When this goes live, I’ll be on the road to the Financial Bloggers Conference outside of Chicago. That translates to a day off here.

Monday, I’ll be back with a whole bucket full of bloggy goodness.

The no-pants guide to spending, saving, and thriving in the real world.

When this goes live, I’ll be on the road to the Financial Bloggers Conference outside of Chicago. That translates to a day off here.

Monday, I’ll be back with a whole bucket full of bloggy goodness.

If you don’t know why you are hear, please read about the 21 Day Happiness Training Challenge.

After months of research and planning I recently had a successful garage. Here’s my how-to yard sale manual.

Step 1: Preparation. You can never be too prepared. I detail advertising, setup, planning and more.

Step 1.5: Marketing. Here is the text of the ads I placed.

Step 2: Management. Pricing, haggling, staffing, and other “Day Of” issues.

Step 3: Wrap-up. It’s done. What now?

Finally, we’ve got a Page of Tips. This is sure to grow over time.

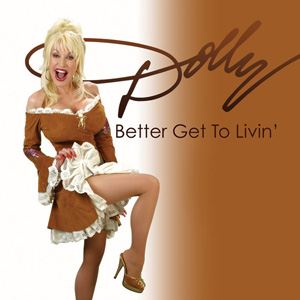

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.

Have you ever seen a kid come off a wrestling mat, crying his eyes out because he lost?

Often, that kid will get told to be tough and stop crying.

That’s wrong.

I’m not opposed to teaching kids not to cry under most circumstances, but just after an intense competition, I love it. It’s the best possible sign that the kids was pouring his soul into winning. It means he was trying with everything he had.

It means he is–or will be–a winner.

When a kid, particularly a boy in a tough sport, is crying, you know he’s going to try harder and do better next time.

For all of the “tough guy” ability it takes to succeed as a wrestler, I’ve never seen another wrestler teasing the crier. They’ve all been there. Wrestling is a team sport, but you win or lose a match on your own. When you step out in front of hundreds of people and spend 3 to 6 minutes giving every ounce of everything you have to give, only to find it’s not good enough, you’ll often find you don’t have the final reserve necessary to control your emotions.

This is different than a kid crying because he lost a game, just because he lost. Some kids feel entitled to win anything they do, regardless of the effort they put it. That’s also wrong.

Crying at a loss is okay after putting in maximum effort and full energy, not because the dice went the wrong way.

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

A diversified financial portfolio gives investors options in terms of economic fluctuations and, by investing internationally, your finances will have alternative sources of stability. In other words, if your money is spread out among various countries, then an economic crash in one country won’t affect other investments.

It goes without saying that with diversification also comes a learned understanding of various global economies and markets, but with the help of a financial adviser or with a little research, you’ll have the ability to make informed global investments, which is always better than the “eggs in one basket” approach.

Just like there’s diversification with investing internationally, there are also many options when it comes to the way you want to invest your finances. And, with international investing growing in popularity, the investment options available in today’s market are quickly becoming commonplace.

Three of the most popular forms of international investments are mutual funds, exchange traded funds (ETFs), and American depository receipts (ADRs). And, although mutual funds are a common form of investment, ETFs and ADRs trade much like stocks and therefore take a little more financial knowledge to navigate.

If you’re the type of investor that’s worried about financial scares associated with foreclosures and lawsuits, investing internationally has an added advantage of asset protection. With investing abroad, many foreign financial institutions are able to protect your investments from seizure and other threats.

Likewise, investing internationally also comes with confidentiality concerning your finances. International financial institutions are not legally required to divulge your monetary details to anyone. Confidentiality isn’t to say that international investments are exempt from legalities, but they’re entitled to more freedoms.

In terms of household incomes, import/export strengths, younger working populations, and the lean toward free-market economic policies, investing internationally has the potential for more growth than investing in the United States alone, which translates to an increase in return potential in overseas investments.

In fact, according to the International Monetary Fund, the United States is expected to fall below the rest of the world for the next two years when it comes to economic growth. Because of this, companies like Fisher Investments Institutional Group are strategizing toward international investments in strong economic climates across the world.

Much like international investing gives your portfolio safety in numbers as opposed to having all assets invested in one country’s economy, so do currency differences from country to country. In relation to the US dollar, many countries across the world have stronger currencies, which helps boost returns over time.

The flip side of this coin is the idea that fluctuations in currency strengths can just as easily work against your portfolio as they can strengthen it. It’s wise to keep an eye on international currency rates and how they compare to the US dollar, but never invest solely based on rates as a country’s currency can drop in strength overnight.

Otherwise known as tax havens, many countries across the world offer attractive tax incentives to foreign investors. These incentives are meant to strengthen other country’s investing environments as well as attract outside wealth.

These tax incentives are particularly attractive to US investors due to the increasingly high taxes in the country. As a result, the United States government is creating more defined restrictions and laws when it comes to international investment tax incentive regulations.

Because the United States has both the world’s largest economy and stock market, financial opportunities are almost maxed out due to over-investing. On the other hand, emerging markets in other countries are growing in size and strength, which is quickly resulting in stronger economies and more investment opportunities.

By ignoring the potential of other world markets, you’re also ignoring global economies and stock markets that offer unforeseen investment potential when compared to the United States, which is something every investor should keep in mind.

So, from portfolio diversification to investment growth, investing internationally is a great way to expand your financial horizons.

This is a guest post.