Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

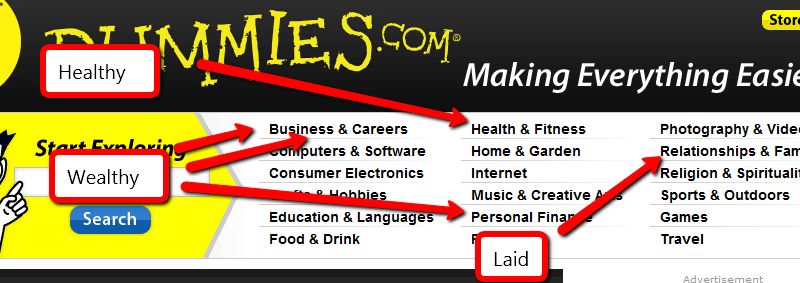

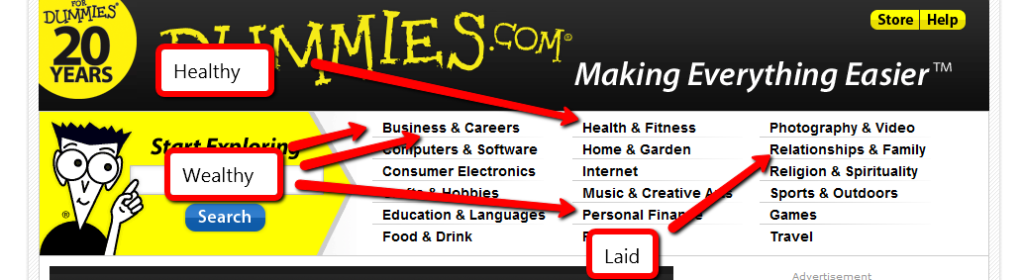

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

Have you ever set a goal…and failed?

At some point, it happens to all of us. After all, our reach should exceed our grasp, right? That doesn’t make it easy to admit failure, or to correct it. Did you let a New Year’s resolution lapse, or slip off of a diet? Have you started shopping indiscriminately again, or stopped going to the gym?

It’s okay if you did, but it’s time to fix it.

How can you get back on track after failing a goal?

Just like when you first started towards your goal, you have to decide when you’re going to get back on board. If you can’t decide, just pick the beginning of the next month. A new beginning is a great time to tackle your new beginning.

You failed once. Accept it and move on. Past behaviors don’t have to be an indicator of future performance. Just do better this time.

Somebody has noticed that you aren’t on the wagon. Your coworkers are seeing you eating candy, or your spouse has noticed you buying things you don’t need. Talk to these people. Tell them you’re going to redo the things you’ve undone. You’ll change the world, but you have to start with yourself.

Unless I have seriously misjudged my audience, you are human. Humans sometimes make poor decisions. Being ashamed won’t help you, but take the opportunity to learn from the past. Do you know what caused you to fail? Are there triggers to your behavior that you can avoid this time around? When I quit smoking, I tried to avoid rush hour, because I smoked heavily while I drove and I wanted to avoid being in car for as long as possible, minimizing one of my triggers. What cause your lapse, and can you avoid it?

This one should be the most obvious, but the fact that it’s a problem means it’s not. Do whatever it takes to not make the same mistakes and uphold your goals. Don’t smoke. Don’t eat garbage. Exercise more. Whatever you’ve decided to do or not do, do it….or not.

Have you missed a goal? How have you picked it back up?

I’m a debtor.

I’d like that to be otherwise, but I’m pretty close to the limit of what I can do to change that. Don’t get me wrong, it’s changing, but there is a limit to how many side projects I can take on at one time. So, I’m in debt and likely to stay that way for the next couple of years.

As part of my budget, I set up a few categories of items that are either necessities or “really wants” without being immediate expenses. For example, I’m setting aside some money each month for car repairs, even though my car isn’t currently broken. When it comes time to fix something, I hope to have the money available to fix it, without having to scramble or <spit> tap into my emergency fund.

All told, I have about a dozen of these categories set up, each as a separate INGDirect savings account. Twice a month, a few hundred dollars gets transferred over and divided among the savings goals. Most of these goals are short-term; they will be spent within the year, like the account for my property taxes. Some of them are open-ended, like my car repair fund. Some are open ended, but will eventually end, like the fund to finance my son’s braces. All of the accounts are slowly growing.

As I’ve watched the progress of my savings accounts, I’ve noticed something funny.

It may only be a few thousand dollars, but it’s more money than I have ever had saved. The vast majority of this money will be spent over the next few years, but having it there, now means that I have tomorrow covered. For the first time in my life, I’m not living paycheck to paycheck. No matter what happens, I know I can make ends meet for a couple of months. That fact alone has reduced my stress level more than I could have imagined.

Two years ago, I was sure I was going to file bankruptcy. Now, I’m looking at being just two years away from having all of my debt gone. I have faith that my future will be bright, and only getting brighter. If I can dig myself out of this hole once, I can do it again, no matter what happens.

