- RT @kristinbrianne: Get Talk and Txt Unlimited Cell Svc w/ Free Phone for $10 per month by joining DNA for Free. http://tinyurl.com/yyg5ohn #

- RT: @ChristianPF is giving away an iPod Touch! – RT to enter to win… http://su.pr/2LS3p5 #

- 74 inch armspan and forearms bigger than my biceps. No, I don't button my shirt cuffs. #

- RT @deliverawaydebt Money Hackers Network Carnival #111 – Don't Hassel the Hoff Edition http://bit.ly/9BIAvE #

- @bargainr What would it take to get you to include me in the personal-finance-bloggers list? #

- Working on a Penfed application to transform my worst interest rate into my best. #

- Gave the 1 year old pop rocks for the first time. Big smiles. #

- @Netflix @Wii disc works well and loads fast. Go, go gadget movie! #

What is a Mechanic’s Lien?

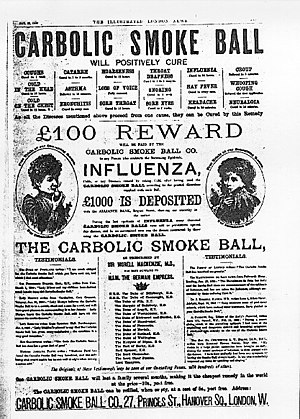

- Image via Wikipedia

When you hire someone to work on your property or provide material to build or improve it, they are entitled to get paid. A mechanic’s lien is the method of enforcing that payment.

Here is what you need to know about mechanic’s liens.

A contractor must usually give you written notice of intent to file a lien if the contract isn’t paid. He needs to do this within a short time of beginning the work. The notice will include text to the effect that subcontractors also have the right to file a lien if they are not paid. This notice gives you two methods of defense: You can pay the subcontractors directly and withhold that amount from the payment to the contractor, or you can withhold the final payment until you have received a lien waiver from each of the subcontractors.

If the notice isn’t given correctly, the contractor forfeits his right to file a lien. Also, in most places, if a contractor is supposed to be licensed to do the work, but isn’t, he’s not able to file a lien.

Subcontractors must also provide notice on intent within about 45 days–depending on the state–of the time they first provide services or material, or the lien is not enforceable.

Protecting Yourself

First, you only have to pay once. If you pay the contractor in full before getting the notice of intent from the subcontractors, you can’t be forced to pay again.

Next, make the contractor provide a list of all subcontractors and keep track of any notices of intent you get. Get lien waivers from everyone involved before you make the final payment to the contractor.

Finally, you have the rights defined in the notice of intent to file a lien. You can either pay the subcontractors directly, or you can withhold the final payment until you receive lien waivers from each subcontractor.

Resolution

The lien holder has 120 days to file the lien and 1 year to enforce it. Enforcing simply means that it a suit has been filed. Once that happens, you can either pay the contractor, attempt to settle with the contractor, or you can take the contractor to court to determine the “adverse claims” on your property. There aren’t too many choices at this point.

Do yourself a favor and get lien waivers before you make the final payment on any work done on your property.

30 Day Project – January

This month, I have two 30 Day Projects.

My first project is to start waking up at 5am. This will add an extra 90 minutes to my day, which will give me time to manage all of my other 30 day projects. I’ll be able to wake up to a quiet house, walk the dog, eat breakfast and not start every day in a rush to get out of the house. Today was my exception. After watching 2010 arrive, I didn’t get up early.

The second project is to start reading to my children every night before bed. We read to the kids often, but not every day. That’s going to change. We are also working on breaking the girls of the family bed. If I can read them to sleep each night, it will help. Good, educational family time that makes it easier to sleep every night.

These are both habits I want to keep long after the month is up.

The Benefits of Ignorance

For years, we had a sweet deal with day care. We had three kids and we were the only family with three kids, so we got a bulk discount that essentially made my oldest free. Compared to the regular price, I think we were paying about ten dollars a week for him to be in daycare, which was great, since he was only there before and after school.

Then he aged out of daycare, and we lost our sweet, sweet deal.

Then the prices went up across the board.

We lost the sweet deal, and then the price went up and our youngest hit the next age bracket.

On the price sheet, the age brackets went from birth to 1, from 1 to 2, and from 2 to kindergarten. I made the mistake of interpreting that to mean that her fee would change when Baby Brat turned three, not when she turned two. I’ve been making that mistake since December when the price went up.

