- RT @mymoneyshrugged: The government breaks your leg, and hands you a crutch saying "see without me, you couldn't walk." #

- @bargainr What weeks do you need a FoF host for? in reply to bargainr #

- Awesome tagline: The coolest you'll look pooping your pants. Yay, @Huggies! #

- A textbook is not the real world. Not all business management professors understand marketing. #

- RT @thegoodhuman: Walden on work "spending best part of one's life earning money in order to enjoy (cont) http://tl.gd/2gugo6 #

Check Your Bills

Today, I discovered our AOL billing information. Turns out we’ve been paying for dial-up via automatic bill paying that we thought we cancelled in 2000. $1,800 later, we called to cancel. Customer service congratulated us on being loyal members for over 13 years. FML -Jay

- Image by roberthuffstutter via Flickr

I am a huge fan of automating my finances. My paycheck is direct-deposited. My savings are automatically transferred from my checking account to my savings account. Almost every bill I receive regularly is set up as an automatic payment in my bank’s bill-pay system. I even have my debt snowball automated.

The only question left is whether it’s possible to automate too far. Can you automate past the point of benefit, straight into detriment? The primary benefit of automation is knowing that you can’t forget a payment. The other benefit is freeing up your attention. You don’t have to give any focus to paying your bills, freeing you to worry about other things.

The problem with the second benefit is the same as the benefit. If you don’t give your bills any attention, how do you know if there is a problem? If something changes–an extra fee or a mis-keyed payment–you won’t notice because you haven’t been giving the bills any focus.

Sometimes, this means you are paying an extra fee without noticing it. Sometimes, if your due date changes, it can mean late fees. Even if nothing goes wrong, you are missing the opportunity to review what you are paying to ensure your needs are being met as efficiently as possible.

What can you do about it? I put a reminder on my Life Calendar to check my bills each month. I pick one bill each month and try to find a way to save money on it. I review the services to make sure they are what I need and if that doesn’t help, I call and ask for a lower price. If it’s a credit card, I ask for a lower interest rate. For the cable company, I ask if they will match whatever deal they have for new customers.

Every company can do something to keep a loyal customer happy. All you have to do is ask.

Do you automate anything? How do you keep track of it all?

A Bit of Christmas Magic

On Thursday, my wife left with my kids and dog. I had to work all day on Friday, so she took off to get an early start on Christmas at my brother’s house. I followed Saturday morning.

Two nights with no whining, and a bed to myself.

Friday afternoon, my wife called to tell me about her day.

When she got to my brother’s, she took her tailgate down to get the suitcases out of the back of her truck. She left the plastic container full of presents in her truck, since we’d be exchanging presents at my parent’s house nearby.

Friday morning, she left to feed her shopping addiction for a few hours.

When she got to the giant store that had our new car seats on sale, she discovered that she had neglected to put the tailgate back up on the truck when she unpacked. This was the box that held most of our budgeting overspend.

Gone.

When she called me, she was retracing her steps, hoping to find the box.

I was upset.

She didn’t find the box on the side of the road.

Gone.

Normally, this would be a strong object lesson in the futility of rampant consumerism. A lot of zen-like “the stuff you own is fleeting”, amidst the wailing of children who are discovering that their Christmas presents evaporated in a ditch somewhere.

Somebody found the box. I don’t know who.

Whoever it was, opened the box and saw the tears of small children inside. She read the name tags and, amazingly, recognized enough of the first names to place the family.

Keep in mind that I live more than 100 miles away, and moved out of the town 15 years ago.

This anonymous Christmas elf brought the box into a nearby gas station, and asked them to call my parents, since the names on the tags matched those of my parents’ grandchildren.

Everything was still in the box.

Everything was still intact.

Anonymous Christmas Elf saved Christmas for my family

.

Regret

There comes a time when it’s too late to tell people how you feel.

There will come a day when the person you mean to talk to won’t be there. Don’t wait for that day.

“There’s always tomorrow” isn’t always true.

Credit Peril

When my mother-in-law died, we went through all of her accounts and paid off anything she owed.

The Discover card she’d carried since the 80s–a card that had my wife listed as an authorized user–had a balance of about $700. We paid that off with the money in her savings account. They cashed out the accumulated points as gift cards and closed the account.

A few months ago, we decided it was time to buy an SUV, to fit our family’s needs. We financed it, to give us a chance to take advantage of a killer deal while waiting for the state to process the title transfer on an inherited car we have since sold.

Getting good terms was never a worry. Both of us had scores bordering on 800. Since our plan was to pay off the entire loan within a few months, we asked for whatever term came with the lowest interest rate.

Then the credit department came back and said that my wife’s credit was poor. I chalked it up to a temporary blip caused by closing the oldest account on her credit report and financed without her. No big deal.

Since we decided to rent our my mother-in-law’s house, we’ve discussed picking up more rental properties. That’s a post for another time, but last week, we went to get pre-approved for a mortgage. During the process, the mortgage officer asked me if my wife had any outstanding debt that could be ignored if we financed without her.

Weird.

A few days ago, we got the credit check letter from the bank. Her credit score? 668.

What the heck?

I immediately pulled her free annual credit report from annualcreditreport.com, which is something I usually do 2-3 times per year, but had neglected for 2012.

There are currently two negatives on her report.

One is a 30 day late payment on a store card in 2007. That’s not a 120 point hit.

The other is an $8 charge-off to Discover. As an authorized user. On an account that was paid.

Crap.

We called Discover to get them to correct the reporting and got told they don’t have it listed as a charge-off. They did agree to send a letter to us saying that, but said they couldn’t fix anything with the credit bureaus.

Once we get that letter, it’s dispute time.

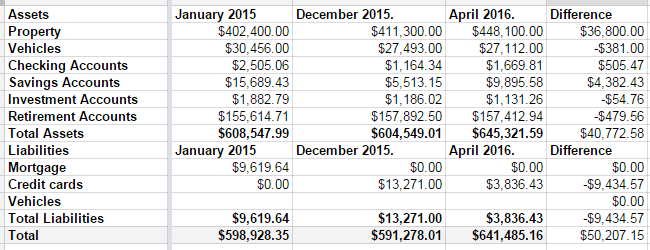

Net Worth, April 2016

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.