- RT @ScottATaylor: Get a Daily Summary of Your Friends’ Twitter Activity [FREE INVITES] http://bit.ly/4v9o7b #

- Woo! Class is over and the girls are making me cookies. Life is good. #

- RT @susantiner: RT @LenPenzo Tip of the Day: Never, under any circumstances, take a sleeping pill and a laxative on the same night. #

- RT @ScottATaylor: Some of the United States’ most surprising statistics http://ff.im/-cPzMD #

- RT @glassyeyes: 39DollarGlasses extends/EXPANDS disc. to $20/pair for the REST OF THE YEAR! http://is.gd/5lvmLThis is big news! Please RT! #

- @LenPenzo @SusanTiner I couldn’t help it. That kicked over the giggle box. in reply to LenPenzo #

- RT @copyblogger: You’ll never get there, because “there” keeps moving. Appreciate where you’re at, right now. #

- Why am I expected to answer the phone, strictly because it’s ringing? #

- RT: @WellHeeledBlog: Carnival of Personal Finance #235: Cinderella Edition http://bit.ly/7p4GNe #

- 10 Things to do on a Cheap Vacation. https://liverealnow.net/aOEW #

- RT this for chance to win $250 @WiseBread http://bit.ly/4t0sDu #

- [Read more…] about Twitter Weekly Updates for 2009-12-19

Link Roundup

What has happened to this week? It’s already Friday afternoon, and I’m short a post today. Since I skipped the link roundup last week while I was off with family, I’ll do it early this week and cheat you out of a real post today.

Finance links:

I enjoy trying new foods and eating out. Christian PF provides tips on doing that frugally.

Trent talks about “Family Dinner Night”. Invite a bunch of friends over to help prep and eat a buffet-style meal. Good time for everyone on the cheap.

Free Money Finance shares his 14 Money Principles.

MoneyNing shares how to buy school supplies for less.

Miscellaneous links:

Netflix just volunteered to shaft its customers again. There’s a 28 day wait to get most new releases, now. If I didn’t have almost 500 movies in my queue, I’d be royally ticked.

Mother Earth News has plans for a smoker/grill/stove/oven. I’d love to build a brick oven with a grill and smoker. A complete, wood-fired cooking center would be perfect for my house.

Major kitchen cleaning on Lifehacker. We’re doing this tomorrow, as part of our April Declutter.

That’s the highlight of my trip around the internet this week.

Twitter Weekly Updates for 2010-05-17

- @Elle_CM Natalie's raid looked like it was filmed with a strobe light. Lame CGI in reply to Elle_CM #

- I want to get a toto portable bidet and a roomba. Combine them and I'll have outsourced some of the least tasteful parts of my day. #

- RT @freefrombroke: RT @moneybeagle: New Blog Post: Money Hacks Carnival #115 http://goo.gl/fb/AqhWf #

- TED.com: The neurons that shaped civilization. http://su.pr/2Qv4Ay #

- Last night, fell in the driveway: twisted ankle and skinned knee. Today, fell down the stairs: bruise makes sitting hurt. Bad morning. #

- RT @FrugalDad: And to moms, please be more selective about the creeps you let around your child. Takes a special guy to be a dad to another' #

- First Rule of Blogging: Don't let real life get in the way. Epic fail 2 Fridays in a row. But the garage sale is going well. #

The Do-Over

This post is from Kevin @ DebtEye.com. Kevin is a co-founder @ DebtEye.com, where he helps consumers manages their finances and find the optimal way to get out of debt. . This is guest post is part of a blog swap for the Yakezie, answering the question “If you had one financial do-over, what would it be and why?”.

I usually look on the brighter side of things. There’s never an incident where I wish I could go back in time and change things. Everyone will eventually make mistakes, but it’s up to them to learn from these mistakes and make sure it never happens again. However, if there was one moment in the past I could change, It would be not buying a house straight out of college.

Throughout my college days, I have been fortunate to have saved up enough money for a down-payment on a house. That’s not enough to maintain debt-free living. I worked with several internet gaming companies and acted as an affiliate for them. I saved up around $25,000 and decided to buy a condo with my brother.

I thought it would be cool to own a condo in the city. I was really looking forward to turning this new place in a bachelor’s pad. This was probably the worst decision I’ve made. I always believed that it was better to buy a property instead of renting one, since some of the payment would go towards paying down the loan. Of course, I realized that this wasn’t the smartest of ideas.

Here are some reasons why I regret it:

- Property Taxes: Property taxes in Chicago are one the highest in the nation. For a $320,000 property, annual real estate taxes were roughly about $5,800/year. Property taxes usually go up every year, it can be difficult for some people to maintain these payments.

- Valuation: Thankfully, the property only decreased 10% in the past 2 years. It’s not as bad as some areas, but the timing to buy a property was poor.

