- Dora the Explorer is singing about cocaine. Is that why my kids have so much energy? #

- RT @prosperousfool: Be the Friendly Financial “Stop” Sign http://bit.ly/67NZFH #

- RT @tferriss: Aldous Huxley’s ‘Brave New World’ in a one-page cartoon: http://su.pr/2PAuup #

- RT @BSimple: Shallow men believe in Luck, Strong men believe in cause and effect. Ralph Waldo Emerson #

- 5am finally pays off. 800 word post finished. Reading to the kids has been more consistent,too. Not req’ing bedtime, just reading daily. #

- Titty Mouse and Tatty Mouse: morbid story from my childhood. Still enthralling. #

- RT @MoneyCrashers: Money Crashers 2010 New Year Giveaway Bash – $7,400 in Cash and Amazing Prizes http://bt.io/DDPy #

- [Read more…] about Twitter Weekly Updates for 2010-01-16

Choosing the Best Term Life Insurance

This is a guest post.

Term life insurance is arguably the simplest form of life insurance offered by companies today. It is a dramatically different policy than universal or whole life plans. The latter tend to charge policyholders much higher premiums over the lifetime of their policies. However, whole life plans remain in effect for the lifetime of the insured, until death occurs or the policy is cancelled. On the other hand, term life insurance policies last for a fixed length of time, and the periods usually range from five, 10, 15, 20, or 30 years. With a term plan, the premiums you will pay are much lower, and if you pass away during the term of your policy, your beneficiaries will receive a full death benefit from your plan.

Types

Term life insurance generally falls into one of five different categories. Level, decreasing, renewable, return of premium, and convertible are the five kinds of term life insurance policies that companies typically offer their customers. The best method for selecting term life insurance is to consider your amount available to spend along with your age in order to decide which variety is the best fit for you and your family.

If you choose level term insurance, you will get a predetermined dollar amount of coverage for a set length of time. You will enjoy low overhead and you will have peace of mind knowing that your premiums will never fluctuate with the vicissitudes of the market. The predictability of a level term plan is perhaps the greatest feature of this type. Another type of term life insurance is decreasing term life insurance. It is strikingly similar to a level plan, and the only real variation is the amount of money your beneficiaries will receive if you die. With a decreasing term plan, the amount of your death benefit decreases over time. A good reason for choosing decreasing term life insurance is having small children. You know that you need the money more now while they are young, so paying less for life insurance in the short term is a good idea.

A convertible term plan is a hybrid. It lets a policyholder change their existing term life policy into a whole life plan without facing hefty penalties for doing so. Another option, a return of premium term life insurance plan, is very similar to level term plans. The major dividing factor between the two is that a return of premium plan actually gives back all the money paid in premiums to the beneficiaries if the insured dies during the term of the policy. It’s best to pick this plan if you want coverage for your family but you death is highly unlikely to occur during the term of your policy.

How to Qualify?

The uniting thread between most term life plans is that you are required to fill out a formal application first, and then you must pass a physical exam so that you may qualify for life insurance coverage. Additionally, most life insurance plans force you to repeat the exam each time you choose to renew your policy. However, if you choose a type of term life insurance called renewable term life insurance, you are allowed to bypass this stipulation entirely, so you can score some massive savings on premiums you will pay in the future. It’s best to choose this type of term life insurance if you are already older, or if you have health conditions that you expect to get dramatically worse during the term of your plan.

During the medical exam, your physician will take a full and extensive medical history from you. This is so that the insurance company can get a complete and accurate picture of your health in order to assign you the right amount of premium for your plan. Next, the insurance company will consider your motor vehicle record. This is so the insurance company can get a feel for whether you pose a big enough risk on the road to have a high likelihood of an accident that may cause your death and end your policy.

Then, your doctor may ask you other health and lifestyle questions if the life insurance company requires him or her to do so. You will need Attending Physician Statements (APS) that certify your answers and the results of your medical tests were true and accurate to the best of your knowledge. You will also need Medical Information Bureau (MIB) reports for your application as well as corporate documents if you are applying for business coverage. After you have submitted all of these materials, your insurance company should be able to render a decision about whether they will award you a term life insurance policy, as well as how much your annual premiums will cost you.

I Accidentally Bought a Bus

Last weekend, I was having dinner with my friend and business partner. After our carry permit class, we try to get dinner, unwind from the class, debrief, and figure out how to improve our business.

Over the course of this discussion, the idea of owning a bus came up. It was part of an impractical-but-useful solution to one of our larger expenses. My partner mentioned that he had a friend who owned a bus, so I asked him to find out how much he was asking.

A few days later, he called me and said simply, “We bought a bus.”

Oops.

What year?

“I don’t know.”

How big?

“Huge!”

Does it run?

“It used to. It probably still does, but they lost the key.”

Crap.

So we own a bus. It’s a 1987 Ford B700. It’s 20,000 pounds empty, has a 429 motor that doesn’t leak oil, and an air horn.

