- Watching Gamers:Dorkness Rising #

- Charisma? Weee! #

- Tweeting a dork movie? I'm a bit of a geek. #

- We just met and the first thing you do, after boinking a stranger in the presence of the king, is to murder a peasant? #

- Every movie needs a PvN interlude. #

- Everything's better with pirates. #

- Waffles? Recognize. #

- The Spatula of Purity shall scramble the eggs of your malfeasance. #

- Checkout clerks licking their fingers to separate bags or count change is gross. #

- Watching Sparkles the Vampire, Part 2: Bella's Moodswing. #twilight #

- @penfed was a waste of money. $20 down the drain to join, wouldn't give a worthwhile limit, so I can't transfer a balance. #

- @JAlanGrey It's pretty lame. The first one was ok. This one didn't improve on the original. in reply to JAlanGrey #

- RT @tferriss: Are you taking snake oil? Beautiful data visualization of scientific evidence for popular supplements: http://ping.fm/pqaDi #

- Don't need more shelves, more storage, more organization. Just need less stuff. #

- @BeatingBroke is hosting the Festival of Frugality #226 http://su.pr/80Osvn #

- RT @tferriss: Cool. RT @cjbruce link directly to a time in a YouTube video by adding #t 2m50s to end of the URL (change the time). #

- RT @tferriss: From learning shorthand to fast mental math – The Mentat Wiki: http://ping.fm/fFbhJ #

- RT @wisebread: How rich are you? Check out this list (It may shock you!!!) http://www.globalrichlist.com/ #

- RT @tferriss: RT @aysegul_c free alternative to RosettS: livemocha.com for classes, forvo.com for pronunc., lang8.com for writing correction #

- Childish isn't an insult. http://su.pr/ABUziY #

- Canceled the Dish tonight. #

You’re not alone: Help with Bankruptcy & Debt

Frequently regarded as an indication of personal failure, bankruptcy is still today widely considered a highly sensitive topic. Many will even feel uneasy speaking about their debt problems with close relatives and friends. If you, too, are facing serious debt issues and are in need of help, rest assured you are not the only one afraid of sliding into bankruptcy. In fact, thousands of households in the UK are threateningly close to insolvency and most are experiencing the exact same feelings of shame and despair. This perfectly understandable reaction has, meanwhile, unfortunately overshadowed the fact that there are hands-on practical steps especially designed to help you resolve your debt situation.

Frequently regarded as an indication of personal failure, bankruptcy is still today widely considered a highly sensitive topic. Many will even feel uneasy speaking about their debt problems with close relatives and friends. If you, too, are facing serious debt issues and are in need of help, rest assured you are not the only one afraid of sliding into bankruptcy. In fact, thousands of households in the UK are threateningly close to insolvency and most are experiencing the exact same feelings of shame and despair. This perfectly understandable reaction has, meanwhile, unfortunately overshadowed the fact that there are hands-on practical steps especially designed to help you resolve your debt situation.

There is a good reason why addressing the issue of bankruptcy has an urgent ring to it. Recent statistics indicate a steady rise of individual company insolvencies in the UK, particularly since the 1990s. According to the British Insolvency Service, the rate of bankruptcy on an individual level has risen from a total of 24,441 in 1997 to staggering 106,645 in 2007 in England and Wales. Alarmingly, the peak doesn’t seem to have been reached yet. As respected online-service ‘This is Money’ reports, ‘record numbers of people were declared insolvent in England and Wales’ in 2010, further noting that ‘an all-time high of 135,089 people were declared insolvent in 2010—0.7% up on the total for 2009.’ As you can gather from these numbers, you are certainly not alone with your debt problems: Around 140,000 adults are facing bankruptcy as a direct consequence of mishandling their debt issues, which translates to 385 new cases per day. It has already been pointed out that ‘the number of victims will be enough to fill both the London 2012 Olympic stadium and the Emirates Stadium.’

So, if you’re facing bankruptcy, there’s no need to feel ashamed. By taking an active stance and addressing your debt issues, you may even be able to avert insolvency altogether. With years of experience and several distinctions to our credit, the Debt Advisory Line have established themselves as leading experts in the field of debt management. We’ve already helped thousands of individuals and households who thought bankruptcy was their only option. Settling debt issues is our forte – and you shouldn’t settle with anything less.

This post brought to you by Debt Advisory Line.

Pros and Cons of Cashback Credit Cards

The news that the Bank of America is introducing a cashback credit card is of little surprise. The credit card industry is competitive and customers enjoy the thought of earning while they are spending!

There are both pros and cons of cashback credit cards however and they are not suitable for every circumstance. So, before committing to a card, consider the advantages and disadvantages.

Firstly, cashback cards can be financially profitable but this depends on whether you have the funds to make the repayments. If you are having difficulties with debt, these cards are probably not the most suitable.

The strategies for maximizing your benefits from cashback credit cards depend on making repayment deadlines. Prioritize cards that have a 0% APR introductory rate.

If you can make your repayments within this 0% interest rate, or on time each month, you will not incur any interest charges. It is important to be organized so that you always meet repayment dates.

