Please email me at:

Or use the form below.

[contact-form 1 “Contact form 1”]

The no-pants guide to spending, saving, and thriving in the real world.

Today, I continuing the series, Money Problems: 30 Days to Perfect Finances. The series will consist of 30 things you can do in one setting to perfect your finances. It’s not a system to magically make your debt disappear. Instead, it is a path to understanding where you are, where you want to be, and–most importantly–how to bridge the gap.

I’m not running the series in 30 consecutive days. That’s not my schedule. Also, I think that talking about the same thing for 30 days straight will bore both of us. Instead, it will run roughly once a week. To make sure you don’t miss a post, please take a moment to subscribe, either by email or rss.

On this, day 2 of the series, you need to gather all of your bills: your electric bill, your mortgage, the rent for your storage unit, everything. Don’t miss any.

Go ahead, grab them now. I’ll wait.

Did you remember that thing that comes in the plain brown wrapper every month? You know, that thing you always hope your neighbors won’t notice?

Now, you’re going to sort all of the bills into 5 piles.

Pile #1: These are your monthly bills. This will probably be your biggest pile, since most bills are organized to get paid monthly. this will include your credit cards, mortgage(do you rent or buy?), most utilities and your cellphone.

Pile #2: Weekly expenses. When I look at my actual weekly bills, it’s a small stack. Just daycare. However, there are a lot of other expenses to consider. This stack should include your grocery bill, gas for your car, and anything else you spend money on each week.

Pile #3: Quarterly and semiannual bills. I’ve combined these because there generally aren’t enough bills to warrant two piles. My only semi-annual bill is my property tax payment. Quarterly bills could include water & sewer, maybe a life insurance policy and some memberships.

Pile #4: Annual bills. This probably won’t be a large pile. It will usually include just some memberships and subscriptions.

Pile #5: Irregular bills. The are some things that just don’t come due regularly. In our house, school lunches and car repairs fall into this category. We don’t have car problems often, but we set money aside each month so our budget doesn’t get flushed down the drain if something does come up.

Now that you have all of your expenses together, you know what your are on the hook for. Next time, we’ll address income.

Saving is hard. For years, we would either not save at all, or we’d save a bit, then rush to spend it. That didn’t get us very far. Years of pretending to save like this left us with nothing in reserve. Finally, we’ve figured out the strategy to save money.

First and foremost, make more than you spend. This holds true at any level of income. If you don’t make much money, then you need to not spend much, either. Sometimes, this isn’t possible under current circumstances. In those cases, you need to either increase your income or decrease your expenses. Cut the luxuries and pick up a side hustle. The wider the gap between your bottom line and your top line, the easier it is to save.

Next, make a budget and stick to it. There is no better way to track both your income and your expenses. I’ve discussed budgets before, so I won’t address that in detail today. Short version: Make a budget. Use any software you like. Use paper if you want. Make it and use it.

Pay yourself first. The first expense listed on your budget should be you. Save first. If you can’t afford to save, you can’t afford some of the other items in your budget. Cut the cable or take the bus, but save your money. Without an emergency fund, your budget is just a empty dream when something unexpected comes up. And something unexpected always comes up.

Automate that payment to yourself. Don’t leave yourself any excuse not to make that payment. Set up an automated transfer to another bank and forget about it. Schedule the transfer to happen on payday, every payday.

Now comes the hard part: Forget about the money. Don’t check your balance. Don’t think about it in any way. Just ignore it. For the first month or two, this will be difficult. After that, you’ll forget it exists for a few months and come back amazed at how much you’ve saved.

If you don’t forget about it, and you decide to dip into the account, you are undoing everything you’ve worked so hard to save. Do yourself a favor and leave the money alone.

Baby Steps” width=”180″ height=”240″ />

Baby Steps” width=”180″ height=”240″ />Fixing a lifetime of financial mistakes can be an intimidating process. Scratch that. It’s always an intimidating process. Where do you start? You’ve got a pile of bills, a dozen messages from bill collectors and two bi-weekly paystubs. What next?

Traditionally, and according to Dave Ramsey, the first step to fixing your finances is to make a budget, but he and tradition are wrong. The first step is to get everybody involved in your finances on the same page. If your spouse isn’t on board with paying off the debt and spending responsibly, nothing else will work.

Once you have that out of the way, you can move on to the traditional first step, making a budget. I’ve gone over my process to build a personal financial plan in quite a bit of detail, so I’ll just hit the highlights this time.