This has brought a calm that I can’t easily explain. I don’t have to worry about where next week’s groceries are going to come from, or how we’re going to afford braces in a couple of years.

Having an emergency fund and some auxiliary funds has been entirely worth the work we’ve done for last two years. Have you noticed any changes as you pay off your debt and build savings?

“Walk on road, hm? Walk left side, safe. Walk right side, safe. Walk middle, sooner or later, [makes squish gesture] get squish just like grape. Here, karate, same thing. Either you karate do “yes”, or karate do “no”. You karate do “guess so”, [makes squish gesture] just like grape. Understand?” -Mr. Miyagi

It occurred to me that lately, I’ve changed my day-to-day cash flow plans a couple of times.

A year ago, I was running on a fairly strict cash-only plan.

A month ago, I was running on a strict budget, but doing it entirely out of my checking account.

Now, I’m loosening the budget reins, and moving all of my payments and day-to-day spending to a credit card, including a new balance that I can’t immediately pay off.

The thing is, changing plans too often scares me. Like the quote at the beginning of this post, I start worrying about being squished like a grape.

The simple fact is that any plan will work.

If you want to get out of debt, just pick a plan and run with it. If that means you follow Dave Ramsey and do the low-balance-first debt snowball, good for you. Do it. If you follow Suze Ormann and do a high-interest first repayment plan, great. Do it. If you follow Bach and pay based on a complicated DOLP formula to repay in the quickest manner, wonderful! Do it!

Just don’t switch plans every month. If you do that, you’ll lose momentum and motivation. Squish like grape! Just pick a plan and go. It really, truly does not matter which plan you are following as long as you are following through.

This applies to other parts of your life, too. For example, there are a thousand fad diets out there. Here’s a secret: they all work. Every single one of them, whether it’s Weight Watchers, slow carb, or the beer-only diet. The only thing that matters is that you stick to the diet. If you manage that, you will lose weight on any diet out there. Except for the jelly bean and lard diet. That one will make you extra soft.

Another secret: the productivity gurus are right. Every single one of them. David Allen, Stephen Covey, Steve Pavlina, and the rest. They all have the One True Secret to getting the most out of your day. Really. Pick a guru and go! But don’t try to Get Things Done in the morning and do 7 Habits at night. Changing systems, changing plans, changing your mind will make you sabotage yourself.

The real secret to accomplishing great things, whether it’s paying off $100,000 of debt, dropping 40 pounds in 3 months, or tripling your productivity is to do it. Just get started and, once you’ve started, don’t stop. If you keep going and stay consistent, you’ll accomplish more than anyone who hops from system to system every few weeks.

Even as a growing number of analysts are questioning the details of Obamacare, the sudden hospitalization of Teresa Heinz Kerry, the wife of former senator and current U.S. Secretary of State John Kerry, provides additional fodder to the ongoing healthcare debate.

Heinz, who is 74 years old, is the heir to the Heinz ketchup fortune. She is the widow of former Senator John Heinz, who was killed in 1991 in an aviation accident. Her marriage to Kerry in 1995 occurred when he was the senator from Massachusetts. Heinz was hospitalized on Sunday and is reported to be in critical condition after being flown to Massachusetts General Hospital in Boston.

Heinz was treated for breast cancer in December 2009 and went through two operations for lumpectomies. It is not known what specific health issues resulted in the current hospitalization. However, sources indicated that there was concern over the return of the cancer.

Regardless of the source of the current illness, it is taken for granted that Heinz will receive the very best of medical care, with cost being of no concern to treatments pursued. In the earlier process of treating her cancer, numerous doctors at the nation’s finest medical facilities were consulted. The issue of Heinz not having to worry about the costs of her care is the central theme of many who criticize our nation’s health care system.

For the millions of Americans who live daily without health insurance or any form of coverage, there is a constant concern over how they would deal with a medical emergency. These individuals know that they are one accident or serious illness away from devastating financial hardship. In fact, the single biggest reason for bankruptcy in the U.S. today is medical bills. According to the latest studies, the average hospital stay billed out at $15, 700, with an average daily cost of nearly $4,000.

These costs are onerous because so many people today find health insurance increasingly unaffordable. While the political debate over the current healthcare reform continues, there is one simple fact. That reality is that the annual cost of private health insurance, already out of the reach of many, has risen by as much as 50 percent in the last two years. Many plans for a family of four are now over $15,000 and it is predicted that a bronze plan under the implemented Obamacare will exceed $20,000 for that same family.

All of this brings us back to the hospitalization of Heinz. The reality we live in today means that many people diagnosed with cancer or other similar diseases have little hope of receiving the treatment or care that the wealthy can afford. Even with quality health care insurance, the co-pays and other costs create burdens that many cannot carry.

There are no simple or ready solutions to this situation. The morality of one patient dying because chemotherapy is too expensive while one with a large bank account survives is an issue that will see intensified debate in the coming months and years. Regardless of what caused the current hospitalization, Heinz is one of the lucky ones who will have superb medical care without financial considerations.