- Working on my day off and watching Teenage Mutant Ninja Turtles. #

- Sushi-coma time. #

- To all the vets who have given their lives to make our way of life possible: Thank you. #

- RT @jeffrosecfp: While you're grilling out tomorrow, REMEMBER what the day is really for http://bit.ly/abE4ms #neverforget #

- Once again, taps and guns keep me from staying dry-eyed. #

- RT @bargainr: Live in an urban area & still use a Back Porch Compost Tumbler to fertilize your garden (via @diyNatural) http://bit.ly/9sQFCC #

- RT @Matt_SF: RT @thegoodhuman President Obama quietly lifted a brief ban on drilling in shallow water last week. http://bit.ly/caDELy #

- Thundercats is coming back! #

- In real life, vampires only sparkle when they are on fire. -Larry Correia #

- Wife found a kitten abandoned in a taped-shut box. Welcome Cat #5 #

The Luxury of Vacation

This was a guest post I wrote last year to answer the question posed by the Yakezie blog swap, “Name a time you splurged and were glad you did.”

There are so many things that I’ve wanted to spend my money on, and quite a few that I have. Just this week, we went a little nuts when we found out that the owner of the game store near us was retiring and had his entire stock 40% off. Another time, we splurged long-term and bought smartphones, more than doubling our monthly cell phone bill.

This isn’t about those extravagances. This is about a time I splurged and was glad I did. Sure, I enjoy using my cell phone and I will definitely get a lot of use out of our new games, but they aren’t enough to make me really happy.

The splurge that makes me happiest is the vacation we took last year.

Vacations are clearly a luxury. Nonessential. Unnecessary. A splurge.

When we were just a year into our debt repayment, we realized that, not only is debt burnout a problem, but our kids’ childhoods weren’t conveniently pausing themselves while we cut every possible extra expense to get out of debt. No matter how we begged, they insisted on continuing to grow.

Nothing we will do will ever bring back their childhoods once they grow up or—more importantly—their childhood memories. They’ll only be children for eighteen years. That sounds like a long time, but that time flies by so quickly.

We decided it was necessary to reduce our debt repayment and start saving for family vacations.

Last summer, we spent a week in a city a few hours away. This was a week with no internet access, no playdates, no work, and no chores. We hit a number of museums, which went surprisingly well for our small children. Our kids got to climb high over a waterfall and hike miles through the forest. We spent time every day teaching them to swim and play games. Six months later, my two year old still talks about the scenic train ride and my eleven year old still plays poker with us.

We spent a week together, with no distractions and nothing to do but enjoy each other’s company. And we did. The week cost us several extra months of remaining in debt, but it was worth every cent. Memories like we made can’t be bought or faked and can, in fact, be treasured forever.

Optimized to Go, Part 1

Last weekend, we held a garage sale at my mother-in-law’s house. It was technically an estate sale, but we treated it exactly as a garage sale.

A week before we started, a friend’s mother came to buy all of the blankets and most of the dishes, pots, and non-sharp utensils so she could donate them all to a shelter she works with. She took at least 3 dozen comforters and blankets away.

Even after that truckload, we started with two double rows of tables through the living room and dining room. The tops of the tables were as absolutely full as we could get them, and the floor under the tables was also used for displaying merchandise.

Have you ever had to display 75 brand-new pairs of shoes in a minimal about of space? They claimed about 16 feet of under-table space all by themselves. Thankfully, the blankets weren’t there anymore.

We also had half of the driveway full of furniture, toys, and tools.

We had a lot of stuff.

Now, most people hold a sale to make some money. Not us. We held a sale to let other people pay us for the privilege of hauling away our crap. As such, it was all priced to move. The most expensive thing we sold was about $20, but I can’t remember what that was. Most things went for somewhere between 25 cents and $1.

At those prices, we sold at least 2000 items. That isn’t a typo. We ended the day with $1325. After taking out the initial seed cash, lunches we bought for the people helping us, and dinner we bought one night, we had a profit of $975.

At 25 cents per item.

We optimized to sell instead of optimizing for profit. At the end of a long summer of cleaning out a hoarding house, it all needed to go.

In the next part, I’ll explain exactly how we made it work.

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

Flatbed Trucks: Why Buy When You Can Rent?

This is a guest post.

The goal of any business is to maximize profits while limiting expenses. Yet sometimes, a business may need a certain piece of equipment for a special project or other task. For example, a flatbed truck may be needed sometimes, but not enough times to justify spending the money to buy one. When this is the case, renting the truck becomes the smart option.

Renting a flatbed truck is perfect when working with heavy, oversized or irregular shaped cargo. Many times these trucks may only be needed for one or two days, perhaps only a few hours. When this is the case, renting a truck makes perfect sense. Any town and city has numerous rental truck options from which to choose, with the most popular brand being U-Haul. Flatbed trucks come in a variety of sizes, ranging from 8-22 feet in length. They can be rented for several days or only a couple of hours, depending on one’s needs. If necessary, the trucks can also be rented on a weekly or monthly basis.

A truck hire can also be very cost-effective for a business. Buying a flatbed truck can cost a business $40,000-$50,000 or possibly more, depending on the size of the truck. As with any new vehicle purchase, as soon as it’s driven off the dealer’s lot it begins to depreciate, therefore giving a business owner an investment whose value is less and less as time goes by. By renting a truck only when necessary, it saves a business substantially in terms of making a capital investment. Rental prices vary among different businesses, with most averaging $50-$100 per day depending on the truck that’s rented. Generally, the bigger the truck the more it costs to rent. There are usually no hidden charges or fees associated with renting trucks, so long as they are returned on time, in good condition and with the same amount of fuel they had when they left the rental lot. Also, the person who rents the truck is not the only person allowed to drive it. Most rental places allow up to three other people to be added to the driver’s list for an additional fee, often averaging around $10.

Most truck rental places allow reservations to be made online, and payments can be made with credit cards. Reserving online and paying with a credit card allows a business to take advantage of discounts, for most businesses will offer discounts for reserving online. Those who drive flatbed trucks only need to be at least 18 years old with a valid driver’s license, and the trucks do not require any special licenses to operate.

Many companies also provide 24/7 roadside assistance for renters, so if the truck breaks down while being used it can be picked up and replaced at no charge. With all these benefits, it makes far more sense for a business to rent a truck for its occasional needs rather than purchase one for a task now and then.

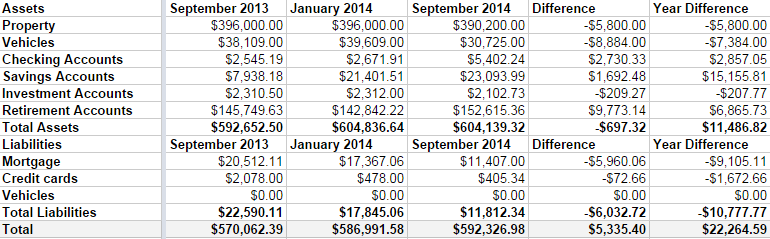

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.