celebrating, today, the theme is the Independence Day movie.

Coolest ID4 fact, ever: A promotional piece that aired in Spain for this film set off a “War of the Worlds” type of wide spread panic. The promo featured a popular Spanish news anchor and the piece ran as if there really WAS an alien attack to occur on July 4.

The explosion of the Welcome Wagon Helicopters was actually footage of a pyrotechnics accident on set.

Miss T. gives us Seven Reasons to Avoid Penny Auction Sites. She does a great job of explaining the evil that is Penny Auctions, from outright fraud to the rip-off that is the basic business model. Some of these sites make $5000 or more on an iPad auction. They don’t even have to carry an inventory before running an auction.

Independence Day holds the record for most miniature model-work. It beat the previous record by double.

Philip submits Turn Wasted Extra Money Into a Debt Payment. I have a friend who is positive he can’t reduce his monthly expenses at all, while eating out almost every day.

The alien ship “miniature” was 65 feet across.

Boomer presents Financial Support For Your Adult Children. I love my parents. A lot. I couldn’t imagine moving back in with them, and I’m pretty sure they’d feel the same way soon enough. Although, Mom, if you’re reading this, can I have an allowance again?

This was the highest grossing film in 1996.

Suba presents Why you should not use 401k. I’ve never questioned the wisdom of maxing out a 401k. It’s good to see those assumptions challenged and the numbers crunched.

President Whitmore: Good morning. In less than an hour, aircraft from here will join others from around the world. And you will be launching the largest aerial battle in the history of mankind. Mankind, that word should have new meaning to all of us. We cannot be consumed by our petty differences anymore. Perhaps it is fate that today is the fourth of July, and we will once again be fighting for our freedom. But not for freedom from tyrrany or oppression or persecution. We’re fighting for our right to live, to exist. And should we win the day, the Fourth of July will no longer be known as an American holiday, but as the day when the world stood up and declared in one voice that we will not go quietly into the night! We will not vanish without a fight! We’re going to live on! We’re going to survive! Today we celebrate our Independence Day!

FMF presents Save Money on Groceries by Shopping on Wednesday posted at Free Money Finance.

Harri Pierce presents Have a second hand summer posted at TotallyMoney.

Daniel presents Top 10 Reasons to Shop Online vs. Shopping In-Store posted at Sweating The Big Stuff.

President Whitmore: It’s a fine line between standing behind a principle and hiding behind one.

Philip Taylor presents The Best Time to Buy posted at PT Money Personal Finance.

Outlaw presents Pay Yourself First and Have Money in the Bank posted at Outlaw Finance.

Crystal presents Frugal Tips for the Pet Dog posted at Budgeting in the Fun Stuff.

Matt presents The Price of Water posted at Stupid Cents.

That’s right! That’s what you get! Look at you! Ship all banged up! Who’s the man? Who’s the man?! Wait until I get another plane! I am going to line up all your friends right beside you! ~ Captain Steven Hiller

Alan presents The Cost of Online Gaming: Free to Play posted at Canadian Finance Blog.

Paula @ AffordAnything.org presents Diets and Debt: Managing Money and Your Weight posted at AffordAnything.org.

Kay Lynn presents Summer Fun for the Frugal Family posted at Bucksome Boomer.

Jacob @ My Personal Finance Journey presents Top 10 Money Saving Tips posted at My Personal Finance Journey.

Glen Craig presents The Cost of Clutter on Your Finances and Life posted at Free From Broke.

Eddie presents 55 Suggestions To Save $1000 posted at Finance Fox.

Darwin presents Are You Better Off Than Your Parents? posted at Darwin’s Money.

Sustainable PF presents Sustainability Tip #179: Loose Cap Lose Gas posted at Sustainable Personal Finance.

WHOOOOO!!!!!!!!! Elvis has left the building! ~ Captain Steven Hiller

I hope you enjoyed the carnival. Please take a moment to subscribe to Live Real, Now.

I’m not a huge fan of New Year’s resolutions. Generally speaking, if you don’t have the willpower to do something any other time of the year, you probably won’t grow that willpower just because the last number on the calendar changed.

Seriously, if you’ve got something worth changing, change it right away, don’t wait for a special day.

That said, this is the time of the year that many people choose to try to improve…something. Some people try to lose weight, other people quit shooting meth into their eyeballs, yet others(the ones I’m going to talk about) decide it’s time to get out of debt.

Now most people are going to throw out some huge and worthless goals like:

The problem with goals like that is the definitions. What is “some”, “more”, “better”, or “less”? How do you know when you’ve won.

It’s better to take on smaller goals that have real definitions.

Try these:

But Jason, I hear you saying, where am I going to find $1000 to save? Well, Dear Reader, I’m glad you asked. Next time though, could you ask in a way that others can hear so my wife doesn’t feel the need to call the nice men in the white coats again?

Let’s break that goal down even further.

Instead of saving $1200, let’s call it $100 per month. That’s a bite-sized goal. Some people don’t even have that to spare, so what can they do?

Let’s make that resolution something like “I’m going to have frozen pizza instead of my regular weekly delivery.” If your house is anything like mine, that brings a $60 pizza bill down to $15 for some good frozen pizza for a savings of $45. If you order pizza once a week, that’s $180 saved each month, double your goal. That’s a win with very little suffering.

Now, you can take that extra $80 that you hadn’t even planned for and throw it at your credit cards. That’s a free payment every month. Before you know it, you’ll have your cards paid off and a decent savings account.

Then you can thank me because I made it all possible.

First, my disclaimer: I’m not destitute.

However, I’m trying to spend Christmas acting like I am a pauper.

Why, with small children and beautiful-and-more-than-deserving wife, would I want to deprive my family of a bountiful holiday?

Before we get into the reasons for being a horrible grinch bent on depriving my children of their god-given right to rampant consumerism, let’s look at the Philosophy of Destitution.

The primary reason to pull back and tone it down is basic frugality. Excessive anything is not frugal. I am training my children–and for that matter, my wife and my self–in the finer arts of personal responsibility and frugality. Accumulating debt for a fleeting holiday is insane. If we can’t afford to buy it, we certainly can’t afford to give it. Anything else would be setting a bad example and children learn best by example.

Another piece of the Philosophy of Destitution(when I read this word, I hear a deep, booming voice in my head, like a 30s radio superhero voiceover) is “green”. I consider myself a conservationalist rather than an environmentalist, so don’t read too much into that color. I try to be responsible, instead of destructive and I try to avoid being wasteful. Toys that won’t be played with are wasteful. A garbage can full of packaging for those same toys costs money. It is much cheaper to avoid the landfill here.

Back to “Why”. Why would I be willing to deprive my family?