What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

I’m not a huge fan of New Year’s resolutions. Generally speaking, if you don’t have the willpower to do something any other time of the year, you probably won’t grow that willpower just because the last number on the calendar changed.

Seriously, if you’ve got something worth changing, change it right away, don’t wait for a special day.

That said, this is the time of the year that many people choose to try to improve…something. Some people try to lose weight, other people quit shooting meth into their eyeballs, yet others(the ones I’m going to talk about) decide it’s time to get out of debt.

Now most people are going to throw out some huge and worthless goals like:

The problem with goals like that is the definitions. What is “some”, “more”, “better”, or “less”? How do you know when you’ve won.

It’s better to take on smaller goals that have real definitions.

Try these:

But Jason, I hear you saying, where am I going to find $1000 to save? Well, Dear Reader, I’m glad you asked. Next time though, could you ask in a way that others can hear so my wife doesn’t feel the need to call the nice men in the white coats again?

Let’s break that goal down even further.

Instead of saving $1200, let’s call it $100 per month. That’s a bite-sized goal. Some people don’t even have that to spare, so what can they do?

Let’s make that resolution something like “I’m going to have frozen pizza instead of my regular weekly delivery.” If your house is anything like mine, that brings a $60 pizza bill down to $15 for some good frozen pizza for a savings of $45. If you order pizza once a week, that’s $180 saved each month, double your goal. That’s a win with very little suffering.

Now, you can take that extra $80 that you hadn’t even planned for and throw it at your credit cards. That’s a free payment every month. Before you know it, you’ll have your cards paid off and a decent savings account.

Then you can thank me because I made it all possible.

The American Dream has been perverted. Life, liberty, and the pursuit of happiness has been cruelly warped to mean

“Toys, free stuff provided at the expense of others, and the ability to buy and do anything I want without regard for the consequences.” To fund this horrible new dream, the people who can’t convince a government program to finance it for them often turn to credit. Credit is the art of putting your future into hock for something that you probably don’t need or want and that won’t work by the time you are finished making payments.

Ick. I’ve chosen not to live my life that way. Every day, more people are waking from the consumerism fog and deciding to reel their lifestyles back in and take control of their lives. They take a look at the world around them, compare it to their check register, and realize that it’s just not sustainable. You can’t survive on credit forever. Eventually, you will realize that there isn’t enough money to continue to buy things today on tomorrow’s paycheck.

What’s the first thing you should do when you decide that a “normal” life—a life in debt—isn’t the way you are going to live your life?

Well, when you find yourself standing in a grave, stop digging. You can’t dig yourself out of a hole and you can’t borrow your way out of debt. If you want to get out of debt, you need to stop using more debt. Period.

It may seem impossible, and the people around you may try to convince you that you are crazy. It is not impossible, just time-consuming. Short of finding an insane amount of money hiding under your front step or a winning lottery ticket blowing across the sidewalk, there are no shortcuts to getting out of debt. It’s just a matter of making the payments and not using more credit.

As far as the haters, screw ‘em. They are brainwashed into thinking their unsustainable and insane lifestyle is not only normal, but necessary. You don’t get life advice in a padded room, and you don’t plan your finances with a debt-addict.

Getting out of debt is a simple process, but that doesn’t make it easy. It only has two real steps: stop using debt, and keep making the payments.

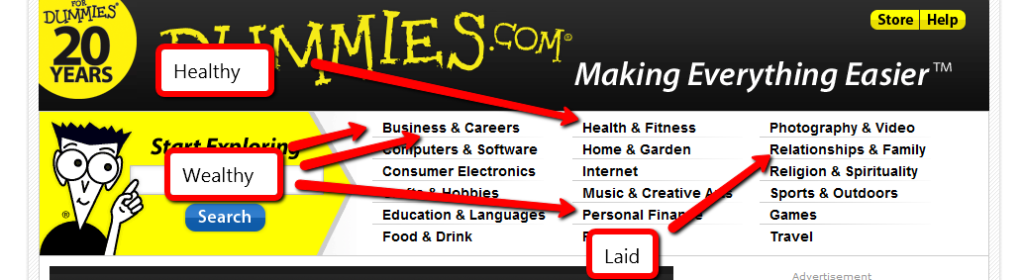

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

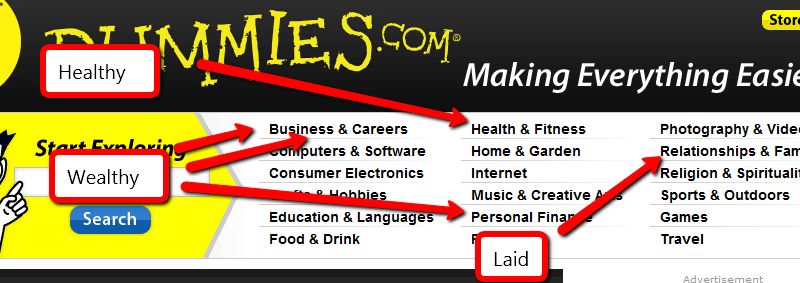

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Brains!

Nobody has ever accused a zombie of being smart. The are, after all, dead and rotting. Their primary means of education themselves is eating the brains of the living, which is hardly an efficient learning style. Besides, in a strictly Darwinian sense, their victims are among the least qualified to teach useful skills.

Zombies smell. They are little more than flesh-eating monsters. They are lousy in the sack. Yet, for all their flaws, have you ever heard of a zombie in debt or worried about financing retirement? They are obviously doing something right.

What can you learn from a zombie? That depends on the type of zombie. Not all of the life-challenged were created equal.

There are 3 main types of zombies:

1. Slow shamblers are best recognized by their lurching gait and unintelligible grunting, similar to a frat party at 3AM. They are rarely fresh specimens. Arguably the the scariest of all zeds, due to the sheer inevitability of their assault, they do always get where they are going, even if it takes a while. Trapped in a pit or a pool, they will keep trying to reach their goal. A slow shambler, were he able to effectively communicate beyond the basic “Hey, can I eat your brain?” would tell you to approach your goals like the famous tortoise: slowly. Set aside an affordable amount in savings every week, no matter what. Even if your are stuck saving just $10 each month, you will eventually get your sweet, sweet brains.

2. Voodoo zombies are the still-living, yet mindless minions on a voodoo priest. These unlucky non-corpses crossed the wrong people–usually by stealing or not repaying their debts–and ended up cursed for it. They are forced to do the bidding of their masters until such time as their debt has been repaid, if ever. Their warning is to always pay your debts and do not steal. Honest, ethical behavior is the best way to avoid this fate.

3. Runners are almost always “fresh” to the game. As they decompose, they slowly transform into slow shamblers. These fellas can often pass for the living…from a distance. By the time you get close enough to identify them as monsters, your brains are on the menu. They are capable of sprinting for short distances and, on occasion, have even been seen to run up vertical walls. To properly categorize the runners, we have to break them down into 2 sub-groups. The first sub-group is the envy of all zombies still capable of envy. They have used their skills to trap enough prey(that’s us, folks!) that they will feel no hunger for the foreseeable future. They are secure. They are the successful runners. The other sub-group tries to emulate the first, but lack both planning and follow-through. While the first group builds momentum to secure their future, the second group tends to use that momentum to smack face-first into the wall, confused at where their lunch went. Constantly charging from one thing to the next, they never manage to sink a claw into their goals. To avoid falling into the second group, you’ll have to settle on a strategy and pursue it with all the single-minded, decomposing determination you can muster.

You know what they say: “Great minds taste alike.” What kind of financial zombie are you?

There are two options to choose from.