- Watching Gamers:Dorkness Rising #

- Charisma? Weee! #

- Tweeting a dork movie? I'm a bit of a geek. #

- We just met and the first thing you do, after boinking a stranger in the presence of the king, is to murder a peasant? #

- Every movie needs a PvN interlude. #

- Everything's better with pirates. #

- Waffles? Recognize. #

- The Spatula of Purity shall scramble the eggs of your malfeasance. #

- Checkout clerks licking their fingers to separate bags or count change is gross. #

- Watching Sparkles the Vampire, Part 2: Bella's Moodswing. #twilight #

- @penfed was a waste of money. $20 down the drain to join, wouldn't give a worthwhile limit, so I can't transfer a balance. #

- @JAlanGrey It's pretty lame. The first one was ok. This one didn't improve on the original. in reply to JAlanGrey #

- RT @tferriss: Are you taking snake oil? Beautiful data visualization of scientific evidence for popular supplements: http://ping.fm/pqaDi #

- Don't need more shelves, more storage, more organization. Just need less stuff. #

- @BeatingBroke is hosting the Festival of Frugality #226 http://su.pr/80Osvn #

- RT @tferriss: Cool. RT @cjbruce link directly to a time in a YouTube video by adding #t 2m50s to end of the URL (change the time). #

- RT @tferriss: From learning shorthand to fast mental math – The Mentat Wiki: http://ping.fm/fFbhJ #

- RT @wisebread: How rich are you? Check out this list (It may shock you!!!) http://www.globalrichlist.com/ #

- RT @tferriss: RT @aysegul_c free alternative to RosettS: livemocha.com for classes, forvo.com for pronunc., lang8.com for writing correction #

- Childish isn't an insult. http://su.pr/ABUziY #

- Canceled the Dish tonight. #

Twitter Weekly Updates for 2010-05-01

- RT @Dave_Champion Obama asks DOJ to look at whether AZ immigration law is constitutional. Odd that he never did that with #Healthcare #tcot #

- RT @wilw: You know, kids, when I was your age, the internet was 80 columns wide and built entirely out of text. #

- RT @BudgetsAreSexy: RT @FinanciallyPoor "The real measure of your wealth is how much you'd be worth if you lost all your money." ~ Unknown #

- Official review of the double-down: Unimpressive. Not enough bacon and soggy breading on the chicken. #

- @FARNOOSH Try Ubertwitter. I haven't found a reason to complain. in reply to FARNOOSH #

- Personal inbox zero! #

- Work email inbox zero! #

- StepUp3D: Lame dancing flick using VomitCam instead or choreography. #

- I approve of the Nightmare remake. #Krueger #

Jobs I’ve Had

I’ve always worked. From the time I was young, I knew that, if I wanted to feed my G.I. Joe addiction, I needed a way to make money.

So I got a job.

I was the only kid in first grade earning a steady paycheck.

In the years since, I’ve had a dozen or so jobs at 10 different companies. The question has been asked, so this post is my answer: these are all of the jobs I’ve ever held.

- Paper route. Starting at age 6, I split a paper route with my brother. Initially, I made about $6 per month, which was enough for 1 G.I. Joe.

- Farm hand. I spent a couple of summers in junior high and high school doing odd farm jobs outside of my home town.

- Dishwasher. Starting in 9th grade, I gave up a study hall to work in the school cafeteria, serving food and washing dishes. It paid minimum wage for 1 hour per school day.

- Construction. For a couple of summers, I worked for my dad’s construction company. He was easily the hardest boss I’ve ever had, which was great preparation for the rest of my working life. The drunk bar owner who didn’t allow his employees a lunch break and got upset if they sat down on a smoke break was nothing by comparison. Thanks, Dad. Every employer since has been astonished by my work ethic, even when I’m having an off day.

- Dishwasher, take 2. Sixteen years old, thumped by the wisdom of “If you want a car, get a job to pay for it.” So I did. It paid a bit over minimum wage and gave me my first “Who the heck is FICA and why is he robbing me?” moment. I eventually got promoted to cook, which came with better pay, worse hours, and more opportunities to flirt with waitresses. It was grand.

- Palletizer. This is a fancy way of saying I stood at the end of a conveyor belt, picked up the 50 pound bags of powder as they came down the line, and stacked them neatly on a pallet. Rinse and repeat. 1500 times per night. By the time I left this job, I had arms that would make Popeye cry.

- Cook, take 2. I held this job at the same time as the palletizer position. I’d work 8 hours stacking pallets, then head to job #2, 5 miles away. My car was broken at the time, so I rode my bike. In the winter. In Minnesota. I was working 14-16 hour days, lifting a total of 75,000 pounds, biking 10 miles per day. I was in great shape and tough. I wasn’t tough enough, though. I could only maintain this schedule for a couple of months.

