What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.

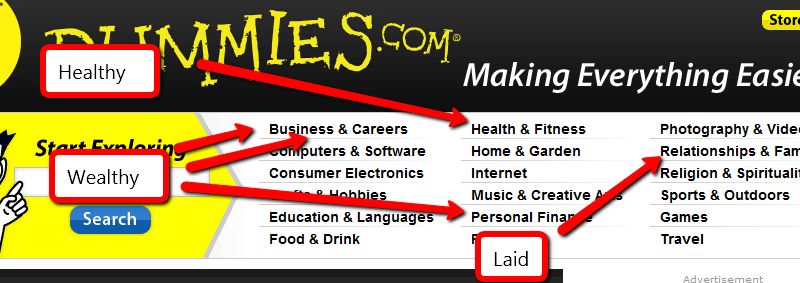

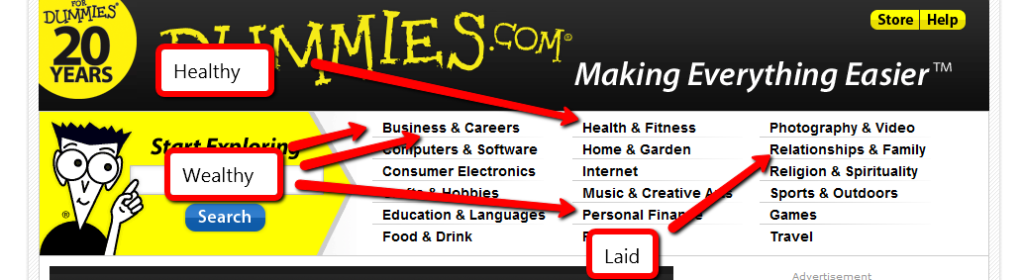

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.

It’s true that the benefits of a parent cannot be measured or quantified in any meaningful way. It’s hard to put a price on the emotional commitment and special experience of raising a child as a parent, some of which may not even be realized by the parents themselves until afterwards. But it is undeniable that the experience of parenthood is a rewarding and special time in someone’s life.

It’s been a month since I’ve written a post for the budget series, so I’ll be continuing that today. See these posts for the history of this series.

This time, I’ll be reviewing my non-monthly bills. These are the bills that have to be paid, but aren’t due on a monthly basis. Some are annual, some are quarterly.

Reviewing this list, there doesn’t seem to be too much I can cut and accomplish any meaningful savings. Am I missing something?

Welcome to the Best of Money Carnival #87, the Gold Rush Edition.

On January 24th, 1848, gold was discovered in Coloma, California by construction overseer James W. Marshall. The following year, one hundred thousand people moved to California to either strike it rich, or profit from those who were trying to strike it rich. The gold rush began 163 years ago today.

10. N.W. Journey presents Business use of Home Deduction posted at Networth Journey and says, “How to deduct your business home expenses.”

Some people recommend stockpiling gold so you’ll have something of value to spend after society as we know it collapses. Does anyone know how to make change from a gold bar for a loaf of bread?

9. Darwin presents Present Value of Money Explained – MBA Monday posted at Darwin’s Money and says, “One of the most important financial concepts is also one of the most misunderstood. Make sure you understand the Present value of Money – with these real life examples. It will save you thousands!”

In 1854, a 195 pound gold nugget was found at Carson Hill in California. It was valued at $43,534. That would be worth $3,160,357.20 today.

8. RJ Weiss presents What Your Optimal Income? posted at Gen Y Wealth and says, “An exercise to find your optimal income level.”

Q: Which weighs more: a pound of feathers, or a pound of gold? A: A pound of feathers. Gold is weighed using Troy Weight, which only has 12 ounces per pound.

7. BWL presents How To Select A Financial Advisor posted at Christian Personal Finance and says, “Find out how to select the best financial adviser for you.”

Until the onset of modern electronics, which use gold because it doesn’t corrode or tarnish, gold had no practical value of its own. Its entire value resided in the fact that it was pretty and relatively scarce.

6. Miss T presents 10 Ways to $ave Energy Comfortably | Prairie EcoThrifter.com posted at Prairie Eco-Thrifter and says, “How great is it to save money and the planet at the same time?!”

Q: Which weighs more: a ounce of feathers, or a ounce of gold? A: A ounce of gold. Troy Weight has fewer ounces that avoirdupois, but each ounce weighs more. There are 31.1 grams in a Troy ounce, but only 28.4 grams in a standard ounce.

5. Craig Ford presents Employers Look at Credit Reports | Ludicrous or Smart Business? posted at Money Help For Christians and says, “Should employers be able to see your credit report?”

Outside of collectible or government-issued coins, gold is priced according to it’s spot price, which fluctuates constantly. Dealers will generally pay a percentage under spot when buying gold, then sell for a percentage over spot. Always know the spot price of gold before you agree to buy or sell any.

4. MoneyNing presents Tax Time: Do I Have to Report that Income? posted at Money Ning and says, “Did you receive any income last year? Do you really have to report everything?”

Gold is the 58th most rare natural element, out of 92.

3. Silicon Valley Blogger presents I Just Lost My Job! How I’m Downsizing My Household Expenses posted at The Digerati Life and says, “I share my story of job loss and what ideas I have for paring down my expenses in order to cope with this loss of income. In the meantime, I’m doing what I can to find a new job!”

Only 20% of the gold from the Gold Rush deposits has been reclaimed. The rest is still out there.

2. The Financial Blogger presents 5 Reasons Why You Need A Partner In Your Business posted at The Financial Blogger and says, “A post outlining the benefits of a business partner.”

As of the end of 2009, more than 160,000 tons of gold have been mined, most of which was done in the latter half of the 20th century.

And the winner is…

1. Amanda L Grossman presents Frugal Lessons from People Who Survived the Great Depression posted at Frugal Confessions – Frugal Living and says, “Have you ever met someone who was alive during the Great Depression? They are changed people. The Great Depression left a great impression on their thoughts, their styles, and their habits. I am fascinated by this time period, and researched the question of what frugal habits these people developed to survive.”

I’d like to thank everyone who participated. Next week’s host is PT Money, so don’t forget to submit your entry!