- RT @mymoneyshrugged: The government breaks your leg, and hands you a crutch saying "see without me, you couldn't walk." #

- @bargainr What weeks do you need a FoF host for? in reply to bargainr #

- Awesome tagline: The coolest you'll look pooping your pants. Yay, @Huggies! #

- A textbook is not the real world. Not all business management professors understand marketing. #

- RT @thegoodhuman: Walden on work "spending best part of one's life earning money in order to enjoy (cont) http://tl.gd/2gugo6 #

Be Prepared or Be Me

We had some nasty storms roll through over the weekend. There was a lot of tornado-ish activity, 70 mile-an-hour gusts of wind, hail, and an electrical blackout. For almost 24 hours, we were living in the stone age, with nothing but smartphones for internet, and high-lumen flashlights being used to see. With no cartoons for the girls, we were forced to read them bed-time stories, while my son and his friends were forced to use their imaginations to entertain themselves.

Every time we called, the electric company added 12 hours to their estimated repair time. Amazingly, they came in 7 hours ahead of schedule, if you don’t count the first two revisions.

By Saturday afternoon, we were out shopping for things we should have already had ready.

For years, we had discussed buying a generator. For some reason, it never became a priority. We have a large freezer and refrigerator full of food. With no electricity, a generator was suddenly prioritized. All of the places near us were sold out of budget-priced generators when we decided it was better to drop $400 on that than to lose $600 worth of food. We did find one, eventually, but it would have been better to take it out of the garage than have to shop for it when we needed it. Naturally, 10 minutes after we got it home, the power came on. Do yourself a favor: if you own a home and have a small corner available for storage, start shopping for a generator. Pick one up on sale instead of waiting until you have no real choice.

We have a ton of batteries. It’s one of the things we stock up on when they are on sale. Unfortunately, our broadest-beam flashlight takes a 6-volt battery, and we don’t keep a spare. By the end of the night, it was getting pretty yellow and dim. Another night would have killed it completely. This wasn’t a widespread blackout, so there was no shortage of batteries, but it would have been nice to have the spare already at home. Check your emergency supplies and make sure you have replacement batteries that fit everything you need.

The one thing that would have improved the night most is a good lantern. We had our 5, plus two of my son’s friends all trying to play board games by flashlight. A lantern could have been set on the entertainment center and lit most of the room.

For everything we were without due to the blackout, the one thing I truly missed was the air conditioner. When the storm died, so did the wind. Completely. Opening all of the windows didn’t help at all. Other than that, it was nice to have everyone forced to interact. Nobody was whining about being bored and we were all having fun.

I want to schedule a pseudo-blackout more often.

Net Worth Update

Welcome to the New Year. 2013 is the year we all get flying cars, right?

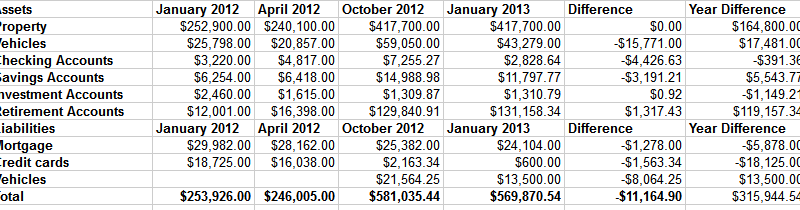

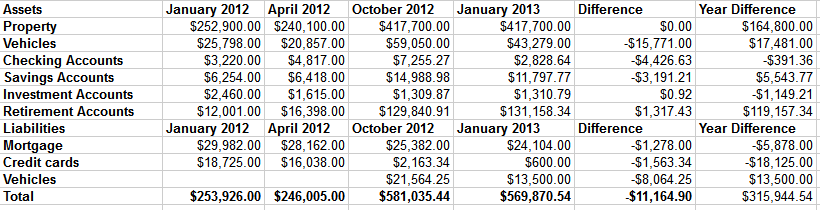

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

Saturday Roundup – Side Hustles Rock

- Image via Wikipedia

We’re busy cleaning for our party next weekend, followed by spending an evening lying in a coffin in my yard, scaring the crap out of kids and giving them candy.