- Machine operator. During my stint with this company, I’d put a little piece of metal into a great big machine, push a button, then spend 15-20 minutes listening to the great big machine carve the little piece of metal into something worth selling. This was about when I started shopping for books based primarily on thickness. One night, I read The Stand in my spare time. I’d also pass the night by burning scrap magnesium flakes in the parking lot. What can I say? Twelve hour graveyard shifts with 3 hours of actual work are boring. I left a few months after my son was born, because I was missing too much of my family time. I took a 30% pay-cut, before overtime, to be with my wife and kid.

- Debt collector. I worked my way through college by collecting on defaulted student loans. I firmly believe that we should all live up to our obligations and responsibilities, including paying your bills, so I didn’t have a moral dilemma with the work. There are some bad apples, but I don’t see collectors as pariahs.

- Systems Administrator. After I graduated college, I got promoted and spent the rest of my time there managing the collection and auto-dialer software and the hodge-podge of other applications we needed, some of which, I wrote.

- Software engineer. This is where I am now. I’ve written a medium-scale ecommerce application that handles the online sales for quite a few companies, mostly in the B2B arena. The job also includes a large chunk of training, management, and even sales. I don’t particularly enjoy sales, but a programmer geek who can manage other programmers, coordinate with sales & marketing, and talk to customers during a sales demo is a rare bird.

To recap: I’m 32 and I’ve had 1 month out of the last 26 years that didn’t come with a paycheck. I’ve worked for 10 different companies and I start the job before this one when I was 20.

How many jobs have you had? What was the most memorable, or the oddest?

The Obligatory Thanksgiving Post

Tomorrow is Thanksgiving. Tomorrow is also Thursday, and I don’t post on Thursdays, so I’ll be posting about Thanksgiving today.

Thanksgiving is a day to be thankful for–first and foremost–capitalism.

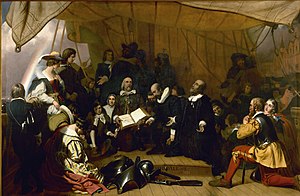

When the Pilgrims first landed, they set up a communal farming arrangement, figuring that a good Christian community could take care of its own. From each according to his ability, to each according to his need, and all that. Everyone worked for the good of everyone else, so everyone benefited, right?

The Pilgrims, like every other group that has ever advocated communism, neglected to consider human nature. If you have no incentive to work, you don’t. If sleeping in and making babies still gets you fed and clothed, why work?

On the other side, if you work hard, only to see your hard work go to benefit your lazy neighbor, sleeping in and rattling the headboard, but never doing anything productive, why bother?

It didn’t take long for the Pilgrims to notice this tragedy of government wasn’t working.

The strong, or man of parts, had no more in devission of victails and cloaths, then he that was weake and not able to doe a quarter the other could; this was thought injuestice. The aged and graver men to be ranked and equalised in labours, and victails, cloaths, etc., with the meaner and yonger sorte, thought it some indignite and disrespect unto them. And for mens wives to be commanded to doe servise for other men, as dresing their meate, washing their cloaths, etc., they deemd it a kind of slaverie, neither could many husbands well brooke it. Upon the poynte all being to have alike, and all to doe alike, they thought them selves in the like condition, and ove as good as another; and so, if it did not cut of those relations that God hath set amongest men, yet it did at least much diminish and take of the mutuall respects that should be preserved amongst them.

It didn’t take long before nobody was working. Neighbors resented each other, because everyone had a right to the work of the other, with no need to compensate each other. That’s a case of “I’m starving because you aren’t working hard enough, but it’s not my fault you’re starving.”

At one point, the production of the colony was down so much that the colonists’ ration of corn was just 4 kernels per day. That’s how you kill a colony.

But they learned from their mistakes before they all died.

Yet notwithstanding all those reasons, which were not mine, but other mens wiser then my selfe, without answer to any one of them, here cometh over many quirimonies, and complaints against me, of lording it over my brethern, and making conditions fitter for theeves and bondslaves then honest men, and that of my owne head I did what I list. And at last a paper of reasons, framed against that clause in the conditions, which as they were delivered me open, so my answer is open to you all. And first, as they are no other but inconvenientes, such as a man might frame 20. as great on the other side, and yet prove nor disprove nothing by them, so they misse and mistake both the very ground of the article and nature of the project. For, first, it is said, that if ther had been no divission of houses and Lands, it had been better for the poore. True, and that showeth the inequalitie of the condition; we should more respecte him that ventureth both his money and his person, then him that ventureth but his person only.

The slavery of working for the benefit of others didn’t work, unless you were “theeves and bondslaves”. Then, it was great, living off of the sweat of others.

To make a long story short, the starvation ended when the Pilgrims were given parcels of land and told they could keep what they built from it. They went from the edge of extinction to being prosperous in a short time. The old and weak were cared for, not by the governor’s decree, but by the generosity of their neighbors.

Everybody in the colony won.