Once the 0% APR has finished, cashback credit cards will often then revert to a high APR. If you cannot pay all your debt, these charges will mount up quickly.

If this is likely to happen to you, consider looking at alternative cards with a low but constant APR, so that you do not encounter such high charges while repaying your debt.

Cashback cards are not always the smartest move financially when it comes to outstanding debt. Although they may offer a 0% balance transfer, this is not always as simple as it sounds.

If you transfer an outstanding balance to a new card, even with a 0% APR introductory period, any repayments made will be charged against your newest purchases.

This means that it is more difficult to pay off the original balance transfer if you are also using the card to purchase new items and of course, it is very tempting to do so as you have the 0% APR available.

Be aware that if you do not pay the balance transfer amount by the end of the 0% period, you will then have to pay a much higher rate on this amount.

So you either need to be sure that you can pay off the balance transfer in full in addition to new purchases or consider using a separate card just for a balance transfer.

Although this may seem more work, it can potentially save you a great deal of money in interest charges. Remember any credit card is only worthwhile if it helps you manage your money.

Some cashback cards also have a minimum spend requirement and often this is paired with a specific time frame. Read all the criteria about the card before committing to it.

Otherwise, you could be charged for not reaching the minimum spend limit or not doing so within the required time frame. Consider these issues when choosing a card.

Cashback cards can be very useful and allow you to earn money while you are spending, but they need to be used with wisdom. Research your options to ensure you select the right card for you.

Post by MoneySupermarket.

Vacation, Shmaycation, Staycation?

Last week was our family vacation. This year, we decided to keep it cheap, since we raided our savings a few months ago to cover my son’s vision therapy.

Here’s what we did:

Friday (Yes, I started vacation on a Friday): My wife worked a half day, then we drove to visit my parents, roughly 120 miles north of our house. $110 for gas, round-trip, and $10 for drive-through lunch. $120 total.

Saturday: We went to the county fair and Dairy Queen. $18 for admission. $30 for ride tickets. $35 for food and ice cream. The ride tickets were totally worth it. My son and I discovered that he can handle the fun rides, which thrills me. $83 total.

Sunday: We had a picnic at the bottom of Inspiration Peak, the third highest point in Minnesota, followed by a hike to the top. That evening, my brother, his wife, my wife, and I tricked my parents into babysitting and escaped for several hours of adult time. After a couple of overpriced drinks at a crap restaurant, we went somewhere nicer and cheaper. A nice dinner, a few drinks, and a round of drunken go-karts later, we spent $90 for the evening.

Monday: Back to the go-kart park for the afternoon, and the return drive home in the evening. The go-kart park included 3 rounds of go-karts, mini-golf, and a round of bumper boats. $40.

Tuesday: A hands-on kids museum, a natural history museum that was hosting a portable planetarium, and a teppenyaki restaurant. We used museum passes for the museums, so this cost a total of $160. By far, the most expensive part was the restaurant. The museums cost a combined $30.

Wednesday: We spent the day at the Monster Mall’s indoor theme park, Nickelodean Universe, where we tested my son’s ability to handle the fun rides for $70. Then we ate at the Rainforest Cafe for $116, and we got my wife’s anniversary present, a family portrait at an “old time” photo studio. We chose a 1920s theme. I must say, I look dashing in a zoot suit. $260 total.

Thursday: My wife had to work on Thursday because she was short of vacation time, so I had the brats to myself. We went to a pick-your-own apple orchard where we picked a large bag of apples, a bottle of real, locally-made maple syrup and 3 cookies-on-a-stick. Afterwards, Brat #1 and I went to a Chinese buffet and the comic book store while the women-folk went to a saddle-club meeting. $60 total.

Friday: We had a fried chicken picnic at the largest playground in the area, and otherwise took it easy. $12.

Saturday: On Saturday, my girls rode in a horse show for the saddle club while my wife put in her volunteer work hours. Registration and the food for the potluck ran $40.

Sunday: I had to teach a gun class, so I made money, instead of spending it. My wife and kids played around the house.

Total, our vacation cost us $865, for 10 days of memories. If we would have skipped the restaurants, it would have cost $465, but we wanted those experiences, too. Our vacation fund has $906 in it, so we did all right.

SOPA Is Evil

So the record companies, the movie studios, the obsolete media, and some large software companies want the ability to nuke a website from orbit if they find any of their intellectual property there.

So the record companies, the movie studios, the obsolete media, and some large software companies want the ability to nuke a website from orbit if they find any of their intellectual property there.

Or a hint of their intellectual property.

Or, “Oops, I guess that wasn’t ours. How much business did you lose during the 6 month appeal of a non-judicial takedown?”

Pure crap.

I’m not saying that from the perspective of some junior high pirate watching free porn in his parents’ basement. Intellectual property is the basis of my livelihood. I am a Microsoft Certified Professional; a software engineer. I am a blogger; a writer. I am a web developer; again, pure IP.

Giving private companies the right to arbitrarily take down sites for what may or may not be an actual violation is absurd.

