- "The best way to spend your money is to spend it on time, not on stuff." http://su.pr/2tr5iP #

- First bonus by stock options today. Not sure I'm impressed. #

- RT @chrisguillebeau: US border control just walked the train asking "Are you a US citizen?" Native American guy says: "One of the originals" #

- @FARNOOSH My credit score is A measure of my integrity not THE measure. in reply to FARNOOSH #

- I'm listening to a grunge/metal cover of "You are my sunshine" #

- There's something funny about a guy on reality TV whining about how private he is. #LAInk #

Choosing an eCommerce Platform to Sell Products Online

According to the U.S. Online Retail Forecast, 2011 to 2016, a report conducted by global research and advisory firm Forrester, eCommerce sales in the United States topped $200 billion in 2011. This figure is set to rise by a staggering 62% by 2016, with the resulting $327 billion in annual eCommerce sales accounting for 9% of total retail sales. Spurred by innovative shopping models and online loyalty programs, the eCommerce sales channel is clearly benefiting from the increasing levels of comfort customers are feeling while shopping online. It’s not too late for companies of all sizes to reap the benefits of growth in this area. Assuming a product is ready to sell, the digital landscape boasts several eCommerce platforms and related services that will help companies to sell products online.

eCommerce Platforms: Several Flavors of Opportunity

eBay and Amazon: Ready Made eCommerce Platforms

Online retailers eBay and Amazon offer a quick and easy route for any business to start selling products online. The global reach of these sites means marketers gain immediate access to an audience of millions of potential customers. Despite increasing publicity in respect of the fees charged by the sites, particularly by eBay, a growing number of traders boast a turnover in excess of $1m. If nothing else, these platforms represent a practical opportunity for new companies to get started in online retail.

Shopify: Out-of-the-box Online Retail Stores

To date, over 20,000 business owners are using Shopify to realize the benefits of selling products online. This creative software allows businesses to use their own domain name, includes eCommerce hosting and an integrated shopping cart. It also boasts many online store designs customizable with over 100 ecommerce website templates. Payment for the service is made monthly with different plans available to suit businesses of varying sizes.

Facebook: Move Over Farmville

The phenomenal growth of social media has surprised most Internet users. With Facebook membership expected to exceed 900 million users by the end of 2012, a report from comScore, ‘The Power of Like, ‘ claims that customers are between 40 and 150 times more likely to consume branded content that is visible in their newsfeed than they are to visit a particular business page. Startups like 8th Bridge and Payvment are helping online retailers take advantage of this trend with the provision of innovative eCommerce solutions that encourage users to shop where they socialize.

Wordpress: It’s not just for Bloggers

While it’s true to say that WordPress was initially targeted at bloggers, it is now better described as a competent eCommerce and CMS platform. It’s a perfect option for those businesses who prefer to do things their way. Users can take advantage of free or premium eCommerce website templates and various WordPress plugins that will see their site turn from a basic blog site to a fully functional online retail store in minutes. Although all the potential eCommerce platforms discussed required that due diligence is given to marketing and optimization strategies, a business running its own online store should prioritize these aspects of success.

From Bricks to Clicks

The ‘clicks not bricks’ mentality is set to grow beyond the most idealistic of visions. Savvy business owners will give appropriate consideration to which eCommerce platforms will best suit their needs and that of their business. Many will come to the conclusion that the best solution is a combination of platforms.

This is a guest post.

