Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Hayden Panettiere has formally announced her engagement! The starlet will be marrying Vladimir Klitschko, who is a world renowned boxer that has won an Olympic gold medal. The unexpected public revelation has sparked rumor trails regarding glitzy wedding plans. While no date has been set, and nothing has been confirmed, there is widespread speculation that the event is going to be glamorously over-the-top.

Although Panettiere’s fiance is 13 years older than her, it is the first marriage for both partners. This may instill extra incentive for the couple to make their officiation an extremely flashy occasion. Because Klitschko is a famous Ukrainian athlete, he will also be anticipating a magnificently choreographed wedding. Both individuals could invest fortunes in perfecting their walk down the aisle together.

Of course, one of the biggest decisions that Panettiere faces is the selection of her gown. All eyes will be on the fabric that she chooses for this special day. If they go through with a public wedding, the dress will be permanently immortalized in global media. She is going to want to show off flawless class, glimmering austerity and sizzling sultriness. Fashion critics are eagerly anticipating her selection. The high-end designer that she picks will receive a tremendous boost in popularity, especially if she pulls off a beautiful presentation.

A crazy wedding would be completely in character for the young television star. Her most known role was a bubbly cheerleader on the long-running series, “Heroes.” With vivacious charm, she became a sex symbol across the country. Explosiveness is simply a part of her personality, so a bombastic celebration is to be expected. Furthermore, Ukrainian wedding parties have a tendency to be more raucous than American traditions. If they follow any of the groom’s cultural practices, the event could become out of control.

The massive ring on Panettiere’s finger indicates no desire for privacy regarding this affair. In fact, it was an invitation for the mainstream media to cover the entire ordeal. This hints that the couple might be planning a gigantic wedding event. They can easily afford it, and the public celebrations will rapidly enhance the star’s critical acclaim.

In contrast, a private exchange of vows would disappoint her legions of fans. Furthermore, paparazzi could still infiltrate the wedding to snap pictures. To avoid any uninvited intrusions, the couple should be open to media coverage during their nupital arrangements. This will let them control the event, and allow them to recoup some of the expenses through lucrative network contracts. Regardless of how they conduct the wedding, it is certain that the whole world will be diligently watching with admiration, and perhaps a slight tinge of jealousy.

On Father’s Day, 3 years ago, my third and final kid was born. My kids are all horrible brats and I love them dearly.

I wouldn’t give up fatherhood for anything. Watching my kids grow and learn, steering their development, and teaching them how to navigate life is the most fulfilling thing I’ve ever been a part of. Also the most frustrating. I can’t imagine being anywhere else, not being with my kids. I have no respect for deadbeat parents.

I am incredibly grateful that I had a proper model for manhood and fatherhood. My dad taught me the concepts of honor, integrity, and responsibility. I couldn’t be the man I am now, if he wasn’t the man he is. Thanks, Dad.

Sometimes, the coolest things in the world are the things most likely to kill you. Call me crazy, but I’d happily strap a 1200 cc propeller to my crotch and find out what 10,000 feet looks like.

Via Budgeting In The Fun Stuff, Super Frugalette reminds us that, when there’s a significant amount of money involved, spending a few hundred dollars on an attorney isn’t wasteful.

Fivecentnickel discuss multi-level marketing. It doesn’t matter which company you are in, if your downline is more important that your product, it’s a bad business model.

Keith Ferrazzi shows us how to improve our body language when it really matters.

When I started driving, I tossed my car in a ditch going way too fast. Naturally, it was my parents’ fault for giving me the curfew I was trying to beat. They never would have bought it if I would have told them I was driving like my grandma and it jumped into the trees by itself. Why does the FBI think that’s believable? Corruption, maybe?

Financial Samurai talks about living a life without regrets, which is a personal goal of mine.

Food storage will become critical when the zombies come.

Beer is good. Even the cave-men thought so.

Carnivals I’ve Rocked and Guest Posts I’ve Rolled

3 Ways to Keep Your Finances Organized was an Editor’s Pick in this week’s Festival of Frugality. Thanks!

5 Reasons Your Wealth Isn’t Growing was included in this week’s Carnival of Personal Finance.

Money Problems: Insurance was included in the Totally Money Blog Carnival.

