- Up at 5 two days in a row. Sleepy. #

- May your…year be filled w/ magic and dreams and good madness. I hope you…kiss someone who thinks you’re wonderful. @neilhimself #

- Woo! First all-cash grocery trip ever. Felt neat. #

- I accidentally took a 3 hour nap yesterday, so I had a hard time sleeping. 5am is difficult. #

- Wee! Got included in the Carnival of Personal Finance, again. http://su.pr/2AKnDB #

- Son’s wrestling season starts in two days. My next 3 months just got hectic. #

- RT @Moneymonk: A real emergency is something that threatens your survival, not just your desire to be comfortable -David Bach # [Read more…] about Twitter Weekly Updates for 2010-01-09

Make Yourself Accountable

Everybody knows the reputation New Year’s resolutions get for being abandoned in under a month. Following through with your saving and budget goals can be difficult. There are thousands of strategies for keeping your resolutions, but I’ve found that the best goal-keeping mechanism is to make yourself accountable. There are several ways to accomplish this.

Make Firm Goals. If your goals are open to interpretation, it’s easy to interpret them in a way that lets you off the hook. Make the goals concrete and immune to interpretation, and that can’t happen. “Get up earlier” may mean five minutes, which is technically meeting the goal, but not really. “Get up at 5am” is clear and concrete.

Get a “Goal Buddy”. When I am out shopping, if I’m struck by the impulse to buy something I probably don’t need, I call my wife. She’s more than happy to encourage me to put the movie or game back on the shelf. I have a friend who will call me up if he’s thinking about buying a new gadget so I can talk him down. Friends don’t let friends mortgage their futures.

Go Public. As you may have noticed, I’m being as open as possible with my goals for the year. I have laid out clear goals and I provide fairly frequent updates through both this site and twitter. If I fail, I fail in front of an audience. That’s strong encouragement to succeed. Tell your family, friends and coworkers. Announce your goals on the internet. Make it as difficult as possible to fail gracefully.

Punish Yourself. I have a line item in my budget called “In the hole“. If I go over budget one month, the overage is entered as an expense the following month. This serves the double purpose of getting the budget back on track and forcing me to sacrifice something the next month to make that happen. Another option may be to write out a check to a charity you hate, and drop it in the mail if you miss your goal. Anything unpleasant can work as your punishment.

How do you keep your goals?

Hunting Trip Stress

Vegans and hippies won’t enjoy this post.

Friday, I went to a cabin in the woods for a weekend hunting trip with my dad, my brother, and a few other people.

My wife didn’t think it’s a good idea. In fact, she was terrified that I’d walk into the woods and come out in a body bag.

Statistically, it’s safe. Out of 12.5 million hunters, there are only around 100 fatal hunting accidents every year. I think I went hunting for the first time when I was 12, and continued to do so until I was 17, then life started interfering.

That doesn’t matter. By definition phobias aren’t rational. She’s worried and stressing hard.

If she’s had such a hard time with it, why did I go?

First, I asked her six months ago if she’d be all right with the trip. I knew she had some phobias, and have–in fact–tried to make the trip before. Six months ago, she said yes. It was a bit late to back out after I’ve committed to a share of the cabin, bought the bright orange gear, and agreed to drive my brother.

The second reason was more important.

This is one of the few things my dad and I both enjoy. I’m a geek, he’s not. I dig horror and sci-fi, he’s into westerns.

But we both enjoy hunting. The first time he treated me like an adult was the first year we went hunting together, 15 years ago.

My dad taught me to be the man I am. Without him, I have no idea who I’d be or what I’d be doing. My integrity, my work ethic, and my moral code can all be traced to the things he taught me.

This is my chance to spend time with him and have a good time with no TV or whiny kids interfering.

Trading this for a few days of stress at home is something I’m willing to do.

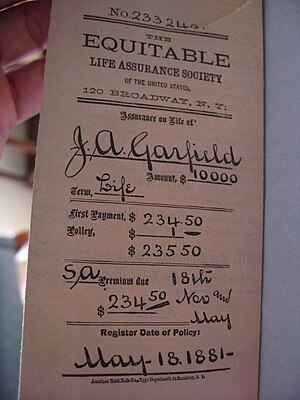

Protection for your Loved Ones

This is a guest post.

Life cover insurance acts as a safety net to pay for a family’s expenses should a wage earner become critically ill or die prematurely. Life cover includes life insurance as well as disability, critical illness, mortgage and income protection insurance policies.

Importance of life cover insurance

In most families, at least one adult is a wage earner and uses their income to pay for necessities such as food, clothing and rent or mortgage. If the wage earner becomes disabled, too ill to work, or dies, life cover insurance can pay for these expenses.

Stay-at-home parents provide valuable, though unpaid, services to the family. Without that person, the family would have to pay for childcare, household upkeep, errand running, and every other chore the stay-at-home parent did. If the stay-at-home parent has life insurance, these expenses can be covered.

Life cover insurance can pay off mortgages and education loans.

Live cover insurance policies will pay funeral costs, which can be substantial.

Family owned businesses can be insured and protected if the owner dies.

Objections

Life cover insurance is too expensive.

Insurance companies have plans to suit every budget and life circumstance. While young and healthy adults will generally receive the most affordable policies, older adults have plenty of reasonably priced options as well.

Disability or severe illness is unlikely.