Twitter Weekly Updates for 2010-01-02

- RT @kristinbrianne: You won't believe it… I just entered to win the #KodakSweeps on http://tweetphoto.com/contest Pls RT #

- RT @wilw The single most insulting thing you can tell a creative person is, upon viewing their creation, "you have too much free time." #

- Hmm. I share a birthday with Linus Torvalds. #

- @freefrombroke I'm following you and would love to be followed back. in reply to freefrombroke #

- RT: @SuburbanDollar: New Post: : The Art of Delayed Gratification http://bit.ly/5gsKXy #

- RT @FrugalYankee: #NEWYear's #QUOTE: All the things I really like to do are either immoral, illegal or fattening. ~ Alexander Woollcott #

- Crackberry is certainly accurate. I may be too connected. #

- MIL thinks a Kitchenaid stand mixer will make it easier to remove the snow in the driveway. Bad logic, but she's buying one for us, anyway. #

- What magic is in a saw-palmetto capsule and why does my prostate need the power of 1000 of them? #

- RT: @SuburbanDollar: Sounds like he's asking you to rent him a date. #

- RT @hughdeburgh: "I'd rather die fighting for freedom than live as a slave." ~ Judge Andrew Napolitano #Iran #in2010 #USA #

- Happy New Year, 3 minutes early. #

- Billy Jack vs Chuck Norris. Winner? #

- Getting my hair brushed by an 18 month old while watching Married With Children. It's a good evening. #

- RT @FrugalYankee: #NEWYEARS #QUOTE: The most important political office is that of private citizen. ~ Louis Brandeis #

- RT @ScottATaylor: 40,697 Laws Take Effect Today http://ff.im/-dFXNR #

- 5AM. It'd be so easy to go right back to sleep. #

The Luxury of Vacation

This was a guest post I wrote last year to answer the question posed by the Yakezie blog swap, “Name a time you splurged and were glad you did.”

There are so many things that I’ve wanted to spend my money on, and quite a few that I have. Just this week, we went a little nuts when we found out that the owner of the game store near us was retiring and had his entire stock 40% off. Another time, we splurged long-term and bought smartphones, more than doubling our monthly cell phone bill.

This isn’t about those extravagances. This is about a time I splurged and was glad I did. Sure, I enjoy using my cell phone and I will definitely get a lot of use out of our new games, but they aren’t enough to make me really happy.

The splurge that makes me happiest is the vacation we took last year.

Vacations are clearly a luxury. Nonessential. Unnecessary. A splurge.

When we were just a year into our debt repayment, we realized that, not only is debt burnout a problem, but our kids’ childhoods weren’t conveniently pausing themselves while we cut every possible extra expense to get out of debt. No matter how we begged, they insisted on continuing to grow.

Nothing we will do will ever bring back their childhoods once they grow up or—more importantly—their childhood memories. They’ll only be children for eighteen years. That sounds like a long time, but that time flies by so quickly.

We decided it was necessary to reduce our debt repayment and start saving for family vacations.

Last summer, we spent a week in a city a few hours away. This was a week with no internet access, no playdates, no work, and no chores. We hit a number of museums, which went surprisingly well for our small children. Our kids got to climb high over a waterfall and hike miles through the forest. We spent time every day teaching them to swim and play games. Six months later, my two year old still talks about the scenic train ride and my eleven year old still plays poker with us.

We spent a week together, with no distractions and nothing to do but enjoy each other’s company. And we did. The week cost us several extra months of remaining in debt, but it was worth every cent. Memories like we made can’t be bought or faked and can, in fact, be treasured forever.

What Can Cause Damage to Your Credit?

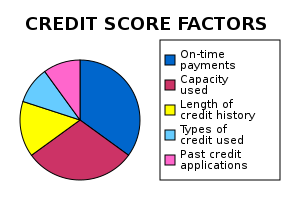

Credit scores move up and down as new financial data is collected by the credit bureaus. Many factors can cause a credit score to rise or fall, but most people don’t have a clue what they are. Understanding what affects credit can help keep your number in a good score range, where it should be. But, even a bad score can recover more quickly than most people realize, even after a bankruptcy or default. Here are some factors that can help you understand why credit moves up or down:

Late Payments

About 30% of your score is made up from your payment history. This is comprised from things like credit card bills, auto loan payments, personal loans, and mortgages. At this time, bills like utilities or rent are not factored into your score, unless they are sent to a collection agency. If you are late to pay your credit card bill, it will show up on your credit file. One late payment will probably not have much of an effect, but a history of this over time can drop your score. It is very important to keep bill payment current as a courtesy to creditors and the benefit of your own financial history.

