Am I the only one who just noticed that it’s Wednesday? The holiday week with the free day is completely screwing me up.

Just to make this a relevant post:

Spend less!

Save more!

Invest!

Wee!

The no-pants guide to spending, saving, and thriving in the real world.

As I’m sure you’ve all heard by now, a young Mr. John Luke Robertson is engaged to be married at the ripe age of nineteen. While I’m positive you may be reeling in awe at how anyone could fathom being married at that age, the idea isn’t such a terrible one. The Robertsons have done more than build an outdoorsman’s empire; they’ve set the standard for wholesome values and American family dynamic. Even though I’m sure the two lovebirds won’t be dining on ramen and sharing a ramshackle apartment on the cheap side of town, they have the right idea. Let’s take a moment to explore why marrying young may not be such a bad idea for those of us less waterfowl adept.

As I’m sure you’ve all heard by now, a young Mr. John Luke Robertson is engaged to be married at the ripe age of nineteen. While I’m positive you may be reeling in awe at how anyone could fathom being married at that age, the idea isn’t such a terrible one. The Robertsons have done more than build an outdoorsman’s empire; they’ve set the standard for wholesome values and American family dynamic. Even though I’m sure the two lovebirds won’t be dining on ramen and sharing a ramshackle apartment on the cheap side of town, they have the right idea. Let’s take a moment to explore why marrying young may not be such a bad idea for those of us less waterfowl adept.

In the beginning, there was man. Man loved woman. Woman loved man. They found that they were so completely enamoured with one another that they couldn’t stand the idea of a moment apart and decided, “Hey, let’s spend every moment of or life together, forever.” There they are. Two young, ambitious people with the world ahead of them. Now what?

Likely, college is still looming for the two. Instead of struggling to work through school while paying for housing, they help each other. Two incomes mean half the burden and twice the savings. Instead of going out at night, they stay in studying, bonding, burning cookies and making lasting memories. After four years, that time spent at home has paid off. Instead of tarnishing their unblemished credit by applying for for small loans to stay afloat and likely defaulting, they’ve been paying off credit cards, paying on student loans, and thusly establishing good credit.

Speaking of homes, it’s about time for that. Thanks to the lack of partying and indecision, they left school with great GPA’s, promising careers, and a near perfect credit history. They purchase a home. Likely, a nice home with room to grow and most importantly, equity. Now that they’ve made the leap, the mortgage payment isn’t much more than the rent would have been and they can afford to pay a little extra toward the principle each month. Settling down so early has paid in dividends, via two incomes and ever increasing property value. Our couple has accomplished in five years what would take a single graduate closer to ten or fifteen to obtain.

They may or may not decide to have children. In the event that they do, the kids will have grown and left the nest before our couple has even reached 45. Diligently working and supporting each other, they have continued to save. The house is paid off and the kids are gone. Retired at 50, they own their home outright. They can relax and spend the rest of life enjoying it from a comfy porch swing. There is no struggle or financial burden. They are free, while others their age may still be living paycheck to paycheck and worrying about keeping a roof overhead.

You may still consider the idea of marrying young to be frivolous, but it is likely that at this point in your life you could have been twice as well off had you only settled down with that girl from high school who would have followed you to the end of the Earth. Following your heart may not only make you happy, it can make you stable, self sufficient and and financially secure. They don’t make a duck call for that.

Welcome to the New Year. 2013 is the year we all get flying cars, right?

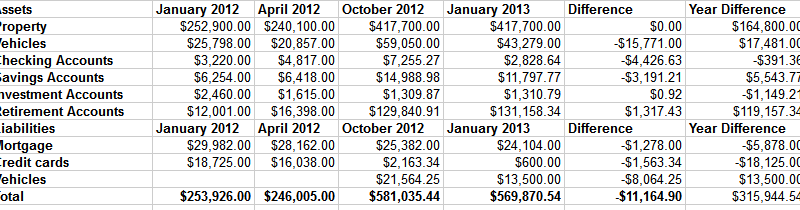

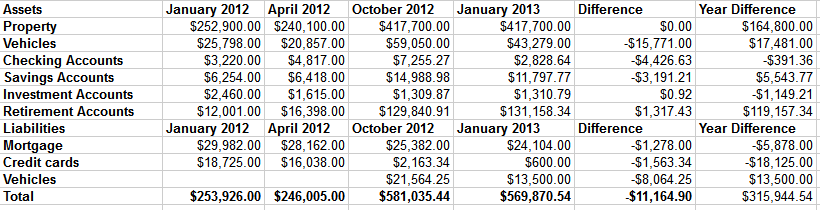

Here is my net worth update, along with the progress we made over the course of 2012.

As you can see, our net worth contracted by about $11,000. Part of that difference is due to selling our spare cars and–against my better judgement–taking payments with a lien on one of them. That is supposed to be paid off within a couple of months. If not, I’ll play repo man again.