The best posts of the week:

Right now, I am actively pursuing 4 separate side hustles, 3 of which are generating actual cash. It’s about $500 a month at the moment, but each of them are growing. My goal is to hit $1500 a month by spring and have full replacement income within 2 years. Everybody should have some kind of side income, just as a safety net.

One of my side hustles involves training in a niche with 200 companies competing for about 10,000 one-day students each year. I could try to compete on price, but that’s an arms race to bargain-basement pricing. Instead, we compete on value, and as such, we’re on track to bring in several multiples of our share of students this year, with growth projected to go well beyond that next year.

Knowing how much more I enjoy my side projects over my straight job, I want to encourage my kids to develop their own lines of income that will allow them to live the lives they want to live, without being a leech on society.

If they can start to get some of their own income, they can learn the value of the things they own, instead of assuming that everything is free. I will not spoil my kids.

Finally, a list of the carnivals I’ve participated in:

Actions Have Consequences has been included in the Festival of Frugality.

If I missed anyone, please let me know. Thanks for including me!

Optimized to Go, Part 1

Last weekend, we held a garage sale at my mother-in-law’s house. It was technically an estate sale, but we treated it exactly as a garage sale.

A week before we started, a friend’s mother came to buy all of the blankets and most of the dishes, pots, and non-sharp utensils so she could donate them all to a shelter she works with. She took at least 3 dozen comforters and blankets away.

Even after that truckload, we started with two double rows of tables through the living room and dining room. The tops of the tables were as absolutely full as we could get them, and the floor under the tables was also used for displaying merchandise.

Have you ever had to display 75 brand-new pairs of shoes in a minimal about of space? They claimed about 16 feet of under-table space all by themselves. Thankfully, the blankets weren’t there anymore.

We also had half of the driveway full of furniture, toys, and tools.

We had a lot of stuff.

Now, most people hold a sale to make some money. Not us. We held a sale to let other people pay us for the privilege of hauling away our crap. As such, it was all priced to move. The most expensive thing we sold was about $20, but I can’t remember what that was. Most things went for somewhere between 25 cents and $1.

At those prices, we sold at least 2000 items. That isn’t a typo. We ended the day with $1325. After taking out the initial seed cash, lunches we bought for the people helping us, and dinner we bought one night, we had a profit of $975.

At 25 cents per item.

We optimized to sell instead of optimizing for profit. At the end of a long summer of cleaning out a hoarding house, it all needed to go.

In the next part, I’ll explain exactly how we made it work.

Mortgage Race

I spent last week at the Financial Blogger Conference. Saturday night was the big debauch, a 90s themed hip-hop dance party.

Yeah.

Instead, Crystal, Suba, and I hosted a super-secret pizza party to let some of the less “dance party” inclined attendees discuss things like the sanitary concerns of group body shots, sex toys, and horror movies.

During the course of the party, Crystal and I decided to race to pay off our mortgages.

Her balance is just under $25,000.

My balance is $26,266.40.

We both technically have the cash to pay off the balances right now, but we are both dealing with secondary housing issues. She’s building a new one, and I’m updating an inherited house. Neither of us is willing to use our cash reserves to pay off the balance right this moment.

Now that my credit card is paid off, I’ve moved that money to an extra interest-only payment on my mortgage, effectively doubling my mortgage payment, which puts my projected payoff date as about the end of next year. Crystal’s aiming for June, so I’ll have to hurry.

We do have tenants lined up for February, and all of the non-expense related rent will go to the mortgage.

I think I can win.

Update:

I forgot to mention the terms of the bet. The loser has to go visit the winner. When I win, Crystal’s going to fly to Minnesota to experience snow.