There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

The no-pants guide to spending, saving, and thriving in the real world.

I once worked for a company that was so confused that, not only did I not meet my last immediate supervisor for 6 months, but he didn’t know what I did or who I supported. He was my supervisor on paper for payroll and organizational purposes only.

Does your boss know what you do?

More recently, I was called into my current boss’s office to get scolded for low productivity since I don’t produce as much as the other programmers.

That’s not my favorite thing to do in the afternoon. I’d rather spend the afternoon playing Angry Birds improving our software.

In response, I spent the week logging my time. Before I left on Friday, I sent my boss an email that started out with:

When we spoke on Monday, you compared my productivity unfavorably to the other developers. I don’t think that’s a fair comparison as I do more categories of tasks than the others. I don’t think you realize how many additional responsibilities I’ve taken on over the years.

I continued from there with a summary of each day’s work last week. The short version is that, while being productive, I spend less than half of my time on my primary job function because I’ve slowly taken on a managerial role.

I’m on vacation this week, so it will be a few days before I find out if my email will make a difference.

Now, this scolding was my fault. I know I spend my day doing much more than just writing code. I’ve told my boss that before, but I’ve never made sure he understands the scale of the extra work, and I’ve never proven it with a detailed log.

This was poor personal marketing.

In the future, I have to make sure that I keep him in the loop with a summary of the extra work I do, like the training, product demos, sales calls, and estimates I’m involved in.

We’ll see how well that works.

How would you handle a situation like this? Daily emails? Whining? Kicking a garbage can across the room?

This was a guest post I wrote last year to answer the question posed by the Yakezie blog swap, “Name a time you splurged and were glad you did.”

There are so many things that I’ve wanted to spend my money on, and quite a few that I have. Just this week, we went a little nuts when we found out that the owner of the game store near us was retiring and had his entire stock 40% off. Another time, we splurged long-term and bought smartphones, more than doubling our monthly cell phone bill.

This isn’t about those extravagances. This is about a time I splurged and was glad I did. Sure, I enjoy using my cell phone and I will definitely get a lot of use out of our new games, but they aren’t enough to make me really happy.

The splurge that makes me happiest is the vacation we took last year.

Vacations are clearly a luxury. Nonessential. Unnecessary. A splurge.

When we were just a year into our debt repayment, we realized that, not only is debt burnout a problem, but our kids’ childhoods weren’t conveniently pausing themselves while we cut every possible extra expense to get out of debt. No matter how we begged, they insisted on continuing to grow.

Nothing we will do will ever bring back their childhoods once they grow up or—more importantly—their childhood memories. They’ll only be children for eighteen years. That sounds like a long time, but that time flies by so quickly.

We decided it was necessary to reduce our debt repayment and start saving for family vacations.

Last summer, we spent a week in a city a few hours away. This was a week with no internet access, no playdates, no work, and no chores. We hit a number of museums, which went surprisingly well for our small children. Our kids got to climb high over a waterfall and hike miles through the forest. We spent time every day teaching them to swim and play games. Six months later, my two year old still talks about the scenic train ride and my eleven year old still plays poker with us.

We spent a week together, with no distractions and nothing to do but enjoy each other’s company. And we did. The week cost us several extra months of remaining in debt, but it was worth every cent. Memories like we made can’t be bought or faked and can, in fact, be treasured forever.

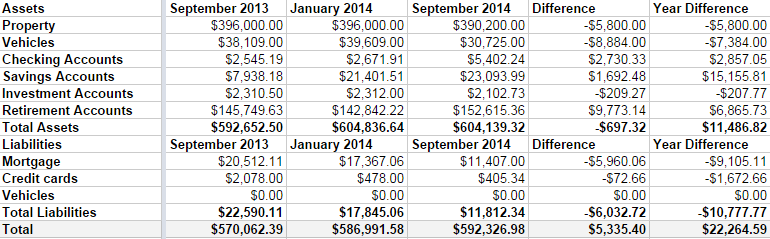

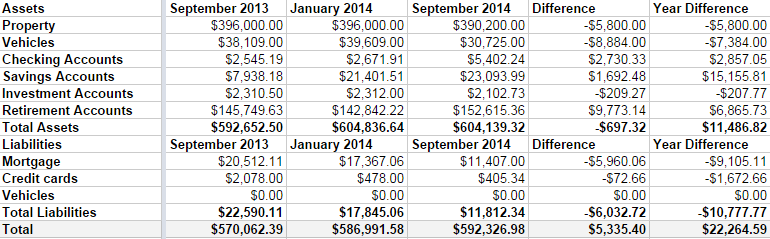

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.