- @ChristianPF Is Giving Away An iPad! and more! RT to enter to win or click to find out other ways to enter… http://su.pr/1cqxH5 #

- No, I won't ship my china cabinet to Nigeria. Kthxbye. #craigslistscam #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- @punchdebt I vote for the Fuzzy Bunny Gang. in reply to punchdebt #

- Packing for 36 hours in Chicago. #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

- In the airport. It's been a while. #

- RT @pogpog 8 Month Old Deaf Baby’s Reaction To Cochlear Implant Being Activated – Pogpog http://bit.ly/cL4XEr #

- @LiveRealNow is giving away a copy of Delivering Happiness(@dhbook). Follow and RT to enter. http://bit.ly/czd31X #

Refinancing Through the HARP Program

HARP Refinance

If you owe more than your house is worth, and want to refinance to today’s low interest rates, you need to check out the HARP program. Millions of homeowners with underwater homes are finding relief in a new version of the Home Affordable Refinance Program (HARP). Refinancing to lower interest rates could slash your monthly mortgage payment or shorten the time it takes to pay-off your mortgage.

The new HARP loosened qualification rules, making it it easier for underwater homeowners to qualify for a refinance. When HARP 2.0 was released in November 2011 you had to work with your original lender. Since March 2012, when Fannie Mae and Freddie Mac rolled out the automated underwriting systems, you can work with any participating HARP lender. That means more competition for your business and better rates for you

HARP 2.0’s Hurdles

There are two series of hurdles you must clear before you can refinance your loan under HARP 2.0. The first set of hurdles concerns the loan itself. The three key eligibility questions are:

- Is the loan owned by Fannie Mae or Freddie Mac?

- If so, was the loan purchased by Fannie or Freddie on or before May 31, 2009?

- The loan was not refinanced under HARP before (some exceptions apply).

If you answer yes to these three questions, then your loan may be eligible for HARP.

Tip: If your loan is a FHA loan, then check out a FHA streamline refinance loan.

The second set of hurdles concerns your finances and property. Fannie Mae and Freddie Mac set up the basic guidelines. There are two basic ways your loan can be processed:

- Manual Underwriting System: Only your original lender (who is also your current servicer) can process a HARP loan through the manual underwriting system.

- Automated Underwriting System: Any participating lender can process a HARP loan through the automated system.

Keep in mind that lenders are free to have stricter qualifying rules than the basic Fannie and Freddie requirements.

When shopping for a HARP loan, here are some of the main points to look out for:

- Credit Score Requirements: Fannie and Freddie have no minimum FICO score requirements. However, each lender has its own credit score requirements, so if you are denied by one lender, keep shopping.

- Income Requirements: Your original lender can approve a loan with no debt to income ratio (DTI) requirement. However other lenders must qualify you based on your DTI. The rule-of-thumb for a HARP loan is a 45% maximum DTI.

- Timely Mortgage Payments: The HARP program allows for no late mortgage payments in the last 6 months and one late (30 days) payment in the preceding 6 months. However, some lenders do not allow any late payments.

- Investment Properties Qualify: You can refinance a second home or rental property under HARP 2.0.

- Fees: Lenders are not consistent in the fees or the interest rates they charge for HARP 2.0 loans. Some lenders charge a few hundred dollars for HARP 2.0 loan fees, and others charge thousands. It pays to shop around, so you can compare interest rates and fees.

- Condos: While HARP guidelines for condos are tricky, many more condo owners will qualify for a loan under HARP 2.0 than under the first version of HARP.

Applying for HARP

First, go to the Fannie Mae and Freddie Mac Web sites to learn if either owns your loan and whether they bought your loan on or before May 31, 2009. If so, you can contact either your current mortgage servicer or shop around with the many lenders who are offering the HARP 2.0 loan.

If your application is rejected, ask for the specific reason why. If you applied with your original lender, find out whether the lender used the manual or automated system. Request manual underwriting if your original lender turned you down based on automated underwriting, as it may result in your loan being approved.