Unlicense Health Insurance was included in last week’s Carnival of Personal Finance.

Thank you! If I missed anyone, please let me know.

Last week, the Yakezie shared what they would do with a single financial do-over.

– Melissa from Mom’s Plans shares her biggest financial mistake at Barbara Friedberg Personal Finance: Opening an eBay Store and Using Credit. It is a great story about how not to grow your business and how competing priorities can pose a real challenge.

– Budgeting in the Fun Stuff shares her biggest financial mistake and potential do-over at Super Frugalette: Investing in a Friend’s Business. Its a good, but costly lesson learned about small business.

– Eric from Narrow Bridge Finance shares how He Wouldn’t Have Paid Down His Student Loans So Fast at The Saved Quarter. This may seem counter-intuitive, but he has some good points. Check it out.

– Mr. S from Broke Professionals shares how He Wouldn’t Have Bought a New Car at My Personal Finance Journey. This has some great analysis, especially considering the new car was a hybrid!

– The College Investor posted at Wealth Informatics: What you should know when you are investing?

– Wealth Informatics posted here: If you had one financial do-over, what would it be and why?

– Barbara Friedberg shares how She Was Scammed at Mom’s Plans. You have to watch out for the hard sell!

– Joe at Retireby40 tells us about How He Invested his 401(k) in Company Stock right before the dot com crash, at Financially Consumed. A financial adviser may have helped avoid this one!

– Financially Consumed shares his Car Purchase Do-Over And Over at Retireby40. Car addicts have it tough!

– LaTisha from FSYA shares her do-over story in It’s Never Too Late at Little House in the Valley. Sometimes the do-over is quicker and more painless than most.

– Little House yell’s Do-Over! Do-Over! at FSYA Online. It looks at the road to saving more, starting on an elementary school playground!

– The Single Saver asks, What Are The Long Term Consequences of Small Purchases at Totally Money. A cool post on how past purchases cost future returns!

– Miss Moneypenniless from Totally Money shares her story of Vacationing to the Brink of Bankruptcy. Sometimes a vacation can be fun, but the bills afterward may be daunting.

– Super Frugalette shares How a Lawyer Could Have Saved Her $24,700 at Budgeting in the Fun Stuff. Maybe lawyers are worth it sometimes?

– Jason from Live Real, Now shares how he Amassed $90,000 of Debt at Debt Eye. A good lesson in living a little more frugally.

– Kevin from Debteye shares his do-over: Not Buying a House Right Out of College at Live Real, Now. I have said it before that buying a house can be challenging right out of college.

– Penny from The Saved Quarter shares how She Would Have Finished College Before Having Kids at Narrow Bridge Finance. An awesome story that has will soon have a happy ending!

– Jacob from My Personal Finance Journey shares how he was Scammed on eBay at Broke Professionals. An important lesson for anyone selling or buying online.

– Marissa from Thirty-Six Months shares how she Accumulated a Ton of Student Loan Debt at So Over Debt. If you are going to live the life, you’re going to pay the price!

– Andrea from So Over Debt shares How She Would Have Started Saving for Retirementat Thirty-Six Months. I would love to read a post on each of the stories you mentioned getting to where you are now!

– Below Your Means shares his story about A Missed Investment Opportunity. There are so many times I wish I could have gone back and bought a stock!

Get More Out of Live Real, Now

There are so many ways you can read and interact with this site.

You can subscribe by RSS and get the posts in your favorite news reader. I prefer Google Reader.

You can subscribe by email and get, not only the posts delivered to your inbox, but occasional giveaways and tidbits not available elsewhere.

You can ‘Like’ LRN on Facebook. Facebook gets more use than Google. It can’t hurt to see what you want where you want.

You can follow LRN on Twitter. This comes with some nearly-instant interaction.

You can send me an email, telling me what you liked, what you didn’t like, or what you’d like to see more(or less) of. I promise to reply to any email that isn’t purely spam.

Have a great week!

Ten years ago, I buried myself in debt. There was no catastrophic emergency or long-term unemployment, just a series of bad decisions over the course of years.

