What would your future-you have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

What would your future-you have to say to you?

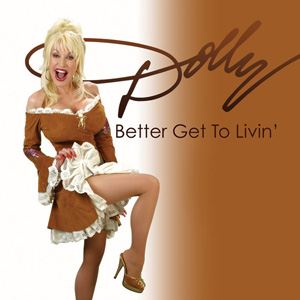

America’s country sweetheart, Dolly Parton, was in a car accident recently. Although she was only a passenger in this minor fender-bender, she still suffered some injuries requiring a quick hospital visit and rest. The offending driver did not stop as he was supposed to and struck Parton’s vehicle. Parton surely has auto insurance, and hopefully the offending driver has coverage as well.

Every month, you pay a premium toward your coverage balance. Coverage varies by state, from hospital bills to repairing damaged street items, like guard rails. People with expensive cars pay higher premiums while inexpensive cars have lower amounts. Some buyers only purchase the bare minimum of coverage, called comprehensive. This coverage does not help in the Parton crash because it typically covers vehicle damage from objects, like flying rocks, rather than a collision situation.

How Much Does That Part Cost?

Repairing a vehicle after a car crash can lead to astronomical figures. A simple dent in the bumper may warrant an entire part replacement costing thousands of dollars. The offending driver in Parton’s accident is at fault. His insurance should cover Parton’s insurance deductible and any other expenses that arise. If he is not covered, she could technically sue him for damages, although there may not be many funds to pay out.

Those Medical Bills

Coupled with a car repair, Parton and her driver also went to the hospital. The offending driver uses his auto insurance to cover their medical bills. Any bills generated from the driver or passenger’s injuries goes directly to the offending driver’s insurance. If he is not properly covered with this policy feature, he must pay for the bills out-of-pocket. With medical bills costing thousand of dollars, he probably called his insurance agent right away to see if his policy has that coverage.

Luckily, Parton’s accident was not severe, but ongoing injuries can slowly siphon funds out of the offending driver’s account. If Parton has whiplash, for example, she may need multiple visits to a chiropractor or other specialty doctor. Each visit should be covered by the offending driver’s insurance. Because she has good insurance coverage does not mean that her policy should pay out. The party at-fault always pays for both car repairs and medical bills. With treatment that takes several weeks to a few months, the offending driver’s insurance rates will typically jump next policy year.

Someone Has To Pay For It

Depending on the insurance company, an accident on your record causes your premiums to rise. You are now considered a risk to the company. It is possible that you will cause another accident incurring more cost. Insurance companies must weigh their risky customers with their good drivers. Hopefully Parton recuperates quickly so the offending driver’s rates do not remain high for several years.

You may not think of auto insurance as a top priority, but the reality of Parton’s fender-bender shows everyone that accidents happen at any time. Even celebrities must cover their vehicles with good insurance to protect their assets.

Today, I continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

This is day 3 and today, you are going to take a look at your income.

We are only interested your take-home pay, because that is what you have to base a budget on. If you base your budget on your gross pay, you’re going to be in trouble when you try to spend the roughly 35% of your check that gets taken for taxes and benefits.

Income is a pretty straight-forward topic. It is—simply—how much money you make in a month. If you are like most people, the easiest way to tell how much money you make is to look at your last paycheck. Then, multiply it by the number of pay periods in a year and divide the total by 12.

Here’s the formula: Cash x Yearly Pay Periods / 12. Yay, math!

If you get paid every 2 weeks, multiply your take-home pay by 26, then divide by 12 to figure your monthly pay. For example, if you make $1000 every two weeks, your annual take-home pay is $26,000. Divide that by 12 to get your monthly pay of $2166.66. If you get paid semi-monthly, you’ll take that same $1000 x 24 / 12, for a total of $2000 per month.

Now you know how much you make each month. Woo!

Is it enough? Who knows? We’ll get into that later. In the meantime, spend some time thinking about ways you can make more money. Do you have a talent or a hobby that you can turn into cash?

There are always ways to make some extra money, if you are willing. Sit down with a friend or loved one and brainstorm what you can do. Write down anything you can do, you enjoy, or you are good at. Remember, there are no stupid ideas when you are brainstorming. The bad ideas will get filtered out later.

How could you make some (more) side cash?

This is a guest post written by Jason Larkins. He writes at WorkSaveLive – a blog he started to help people change the way they think about their finances, careers, and lives.

Who doesn’t like to buy stuff?

Okay…I’m sure there are a few of you out there that take pride in never buying a new “toy,” but I know personally that I LOVE stuff!

Not to the point that I make dumb financial decisions that jeopardizes my family’s financial well-being, but I do have that natural American desire to have nice things and to be able to do fun stuff!

If you’re in the market to buy a Big-Ticket item (i.e. a new car, TV, or other technology gadget), what are some of the things you should be thinking through as you contemplate making the purchase?

The first mistake people make is buying on impulse. The massive majority of Americans don’t even have a thought process when it comes to buying toys, so that’s why I decided to dedicate a post on a few things you should ponder.

1. Avoid spending extra for add-ons, or features, that you’re never going to use.

It is easy to get an appliance or technology gadget that has a ton of amazing features on it – but why pay for them if you won’t use them?

Consider buying the item that may be a step below what you’re looking at.

I know that I personally love the thought of having an Ipad 2, but am I really going to utilize it to it’s full capabilities?

Probably not!

It doesn’t mean I shouldn’t have one, but it does mean I can look at the older Ipad and save some money. Or, I can avoid the purchase altogether if I don’t think it’s going to be worth the money.