A few weeks ago, I dropped off the kids and forgot to pay for the week, so my wife paid when she picked up the girls. When my wife picked up the girls, she noticed that we hadn’t paid. She had no idea how much we needed to pay because she has never been the one that’s been responsible for making the payments.

Our provider added up the cost and found it was $15 per week less than we’d been paying.

When I balanced the checkbook the following weekend, I noticed that she paid less than our normal rate. We called daycare and now we’re making up for the last 17 weeks of overpayments by paying less each week. We’re paying about $65 less per week. When we’re caught up, we’ll be paying $60-75 less per month, depending on the month.

All due to sweet, sweet ignorance. Ignorance really can be bliss. Sometimes when you know what’s going on, you just assume that you’re making the right decision and you’re afraid to ask questions for fear of looking stupid. If you don’t know, and there’s nothing you should have known, and it’s possible to save quite a bit of money by just acknowledging the fact that you don’t know.

Also, lesson learned: If you’re not sure, ask! Don’t assume when there’s a chance your assumption could be costing you money.

Making the Sale: How to Alienate Your Customers

Have you ever walked into a store only to be instantly surrounded by salespeople trying to sell you whatever their corporate office has decided is the most important thing for them to sell this week?

I remember walking into a big blue electronics store to buy a TV. The beautiful corner-unit entertainment center that perfectly matches my living room will fit–at most–a 32″ screen. Unfortunately, any questions I asked were answered with an attempted upsell to a big screen. I don’t want a fancy TV. I don’t have room for it. It doesn’t fit my needs.

Why do the salespeople persist in strong-arming me into something I can’t use?

Later, I’ll be visiting a couple of potential customers. I know from talking to them that they are expecting a hard sell and a push to sign a contract today.

I don’t do that. I can’t do that.

My goal for these meetings is to find out what these people want, and–more important–what they need. How can I know what they need before I have a chance to sit down and ask them? Even bringing a proposal to the meeting would show that I cared less about them than I do about their checkbooks.

Here’s my checklist of items to bring:

- Notebook

- Pen

- Spare pen

- Business card

- My winning personality

That’s it.

I can accomplish more with “How can I help you succeed?” than I can with “You really need to buy this from me, today.”

If the high-pressure sales-weasels at the big blue electronics store had been taught that lesson, I may have gone home with a high-end (though smaller) TV, rather than going home to buy online.

Have you ever had a sales-weasel try to convince you that you want something you don’t need or need something you don’t want?

Making Up Stories

Saturday night, as I was walking out of the pizza place, I saw a beautiful young brunette standing on the sidewalk talking on her cell phone.

As I walked past, I heard, “I could pay my rent if they’d just give me my last paycheck! They owe me like $200.”

That’s it.

Have you ever heard a tiny piece of a conversation and used that to build a back story in your own mind?

I do that all of the time.

In fact, I’m going to do that now.

First, what can I know from those two sentences?

- She was unemployed. She was more worried about her last paycheck than her next one.

- She had worked for a scummy, fly-by-night, something-or-other. Good companies don’t withhold paychecks.

- She had no emergency fund. If she had one, $200 would be an inconvenience, not a disaster.

- She rented, and had roommates. This conversation occurred in the parking lot of a pizza place in a reasonably affluent suburb. For $200, she wasn’t living alone. Whether she rented a room or shared an apartment would be a mere guess.

Those items can–I believe–be taken as fact, given the evidence at hand.

Now for the conjecture:

- She was a waitress. A $200 final paycheck probably means her hourly wage was low. Besides, pretty, young, unskilled girls often become waitresses. It’s one of the few ways to make good money without a degree of any kind.

- The restaurant wasn’t a chain. Chain stores have lawyers and procedures. They don’t withhold final paychecks.

- She invites drama into her life. When you work for a company that makes a habit of shady practices, like withholding final paychecks out of spite, you know it happens. It’s not a surprise. If you continue working there, you are just waiting in line for your turn to have problems.

- She wasn’t close to her family. In an emergency, $200 from Mom & Dad is nothing. In my mind, she only has one parent and isn’t close to that parent, but that’s purely invention.

- Her friends are in the same boat. Short-term planning, no reserve cash, no room to let a friend couch-surf for a couple of weeks.

- Next month, she’ll be having the same problems, but she’ll find someone else to blame. Her ex owes her money, or her roommate stole the last of her cash.

That’s my entirely unsupported guess of a young stranger’s life story. My opinion isn’t flattering, but how could it be, when $200 is enough to make the young woman panic?

Have you ever played this game?