Credit Inquiries

One of the most misunderstood factors that can cause a credit score to drop are “credit inquiries”. An inquiry takes place anytime your credit is checked. This makes up 10% of your total score. What most people don’t know is that there are two different types of credit inquiries, “hard inquiries” and “soft inquires”. Only hard inquiries affect credit and happen when you apply for a new credit card, loan, or mortgage. Soft inquiries on the other hand happen when someone like an employer, landlord, or yourself check your credit report. These are not factored into your credit score at all. Hard inquiries are a necessary part of applying for a loan or credit, so an occasional inquiry will not cause damage. It can only cause problems if there are many hard inquiries in a short period of time. This can be a signal to creditors that you are in financial trouble and are desperately seeking cash.

Credit to Debt Ratio

Your total amount of available credit compared to the amount of credit you use each month, makes up your credit-to-debt ratio. FICO suggests that you use no more than 30% of your available credit before paying off your balance each month. For example if you have $10,000 of available credit spread across 3 different credit cards, the optimal amount to charge would be $3000 or less each month. Maxing out your credit cards can cause your score to drop even if you pay them off completely each month.

Age of Your Credit History

The length of time you have had an open credit account is a major factor of your credit score. It can help to open a credit card when you are younger by getting a co-signer. If you are the parent of a teenager, it may be helpful to open a credit card in their name, but only allow them to use it for emergencies. Having an open credit card in good standing for a long period of time can help build this history. The length of time that you have had credit makes up about 15% of your score.

Different Types of Credit

The last major factor that makes up about 10% of your score comes from the different types of credit that you use. These credit types include revolving, installment, and mortgage. The ability of an individual to successfully handle all of these credit types can show that they are financially well-rounded. This makes up about 10% of the total credit score.

About:

Ross is an investor and website owner.

How to make Forex spread betting accessible to you

Easy to start and accessible, spread betting UK wide has grown in popularity. Forex spread betting in particular has attracted interest from traders all over the country, since it is a leveraged (or margined) product, which means that you are only required to deposit a small percentage of the full value of your position to place a forex trade. This means that the potential for profit, or loss, from an initial capital outlay is significantly higher than in traditional trading. They can go either long or short on their chosen currencies and can trade across a number of currency pairs. While Forex spread betting can be exciting, for newcomers, there are a few things to do before commencing trading. With advice from experts such as City Index, there is a possibility of being a successful trader.

Easy to start and accessible, spread betting UK wide has grown in popularity. Forex spread betting in particular has attracted interest from traders all over the country, since it is a leveraged (or margined) product, which means that you are only required to deposit a small percentage of the full value of your position to place a forex trade. This means that the potential for profit, or loss, from an initial capital outlay is significantly higher than in traditional trading. They can go either long or short on their chosen currencies and can trade across a number of currency pairs. While Forex spread betting can be exciting, for newcomers, there are a few things to do before commencing trading. With advice from experts such as City Index, there is a possibility of being a successful trader.

The first thing any new trader should do is research their market. A combination of technical and fundamental analysis usually works: some traders follow one more than the other, as it works better for them. Over time, you’ll find which research style works for you, while doing so before each trade will help you when looking at each currency pair.

Creating a clear, easy-to-follow spread betting plan is vital. Doing so will prepare you for each trade you make, while simultaneously eliminating any indecision you may have in the event of not having a plan. When trading, it’s also important to make use of the many risk management tools at your disposal. They mean that any potential losses are limited to a pre-set level.

Tying in with any research you do, following the news constantly is imperative. Monitoring any stories which will have a direct impact on the market you’re spread betting on, and looking at the live market regularly is especially important with Forex spread betting.

For beginners in Forex spread betting, there are plenty of resources available online for anyone with an interest in getting into it. Websites of companies like City Index have everything you need to help get you started.