First, make a list of all of your expenses. Include all of your utilities, debt payments, tax payments and absolutely everything else. You need to know the amount of the payment and the frequency. If a bill is due quarterly, divide it by three and you’ll know what you need to set aside each month. Round up in all cases so you can build an automatic cushion.

Next, make a list of your income sources. For most people, this is far easier than tracking their expenses. Figure out your monthly income. If you get paid weekly, that that amount times 52, then divide by 12 to get your monthly income.

Finally, subtract your expenses from your income. If your total is a positive number then you are golden. If you total is negative, you have been a bad monkey. You need to make some cuts, and they may be painful. If your outgoing money is more than your incoming money, it is not possible to get ahead.

Once you have your income and expenses recorded, and you have made the cuts necessary to have a positive balance at the end of the month, you have a successful budget. Congratulations!

You know exactly how much you make, to the penny. You’ve listed all of your bills in a spreadsheet, including the annual payment for your membership to Save the Combat-Wombat. You know exactly how much is coming in and how much has to go out each month. Your income is more than your expenses, yet somehow, you still have more month than money.

What’s going on?

The short answer is that a budget is not enough.

A budget is not…

…a checkbook register. Do you track everything you spend? Are you busting your budget on $10 lattes or DVDs every few days? Is the take-out you have for lunch every day adding up to 3 times your food budget? Are you sure? If you don’t track what you spend, how do you know what you’ve actually spent? You have to keep track of what you are spending. Luckily there are ways to do this that don’t involve complex calculation, laborious systems or even proper math. The easy options include using cash for all of your discretionary spending(no money, no spendy!), rounding your spending up so you always have more money than you think you do, or even keeping your discretionary money is a separate debit account. That will let you keep your necessary expenses covered. You’ll just have to check your discretionary account’s balance often and always remember that sometimes, things take a few days to hit your bank.

…a debt repayment plan. You may know how much you have available, but if you aren’t exercising the discipline to pay down your debt and avoid using more debt, you not only won’t make progress, but you’ll continue to dig a deeper hole. Without properly managing the money going out, watching the money coming in is pointless.

…an alternative to responsible spending. Your budget may say you have $500 to spare every month, but does that mean you should blow it on smack instead of setting up an emergency fund? I realize most heroin addicts probably aren’t reading this, but dropping $500 at the bar or racetrack is just as wasteful if you don’t have your other finances in order. Take care of your future needs before you spend all of your money on present(and fleeting) pleasures.

A budget is a starting point for keeping your financial life organized and measuring a positive cash flow. By itself, it can’t help you. You need to follow it up with responsible planning and spending.

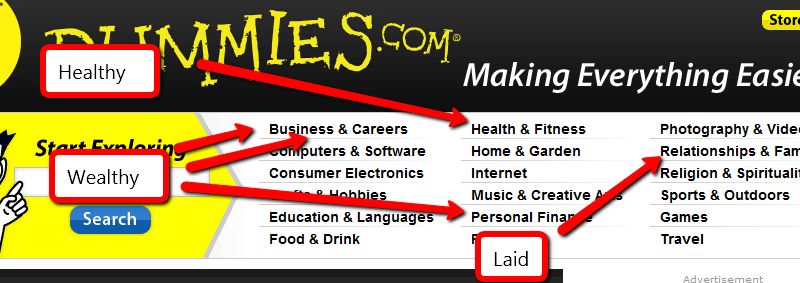

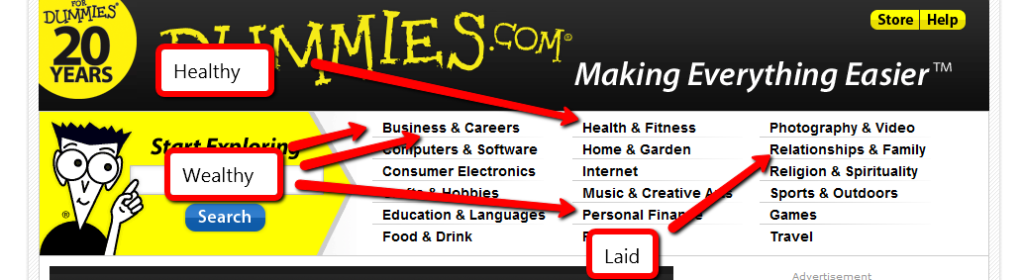

If you want to make money, help someone get healthy, wealthy or laid.

This section was quick.