- Cost: Buying a property involves more money to spruce up the place. New paint, new appliances, new floors, etc. Most of us won’t get a free appliance from the government. Many homeowners have to put in extra care of the property, so when they sell it, it’s still in great condition.

Looking hindsight, I definitely wish I rented instead of owning a home. In this day of age, I think most people can make the clear argument that renting is worthwhile to look into.

How to Die Well

Most people don’t die quickly.

As much as I would rather die suddenly–while putting a smile on my wife’s face–the odds are that I will spend my last hours or days in a hospital, unable to make the decisions about my care.

Will I be doing my vegetable impression after a car accident, or be left unable to speak during a botched Viagra implanantation in my 90s? I don’t know.

There is one thing I know about the end of my life. I do not want to linger for months, blind and deaf, on a feeding tube. I don’t want my family to spend the last few months of my life secretly ashamed of hoping for my burden to end. I’d like my end to be quick enough that the emotions they are feeling aren’t a sad combination of guilt and relief, just sadness at my passing and happiness at having had me.

That’s the legacy I’d like.

The problem is making my wishes known. If I’m lying in a hospital bed, asking to be allowed to die, they’ll consider me suicidal instead of rationally considering my request. If I’m completely incapacitated, I won’t even be able to ask.

I can certainly make my wishes known beforehand, but how will my family be able to communicate my desires to the doctors in charge and how will they convince the doctor that they aren’t just after my currently imaginary millions?

That’s where a living will comes in. A living will, also know as an advanced directive, is simply a formal document that explicitly states what you want to happen to you if you are too out of it to make your wishes known.

Aging With Dignity has put together an advanced directive called Five Wishes that meets the legal requirements for an advanced directive in 42 states.

The Five Wishes are:

1. Who is going to make decisions for you, if you can’t? For me, the obvious choice is my wife. She appears to like me enough to want me around and love me enough to do what needs to be done, even if it’s difficult. On the chance that we end up in the same car accidents, matching vegetables on a shelf, I’ve nominated my father for the unpleasantness. I don’t think I’ve told him that, yet.

2. What kind of treatment do you want, or want to refuse? When my Grandpa was going, he made sure to have a Do Not Resuscitate order on file with the nursing home, the clinic, and the hospital. He knew it was his time and didn’t want to drag it out.

3. How comfortable do you want to be? Do you want to be kept out of pain, at all costs, even if it means being drugged into oblivion most of the day? Do you want a feeding tube, or would you rather only receive food and fluids if you are capable of taking them by mouth?

4. How do you want to be treated? Do you want to be allowed to die at home? Do you want people to pray at your bedside, or keep their religious views to yourself? Some people want to be left alone, while others are terrified of dying alone. This wish also covers grooming. Personally, if I soil myself, I’d like to get cleaned up as soon as possible. I’ll have enough to deal with without smelling bad, too.

5. What do you want your family to know? This includes any funeral requests you have and whether you’d like to be cremated, buried, or both, but also goes beyond them. Do you want your family to know that you love them? You can also take this section to ask feuding family members to make peace or ask them to remember your better days, instead of the miserable few at the end.

The last 3 wishes are unique to the Five Wishes document, but they are excellent things to include. The most important part of advanced directive is the advanced part. You have the right to want whatever works for you, but your wishes don’t matter if nobody knows about them.

How about you? Do you have a living will? Does your family know what you want to have happen if the worst happens?

Net Worth Update

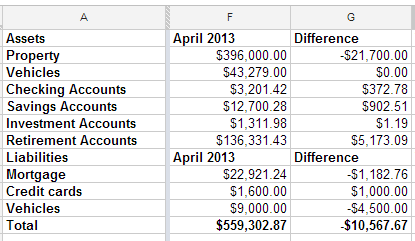

I looked back at the spreadsheet I use to track my net worth, and realized that I have been filling it out quarterly, though I can’t say that has been on purpose. Apparently, I get an itch to see my score about four times per year.

This quarter is the first time in a long time that my net worth has dropped. We got our property tax statements last week and found out that our houses have dropped a combined $21,700. Since we’re not planning to sell, that doesn’t matter much.

What’s interesting to me is that, even though our property values dropped $21,700, our total net worth only fell $10,567. We’ve been hustling trying to get the Tahoe paid off. It’s going a little bit slower than I had hoped, but it’s progressing nicely.

I do feel good that, even if I would have been focusing on my mortgage, I still would have lost the mortgage race. That means my misplaced priorities of acquiring more debt to snatch a fantastic deal didn’t cost me the race. Now, I’ll be forced to take a vacation in Texas, coincidentally in the same town as my wife’s long lost brother. I think we can make that work.

I rounded off the credit card and vehicle totals because one is used every day and paid off every month and the other has a steady stream of money getting thrown at it, so the numbers change often.

All in all, I don’t have any room to complain. I am looking forward to paying off the truck and focusing on the mortgage. We could swing quadruple payments, which would pay off the house shortly after the new year starts.