Actually, 32% of men and 25% of women, ages 40 to 70, will experience a critical illness or disability. http://www.healthinsuranceguide.co.uk/statistics_mainbody.asp

Discussing disability or death is awkward and uncomfortable.

Agreed, but avoiding the topic puts loved ones into economic jeopardy. Without the wage earner’s life cover, a family could lose their home and have to lower their standard of living.

Variety of life cover insurances

Life Insurance

Term insurance is a protection policy, paid for during a specific time period (term), and is active during that time only. Permanent, whole, variable, universal and universal variable life insurance policies all are investment policies. They combine a death benefit (the amount paid out when the insured person dies) with an investment account. Licensed and experienced life insurance agents can help individuals make the best choice for their life situation.

Critical Illness/Disability Insurance

This type of insurance pays for living expenses if a person is diagnosed with a serious illness or disabled and can no longer work.

Mortgage Insurance

This is paid when the mortgage owner dies. This could help prevent the surviving family from having to sell the home.

The time to buy life cover insurance is now!

A 2010 survey (http://www.prnewswire.com/news-releases/ownership-of-individual-life-insurance-falls-to-50-year-low-limra-reports-101789323.html) stated that individual life insurance ownership was at a 50 year low in the United States. An estimated 35 million (30% of households) Americans do not have life insurance, and 11 million of these households have children under 18. Already living paycheck to paycheck, any debilitating injury or death of a wage earning adult could spell financial disaster to the family. Buying life cover insurance is a vital part of caring for loved ones. Just as a wage earner provides a home, food and daily necessities for their family, life cover insurance can take over and provide for the family if the wage earner unable to do so.

Expensive Cheese

Saturday morning, I woke up to a room-temperature refrigerator. I dislike drinking milk that’s 40 degrees warmer than I’m used to.

We called the repairman who showed up at 9PM and poked around in the fridge for a bit before announcing that he didn’t have the needed parts in his truck.

The parts came Monday. The next repairman got there Tuesday afternoon. For those of you keeping track at home, that’s nearly 4 days without a refrigerator.

That poor bacon.

Tuesday’s repairman didn’t think highly of Saturday’s. Apparently, the two parts Saturday ordered never go bad at the same time, so he was guessing.

He also didn’t notice the slice of individually wrapped American cheese that had slipped between a shelf and one of the cold-air vents, preventing any air flow at all.

Grr.

I wish I would have noticed that on Saturday. I now own the most expensive cheese in the world. It’s not Pule, which comes in at $616 per pound. This lowly slice of American cheese cost me nearly $200. At one ounce per slice, that’s $3200 per pound. Of course, I’m counting the lost food. My hamburger, eggs, bacon, milk, and mayonnaise are gone, along with every other perishable bit of food we had on hand.

I don’t know how much the repairs cost. Saturday’s visit, minus the parts, was billed at $95. I didn’t see the total for Tuesday’s visit.

We pay for a repair plan through our gas company. For around $15 per month, we get a list of appliances protected. We don’t have to worry about our washer, dryer, water softener, stove, refrigerator, or our sewer main. Assuming Tuesday’s visit was billed the same as Saturday’s, this one repair paid for the plan for an entire year. When you count our sewer main–which backs up with tree roots once a year and costs at least $200 to fix–the repair plan is definitely worth it for us.

When we get tenants in my mother-in-law’s house, we’ll have the repair plan set up there, too.

Do you use any kind of repair plan? How is it working out for you?

My Favorite Present

My favorite Christmas present this year was the one I gave to my 13 year old son.

Allow me to walk you through his evening….

First, he opened one of his presents. It was just a small box, about 3 inches by 4. A Japanese puzzle box. Inside the box was a note that read:

Closed off in the smallest room you will find a clue to bring you closer to your prize.

When he checked the cabinet below the sink in our basement bathroom, he found another note that sent him to my business website one a page with a url that contained “the square of my children”. When he eventually figured out that I meant their ages, not their quantity, he found a clue on my website.

This lead him to a section of his Minecraft server. It’s effectively a no-man’s land because he and his friends set off a nuke and turned it into a giant pit. They fall down and die there. Inside the pit was a cave. Inside the cave was a clue. The clue read:

Grandma and Grandpa love you.

What do you do when someone says they love you? You either get scared of the commitment and end a perfectly good relationship, or you say “I love you, too”. When the kid finally called his grandparents to tell them he loves them, they told him to give his parents a kiss.

I’m a jerk.

He came over and gave me a hug and a kiss. I handed him a piece of paper. When he looked at it, he asked if it was supposed to be torn in half. I reminded him that he has two parents, so Mom got a hug and a kiss, too. The resulting clue read:

The Answer to the Question of Life, the Universe, and Everything

Naturally, this points to The Hitchhiker’s Guide to the Galaxy, but the boy hadn’t read far enough into the book to understand the reference, so he had to hit google. After spending time looking for chapter 42, he finally thought to look at page 42, which had this clue:

My Little Pegasus

Two steps to the right

Two steps forward

Two steps up

This clue started at the My Little Pony I set next to a Pegasus in my daughters’ room. The boy was in dense mode because he had to ask his sister what a Pegasus was. She also had to suggest he open the closet door when one step forward made him bump his nose on it.

For all of that work, he got the Ticket to Ride game. He laughed the entire way through the treasure hunt, then decided he hated the whole process. However, for two nights running, he’s stopped the video games to play his new game with his family.

It’s a present he’ll remember forever.