The other part of the difference is in the final preparations for our rental property. The only things left to do are sanding and polishing the hardwood floors and cleaning the living room carpet. The final push to get to this point cost some money. All told, we’re nearly $30,000 into getting the house ready to rent. For the naysayers who think we should have sold it, we would have spent more getting it ready to sell.

Other than that, we’re not doing poorly. Our credit card is still being paid off every month and our mortgage is shrinking. If things continue to go well, we’ll have our truck paid off in a couple of months and the mortgage by mid summer.

Last week, the washing machine in our rental house died. It was older than I am, so this wasn’t really a surprise. It was one of just two appliances we didn’t replace before we moved the renters in.

My wife–bargain shopper that she is–found a replacement on Craigslist. We got it in, then left the dead washing machine next to the replacement, as a warning to any other appliance that thinks it can shirk its assigned work.

This morning, we went over to pull the corpse of our washing machine out of the basement.

Now, I am an out-of-shape desk jockey, my wife is considerably weaker than I am, and a 40 year old washing machine weighs more than 200 pounds.

In the basement.

I’m Superman. Although at one point, I did trade 10 years of the useful life of my right knee in exchange for not letting that thing tumble down the stairs on top of me.

What do you do with a dead washing machine?We could have the garbage company pick it up for $25. Or we could leave it on the curb and wait for some stinking scrapper to take it.

Or…we could join the dark side and scrap it ourselves.

For the uninitiated, scrappers are the people who drive around looking for fence-posts to steal out of other people’s yards, or cut the catalytic converters out of cars parked at park-and-ride bus stops, or steal all of the copper pipes out of your house while your on vacation. Sometimes, they get scrap metal from legitimate sources, I’ve heard.

We decided to go the legitimate route and take the washing machine to the scrap metal dealer in the next town over.

It was pretty easy. We pulled in with the washer in the trailer. A guy on a forklift pulled up and took it, then handed us a receipt to bring to the cashier. She paid us in cash, and we were on our way.

$7.50 richer.

200 pounds of steel, and we made less than $10.

There are people who pay their bills by recycling scrap metal, but I have no idea how. Driving around looking for things to scrap would seem to burn more gas than you’d make turning it in.

Some people scour Craigslist looking for metal things in the free section.

Some people have an arrangement with mechanics to remove their garbage car parts.

Some people are only looking to supplement their government handout checks enough to pay for cigarettes.

Us? We’re going to leave scrapping to the scavengers.

We’re busy cleaning for our party next weekend, followed by spending an evening lying in a coffin in my yard, scaring the crap out of kids and giving them candy.

Right now, I am actively pursuing 4 separate side hustles, 3 of which are generating actual cash. It’s about $500 a month at the moment, but each of them are growing. My goal is to hit $1500 a month by spring and have full replacement income within 2 years. Everybody should have some kind of side income, just as a safety net.

One of my side hustles involves training in a niche with 200 companies competing for about 10,000 one-day students each year. I could try to compete on price, but that’s an arms race to bargain-basement pricing. Instead, we compete on value, and as such, we’re on track to bring in several multiples of our share of students this year, with growth projected to go well beyond that next year.

Knowing how much more I enjoy my side projects over my straight job, I want to encourage my kids to develop their own lines of income that will allow them to live the lives they want to live, without being a leech on society.

If they can start to get some of their own income, they can learn the value of the things they own, instead of assuming that everything is free. I will not spoil my kids.

Actions Have Consequences has been included in the Festival of Frugality.

If I missed anyone, please let me know. Thanks for including me!

Last weekend, we held a garage sale at my mother-in-law’s house. It was technically an estate sale, but we treated it exactly as a garage sale.

A week before we started, a friend’s mother came to buy all of the blankets and most of the dishes, pots, and non-sharp utensils so she could donate them all to a shelter she works with. She took at least 3 dozen comforters and blankets away.

Even after that truckload, we started with two double rows of tables through the living room and dining room. The tops of the tables were as absolutely full as we could get them, and the floor under the tables was also used for displaying merchandise.

Have you ever had to display 75 brand-new pairs of shoes in a minimal about of space? They claimed about 16 feet of under-table space all by themselves. Thankfully, the blankets weren’t there anymore.

We also had half of the driveway full of furniture, toys, and tools.

We had a lot of stuff.

Now, most people hold a sale to make some money. Not us. We held a sale to let other people pay us for the privilege of hauling away our crap. As such, it was all priced to move. The most expensive thing we sold was about $20, but I can’t remember what that was. Most things went for somewhere between 25 cents and $1.

At those prices, we sold at least 2000 items. That isn’t a typo. We ended the day with $1325. After taking out the initial seed cash, lunches we bought for the people helping us, and dinner we bought one night, we had a profit of $975.

At 25 cents per item.

We optimized to sell instead of optimizing for profit. At the end of a long summer of cleaning out a hoarding house, it all needed to go.

In the next part, I’ll explain exactly how we made it work.