- RT @ramseyshow: RT @E_C_S_T_E_R_I_: "Stupid has a gravitational pull." -D Ramsey as heard n NPR. I know many who have not escaped its orbit. #

- @BudgetsAreSexy KISS is playing the MINUTE state fair in August. in reply to BudgetsAreSexy #

- 3 year old is "reading" to her sister: Goldilocks, complete with the voices I use. #

- RT @marcandangel: 40 Useful Sites To Learn New Skills http://bit.ly/b1tseW #

- Babies bounce! https://liverealnow.net/hKmc #

- While trying to pay for dinner recently, I was asked if other businesses accepted my $2 bills. #

- Lol RT @zappos: Art. on front page of USA Today is titled "Twitter Power". I diligently read the first 140 characters. http://bit.ly/9csCIG #

- Sweet! I am the number 1 hit on Ask.com for "I hate birthday parties" #

- RT @FinEngr: Money Hackers Carnival #117 Wedding & Marriage Edition http://bit.ly/cTO4FU #

- Nobody, but nobody walks sexy wearing flipflops. #

- @MonroeOnABudget Sandals are ok. Flipflops ruin a good sway. 🙂 in reply to MonroeOnABudget #

- RT @untemplater: RT @zappos: "Do one thing every day that scares you." -Eleanor Roosevelt #

Annual Fees: Scam or Service?

Annual fees. For a lot of people, this is the worst possible thing about a credit card. That’s understandable, since paying interest is voluntary. If you don’t want to pay it, you just need to pay off your balance within the grace period. Annual fees, on the other hand, get paid, whether you want to or not, if the are a part of your credit card.

When I was 18, I applied for a credit card that raised an undying hatred of Providian in my heart. I was dumb and didn’t read the agreement before applying. When I got the card, I read the paperwork and nearly made a mess of myself. It had a $200 activation fee, a $100 annual fee, a $500 limit, a 24% interest rate, no grace period, and a anthropomorphic contempt for all things financially responsible.

Yes, you read that right. The day you activate the card, you are 3/5 maxed and accruing interest at rates that would make a loan shark blush like my grandma is a strip club. Instead of activating, I cancelled the card and ran away crying. It was a mistake but didn’t cost me anything.

In exchange for all of that, I got…nothing. The card offered no services of any kind in exchange for the annual fee.

On the other hand, I have a card with an annual fee right now. It’s $59 per year, but it offers value in exchange.

This card’s basic offering is a 2% travel rewards plan. With most of our spending on this card, we’ve managed to accumulate $400 of rewards, so far, counting the 25,000 bonus miles for signing up.

In addition, it offers 24 hour travel and roadside assistance. The roadside assistance itself will pay for the fee, because I think I’ll be canceling my AAA account after 16 years. The card’s plan isn’t as nice, but I haven’t been using the AAA emergency services for the past few years, anyway.

It extends the warranty on anything I buy. It includes car rental insurance and concierge service. Concierge service is sweet. Need reservations for dinner? Call the card. Need a tub of nacho cheese? Call the card. Need a pizza? Well, call Zappos.com.

All in all, the card is paying for itself a couple of different ways, so in this case, the annual fee is definitely worth it. I guess there’s a serious difference between Capital One Venture and Providan Screwyou.

How do you feel about annual fees? Love ’em, hate ’em, have a card with one?

Phone Insurance

Thursday, at parent/teacher conferences, I sat on my phone and broke the screen.

Not just the glass, but the LCD.

Not a problem. I pay for Sprint’s repair plan.

Little did I know that Sprint–in their infinite #$!$%#$%–considers a phone unrepairable if there is more than one crack on the screen. That effectively means that any broken screen is a total loss.

It’s good to know my $4/month has been wasted.

Other than a phone I had stolen last year, I still own every phone I’ve ever owned. None have had water damage or anything catastrophic happen to them, so I didn’t get the replacement side of Sprint’s insurance plan.

To summarize:

- I broke my phone in a way that Sprint won’t fix, even though I pay for the fixit plan.

- My phone costs $600 when you aren’t signing a new contract.

- My phone has the most expensive LCD to replace at the moment.

The Total Equipment Protection program costs $11 per month. Given my history, that’s a waste of $11, though it would actually be a waste of $7, since I have been happy to pay $4 for the repair plan.

$7 per month since I got my first smartphone in about 2008, means I’ve saved $420 in insurance fees I haven’t used.

