- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

Mortgage Race, Part 2

As I mentioned last month, Crystal and I are in a race to pay off our mortgages. The loser(henceforth known as “Crystal”) has to visit the winner. Now, since–judging by the temperature–Crystal lives in Hell, I think it would be good for her to visit in the winter. There something about the idea of going ice fishing, staring at a hole in the ice while sitting on a 5 gallon bucket, cursing the day I was born.

Today, she threw down the gauntlet again. She has apparently decided that, since her prerequisites are met, she’s going to win. Sure, she’s closed on her house and built her savings back up to $20000, but it doesn’t matter. I’ve sent a small army of arson-ninjas to keep her from getting ahead. They are so small, they can only carry tiny matches and single drops of gasoline, so the damage they can do is tiny, but it will add up. Just a word of advice: if you hire an army of arson-ninjas, go for the upsell and get ninjas that are at least 2 feet tall. Anything less is just inefficient.

When I announced the race last month, my mortgage balance was $26,266.40. Today, it is $25,382.53. In three days, there will be another $880 applied to the principal.

In February, our renters will move in and we’ll conservatively have another $650 to pay. When that starts, our balance should be around $23,000. Adding a portion of the rent payment should mean we pay off the house in May 2014. However, when I bring in our side hustle money, that will bring us back to September 2013.

Crystal’s projected payoff is July 2013, so I’ll have to hustle.

How come my back hurts?

My favorite book series is the Sword of Truth by Terry Goodkind. It’s a good sword-and-sorcery, good-versus-evil fantasy.

But I’m not here to talk about that series. Rather, I’m going to talk about one particular scene in book 6, Faith of the Fallen.

There’s a scene where Richard, the protagonist, ends up in a socialist workers’ paradise, where the government controls distribution and everybody is starving. Jobs are hard to come by, because everything is unionized and unions control access to work. That’s a non-accidental parallel to every country that has embrace socialist principles, or even leans that way. Go open a business with employees in France, I dare you.

So Richard goes out of his way to help someone with no expectation of reward. This person then offers to vouch for him at the union meeting, effectively offering him a job.

This is the conversation that follows:

Nicci shook her head in disgust. “Ordinary people don’t have your luck, Richard. Ordinary people suffer and struggle while your luck gets you into a job.”

“If it was luck,” Richard asked, “then how come my back hurts?”

If it was luck, how come my back hurts?

Seneca, a 2000-year-dead Roman philosopher said, “Luck is where the crossroads of opportunity and preparation meet.”

I won’t lie, I’ve got a pretty cushy job. I make decent money, I work from home, I love my company’s mission, and I kind of fell into the job.

By fell into, I mean:

- I started teaching myself to program computers when I was 7.

- I worked in a collection agency collecting on defaulted student loans to put myself through college while I had a baby at home.

- When I graduated, I went out of my way to help anyone I could, which positioned me for a promotion, getting my first programming job. The first one is the hardest.

- I spent 3 years studying the online marketing aspects of what I’m doing, with no promise of a payoff.

- I launched a side business in the same industry as the company I work for.

- I built a relationship with an author to include his books in the classes I teach. He happened to move to the company I’m with.

- I offered advice–for free, on a regular basis–on certain aspects of his business and his responsibilities with this company.

- He offered me a job.

That’s 25 years and tens of thousands of dollars spent earning my luck. How come my back hurts?

I have a friend on disability. He has a couple of partially-shattered vertebrae in his back, but he keeps pushing off the corrective surgery because the payments would stop after he heals. He refuses to get a regular job, because his payments would stop. He lives on $400 per month and whatever he can hustle for cash, and he will make just that until the day he dies. And he complains about his bad luck.

His back literally hurts, but not metaphorically. His bad luck is the product of deliberately holding himself down to keep that free check flowing.

I have another friend who made some bad decisions young. Some years ago, he decided that was over. He took custody of his kid and started a business that rode the housing bubble. When the bubble popped, so did his business. Instead of whining about his luck, he worked his way into an entry-level banking job.

He put in long (long!) hours, bending over backwards to help his customers and coworkers, and managed a few promotions, far earlier than normal. His coworkers whined about it. He’s so lucky. If it was luck, why does his back hurt?

We make our own luck.

If you bust your ass, working hard and helping people–your coworkers, your customers, your friends, your neighbors–and you are willing to seize an opportunity when it appears, you will get ahead. When you do, the people around you who do the bare minimum, who refuse–or are afraid–to seize an opportunity, who always ask what’s in it for them, they will will whine about your luck.