We bought a (short) series of new cars, a house full of furniture, electronics, hundreds of books and movies, and so much more. We threw a wedding on credit and financed an addition on our house. We didn’t gamble or drink it away, we just spent indiscriminately. We have a ton of stuff to show for it and a peeling credit card to prove it.

What changed?

In October 2007, we found out brat #3 was on the way. Don’t misunderstand, this was entirely intentional, but our…efficiency caught us by surprise. It took several years to get #2. We weren’t expecting #3 to happen in just a couple of weeks. #2 wasn’t even a year old when we found out she was going to be a big sister. That’s two kids in diapers and three in daycare at the same time.

The technical term for this is “Oh crap”.

I spent weeks poring over our expenses, trying to find a way to make our ends meet, or at least show up in the same zip code occasionally.

I finally made my first responsible financial decision…ever. I quit smoking. At that point, I had been smoking a pack a day or more for almost 15 years. With the latest round of we’re-going-to-raise-the-vice-tax-to-convince-people-to-drop-their-vices-then-panic-when-people-actually-drop-their-because-we-made-them-too-expensive taxes, I was spending at least $60 per week, at least.

Interesting side story: A few years ago, Wisconsin noticed how many Minnesotans were crossing the border for cheap smokes and decided to cash in by raising their cigarette taxes. The out-of-state market immediately dried up. Econ 101.

So I quit, saving $250 per month.

Our expenses grew to consume that money, which we were expecting. (Remember, we were expecting a baby!) Unfortunately, our habits didn’t change. We still bought too much, charged too much on our credit cards, and used our overdraft protection account every month. At 21% interest!

Nothing else changed for another year and a half. My wife would buy stuff I didn’t like and we’d fight about it. I’d buy stuff she didn’t like and we’d fight about it. When we weren’t arguing about it, we’d just silently spend it all as fast as we could.

Bankruptcy was looming. We had $30,000 on our credit cards and our overdraft protection account was almost maxed out. Have you ever thought you’d have to sell your house quickly?

One day, while I was researching bankruptcy attorneys, I ran across Dave Ramsey. When I got to daycare that evening to pick up the kids, I noticed they had The Total Money Makeover on the bookshelf, so I asked to borrow it.

I read the book twice, had a very frank discussion with my wife about the possibility of bankruptcy, and we set out on the path to financial freedom together.

What made you decide to handle your finances responsibly? Or, perhaps more importantly, what’s holding you back?

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.

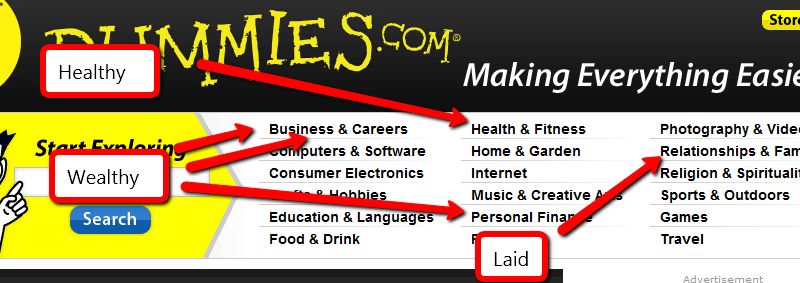

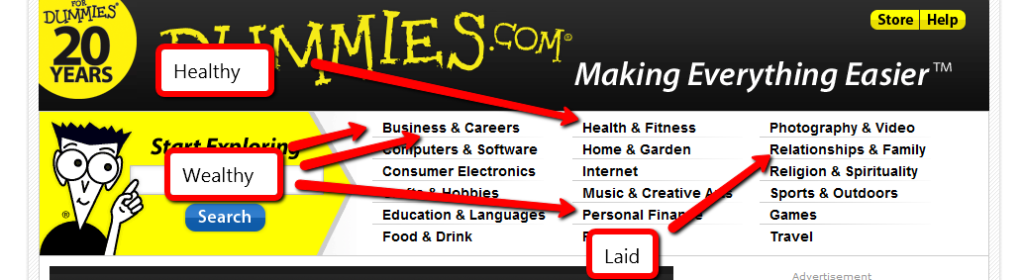

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.