7 Benefits of Investing Internationally

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

When it comes to financial investments, it’s always better to go with an informed decision than one that relies merely on chance – besides, gambling only works when luck’s on your side. Fortunately, international investments are a financially secure and reliable form of investing as long as you know your limitations. So, in keeping with the idea of sound financial decisions, here are seven benefits of investing internationally:

Diversification of Your Funds

A diversified financial portfolio gives investors options in terms of economic fluctuations and, by investing internationally, your finances will have alternative sources of stability. In other words, if your money is spread out among various countries, then an economic crash in one country won’t affect other investments.

It goes without saying that with diversification also comes a learned understanding of various global economies and markets, but with the help of a financial adviser or with a little research, you’ll have the ability to make informed global investments, which is always better than the “eggs in one basket” approach.

Investing Abroad Means More Options

Just like there’s diversification with investing internationally, there are also many options when it comes to the way you want to invest your finances. And, with international investing growing in popularity, the investment options available in today’s market are quickly becoming commonplace.

Three of the most popular forms of international investments are mutual funds, exchange traded funds (ETFs), and American depository receipts (ADRs). And, although mutual funds are a common form of investment, ETFs and ADRs trade much like stocks and therefore take a little more financial knowledge to navigate.

International Protection and Confidentiality

If you’re the type of investor that’s worried about financial scares associated with foreclosures and lawsuits, investing internationally has an added advantage of asset protection. With investing abroad, many foreign financial institutions are able to protect your investments from seizure and other threats.

Likewise, investing internationally also comes with confidentiality concerning your finances. International financial institutions are not legally required to divulge your monetary details to anyone. Confidentiality isn’t to say that international investments are exempt from legalities, but they’re entitled to more freedoms.

Investment Growth on an International Level

In terms of household incomes, import/export strengths, younger working populations, and the lean toward free-market economic policies, investing internationally has the potential for more growth than investing in the United States alone, which translates to an increase in return potential in overseas investments.

In fact, according to the International Monetary Fund, the United States is expected to fall below the rest of the world for the next two years when it comes to economic growth. Because of this, companies like Fisher Investments Institutional Group are strategizing toward international investments in strong economic climates across the world.

Currency Diversification Strengthens Portfolios

Much like international investing gives your portfolio safety in numbers as opposed to having all assets invested in one country’s economy, so do currency differences from country to country. In relation to the US dollar, many countries across the world have stronger currencies, which helps boost returns over time.

The flip side of this coin is the idea that fluctuations in currency strengths can just as easily work against your portfolio as they can strengthen it. It’s wise to keep an eye on international currency rates and how they compare to the US dollar, but never invest solely based on rates as a country’s currency can drop in strength overnight.

A Reduction in Taxes

Otherwise known as tax havens, many countries across the world offer attractive tax incentives to foreign investors. These incentives are meant to strengthen other country’s investing environments as well as attract outside wealth.

These tax incentives are particularly attractive to US investors due to the increasingly high taxes in the country. As a result, the United States government is creating more defined restrictions and laws when it comes to international investment tax incentive regulations.

Investment Potential in the United States is Dwindling

Because the United States has both the world’s largest economy and stock market, financial opportunities are almost maxed out due to over-investing. On the other hand, emerging markets in other countries are growing in size and strength, which is quickly resulting in stronger economies and more investment opportunities.

By ignoring the potential of other world markets, you’re also ignoring global economies and stock markets that offer unforeseen investment potential when compared to the United States, which is something every investor should keep in mind.

So, from portfolio diversification to investment growth, investing internationally is a great way to expand your financial horizons.

This is a guest post.

Net Worth Update – January 2014

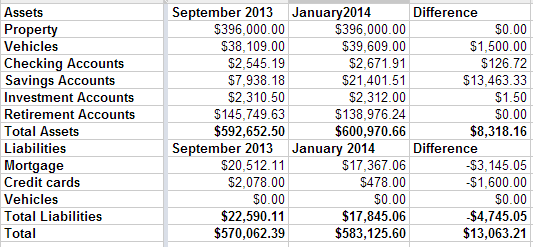

This may be the most boring type of post I write, but it’s important to me to track my net worth so I can see my progress. We are sliding smoothly from debt payoff mode to wealth building mode.

Our highlights right now are nothing to speak of. We did let our credit card grow a little bit over the last couple of months, but paid it off completely at the end of December. It grew mostly as a matter of not paying attention while we were doing our holiday shopping and dealing with some car repairs.

That’s it. We haven’t remodeled our bathrooms yet, but we have the money sitting in a savings account, waiting for the contractor. We haven’t bought a pony yet, but we did decide that a hobby farm wouldn’t be the right move for us. We’ll be boarding the pony instead of moving, at least for the foreseeable future.

Our net worth is up $13,000 since September. Our savings are up and our retirement accounts are down because there are two inherited IRAs that we need to slowly cash out and convert to regular IRAs.