Over the last few years, a law firm called Righthaven(spit!) has been teaming up with news agencies around the country to extort fees out of websites–generally small sites–for violating their copyright. Most of those cases involved individual users–not owners–posting fair-use snippets of articles. Since the cases were filed in Nevada, it would have cost more to fight the suits than to simply pay the blackmail, typically $5,000-$10,000.

Now, add the ability to threaten to administratively shut down the site if settlement isn’t made in 24 hours. That eliminates the ability to consult with an attorney, undermining the legal system completely.

All because once-successful companies can’t cope with the current world.

I’m not a fan of piracy. I enjoy buying movies because that encourages the people who made them to continue to make movies. The delivery system sucks.

Netflix has developed a successful business model out of making it easier to watch movies legally than to pirate them. For $8/month, you can watch as many movies as you’d like. If you have a $50 Roku, or any number of other devices, you can watch right on your TV. Add another $8/month to that, and you can get new DVDs delivered right to your door. For less than $20/month, they are delivering licensed, legitimate content and making a profit doing so.

How did the movie companies respond?

Did they increase the availability of their libraries, to get more wanting-to-be-honest customers paying a small fee to watch their content?

Of course not. They reduced the instant library and extended the amount of time before they would license new movies for rental. They made it harder to get their content legitimately, which increased the amount of piracy.

Now, since Plan A is biting them in the ass, they are pushing for yet more legislation to salvage their failed business models.

Here are three options for watching movies I don’t own:

Option 1: Instant

Through the magic of Amazon Instant, Netflix Instant, or any of the magical Roku channels, I can…

- Open an account. Once.

- Find a movie I want to watch.

- Watch it immediately. This could be included in a membership fee, or as an individual rental.

Option 2: Piracy

I am not recommending illegal activity. This is for the sake of example, only.

- Download torrent software, like uTorrent. Once.

- Go to a site like Torrentz.com and find a movie I want to watch.

- Click the torrent link, let the torrent software open it and download the movie.

- Watch the movie in a couple of hours. For free.

Option 3: Buy it.

- Drive to the store each time I want to watch a movie.

- Spend $15-$20 on the movie.

- Drive home.

- Fight the bank vault of plastic and tape they wrap the movies in.

- Put the DVD in the player.

- Watch 5 minutes of “Don’t Be a Pirate” garbage. Hey jerkface, if I’m watching the DVD, I didn’t pirate it. Bad market-targeting here.

- Watch 15 minutes of commercials that I can’t skip through.

- Watch 15 minutes of

commercialspreviews that I can’t skip through. - Watch the movie. This process takes longer than the piracy and costs more than option 1.

On top of that, I’m told I’m a pirate if I back up my movies for archival purposes. Or if I rip my movies to my network to allow me to watch them conveniently. I’m told that I’m merely licensing the content of the disc, but if the disc fails, I have to buy a new one. I can’t just download the content again.

This is a failure, and it isn’t a legislative failure.

The companies that are embracing modern options are succeeding, and will continue to do so. The companies that refuse, at the expense of their potential customers, will sink.

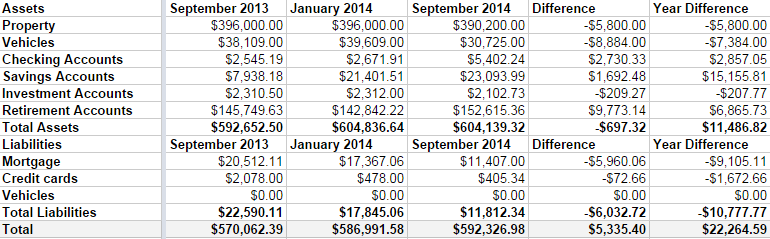

Net Worth Update – September 2014

It’s time for my irregular-but-usually-quarterly net worth update. It’s boring, but I like to keep track of how we’re doing. Frankly, I was a bit worried when I started this because we’ve been overspending this summer and Linda was off work for the season.

But, all in all, we didn’t do too bad.

Some highlights:

- Both of our properties lost around $3000 in value. I’m not worried, because we are keeping them both for the long haul. The rental is basically on auto-pilot, so that’s free money every month.

- We sold a boat that appraised for much less I had estimated in the last few updates. I had it listed for $5000, but it was worth $2000.

- I do have a credit card balance at the moment, but that goes away as soon as my expense check clears the bank, which will be in a day or two.

- We’re in the home stretch with the mortgage. There is $11,407 left to go, and we’ve paid down $9105 in the last year. By this time next year, I want that gone, gone, gone.

I can’t say I’m upset with our progress. We’ve paid down $6000 in debt in 2014, including 3 months with 1 income. We aren’t maxing our retirement accounts, yet, but I’d like to be completely debt free before I do that. It’s bad math, but having all of my debt gone will give me such a warm fuzzy feeling, I can’t not do it.

My immediate goal is to hit a $600,000 net worth by my next update in January. I’m only about $7000 off.

Time to hit the casino. Err, I mean, time to up my 401k contribution from 5% to 7%.