Under the hood, it’s got a couple of issues. There are some melted vacuum tubes leading to a vapor box. The vapor box is used to cheat obsolete emissions standards and doesn’t do anything productive. There’s also some belts missing. The belts drive an air pump that pushes clean air into the exhaust system, again, just to cheat emissions standards that we don’t have anymore. Nothing necessary–or even useful–is broken.

Part of the $1000 we paid for the bus went to a locksmith who came and made us a key.

The interior of the beast is 3/4 converted to an RV. There are 4 folding bunks in the back, minus mattresses. There are two RV sofas that fold down to beds, plus seating for another 12 people. No kitchen or bathroom facilities.

We’ve done some research and come up with a few choices for this impulse purchase:

- Flip it. We should be able to at least double our money quickly.

- Finish the RV conversion already in progress. This wouldn’t turn it into a fancy motorhome, but it would make a great deer shack on wheels. I figure we could make this happen for about $500 and turn it into a $3500 toy to sell. Or take deer hunting.

- Turn it into a full RV. This would be more expensive. My estimate is a $5-6000 investment to make it a $10-12000 RV. It would take most of the summer to do, which means we wouldn’t be selling it until spring. I quit wanting to do this when I saw the bus in the light. There’s not a lot of rust, but it’s more than I’d want to fix to make the outside look as good as the inside, in my head.

- Party bus. What’s a better way to spend a Saturday evening that shepherding a drunken bachelorette around with her friends? It’d take about $2000 to outfit the bus, plus insurance, plus licensing, plus the fact that drunken bachelorettes are obnoxious.

- Auction. We got an estimate for a $3000 sale, minus a 20% commission.

- Stunt-jumping. I saw a video of a guy jumping a bus over 20 motorcycles. I could do that. I’m sure one of the race tracks around here would pay good money to have us do that one weekend. Afterward, we’ll melt the bus for scrap.

- Sell the engine and scrap the body. That should bring us at least $1500.

We jumped into this with no real plan, but there are a few ways we could make our money back. I’m expecting a healthy profit on a pretty short timeline.

What would you do if you owned a bus?

George Zimmerman: The High Cost of a Legal Defense

Most people have heard of the controversial nature of the George Zimmerman murder trial. Zimmerman, who defends his actions and is claiming self-defense, is on trial for murdering Trayvon Martin, a 17-year old with a social media profile that projects anything but innocence. While his defense attorneys claim that race had nothing to do with the murder, the prosecution thinks differently. In fact, a majority believe that Trayvon Martin would still be alive today if he hadn’t attacked Zimmerman. Regardless of your stance on the case, there is no denying the fact that Zimmerman’s trial is building strong emotions from both sides.

Fixed Prices Versus Variable Prices

Not everyone has a group of supporters raising money to pay for their legal defense. Just because Zimmerman has bad credit does not mean that he had to leave his legal defense up to a public defender in Sanford. If you do not have a Legal Defense Fund where people can donate money to your defense costs online, you will need to distinguish between fixed prices and variable prices for legal defense. During your consultation, the defense attorney should be able to quote you a fixed price based on the case details. Experienced attorneys do not charge on a pay as you go basis because they are confident their abilities. The actual fixed price of the attorney depends on the case, and can range anywhere between a $1000 and hundreds of thousands of dollars. O’Mara and West, who are defending Zimmerman, have quoted $1 million for their services in total. While they have not be paid completely by the Zimmerman Defense Fund, this is money that is due to them.

The Cost For Expert Witnesses

Zimmerman’s team introduced several expert witnesses including an animator, a medical examiner, and a self defense expert. All of these witnesses are paid to testify, and the cost is not always included in the initial quote. If your case is complex, there may be a need for an expert witness. When you are pricing the cost of defense, see if this is included. Assume that you will spend about 10% more than quoted so that you can cover all of the outside costs.

Zimmerman may have been unemployed and working as a volunteer neighborhood watch member, but he does have one of the most experienced legal defense teams working for him to get a not guilty verdict. You may not need a million dollars, but legal defense is not cheap. Keep in mind that you get what you pay for when legal defense is concerned.

Insurance

Related articles

Carnival Roundup

The Money Makers was included in the following carnivals recently.

Carnival of Financial Planning hosted by The Skilled Investor

Carnival of Financial Independence hosted by Reach Financial Independence

Carnival of Personal Finance hosted by Reach Financial Independence

Aspiring Blogger Financial Carnival hosted by Aspiring Blogger

Carnival of Money hosted by Financial Nerd

Thank you!

Net Worth Update – January 2014

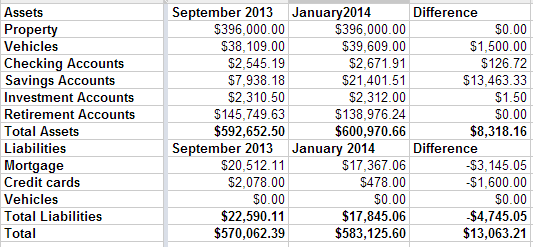

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.