2. Be cautious with offers such as “no money down,” “90 days same as cash,” or “12 months interest free.”

Nearly 88% of the “90 days same as cash” offers are actually converted to payments because the purchaser couldn’t pay off the bill before the offer was up.

3. Don’t buy it just because it’s the cheapest.

Always be sure to do research prior to your purchase – check consumer reviews and product reviews. Saving money may not be worth it if the product breaks down quickly or doesn’t have the functionality that you’re looking for.

1. Prepare for large purchases and pay cash for them.

If you can’t pay cash for the item, then there is a good chance that you can’t afford it.

Determine how much money you will need to spend on a particular item and save up for it! This is going to help you in a couple of ways:

2. Buy at the end of the month, or at the end of the year!

Consumers rarely think of this, but it’s important for you to know that every store (and store manager) has monthly/yearly sales to report.

If they’re wanting to close out the month/year strong, they’re much more inclined to offer you a deal on whatever you’re buying!

3. Avoid the extended warranty!

Insurance (in general terms) is the act of transferring risk – the more people that pool money together to help mitigate risk (buy insurance), then the lower the cost of the insurance becomes.

The reason to avoid the extended warranties is because the cost you’re paying to cover your item also includes: commissions paid to the retail store, overhead for the insurance company (wages for employees, building costs, utilities, etc), and some profit for the insurance company as well.

Sure, you may be in the miniscule percentage of buyers that has their item break down on them, but the reality is that it’s unlikely.

If it was likely for your item to break down, then the insurance wouldn’t be available because it wouldn’t be a profitable endeavor for the insurance company (and they’d be out of business).

Whenever you’re buying something that has a large price tag, you should develop a process that you think through before buying it!

Always pay in cash, get a deal, and make sure you actually need everything you’re paying for.

If you are a parent who is planning to home school your children or if you are already involved in homeschooling and seeking additional resources, using Khan Academy online is highly recommended regardless of the type of material you are trying to teach or learn. Learning with Khan Academy is possible for students of all ages as well as individuals who are simply seeking new methods of learning without having to pay for the education.

Khan Academy is a free online resource for anyone interested in learning new material in a wide range of subjects. Whether you are a parent who is planning on homeschooling your children or if you simply have an avid interest in science, mathematics or even art history, using Khan Academy can ultimately give you the knowledge you need for any reason.

Khan Academy operates as a non-profit organization and offers all courses and materials absolutely free of charge. Using Khan Academy is ideal if you are actively seeking out new lesson plans for your own children but you are stumped for ideas and material yourself.

When you sign up for Khan Academy you can immediately dive into various lessons depending on what you want to learn. Whether you are seeking out assignments in math, science, humanities or even economics and finance, there are plenty of courses in different areas of education. You can also learn all about computer programming and various levels of specific subjects based on whether you are teaching your children or looking to learn something new for yourself.

Learning online from home is a way for you to incorporate well-developed lessons into your everyday homeschooling lesson plans at any time. When you choose to use an online community such as Khan Academy there are also no deadlines or restrictions on the lessons you want to teach or learn more about yourself.

You can also hand pick specific lessons to help with individualizing each one of your children’s educational outline and plans. Depending on the age of your children and their own interests you can choose from a variety of lessons for beginners and those seeking more advanced work.

Teaching your children new material with the use of the online Khan Academy is a way for you to ensure they are truly understanding the lessons before moving on. Additionally, using Khan Academy is ideal if you are seeking educational content that is sourced, referenced and completely free of charge. Khan Academy lessons and content is and always will be free as this is one of the main missions of the academy itself.

Knowing the benefits of using Khan Academy and how it can help you or your children grow educationally is a way to truly take advantage of the services and lessons being offered. Using Khan Academy when homeschooling brings expansive lessons into the home regardless of your own knowledge and areas of expertise when you begin to teach your children.

Debt can be thought of as a disease–probably social. Most of the time, it was acquired through poor decision making, possibly while competing with your friends, occasionally after having a few too many, often as an ego boost. Unfortunately, you can’t make it go away with a simple shot of penicillin. It takes work, commitment and dedication. Here are three steps to treating this particular affliction.

1. Burn it, bash it, torch it, toss it, disinfect. Get rid of the things that enable you to accumulate debt. If you keep using debt as debt, you will never have it all paid off. That’s like only taking 3 days of a 10 day antibiotic. Do you really want that itchy rash bloodsucking debt rearing its ugly head when you’ve got an important destination for your money? Take steps to protect yourself. Wrap that debt up and keep it away.

2. Quit buying stuff. Chances are, you have enough stuff. Do you really need that Tusken Raider bobble-head or the brushed titanium spork? They may make you feel better in the short term, but after breakfast, what have you gained? A fleeting memory, a bit of cleanup, and an odd ache that you can’t quite explain to your friends. Only buy the stuff you need, and make it things you will keep forever. If you do need to indulge, hold off for 30 days to see if it’s really worthwhile. If it’s really worth having, you can scratch that itch in a month with far fewer regrets.

3. Spend less. This is the obvious one. The simple one. The one that makes breaking a heroin addiction look like a cake-walk(My apologies to recovering heroin addicts. If you’re to the point that personal finance is important to you, you’ve come a long way. Congratulations!). Cut your bills, increase your income. Do whatever it takes to lower your bottom line and raise your top line. Call your utilities. If they are going to take your money, make them work for it. If they can’t buy you drinks or lower your payments, get them out of your life. There’s almost always an alternative. Don’t be afraid to banish your toxic payments. Eliminate your debt payments. This page has a useful guide to debt and how to clear it off.

Update: This post has been included in the Festival of Frugality.