This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

The no-pants guide to spending, saving, and thriving in the real world.

This is a conversation between me and my future self, if my financial path wouldn’t have positively forked 2 years ago. The transcript is available here.

What would your future self have to say to you?

If you haven’t been kept under a rock your whole life, you’re likely familiar with actor and comedian John Cleese. Part of the infamous Monty Python crew, he starred in films such as Monty Python’s Quest for the Holy Grail, and television shows such as Faulty Towers. However, are you familiar with what has happened to Mr. Cleese financially over the past few years?

When Cleese divorced his third wife she ended up with a divorce settlement that quite literally made her richer than him, despite the fact that they were married for only 16 years and had produced no children.

Divorce is, unfortunately, a fixture of modern society, and people of both sexes need to know how they can protect their personal finances in case of a divorce. After all, these days more than 50% of marriages end in divorce, so not preparing yourself financially for it is engaging is some rather wishful thinking. So how best to protect yourself and your personal finances, should you be unfortunate enough to have to go through one?

If you are the higher-earning party, get a pre-nup prior to marriage; this simply cannot be overemphasized. Cleese himself, already married to wife number four, incidentally, was told that he should have her sign a prenuptial agreement, he initially didn’t want to, despite having just been taken to the proverbial cleaners. He only reluctantly had one written up when his legal team essentially insisted. Even though prenups can be challenged or modified in court, if you are the party bringing more assets to the relationship, it is irresponsible of you not to solicit a prenuptial agreement from a potential spouse.

Another thing to keep in mind is that you should protect assets you have in joint accounts with your spouse, and also begin to actively monitor your credit, if things become acrimonious between you two. This way, you will prevent them from absconding with the totality of your shared funds, or ruining your credit if they are feeling malicious. If you need further information on how to do this properly, speak with a qualified financial planner.

So if you find yourself considering marriage and either have significant assets to protect or suspect you might have them in the future, you owe it to yourself to look into the legalities surrounding prenuptial agreements, and other thorny issues related to personal finance. Failure to do so can end up seriously impacting your life in a negative way, should you ever be faced with a vindictive or greedy spouse; protect yourself!

I’m incredibly absent-minded. I get involved in something and forget about almost everything else. While that makes me productive at work and helps the time pass, it means I forget to do a lot of things. On the days I am supposed to pick up my son, I have to set reminders so I don’t get wrapped up in a project at work and forget to leave on time.

My solution has been to put everything into Google Calendar. I use 10 different calendars, five of which are mine. I have one for regular scheduling of appointments, one I use to take notes for 30 Day Projects, and one that is copied from the school calendar so I don’t forget late-start days and school vacations. I also use calendars to track the wrestling team’s schedule, family birthdays, and upcoming holidays. I’ve got all of these calendars synced to my phone, I get reminders a week in advance, and I get a daily agenda at 5AM, every day. I don’t forget much anymore.

Over the past few weeks, I’ve been working on a new project–a new calendar. I’ve been reviewing seasonal home-maintenance checklists, medical checkup recommendations, car maintenance lists, and more. All of this has been added to a new Google Calendar, the Home and Life Maintenance Calendar.

This calendar is designed to remind its users to do the things we all need to do, from biannual physicals to replacing your furnace filters, checking your tire pressure to cancer self-exams. The seasonal chores happen in the right seasons, and the monthly reminders happen monthly. It is a work-in-progress and I welcome any recommendations for the things I’ve missed.

So, here it is. Use it, set up reminders, smack me for missing something obvious and enjoy.

[google-calendar-events id=”1″ type=”ajax”]

Update: This post has been included in the Festival of Frugality.

How much would you pay for a kiss from the world’s sexiest celebrity?

That was the focus of a recent study that I can’t find today. There is no celebrity waiting in the wings to deliver the drool, and the study doesn’t name which celebrity it is. That’s an exercise for the reader.

This was a study into how we value nice things.

The fascinating part of the study is that people would be willing to pay more to get the kiss in 3 days than they would to get the tongue slipped immediately.

Anticipation adds value.

Instant gratification actually causes us to devalue the object of our desire.

This goes well beyond “Will you respect me in the morning?”

The last time I talked about delayed gratification, it was in the context of my kids. That still holds true. Kids don’t value the things that are handed to them.

The surprising–and disturbing–bit is that adults don’t, either. If I run out to the store to buy an iPad the first day I see one, I won’t care about it nearly as much as if I spend a week or two agonizing over the decision.

The delay alone adds to the perceived value. The agony turns the perceived value into gold.

If I spend a month searching for the perfect car, the thrill of the successful hunt adds less value than the time it took to do the hunting.

Here’s my frugal tip for today: Delay your purchases. While it may not actually save you any money, you will feel like you got a much better deal if you wait a few days for something you really want.

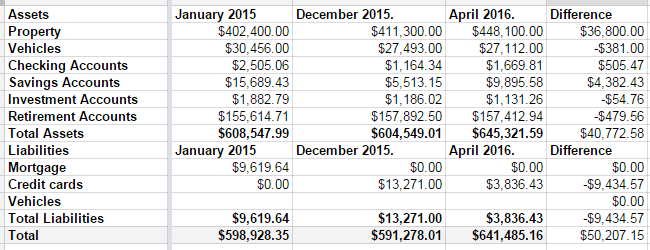

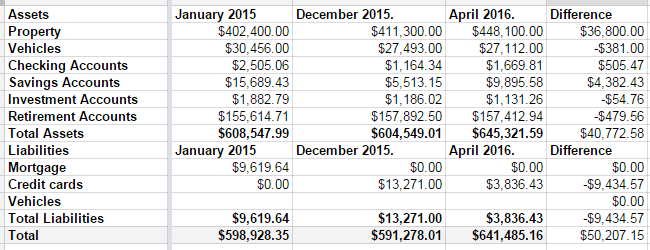

Last year wasn’t a good year for my net worth. It came with a $7000 drop.

Q1 2016, however, was a great quarter.

In December, we had $13,271 in credit card debt. At the time I took this screenshot, it was down to $3836.43. As of this moment, it’s down to $2640.91. If things go as expected this week, I should wake up on Friday to a paid-off credit card. I had to raid some of our savings accounts to make it happen, but it’s happening. Some of it was a tax refund, some of it was the fact that my mortgage payment went away in December.

That’s seven years of hard work, almost to the day. Seven years ago, I was researching bankruptcy, and stumbled across Dave Ramsey. Seven years ago, we were drowning in debt.

Next week, we’re free. No more debt, hanging over our heads. We’re free to take vacations. We’re free to finally save for college, when my son is 16, and stand a chance of being able to pay for it for him. We’re free to do…whatever we want to do. Our monthly nut after the debt is paid–only in fall/winter/spring when my wife is working–is roughly 1/3 of our take-home pay.

That’s how hard we’ve cut to make sure we can pay our bills and make debt die. We do have some things that would be considered extravagant. We’re not savages. But my car is 10 years old. My wife’s is 7. My motorcycles are 35 and 30; one of them was purchased before we cared about our debt.

Back to the net worth….

The biggest change came from our property values, which sucks. That was $36,000 of the difference, which comes with the painful tax bump to go with it. A large chunk of the savings increase was the money we set aside every month to cover the property tax bill, and that will go away next month.

Still, $641,000 dollars is a long way from nothing. I’m pretty happy.