It pays to shop for HARP 2.0 refinance. Many homeowners report one lender will reject their application, but another will offer them an attractive refinance. Second, lenders are not consistent in their offers. As mentioned, closing costs are all over the map. Interest rates vary, too.

Summary

HARP 2.0’s rules are technical. Each lender creates different overlays. If you believe you qualify for HARP 2.0, be persistent! The rules that are in place today could very well be expanded in the future. This is one instance in life where shopping can be the solution to your problem.

Resolving Legal Disputes

Dispute resolution has to do with the impartial rectification of conflict between individuals or parties. More specifically it is the utilization and execution of methods that are designed to resolve conflicts. In a case in which there is a dispute between people or groups, often times a third, neutral, party is selected to be an impartial representative for the disputing persons. Although dispute resolution can refer to resolutions both in and out of the court, it mainly applies to disputes that are settled outside of the legal framework of the judicial system.

Two of the most common types of dispute resolution are known as adjudicative and consensual. While adjudicative resolution requires a third party to mediate the outcome, such as a judge or jury, and usually involves some form of litigation, consensual resolution is the attempt to solve the issue between the two disputing parties without involving a third party, although at times a neutral arbitrator will be selected to preside over the case, though they will often be there not so much for authoritative purposes but more as a council to keep things fair. There is also a third upcoming type of dispute resolution, online dispute resolution, or ODR, which has become more popular in recent years with the rise of the internet’s prominence in daily life, but it is mainly the application of traditional consensual resolution practices, only adapted to the online environment.

Many disputes can be solved simply through adherence to the law, however, sometimes issues arise that the legal structure isn’t equipped to handle, and so a third party is chosen to resolve the conflict. These types of conflict fall within the jurisdiction of the law and so will be relegated to the political system for arbitration. Judicial resolutions are conflicts that will be, hopefully, settled by the court. In the United States, this is often the case with dispute resolution. This form of resolution usually involves litigation. This is the use of outside individuals to argue for or against the disputing parties. In a courtroom, the lawyers are the litigators, while the judge and jury listen to the arguments in order to come to their decisions.

Extrajudicial resolution is non-court settlement of conflict. Also known as alternative dispute resolution, or ADR, this is what people are usually referring to when discussing dispute resolution. ADR is usually more efficient, cost effective, and less time consuming than judicial resolutions. Extrajudicial resolution concerns various types of ways to settle conflict. These include arbitration and mediation. In arbitration neutral individuals will listen to both sides of an argument and render a decision based on evidence. Unlike the court systems, this proceeding doesn’t necessarily include a binding agreement with the parties.

Mediation is used in extrajudicial resolution as a way to open a dialogue between conflicting parties. The idea is to use a trained neutral third party in order to come up with unique solutions to solve the issue. A mediator is trained to be both an effective negotiator as well as an excellent communicator. A mediator is like a judge in that they cannot take sides, and they do not give legal advice either. Their decisions are not obligatorily followed, though they tend to be followed since the mediators are trained to make decisions that benefit both parties.

The techniques used in dispute resolution can be used both in and outside of the court room. It is often used by individuals who wish to speed up the process by not having to get into the political system. However, they are useful in many cases where individuals wish to come to the most beneficial agreement for all the parties involved.