When they do, you will get to ask, “If it was luck, how come my back hurts?”

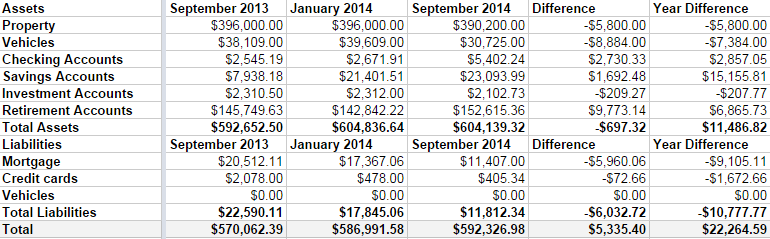

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.

Can Bad Credit Cost You Your Job?

Did you know that having a bad credit history could cost you your job? An increasing number of American employers have turned to running credit checks to screen job

applicants. Some companies even evaluate existing employees on a regular basis by checking their credit reports. If you have outstanding debts, you might consider getting one of those credit cards for bad credit to clean up your report before you apply for your dream job.

Not all companies run your credit history when you apply for a position. However, if you’re applying for a job that entails working with money or valuables, it’s a safe bet that they’ll be checking your credit history. Financial institutions, brokerage companies and jewelry manufacturers all run credit checks, as do hotels, accounting firms, human resource departments and government agencies.

Companies run credit checks because they want to hire employees who won’t be tempted to embezzle company funds to pay off large debts. Some companies fear that employees who carry large debt loads are susceptible to blackmail or bribery. The federal government carries this concern even further, indicating that citizens who owe large debts are considered national security risks.

Many companies feel that your credit report gives them a sneak peak at your true character. Having a good credit history indicates that you are a responsible person with excellent character. Having a bad credit history means that you are an unreliable person of poor character. True or not and fairly or not, this is the current belief running throughout company hiring departments.

Unfortunately, you can’t relax about your credit report even after you’ve been hired for a position. Once you’ve given a company written permission to check your credit report, they can recheck it at a later date. Government and financial organizations often run periodic credit checks on all of their employees. Some companies only recheck your credit history if you are up for a promotion. It’s a good idea, therefore, to keep your credit history squeaky clean.

Keep in mind that having a couple of late payments probably won’t kill your chances of employment or promotion. Most employers look for the really big issues, such as high credit card balances, defaulted student loans, repossessions and foreclosures. Some companies also look for charge-offs and consistent late payments as well.

Steps You Can Take

Financial experts suggest checking your credit report before you start your job search. Read your credit report carefully and make sure that all of the information is accurate. If your report contains incorrect details or any unauthorized charges, dispute these errors immediately and have them corrected to raise your credit score.

If you have a host of unpaid bills, find a way to settle those debts to improve your credit history before applying for jobs. Many people turn to credit cards for bad credit consumers. These cards allow you to consolidate all of your debts into a single debt. Just don’t forget to make the payments on this card.

Be upfront with potential employers about any negative marks on your credit history. Just tell them that you have had past issues with your credit and are now working to clear up all of your debt. There’s no need to go into explicit detail.

Once you have a job, be sure that you check your credit report at least every six months to ensure it contains only correct information. Pay all of your creditors on time. Never take out any new lines of credit unless you are absolutely positive that you can pay it back in a timely manner.

Post by Moneysupermarket

Twitter Weekly Updates for 2010-05-22

- RT @MoneyMatters: Frugal teen buys house with 4-H winnings http://bit.ly/amVvkV #

- RT @MoneyNing: What You Need to Know About CSAs Before Joining: Getting the freshest produce available … http://bit.ly/dezbxu #

- RT @freefrombroke: Latest Money Hackers Carnival! http://bit.ly/davj5w #

- Geez. Kid just screamed like she'd been burned. She saw a woodtick. #

- "I can't sit on the couch. Ticks will come!" #

- RT @chrisguillebeau: U.S. Constitution: 4,543 words. Facebook's privacy policy: 5,830: http://nyti.ms/aphEW9 #

- RT @punchdebt: Why is it “okay” to be broke, but taboo to be rich? http://bit.ly/csJJaR #

- RT @ericabiz: New on erica.biz: How to Reach Executives at Large Corporations: Skip crappy "tech support"…read this: http://www.erica.biz/ #