Today, I paid $298 to replace the LCD on my phone. That includes overnighting the part to the shop since it’s not stocked and I’m leaving town tomorrow.

An insurance claim from Sprint comes with a $150 deductible.

All told, I’m $270 to the good.

Would I get the insurance if I were signing papers today?

Probably not. A $7 monthly bill doesn’t hurt, while a $300 surprise does, but that’s why I have a repair fund.

Do you have insurance on your phone? Have you used it?

George Zimmerman: The High Cost of a Legal Defense

Most people have heard of the controversial nature of the George Zimmerman murder trial. Zimmerman, who defends his actions and is claiming self-defense, is on trial for murdering Trayvon Martin, a 17-year old with a social media profile that projects anything but innocence. While his defense attorneys claim that race had nothing to do with the murder, the prosecution thinks differently. In fact, a majority believe that Trayvon Martin would still be alive today if he hadn’t attacked Zimmerman. Regardless of your stance on the case, there is no denying the fact that Zimmerman’s trial is building strong emotions from both sides.

Fixed Prices Versus Variable Prices

Not everyone has a group of supporters raising money to pay for their legal defense. Just because Zimmerman has bad credit does not mean that he had to leave his legal defense up to a public defender in Sanford. If you do not have a Legal Defense Fund where people can donate money to your defense costs online, you will need to distinguish between fixed prices and variable prices for legal defense. During your consultation, the defense attorney should be able to quote you a fixed price based on the case details. Experienced attorneys do not charge on a pay as you go basis because they are confident their abilities. The actual fixed price of the attorney depends on the case, and can range anywhere between a $1000 and hundreds of thousands of dollars. O’Mara and West, who are defending Zimmerman, have quoted $1 million for their services in total. While they have not be paid completely by the Zimmerman Defense Fund, this is money that is due to them.

The Cost For Expert Witnesses

Zimmerman’s team introduced several expert witnesses including an animator, a medical examiner, and a self defense expert. All of these witnesses are paid to testify, and the cost is not always included in the initial quote. If your case is complex, there may be a need for an expert witness. When you are pricing the cost of defense, see if this is included. Assume that you will spend about 10% more than quoted so that you can cover all of the outside costs.

Zimmerman may have been unemployed and working as a volunteer neighborhood watch member, but he does have one of the most experienced legal defense teams working for him to get a not guilty verdict. You may not need a million dollars, but legal defense is not cheap. Keep in mind that you get what you pay for when legal defense is concerned.

Insurance

Related articles

WWE: Money in the Bank, or all Hype?

Most people will never realize what it’s like to lose $350 million in a single day, but if you’re Vince McMahon you know the feeling all too well. However, before you start collecting money to give to the WWE CEO, let’s remember that despite that setback he’s still worth a cool $750 million. So while he got knocked out of the billionaire’s club, he’s still a full-fledged member of the multi-millionaire’s club.

However, despite the rough financial spot in the road, don’t think the WWE is ready to tap out anytime soon. The WWE Network, an on-demand streaming service launched by the company earlier this year, is already approaching one million subscribers. Despite what will probably be an initial loss of $50 million for the fledgling network, McMahon and other WWE executives believe the network will eventually become a money-maker for the company.

So while Triple H, the Rock and John Cena have helped make the WWE what it is today, there are many other superstars who are helping take the company to even greater heights. In recent years, perhaps none are more well-known and liked than the company’s Divas. Whoever said sex sells sure knew what they were talking about, because it seems the wrestling fans simply can’t get enough of the beauties who fight it out every week for glory and gold. With the show Total Divas on the E! Network for the next several years, fans will continue to get their weekly dose of the ring beauties there as well as on the other shows in the WWE camp.

So while it’s not money in the bank that all of the company’s ventures will pan out as hoped, it’s a good bet Mr. McMahon and those associated with the WWE will continue to figure out what fans are wanting and deliver it to them on a regular basis. And whether or not you are a wrestling fan, you’ve got to admit the WWE is a captivating experience in sports entertainment that keeps fans coming back for more each and every week.

Related articles

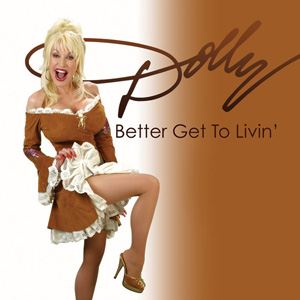

Dolly Parton’s Car Crash and the Importance of Insurance

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.