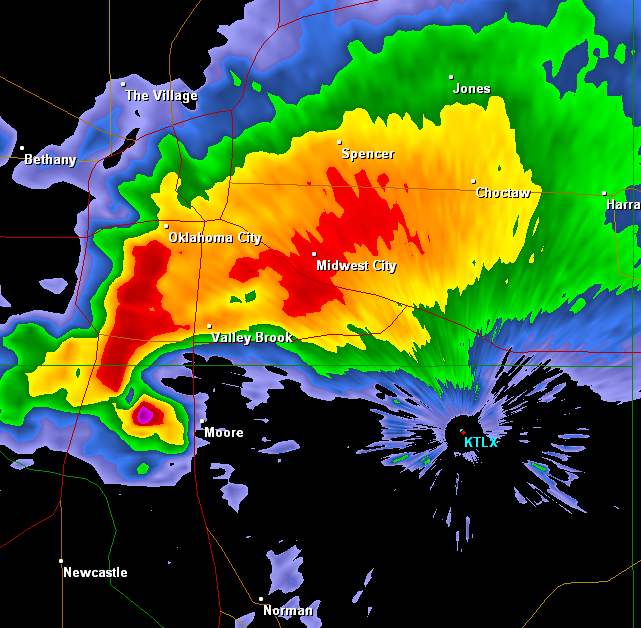

Oklahoma Tornadoes

My heart goes out to all of the victims of yesterday’s tornado in Moore, Oklahoma.

I couldn’t imagine hearing that my kids’ school was demolished around them. Twenty or more dead children in any community is devastating.

On top of the sheer horror of dead children, the town is nearly wiped off of the map. Will they rebuild or cut their losses?

I hope everyone in the town was well insured, but that’s never the case. There will be many in the town that will have lost everything: their homes, their families, their jobs. Family is irreplaceable, but so is your home, if you don’t have insurance. To lose it all and not even have a place to mourn….

Have you checked your insurance policy to make sure you are covered in the event of whatever natural disaster is common in your area?

To help the victims, text REDCROSS to 90999 to make a $10 donation. It’s the least you can do.

Related articles

Yakezie Challenge – I’m In

After watching the Yakezie Challenge progress for 6 months and reading the recap, I’ve decided to participate. Maybe I’m a jerk for waiting until I saw the value instead of immediately jumping in, but I hope not.

The goal for stage 1 was to get to Alexa rank 200,000. I’m currently at 533,108. Six months ago, I was at about 1.8 million, so I’ve improved quite a bit on my own, but I’ve still got a ways to go.

So, here I am.

Family Bed: How to Make It Stop

baby on the cheek.” width=”300″ height=”199″ />

baby on the cheek.” width=”300″ height=”199″ />For years, my kids shared my bed.

When my oldest was a baby, I was working a graveyard shift, so my wife was alone with the baby at night. It was easy to keep a couple of bottles in a cooler by the bed and not have to get out of bed to take care of him when he woke up once an hour to drink a full bottle.

Then he got older. And bigger. And bigger.

We tried to move him to his own bed a few times, but it never worked well. He’d scream if we put him in a crib, so we got him a bed at 9 months old. That just meant he was free to join us whenever he woke up. Brat.

We finally got him to voluntarily move to his own bed after his sister was born. Shortly after she was born, I woke up to see him using her as a pillow. To paint the proper picture, this kid is 5’9″ and wears size 12 shoes. At 11. When I woke him up to tell him what he was doing, he decided to sleep in his own bed.

Method #1 to get your kids in their own bed: Have kid 1 try to crush kid 2 and feel bad about it.

Method #1 isn’t a great solution.

Soon, baby #3 showed up and we had 2 monsters in bed with us again. Once they started getting bigger, it became difficult for the 4 of us to sleep. We tried to get them into their own beds. Unfortunately, even as toddlers, my kids had a stubborn streak almost as big as my own. Nothing worked.

Eventually, they got big enough that I was crowded right out of the bed. At least we had a comfortable couch.

Sleeping on a couch gets old.

When the girls got old enough to reason with, we had a choice: We either had to find a way to convince them they wanted to sleep in their own room, or we had to have a fourth brat for them to attempt to crush at night.

We went with bribery. Outright, blatant bribery.

We put a chart on the wall with each of their names and 7 boxes. Every night they slept in their own beds, they got to check a box. When all of the boxes were checked, they got $5 and a trip to the toy store.

It took 10 days to empty our bed and it’s been peaceful sleeping since. That’s $5 well-spent.

Have you done a family bed? How did it work? How long did it last?