- Screw April Fool's Day. I'm about ready to clear my entire feed queue. #

- I definitely need a reason to get up at 5 or I go back to sleep. #

- Bank tried to upsell me on my accounts today…through the drivethru. #

- Motorcycle battery died this morning. Surprise 4 mile hike. #

- RT @ramseyshow 'The rich get richer &the poor get poorer' is true! Rich keep doing what rich people do & poor keep doing what poor people do #

- RT @ramit: "How do you know if someone is a programmer?" I cannot stop laughing imagining half my programmer friends – http://bit.ly/9MOipi #

Dolly Parton’s Car Crash and the Importance of Insurance

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.

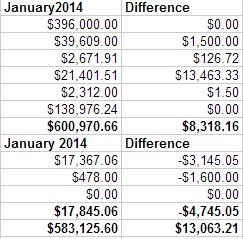

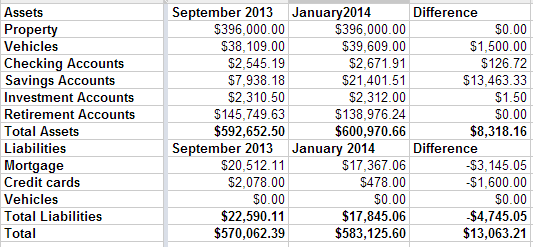

Net Worth Update – January 2014

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.

What motivates me financially?

This post was originally written for a blog swap run by the Yakezie personal finance blog network to answer the question “What motivates you to be financially responsible?“

This may not be the most original motivation, but I am financially motivated by my family. Before I had kids, I didn’t care much about money or “stuff”. My goal was to sell everything I owned and backpack Europe. Yeah, it’s a bit cliché, but that’s the way it is. I was also considering trying to live out of saddlebags while touring the country 1000 CCs at a time.

Now, I’ve got so many other considerations. Four, to be exact. A wife and three kids certainly change your perspective. If it doesn’t, you’ve got flaws that I can’t help you with.

When my family started, it was a huge wake-up call. Suddenly, I had responsibilities (cue scary music). Overnight, I had things to care about that didn’t involve a party, or instant gratification, or, well, me. Merlin the Stork floated down, waved a wand and Poof! I was a grown-up. This may not sound like much of a shock, but my wife and I had baby #1 when we were 20. Adulthood was still pretty new to us, and suddenly we’re parents?

As a grown-up, with three precious little monsters dependent on me for absolutely everything, I had to start worrying about their security. This was more than just keeping them physically safe. I’ve had to manage their emotional health, their physical needs, and their entertainment. They rely on me (and my wife!) for everything. How could I live with myself if I couldn’t put food on the table and a roof over their heads? Winter boots? Clothes without holes? Visits to the doctor? Have you ever noticed how much kids cost, even without considering the Japanese fad games and Barbie dreamhouses? Having a kid is like cutting a hole in your wallet and holding it over a blender nestled comfortably in a roaring fire fueled by napalm.

Then, after I’ve got them clothed, fed, sheltered, and entertained, I have to teach them how to be real people. I’m of the opinion that children in their natural state are little more than wild animals. Generally cuter, but that’s about it. It’s a parent’s job to train that ravenous little beast into an acceptable, successful person. Part of that consists of teaching the little brats how to start paying for their own clothes, food, shelter, and entertainment, and how to manage that without becoming a drain on society. Productivity and success can be defined a thousand different ways, but none of them include letting other people pay your way or borrowing money you have no intention or means of repaying. Ultimately, being an adult–being a successful part of society–involves recognizing your responsibilities and living up to them.

Caring for, providing for, and teaching my children the things I know provides me with an irreplaceable opportunity to watch them grow and learn, while giving me a chance to steer that growth. It is, without a doubt, the best, most satisfying, and most difficult thing I have ever done. The pleasure I get from raising my kids reinforces my desire to become the best person I can be.

Really, I just want to be the guy my kids think I am.

Saturday Roundup – Side Hustles Rock

- Image via Wikipedia

We’re busy cleaning for our party next weekend, followed by spending an evening lying in a coffin in my yard, scaring the crap out of kids and giving them candy.

The best posts of the week:

Right now, I am actively pursuing 4 separate side hustles, 3 of which are generating actual cash. It’s about $500 a month at the moment, but each of them are growing. My goal is to hit $1500 a month by spring and have full replacement income within 2 years. Everybody should have some kind of side income, just as a safety net.

One of my side hustles involves training in a niche with 200 companies competing for about 10,000 one-day students each year. I could try to compete on price, but that’s an arms race to bargain-basement pricing. Instead, we compete on value, and as such, we’re on track to bring in several multiples of our share of students this year, with growth projected to go well beyond that next year.

Knowing how much more I enjoy my side projects over my straight job, I want to encourage my kids to develop their own lines of income that will allow them to live the lives they want to live, without being a leech on society.

If they can start to get some of their own income, they can learn the value of the things they own, instead of assuming that everything is free. I will not spoil my kids.

Finally, a list of the carnivals I’ve participated in:

Actions Have Consequences has been included in the Festival of Frugality.

If I missed anyone, please let me know. Thanks for including me!

Sunday Roundup

My girls have been riding in horse shows lately. Sometimes, it seems like that’s all we’ve been doing on the weekends, but they love it. My wife’s favorite hobby now matches my daughters’ favorite pastime. As a bonus, we’ll never have to paint their room again, with the way they are accumulating ribbons.

Best Posts

It is possible to be entirely too connected.

My life is now complete. It’s possible to buy 95 pounds of cereal marshmallows for just $399. Breakfast at my house just got perfect.

I wholeheartedly agree with Tam, “You don’t need to make any excuses for crashing things into each other at the speed of light in an underground tunnel longer than Manhattan that’s had the air pumped out and been chilled to a couple degrees above absolute zero. That doesn’t need a reason. “

Carnivals I’ve Rocked

Credit Cards: My Failed Experiment was included in the Best of Money Carnival, the Carnival of Wealth, and the Totally Money Blog Carnival.

My niche site article on how to Make Extra Money with Keyword Research was included in the Totally Money Blog Carnival.

Thank you! If I missed anyone, please let me know.