Seriously, those three topics have been making people rich since the invention of rich. Knowing that isn’t enough. If you want to make some money in the health niche, are you going to help people lose weight, add muscle, relieve stress, or reduce the symptoms of some unpleasant medical condition? Those are called “sub-niches”. (Side question: Viagra is a sub-niche of which topic?)

Still not enough.

If you’re going to offer a product to help lose weight, does it revolve around diet, exercise, or both? For medical conditions, is it a way to soothe eczema, instructions for a diabetic diet, a cure for boils, or help with acne? Those are micro-niches.

That’s where you want to be. The “make money” niche is far too broad for anyone to effectively compete. The “make money online” sub-niche is still crazy. When you get to the “make money buying and selling websites” micro-niche, you’re in a territory that leaves room for competition, without costing thousands of dollars to get involved.

Remember that: The more narrowly you define your niche market, the easier it is to compete. You can take that too far. The “lose weight by eating nothing but onions, alfalfa, and imitation caramel sauce” micro-niche is probably too narrowly defined to have a market worth pursuing. You need a micro-niche with buyers, preferably a lot of them.

Now the hard part.

How do you find a niche with a lot of potential customers? Big companies pay millions of dollars every year to do that kind of market research.

Naturally, I recommend you spend millions of dollars on market research.

No?

Here’s the part where I make this entire series worth every penny you’ve paid. Times 10.

Steal the research.

My favorite source of niche market research to steal is http://www.dummies.com/. Click the link and notice all of the wonderful niches at the top of the page. Jon Wiley & Sons, Inc. spends millions of dollars to know what topics will be good sellers. They’ve been doing this a long time. Trust their work.

You don’t have to concentrate on the topics I’ve helpfully highlighted, but they will make it easier for you. Other niches can be profitable, too.

Golf is a great example. Golfers spend money to play the game. You don’t become a golfer without having some discretionary money to spend on it. I’d recommend against consumer electronics. There is a lot of competition for anything popular, and most of that is available for free. If you choose to promote some high-end gear using your Amazon affiliate link, you’re still only looking at a 3% commission.

I like to stick to topics that people “need” an answer for, and can find that answer in ebook form, since I will be promoting a specific product.

With that in mind, pick a topic, then click one of the links to the actual titles for sale. The “best selling titles” links are a gold mine. You can jump straight to the dummies store, if you’d like.

Of the topics above, here’s how I would narrow it down:

1. Business and Careers. The bestsellers here are Quickbooks and home buying. I’m not interested in either topic, so I’ll go into “More titles”. Here, the “urgent” niches look like job hunting and dealing with horrible coworkers. I’m also going to throw “writing copy” into the list because it’s something I have a hard time with.

2. Health and Fitness. My first thought was to do a site on diabetic cooking, but the cooking niche is too competitive. Childhood obesity, detox diets and back pain remedies strike me as worth pursuing. I’m leaning towards back pain, because I have a bad back. When you’ve thrown your back out, you’ve got nothing to do but lie on the couch and look for ways to make the pain stop. That’s urgency.

3. Personal Finance. The topics that look like good bets are foreclosures and bankruptcies. These are topics that can cost thousands of dollars if you get them wrong. I hate to promote a bankruptcy, but some people are out of choices. Foreclosure defense seems like a good choice. Losing your home comes with a sense of urgency, and helping people stay in their home makes me feel good.

4. Relationships and Family. Of these topics, divorce is probably a good seller. Dating advice definitely is. I’m not going to detail either one of those niches here. Divorce is depressing and sex, while fun, isn’t a topic I’m going to get into here. I try to be family friendly, most of the time. Weddings are great topic. Brides are planning to spend money and there’s no shortage of resources to promote.

So, the niches I’ve chosen are:

I won’t be building 9 niche sites in this series. From here, I’m going to explore effective keywords/search terms and good products to support. There’s no guarantee I’ll find a good product with an affiliate program for a niche I’ve chosen that has keywords that are both highly searched and low competition, so I’m giving myself alternatives.

For those of you following along at home, take some time to find 5-10 niches you’d be willing to promote.

The important things to consider are:

1. Does it make me feel dirty to promote it?

2. Will there be customers willing to spend money on it?

3. Will those customers have an urgent need to solve a problem?

I’ve built sites that ignore #3, and they don’t perform nearly as well as those that consider it. When I do niche sites, I promote a specific product. It’s pure affiliate marketing, so customers willing to spend money are necessarily my target audience.